PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906257

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906257

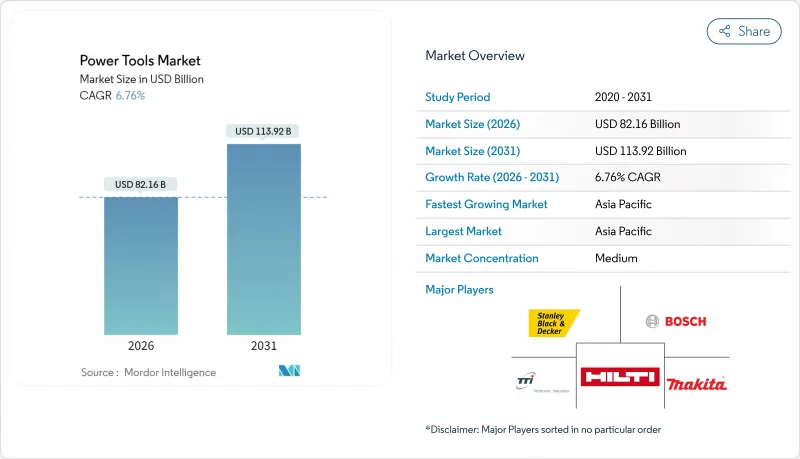

Power Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Power Tools market is expected to grow from USD 76.96 billion in 2025 to USD 82.16 billion in 2026 and is forecast to reach USD 113.92 billion by 2031 at 6.76% CAGR over 2026-2031.

Expanding infrastructure programs, rapid urbanization, and the shift toward cordless technologies sustain demand even as supply chains normalize. Cordless electrification is redefining job-site productivity, while stricter emissions rules in major cities accelerate the replacement of pneumatic and gas-powered units with battery platforms. Rising DIY participation and e-commerce access in emerging economies widen the consumer base, and smart manufacturing incentives in Asia and Europe stimulate factory-floor investments in high-precision, connected tool systems. Competitive intensity remains moderate; leaders safeguard their share through differentiated battery ecosystems, whereas new Chinese entrants leverage localized production and aggressive pricing.

Global Power Tools Market Trends and Insights

Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

Cell chemistries continue to raise energy density by 5-7% annually, giving contractors similar runtime to corded equivalents with the benefit of untethered mobility. DEWALT's tabless cell architecture boosts power 50% while shedding weight, allowing roofers and electricians to carry lighter packs without sacrificing torque.

Electrification of Construction Equipment Fleet in North America & Europe

Sixty-six percent of construction managers in the United States and Canada now expect fully electric jobsites within two years, citing emissions caps and lower lifetime running costs. European municipalities pursue similar goals; OEMs such as Volvo pledge all-electric line-ups by 2030 while mobile fast-charging rollouts shrink range anxiety. Urban projects increasingly specify battery or corded-electric tools, pressuring pneumatic and hydraulic segments yet leaving a niche for engine-driven units on remote sites lacking grid access. Contractors adopting all-electric fleets report up to 60% CO2 savings and 30% shorter project timelines, reinforcing the payback narrative.

Volatility in Lithium & Cobalt Prices Inflating Cordless BOM Cost

US tariffs have lifted the composite duty on Chinese lithium-ion batteries to 58% in 2025, pressuring OEM margins and retail prices. Battery inputs account for 30-40% of high-power cordless tool cost; spikes in spot prices force manufacturers to negotiate alternate offtake deals in Australia and Africa to secure supply and smooth pricing.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Manufacturing

- DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- Saturation of Mature Rental Channels in Western Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric formats captured 63.02% of 2025 revenue in the power tool market, with cordless sub-segments expanding at 7.24% CAGR through 2031 as lithium-ion packs approach corded performance parity. Pneumatic tools retain footholds where compressed-air systems already exist, and hydraulic devices address ultra-high-torque niches such as bridge tensioning. Engine-driven equipment is relegated to off-grid construction and forestry operations due to urban noise and emissions limits. The power tools market size for cordless solutions is projected to widen sharply as multi-brand battery alliances cut ownership costs and simplify charging infrastructure. However, raw-material pricing swings and limited fast-charging availability in developing regions keep corded units relevant for price-sensitive users.

Enhanced ergonomics, brushless drives, and firmware updates now differentiate premium cordless products. Bosch's Professional 18V System and Makita's LXT interchangeable packs highlight how ecosystem consistency locks in customer loyalty. Fleet managers appreciate the reduced downtime and safety gains derived from cable-free worksites, reinforcing the transition.

Drilling and fastening tools accounted for 31.88% of 2025 revenue in the power tool market, reflecting their ubiquity across construction and assembly lines. Impact drivers and wrenches register an 7.78% CAGR thanks to automotive and aerospace tightening specifications that require exact torque and data capture for traceability. Sawing and cutting remain resilient; carbide-tipped blades introduced by Bosch offer 20x life versus bi-metal alternatives, appealing to high-volume carpenters.

Regulations targeting HAVS prompt redesigns in demolition hammers; Bosch's cordless GSH 18V-5 balances 8.5 J impact energy with adaptive speed control to mitigate vibration exposure. Emerging categories such as heat guns and cordless glue tools gain traction in decor and electronics rework, expanding the addressable universe beyond traditional construction trades. Collectively, premium brushless offerings underpin power tools market share retention for tier-one brands despite price competition.

The Power Tools Market is Segmented by Mode of Operation (Electric, and Others), by Product (Drilling & Fastening Tools, and Others), by End-User (Construction & Infrastructure, and Others), by Sales Channel (Offline and Online), and by Region (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 39.55% of 2025 global revenue in the power tool market and is poised for a 7.61% CAGR, anchored by China's 25% capital-investment hike under its upgrading plan and India's Make in India incentives that draw both domestic and foreign OEMs. Localized battery pack production and rising disposable incomes spur cordless adoption, while Japan's mature yet innovation-centric market relies on premium brushless models to differentiate offerings.

North America constitutes a technologically advanced yet slower-growing region in the power tools market. The American Rental Association expects equipment rental revenue to climb to USD 77.3 billion in 2024, reinforcing a substantial recurring demand base. Nevertheless, tariffs on Chinese batteries inflate procurement costs, motivating near-shoring in Mexico, where tool imports surge double digits and supply chains reconfigure to sidestep duties.

Europe shows divergent trajectories in the power tools market: Western markets see rental channel saturation and strict HAVS regulation, whereas Eastern Europe benefits from EU funding and fresh manufacturing capacity. The EU's EUR 8.1 billion IPCEI initiative stimulates smart-factory investments, generating demand for connected precision tools. Environmental compliance pressure favors electric models, and leading OEMs differentiate through low-vibration certifications and recyclable packaging.

- Stanley Black & Decker Inc.

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd.

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Apex Tool Group

- Emerson Electric Co.

- Husqvarna AB

- Honeywell International Inc.

- KYOCERA Corporation

- Festool GmbH

- Cummins Inc. (Tool segment)

- Hitachi Koki (HiKOKI)

- Illinois Tool Works (ITW)

- Ridgid (Emerson)

- Baier Power Tools

- Positec Tool Corporation

- Panasonic Life Solutions

- CEMBRE S.p.A.

- CSUN Power Tools*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Construction Equipment Fleet in North America & Europe

- 4.2.2 DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- 4.2.3 Automotive Light-weighting Demands Higher Precision, Driving Brushless Tools Adoption

- 4.2.4 Government Incentives for Smart Manufacturing (e.g., Made-in-China 2025, EU IPCEI)

- 4.2.5 Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

- 4.2.6 Surge in Modular, Subscription-based Tool-on-Demand Programs Among Contractors

- 4.3 Market Restraints

- 4.3.1 Volatility in Lithium & Cobalt Prices Inflating Cordless Tool BOM Cost

- 4.3.2 Saturation of Mature Rental Channels in Western Europe

- 4.3.3 Regulatory Noise Around Hand-Arm Vibration Syndrome (HAVS) Limiting Heavy Demolition Tool Uptake

- 4.3.4 Fragmented Counterfeit Supply in Emerging Markets Undercutting Brand Premiums

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Industry Policies Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Distribution Channel Analysis

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Mode of Operation

- 5.1.1 Electric

- 5.1.1.1 Cordless

- 5.1.1.2 Corded

- 5.1.2 Pneumatic

- 5.1.3 Hydraulic

- 5.1.4 Engine-Driven

- 5.1.1 Electric

- 5.2 By Product

- 5.2.1 Drilling & Fastening Tools

- 5.2.2 Sawing & Cutting Tools

- 5.2.3 Grinding & Polishing Tools

- 5.2.4 Material Removal Tools (sanders, etc.)

- 5.2.5 Demolition Tools (Breakers, Jackhammers)

- 5.2.6 Impact Drivers & Wrenches

- 5.2.7 Nailers & Staplers

- 5.2.8 Others (heat guns, glue guns, mixers, speciality tools)

- 5.3 By End-user

- 5.3.1 Construction & Infrastructure

- 5.3.2 Automotive

- 5.3.3 Aerospace & Defense

- 5.3.4 Energy & Power Generation

- 5.3.5 Shipbuilding, Marine & Railways

- 5.3.6 Manufacturing (Electronics, Metalworking, Wood Work, etc.)

- 5.3.7 Residential / DIY

- 5.3.8 Others (Utilities, Mining, etc.)

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.1.1 Direct Industrial/ Distributor

- 5.4.1.2 Mass Retail / Home Centers

- 5.4.2 Online

- 5.4.2.1 E-commerce Marketplaces

- 5.4.2.2 Brand-Owned Digital Stores

- 5.4.1 Offline

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Stanley Black & Decker Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Techtronic Industries Co. Ltd.

- 6.4.4 Makita Corporation

- 6.4.5 Hilti Corporation

- 6.4.6 Atlas Copco AB

- 6.4.7 Ingersoll Rand Inc.

- 6.4.8 Snap-on Incorporated

- 6.4.9 Apex Tool Group

- 6.4.10 Emerson Electric Co.

- 6.4.11 Husqvarna AB

- 6.4.12 Honeywell International Inc.

- 6.4.13 KYOCERA Corporation

- 6.4.14 Festool GmbH

- 6.4.15 Cummins Inc. (Tool segment)

- 6.4.16 Hitachi Koki (HiKOKI)

- 6.4.17 Illinois Tool Works (ITW)

- 6.4.18 Ridgid (Emerson)

- 6.4.19 Baier Power Tools

- 6.4.20 Positec Tool Corporation

- 6.4.21 Panasonic Life Solutions

- 6.4.22 CEMBRE S.p.A.

- 6.4.23 CSUN Power Tools*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment