PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906263

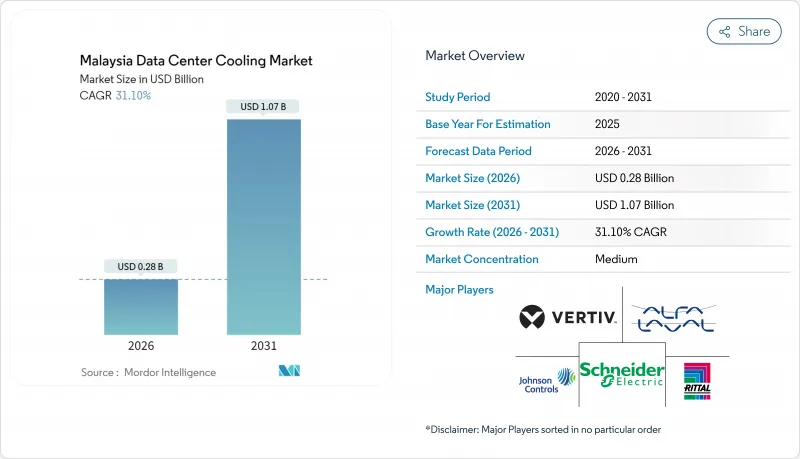

Malaysia Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Malaysia data center cooling market size in 2026 is estimated at USD 0.28 billion, growing from 2025 value of USD 0.21 billion with 2031 projections showing USD 1.07 billion, growing at 31.10% CAGR over 2026-2031.

Momentum is anchored in the nation's emergence as Southeast Asia's preferred data center location, government incentives that reduce operating costs, and artificial-intelligence (AI) workloads that demand advanced thermal management. Foreign direct investment continues to pour into Johor, Cyberjaya and Greater Kuala Lumpur, while renewable-energy procurement schemes encourage operators to upgrade cooling infrastructure for energy efficiency. Liquid-based solutions are gaining attention as rack power densities move past 40 kW, yet air-based systems still dominate installed capacity. Supply-chain localization and component integration, coupled with a growing domestic skills base, position vendors to capture expanding demand even as resource constraints pressure design choices.

Malaysia Data Center Cooling Market Trends and Insights

Strategic Location of Malaysia as Regional Hub in Asia-Pacific

Malaysia's position between Singapore and other ASEAN markets delivers sub-20 ms latency to more than 650 million users, prompting operators to locate compute clusters and corresponding cooling assets locally Submarine-cable density has reached 15 routes, enabling high-availability architectures that rely on redundant chilled-water loops and independent plant rooms. Land costs 30-40% below Singapore allow purpose-built campuses to incorporate chilled-to-liquid conversion rooms and dedicated thermal reservoirs that lower total cost of ownership. Microsoft's Malaysia West cloud region deploys three discrete cooling lines per hall to preserve uptime in AI-heavy zones. As regional digital-economy revenue is forecast to triple to USD 1 trillion by 2030, new campuses continue to allocate capital toward high-efficiency chillers and hot-aisle containment that safeguard performance under tropical conditions.

Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

Johor recorded 1.6 GW of installed IT load in 2024, and signed commitments could push regional demand beyond 5 GW by 2035. Rack densities above 40 kW necessitate liquid-cooling loops with approach temperatures below 2 °C to maintain chip reliability. Princeton Digital Group's 150 MW campus allocates 35% of built-out space to cooling plant and utility corridors, reflecting the growing footprint required for thermal assets. Hyperscale procurements spur local manufacturing of pumps and heat exchangers, and Tenaga Nasional Berhad reports double-digit power demand growth from the segment, reinforcing the long-term outlook for innovative thermal platforms.

