PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906261

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906261

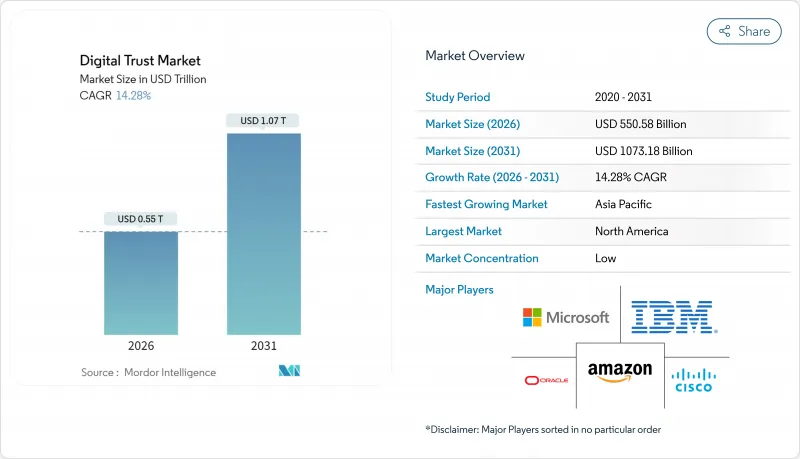

Digital Trust - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The digital trust market is expected to grow from USD 481.79 billion in 2025 to USD 550.58 billion in 2026 and is forecast to reach USD 1073.18 billion by 2031 at 14.28% CAGR over 2026-2031.

Heightened cyber-attack frequency, rising data-breach costs averaging USD 4.88 million in 2024, and stringent global privacy regulations are compelling enterprises to prioritize verifiable trust mechanisms across identities, devices, applications, and data flows. Cloud migration, AI-enabled threat detection, and Zero-Trust architecture adoption collectively accelerate spending, while portable digital identity wallets and machine-to-machine trust requirements enlarge the addressable opportunity. Competitive dynamics remain fluid as platform vendors consolidate capabilities through acquisitions and alliances, enabling integrated offerings that reduce operational complexity for customers.

Global Digital Trust Market Trends and Insights

Rising frequency and cost of data breaches

Cybercrime are growing significantly, and ransomware attacks occur every 11 seconds worldwide. Healthcare incidents average USD 10.93 million per breach, while financial institutions face USD 6.04 million per event. Organizations that deploy AI-driven security and automation shave USD 2.2 million off breach expenses, illustrating technology's dual protective and risk factors. SMEs remain vulnerable; 60% fail within six months of a serious cyberattack, yet 43% of incidents already target them.

Expanding global privacy and e-ID regulations

Seventy-five percent of the world's population will live under modern data-privacy laws by 2025. The European Union's eIDAS 2.0 mandates digital identity wallets for all member states by 2026 and compels private-sector acceptance by December 2027. Divergent frameworks across the US, EU, and APAC increase compliance expense for multinationals. Digital identity platform usage is expected to reach 5 billion people in 2024 as mobile-first schemes proliferate in emerging economies.

Consumer "consent fatigue" eroding engagement

Ninety-seven percent of consumers worry about online data privacy, yet just 8% fully trust brands - down two percentage points in a year. Password exhaustion affects 89% of users; 54% abandon services that require cumbersome log-ins. Streamlined, passwordless flows lift satisfaction without sacrificing security.

Other drivers and restraints analyzed in the detailed report include:

- Rapid cloud adoption triggering Zero-Trust roll-outs

- AI/ML-powered fraud detection becoming table-stakes

- Fragmented regulatory and standards landscape

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained 61.85% of 2025 revenue, anchored by identity verification platforms, certificates, and fraud-detection engines that form the core of digital trust infrastructure. Yet managed and professional services will grow 14.72% CAGR through 2031, reflecting organizations' reliance on third-party expertise for Zero-Trust design, regulatory audits, and crypto-agile transitions. Staffing shortages press enterprises to outsource security operations, pushing MSSP partnerships higher. Training services expand because 74% of breaches still involve human error.

Vendor-consolidation programs amplify services demand; as organizations retire overlapping point tools, integration specialists ensure continuity and data integrity. Among SMEs, managed security offsets talent scarcity, while large enterprises engage consultancies to orchestrate threat-intelligence fusion centers. Platform vendors bundle advisory packages to boost adoption and reduce churn, reinforcing stickiness across their customer base.

