PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906255

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906255

Healthcare Compliance Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

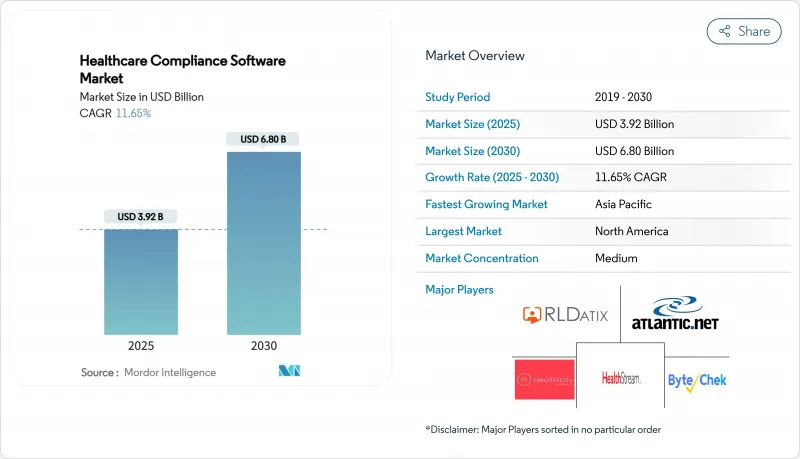

The Healthcare Compliance Software Market was valued at USD 3.92 billion in 2025 and estimated to grow from USD 4.37 billion in 2026 to reach USD 7.51 billion by 2031, at a CAGR of 11.47% during the forecast period (2026-2031).

Rapid digitization of clinical workflows, telehealth expansion, and AI-enabled auditing position compliance platforms as strategic tools for risk mitigation rather than mere regulatory checklists. Vendors that integrate natural language processing to flag rule changes and automate audit trails are capturing share because hospitals report up to 50% workload reductions after deployment. Cloud delivery models remain the preferred choice, enabling provider organizations to scale capacity without incurring capital expenditures while meeting stringent HIPAA and GDPR security mandates. Asia-Pacific emerges as the fastest-growing regional opportunity, fueled by 18.47% CAGR as China, India, and Japan tighten data-privacy laws and digitize provider networks, prompting aggressive adoption of automated compliance solutions.

Global Healthcare Compliance Software Market Trends and Insights

Expansion of Telehealth Requiring HIPAA-Compliant Platforms

Accelerated telehealth uptake now positions virtual visits to account for one-third of all U.S. encounters, compared with 5% before the pandemic. Health systems therefore demand compliance suites that embed end-to-end encryption, multi-factor user authentication, and automated cross-state licensure verification to mitigate interstate practice risk. Vendors differentiating with real-time video-call encryption and digital consent management see stronger adoption among integrated delivery networks. Leveraging secure APIs, these platforms link to electronic health record (EHR) portals so that remote prescriptions and follow-up plans feed directly into longitudinal patient files. The trend broadens the healthcare compliance software market because ambulatory clinics and behavioral health providers, historically slower adopters, now require the same HIPAA safeguards as large hospitals.

Emphasis on Patient-Centered Care

Regulators increasingly tie reimbursement to quality and equity metrics, compelling compliance tools to correlate policy adherence with measurable patient outcomes. Modern platforms capture consumer-reported satisfaction scores alongside clinical indicators to generate dashboards demonstrating compliance impact on value-based contracts. Leading accountable-care organizations integrate these dashboards with population-health engines that stratify risk and trigger targeted interventions. Software firms embedding analytics that link policy execution with readmission and mortality rates earn preference among chief quality officers seeking single-pane visibility. As value-based models expand, this linkage transforms the healthcare compliance software market from penalty avoidance to performance optimization.

Lack of Awareness & Limited IT Resources among Specialty Clinics

Specialty practices often operate with lean technology teams, sometimes fewer than five staff covering all IT functions. This capacity gap delays adoption of full-featured compliance tools that require integration with EHRs and payer portals. Vendors are responding with modular, cloud-native applications that deploy in hours and offer pre-configured templates for dermatology, oncology, and behavioral health. Yet many clinics remain unaware of regulatory nuances specific to their disciplines, relying on outdated manual logs that expose them to audit risk. Until awareness campaigns and simplified offerings scale, this restraint will temper healthcare compliance software market penetration in fragmented outpatient segments.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Manual Healthcare Compliance Methods to Automated Compliance Software

- Integration of AI-Enabled Auditing Reducing Manual Workload

- Perception of Compliance as a Cost Center Lowering Procurement Priority

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms commanded 52.19% of the healthcare compliance software market share in 2025 as providers prioritized scalability and remote access. The segment's 17.42% forecast CAGR exceeds on-premise systems because subscription pricing converts capital expenditure to predictable operating costs and speeds implementation within weeks. Leading vendors bundle automated backup and disaster recovery, ensuring data resilience amid cyber incidents that targeted multiple U.S. hospitals in 2024. Cloud hosting also simplifies continuous rule updates; once a regulation changes, providers receive patches without downtime, unlike traditional installations that require local IT intervention. In parallel, regulatory frameworks such as HIPAA and GDPR publish guidance clarifying that certified cloud providers can meet security mandates, boosting confidence among compliance officers.