Higher Energy Consumption and Water Needs for DC Cooling

Cooling consumes roughly 40% of total facility energy. Malaysia's grid demand could rise 130% by 2026, testing generation reserves Water pressure is more immediate: Johor regulators expect data center demand to hit 673 million L/day while the network can supply only 142 million L/day. A mandate for zero potable-water use within three years forces adoption of air-cooling and recycled-water plants, lifting capital outlays by as much as 35%. Operators able to deploy sealed-loop liquid systems achieve 80-90% electrical savings, but up-front costs remain a hurdle amid intense capex cycles.

Other drivers and restraints analyzed in the detailed report include:

- Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-based architectures maintained 71.20% Malaysia data center cooling market share in 2025 owing to established deployments and operator familiarity. Yet liquid platforms are advancing at 25.85% CAGR, contributing the largest incremental slice of Malaysia data center cooling market size through 2031. Chiller-plus-CRAH designs remain preferred for sub-20 kW racks, but indirect evaporative-assist and economizer coils enable PUE gains that defend air solutions in moderate-density halls. Liquid immersion tanks cut fan energy to near zero, reducing operating overhead amid rising tariff pressure. Hybrid rear-door heat exchangers provide bridge technology, letting operators migrate workloads without wholesale plant upgrades. Component vendors are localizing heat-exchanger skid production to shorten lead times and capture opportunities tied to AI deployments.

Energy and sustainability goals also catalyze liquid investment. Immersion and direct-to-chip loops keep component exit temperatures stable despite 500 kW rack loads, permitting higher compute density per square foot and lowering land expenditure in land-constrained corridors. Princeton Digital Group's Johor campus reported 20% footprint reduction after switching its GPU clusters to two-phase immersion, underlining the long-run cost advantages. As AI clouds scale, liquid systems are likely to displace air in new hyperscale blocks, yet a sizable retrofit business will persist, keeping air players relevant across secondary and enterprise sites.

CRAH and CRAC units account for the largest revenue share of 32.40% of Malaysia data center cooling market size thanks to their ubiquity in both greenfield and brownfield halls. Indirect-liquid chillers pair with plate heat exchangers to boost water-side economization hours, cutting annual electricity by double digits. Cooling towers with intelligent fan drives modulate airflow to track wet-bulb fluctuation, preserving compressor life and shaving peak demand charges. Pumps, valves and variable-frequency drives deliver fine-grained flow control, extending maintenance intervals. Control-and-monitoring platforms emerge as a growth hotspot, offering predictive analytics that prevent component failure and tune valve positions for optimum thermal efficiency.

Software gains prominence as operators chase marginal PUE reductions to offset tariff hikes. University of Maryland's control retrofit raised capacity by 100% and cut PUE 5.5% after installing AI-driven flow analytics. Comparable deployments in Malaysia's Cyberjaya corridor use fiber sensors embedded in cold-aisle tiles to orchestrate fan-speed modulation, resulting in 8% annual energy savings. Vendors able to bundle hardware, software and field services win preference during tender rounds, illustrating market movement toward integrated life-cycle solutions rather than discrete equipment buys.

Malaysia Data Center Cooling Market is Segmented by Cooling Technology (Air-Based Cooling, Liquid-Based Cooling), Cooling Component (Computer-Room Air Handlers (CRAH/CRAC), Chillers and Heat-Exchanger Units, and More), Data Center Type (Hyperscale (Owned and Leased), and More), End-User Industry (IT and Telecom, Retail and Consumer Goods, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Vertiv Group Corp.

- Johnson Controls Inc.

- Geoclima S.r.l.

- Carrier Global Corporation

- GIGA-BYTE Technology Co. Ltd

- Eaton Corporation PLC

- Right Power Technology Sdn Bhd

- Huawei Digital Power Technologies Co. Ltd

- Alfa Laval AB

- Iceotope Technologies Limited

- Daikin Industries Ltd.

- Stulz GmbH

- Munters Group AB

- Delta Electronics Inc.

- Fujitsu Ltd.

- Nortek Data Center Cooling

- NTT Facilities Inc.

- Trane Technologies plc

- Green Revolution Cooling (GRC)

- CoolIT Systems Inc.

- Asperitas BV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of Key Cost Overheads Related to DC Operations (Cooling Focus)

- 4.2.2 Comparative Study of Cooling Technologies (Design Complexity, PUE, Pros/Cons, Weather Utilization)

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy-Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strategic Location of Malaysia as Regional Hub in Asia-Pacific

- 5.1.2 Surge in Hyperscale and Colocation Investments Accelerating Cooling Demand

- 5.1.3 Government Tax Incentives and MyDIGITAL Blueprint Supporting DC Build-out

- 5.1.4 Singapore Data Center Cap Driving Spill-over Build-outs in Johor

- 5.1.5 AI / GPU Workload Density Triggering Shift to Advanced Liquid Cooling

- 5.1.6 National Grid-Modernization (CRESS, RE Power Purchase) Enabling High-Power DCs

- 5.2 Market Restraints

- 5.2.1 Higher Energy Consumption and Water Needs for DC Cooling

- 5.2.2 Rising Electricity Tariffs and Emerging Carbon-Pricing Uncertainty

- 5.2.3 Limited Recycled-Water Infrastructure for Sustainable Cooling

- 5.2.4 Skills Gap in Liquid-Cooling Design and Maintenance Workforce

- 5.3 Market Opportunities

- 5.3.1 Sustainability Push and Emergence of Green / Renewable Data Centers

- 5.4 Value / Supply-Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN MALAYSIA

- 6.1 Analysis of IT Load Capacity (MW) and Area footprint (Sq. Ft.) of Data Centers (for the period of 2019-2031)

- 6.2 Analysis of the major Data Center Hotspots in Malaysia

- 6.3 Analysis of Major Upcoming Hyperscale Facilities in Malaysia

7 MARKET SIZE AND GROWTH FORECAST (VALUE)

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH (Computer-Room Air Handler)

- 7.1.1.3 Cooling Tower (Direct, Indirect, Two-Stage)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Cooling Component

- 7.2.1 Computer-Room Air Handlers (CRAH/CRAC)

- 7.2.2 Chillers and Heat-Exchanger Units

- 7.2.3 Cooling Towers and Dry Coolers

- 7.2.4 Pumps and Valves

- 7.2.5 Control and Monitoring Software

- 7.3 By Data Center Type

- 7.3.1 Hyperscale (Owned and Leased)

- 7.3.2 Enterprise (On-Premise)

- 7.3.3 Colocation

- 7.4 By End-user Industry

- 7.4.1 IT and Telecom

- 7.4.2 Retail and Consumer Goods

- 7.4.3 Healthcare

- 7.4.4 Media and Entertainment

- 7.4.5 BFSI

- 7.4.6 Other End users

8 COMPETITIVE LANDSCAPE

- 8.1 Market Share Analysis

- 8.2 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 8.2.1 Schneider Electric SE

- 8.2.2 Rittal GmbH & Co. KG

- 8.2.3 Vertiv Group Corp.

- 8.2.4 Johnson Controls Inc.

- 8.2.5 Geoclima S.r.l.

- 8.2.6 Carrier Global Corporation

- 8.2.7 GIGA-BYTE Technology Co. Ltd

- 8.2.8 Eaton Corporation PLC

- 8.2.9 Right Power Technology Sdn Bhd

- 8.2.10 Huawei Digital Power Technologies Co. Ltd

- 8.2.11 Alfa Laval AB

- 8.2.12 Iceotope Technologies Limited

- 8.2.13 Daikin Industries Ltd.

- 8.2.14 Stulz GmbH

- 8.2.15 Munters Group AB

- 8.2.16 Delta Electronics Inc.

- 8.2.17 Fujitsu Ltd.

- 8.2.18 Nortek Data Center Cooling

- 8.2.19 NTT Facilities Inc.

- 8.2.20 Trane Technologies plc

- 8.2.21 Green Revolution Cooling (GRC)

- 8.2.22 CoolIT Systems Inc.

- 8.2.23 Asperitas BV

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

11 ABOUT US