On-premises deployments preserved 65.05% share in 2025 as regulated verticals retain critical keys and logs in physical data centers. However, cloud options will log a 15.96% CAGR to 2031 as hyperscalers embed sophisticated threat-intel feeds and elastic processing into native security suites. Organizations implementing cloud controls report USD 2.22 million lower breach costs than purely on-prem rivals.

Hybrid patterns prevail; encryption-intensive workloads remain on-premises, while analytics and policy engines shift to SaaS. Digital trust market size for cloud deployments is projected to advance at 15.96% CAGR, catalyzed by sovereign-cloud initiatives that satisfy data-residency demands. Meanwhile, edge computing in factories and retail branches necessitates distributed trust enforcement close to devices, creating openings for lightweight agentless architectures.

Global Digital Trust Market is Segmented by Component (Solutions and Services), Deployment Mode (Cloud, On-Premises), Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), End-User Industry (Banking, Financial Services and Insurance (BFSI), Healthcare, and More) and by Geography. The Industry Forecasts are Provided in Terms of Value (USD). Covers Growth Trends, Analysis and More.

Geography Analysis

North America led with 34.85% revenue share in 2025, strengthened by state privacy laws - more than 350 bills tabled in US legislatures during 2023 - alongside enterprise budgets that dwarf global peers. Average breach costs of USD 9.8 million justify strategic adoption of AI-powered detection and zero-trust blueprints. Vendor consolidation accelerates as large firms select platform providers able to bundle certificates, IAM, and continuous compliance under unified SLAs.

Asia-Pacific is the fastest-growing region at 14.31% CAGR through 2031, riding on mass-scale mobile internet usage and government-backed e-ID programs. Manufacturing corridors in China, Japan, and India deploy machine-identity frameworks to secure Industry 4.0 assets. Indonesia, the Philippines, and Vietnam drive demand for cloud-native trust layers that balance cost with rapid rollout. Variability across the region necessitates localized biometric solutions and language-aware risk analytics.

Europe benefits from eIDAS 2.0, which sets a common digital-identity baseline and targets 80% citizen-wallet adoption by 2030. Post-quantum cryptography pilots are more advanced here than in any other region, as financial watchdogs urge crypto-agile readiness. Meanwhile, data-transfer restrictions with the US add compliance layers, making on-EU-soil HSM capacity a competitive differentiator for trust-service providers.

- Microsoft

- IBM

- Cisco Systems

- Amazon Web Services (AWS)

- Oracle

- Thales

- Entrust

- DigiCert

- Symantec (Broadcom)

- Okta

- DocuSign

- Ping Identity

- OneTrust

- Trulioo

- Jumio

- Mitek Systems

- Onfido

- CyberArk

- Palo Alto Networks

- Sift

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising frequency and cost of data breaches

- 4.2.2 Expanding global privacy and e-ID regulations

- 4.2.3 Rapid cloud adoption triggering Zero-Trust roll-outs

- 4.2.4 AI/ML-powered fraud detection becoming table-stakes

- 4.2.5 Emergence of reusable / portable digital identitiesf

- 4.2.6 Machine-to-machine trust needs in smart factories

- 4.3 Market Restraints

- 4.3.1 Up-front integration and licensing costs

- 4.3.2 Fragmented regulatory and standards landscape

- 4.3.3 Consumer consent fatigue eroding engagement

- 4.3.4 Limited high-quality labelled data for Trust-and-Safety AI

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud-Based

- 5.2.2 On-Premises

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SMEs)

- 5.4 By End-User Industry

- 5.4.1 Banking, Financial Services and Insurance (BFSI)

- 5.4.2 Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Government and Public Sector

- 5.4.5 Retail and E-Commerce

- 5.4.6 Energy and Utilities

- 5.4.7 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft

- 6.4.2 IBM

- 6.4.3 Cisco Systems

- 6.4.4 Amazon Web Services (AWS)

- 6.4.5 Oracle

- 6.4.6 Thales

- 6.4.7 Entrust

- 6.4.8 DigiCert

- 6.4.9 Symantec (Broadcom)

- 6.4.10 Okta

- 6.4.11 DocuSign

- 6.4.12 Ping Identity

- 6.4.13 OneTrust

- 6.4.14 Trulioo

- 6.4.15 Jumio

- 6.4.16 Mitek Systems

- 6.4.17 Onfido

- 6.4.18 CyberArk

- 6.4.19 Palo Alto Networks

- 6.4.20 Sift

- 6.5 White-Space and Unmet-Need Assessment