Cloud vendors further differentiate by embedding AI micro-services for real-time anomaly detection, which would be resource-intensive to run on local servers. Hospitals leveraging these analytics report double-digit reductions in audit cycle times. Country-level initiatives, including India's ABDM digital-health program and Japan's Medical Information System infrastructure, reference cloud architectures, strengthening regional demand. Consequently, cloud deployments will remain the primary engine driving the healthcare compliance software market through 2031, especially among multi-site health systems seeking unified oversight across geographies.

The Healthcare Compliance Software Market Report is Segmented by Deployment Mode (Cloud-Based, On-Premise, Web-Based), Solution Module (Policy & Procedure Management, Auditing Tools, and More), End User (Hospitals, Specialty & Out-Patient Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserved 44.68% of the healthcare compliance software market share in 2025, supported by rigorous enforcement of HIPAA, HITECH, and the False Claims Act. Widespread cloud adoption accelerates software deployment; surveys reveal 91% of U.S. hospitals now run portions of their infrastructure in the cloud. CMS's push toward total accountable-care participation by 2030 further elevates documentation and quality-reporting requirements, compelling investment in integrated compliance platforms. Provider organizations increasingly bundle compliance modules with EHR upgrades, driving cross-selling opportunities. AI-powered audit capabilities gain traction as board-level scrutiny of fraud and waste intensifies after multiple high-profile enforcement actions in 2024.

Asia-Pacific records the highest growth, forecast at 18.12% CAGR, significantly outpacing the global average. China's Personal Information Protection Law and India's Digital Personal Data Protection Act impose strict penalties, motivating providers to deploy automated monitoring to avoid fines. Public-private partnerships in Japan and Australia fund telehealth expansion in rural regions, and each initiative requires compliance technology to secure patient data transmissions. Multinational life-science firms operating across the region adopt unified platforms to harmonize anti-bribery, pharmacovigilance, and data-privacy controls, further scaling the healthcare compliance software market size.

Europe contributes steady demand as GDPR fines reach new highs, with several hospitals ordered to pay multi-million-dollar penalties for data breaches in 2024. Providers prioritize solutions that consolidate healthcare-specific regulations with broader data-protection mandates, streamlining reporting to supervisory authorities. Middle East & Africa and South America remain emerging markets but post rising adoption in tertiary centers located in the United Arab Emirates, Saudi Arabia, Brazil, and Colombia. Mobile-friendly compliance apps enable frontline staff to complete checklists in low-bandwidth settings, supporting incremental market penetration where fixed networks are sparse.

- RLDatix

- Healthicity LLC

- HealthStream Inc.

- Compliancy Group LLC

- Atlantic.Net

- VielSun

- Accountable HQ Inc.

- Complinity Technologies Pvt Ltd

- Radar Healthcare

- ConvergePoint Inc.

- Beacon Healthcare Systems

- Sprinto

- NAVEX Global

- ByteChek, Inc.

- Verge Health

- MedTrainer

- Protenus

- Intraprise Health

- Symplr

- Accruent (Connectiv)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Tele-health Requiring HIPAA-Compliant Platforms

- 4.2.2 Emphasis on Patient-Centered Care

- 4.2.3 Shift from Manual Healthcare Compliance Methods to Automated Compliance Software

- 4.2.4 Integration of AI-Enabled Auditing Reducing Manual Workload

- 4.2.5 Rise of Value-Based Care Driving Billing-Compliance Automation

- 4.2.6 Increasing Cybersecurity Threats Prompting Robust Compliance Monitoring

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness & Limited IT Resources among Specialty Clinics

- 4.3.2 Perception of Compliance as a Cost Center Lowering Procurement Priority

- 4.3.3 High Implementation Costs

- 4.3.4 Complexity of Multi-Jurisdictional Regulatory Requirements

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Deployment Mode

- 5.1.1 Cloud-Based

- 5.1.2 On-Premise

- 5.1.3 Web-Based

- 5.2 By Solution Module

- 5.2.1 Policy & Procedure Management

- 5.2.2 Auditing Tools

- 5.2.3 Training Management & Tracking

- 5.2.4 Medical Billing & Coding

- 5.2.5 License, Certificate & Contract Tracking

- 5.2.6 Incident Management

- 5.2.7 Accreditation Management

- 5.2.8 Other Modules

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty & Out-Patient Clinics

- 5.3.3 Other Healthcare Facilities

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 RLDatix

- 6.3.2 Healthicity LLC

- 6.3.3 HealthStream Inc.

- 6.3.4 Compliancy Group LLC

- 6.3.5 Atlantic.Net

- 6.3.6 VielSun

- 6.3.7 Accountable HQ Inc.

- 6.3.8 Complinity Technologies Pvt Ltd

- 6.3.9 Radar Healthcare

- 6.3.10 ConvergePoint Inc.

- 6.3.11 Beacon Healthcare Systems

- 6.3.12 Sprinto

- 6.3.13 NAVEX Global

- 6.3.14 ByteChek, Inc.

- 6.3.15 Verge Health

- 6.3.16 MedTrainer

- 6.3.17 Protenus

- 6.3.18 Intraprise Health

- 6.3.19 Symplr

- 6.3.20 Accruent (Connectiv)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment