PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906265

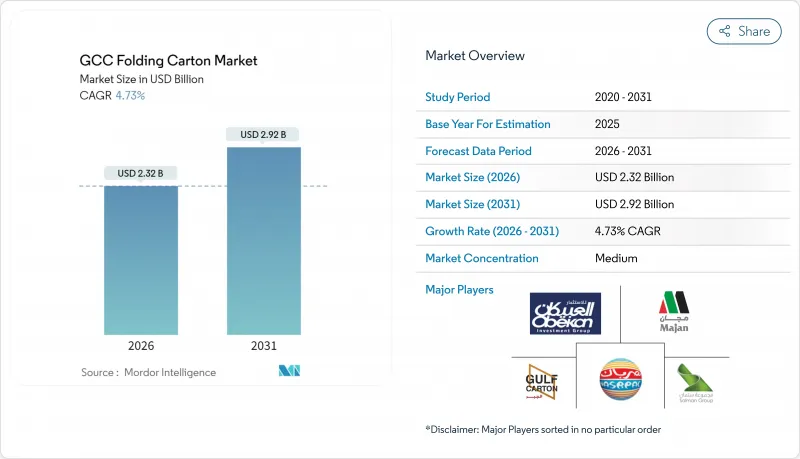

GCC Folding Carton - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC folding carton market is expected to grow from USD 2.22 billion in 2025 to USD 2.32 billion in 2026 and is forecast to reach USD 2.92 billion by 2031 at 4.73% CAGR over 2026-2031.

Robust sustainability mandates, industrial localization programs, and rapid e-commerce expansion are reshaping demand patterns, while digital printing unlocks mass customization at commercially viable costs. Saudi Arabia's scale, regulatory clarity, and Vision 2030 capital spending keep it the single largest consumer, yet the United Arab Emirates (UAE) is setting the regional pace for premium formats and print innovation. Food processing investments, such as giga-projects like NEOM, and the tight alignment of Gulf standards with export-market regulations are widening opportunities for fiber-based secondary and primary packaging. At the same time, pulp cost volatility and chronic water scarcity compel converters to seek resource-efficient machinery, diversified raw-material sources, and agile pricing models, reinforcing the importance of technology-enabled operational resilience in the GCC folding carton market.

GCC Folding Carton Market Trends and Insights

Surge in Sustainable-Fiber Mandates

Across the Gulf, environmental ministries are tightening rules that replace fossil-based substrates with recyclable fibers. Saudi Arabia's new produce-pack decree obliges converters to supply food-grade cartons that meet airflow, moisture, and migration limits, aligning with EU norms and easing export compliance. The UAE's phased ban on non-biodegradable disposables, as outlined in Standard 5009/2009, exerts similar pressure. Meanwhile, GCC Standardization Organization (GSO) documents 2231/2012 and 839/1997 harmonize food-contact rules. Together, these measures encourage substitution from flexible plastics to folding cartons, particularly in secondary packs where the recyclability of fiber resonates with consumers. Brand owners leverage the policy shift to publicize their carbon footprint reductions, thereby increasing demand for certified board grades and barrier coatings that comply with the new mandates.

Packaged Food and Beverage Boom

Saudi Arabia is investing USD 70 billion in food-processing plants by 2030, a 59% increase over 2016, which is expected to increase carton usage for biscuits, dairy products, and ready-meal kits. Parallel facility build-outs by Mars, Mondelez, and PepsiCo in Jeddah and Dubai underscore the need for local converters capable of swiftly turning around high-graphic cartons. On-pack health-claim space, portion-controlled structures, and shelf-ready trays add to board tonnage. Global beverage majors are investing in aseptic lines for juice and specialty drinks, driving demand for wet-strength coated cartons that safeguard shelf life in the hot-chain environments common across the GCC folding carton market.

Import-Linked Pulp Price Volatility

Gulf converters import virtually all virgin and recovered fiber, leaving them vulnerable to swings driven by seasonal Chinese demand, shipping disruptions, and currency shifts. The EU's deforestation regulation reduced certified virgin availability in 2025, which led to increased global spot prices and compressed converter margins. Limited warehouse capacity within industrial zones magnifies exposure, as firms typically hold only a few weeks' worth of raw stock. To cope, large players lock in long-term contracts with Latin American mills or hedge with futures, but smaller operations often pass surcharges downstream, eroding their share in the price-sensitive GCC folding carton market.

Other drivers and restraints analyzed in the detailed report include:

- Localization Incentives Under GCC Industrial Visions

- E-Commerce Demand for Lightweight Branded Boxes

- Water-Scarcity Regulations on Regional Paper Mills

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food applications represented 38.25% of GCC folding carton market share in 2025, driven by dairy multipacks, confectionery trays, and ready-meal sleeves. Saudi investments exceeding USD 70 billion toward 2030 fuel demand for grease-resistant liners and high-graphic retail sleeves that withstand ambient logistics. Meal-kit brands rely on micro-flute cartons housed within corrugated outers, providing space for preparation instructions and QR codes that link to recipe videos. In contrast, pharmaceutical packs are projected to display the fastest CAGR of 5.32%, supported by the establishment of new formulation plants in Jazan and Abu Dhabi. Serialization, braille embossing, and tamper verification dictate procurement of high-precision die-cutters and vision-inspection systems, allowing converters to meet Gulf Centralized Regulatory Committee labeling mandates. Over the next five years, value growth in OTC cough remedies, biologics, and wellness supplements is expected to reinforce the segment's momentum within the GCC, contributing to the market's size.

Beverage cartons continue to gain ground in premium juice, specialty coffee, and flavored milk, where shelf standout and barrier integrity are crucial. Cosmetics and personal care rely on tactile varnish and metallic effects to reinforce luxury positioning in duty-free outlets, a niche amplified by tourism-led retail in the UAE and Qatar. Electronics, tobacco, and industrial goods hold smaller shares but offer upside potential as Vision 2030 manufacturing goals encourage local assembly and export-oriented production, each of which requires compliant secondary packaging. Thus, converters that diversify across high-growth niches mitigate exposure to cyclical food volumes and maximize utilization rates against the backdrop of a structurally expanding GCC folding carton market.

Folding Box Board (FBB) accounted for 36.12% of GCC's folding carton market share in 2025, thanks to its balanced stiffness-versus-cost profile and reliable European supply chains. It remains the default for dry foods, tea, and detergents. However, Solid Bleached Sulfate (SBS) is registering a 5.12% CAGR courtesy of premium chocolate, cosmeceutical, and biotech drug launches that demand pristine whiteness and low odor for high-fidelity branding. As SBS volumes climb, printers deploy oxygen-curable inks and aqueous coatings that maintain brightness while meeting GSO migration limits. White-lined chipboard and recycled kraft board continue to hold their roles in price-sensitive SKUs, supported by the GCC's rising collection rates for old corrugated containers under municipal circular economy programs.

In parallel, virgin kraft grades are gaining a niche in the organic food and baby nutrition segments, where consumers value purity, thereby strengthening their share of the GCC folding carton market. Hybrid constructions with dispersion barriers are emerging, offering grease resistance without the need for plastic lamination. Converters that master in-house coating can down-spec board weight, lowering freight and cost without sacrificing performance. Such material innovation reduces environmental footprint and aligns with government recycling targets, further integrating sustainability into procurement criteria across the GCC folding carton market.

The GCC Folding Carton Market Report is Segmented by End User (Food, Beverages, Pharmaceutical, Personal Care and Cosmetics, Industrial and Automotive, Tobacco, and More), Material Type (Folding Box Board, and More), Printing Technology (Offset Lithography, and More), Coating and Finishing (Aqueous and Water-Based, and More), and Geography (Saudi Arabia, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arabian Packaging Company L.L.C.

- NASR Packaging & Printing Co.

- Banawi Industrial Group (Saudi Paper Converting Co.)

- Gulf Carton Factory Company

- Obeikan Folding Carton Company L.L.C.

- United Carton Industries Company (UCI)

- Napco National Packaging Company L.L.C.

- Al Kifah Paper Products Company

- Noor Carton & Packaging Industry L.L.C.

- Queenex Corrugated Carton Factory L.L.C.

- Majan Printing & Packaging Company S.A.O.G.

- Al Rashed International Shipping Co. Packaging Division

- Saudi Printing & Packaging Company

- Emirates Printing Press L.L.C.

- First Paper Company FPC (Saudia)

- Sharjah Packaging Industries L.L.C.

- Petropack Packaging L.L.C.

- Printpack Middle East FZE

- Rotopack Printing & Packaging Industry L.L.C.

- Saudi Paper Manufacturing Co. (Folding Carton Unit)

- Interplast Co. L.L.C. - Packaging Division

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in sustainable-fiber mandates

- 4.2.2 Packaged food and beverage boom

- 4.2.3 Localization incentives under GCC industrial visions

- 4.2.4 E-commerce demand for lightweight branded boxes

- 4.2.5 Digital printing enabling SKU personalisation

- 4.2.6 Premium carton uptake in Giga-projects (e.g., NEOM)

- 4.3 Market Restraints

- 4.3.1 Import-linked pulp price volatility

- 4.3.2 Substitution by flexible pouches and rigid plastics

- 4.3.3 Shortage of skilled high-colour carton converters

- 4.3.4 Water-scarcity regulations on regional paper mills

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End User

- 5.1.1 Food

- 5.1.2 Beverages

- 5.1.3 Pharmaceutical

- 5.1.4 Personal Care and Cosmetics

- 5.1.5 Industrial and Automotive

- 5.1.6 Tobacco

- 5.1.7 Electronics and Consumer Durables

- 5.2 By Material Type

- 5.2.1 Folding Box Board (FBB)

- 5.2.2 Solid Bleached Sulfate (SBS)

- 5.2.3 White-Lined Chipboard (WLC)

- 5.2.4 Recycled Kraft Board

- 5.2.5 Virgin Kraft Board

- 5.3 By Printing Technology

- 5.3.1 Offset Lithography

- 5.3.2 Flexography

- 5.3.3 Digital (Inkjet and Toner)

- 5.3.4 Gravure

- 5.3.5 Screen Printing

- 5.4 By Coating/Finishing

- 5.4.1 Aqueous and Water-based

- 5.4.2 UV Coating

- 5.4.3 Varnish and Lacquer

- 5.4.4 Film Laminates

- 5.4.5 Metallic and Specialty Effects

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arabian Packaging Company L.L.C.

- 6.4.2 NASR Packaging & Printing Co.

- 6.4.3 Banawi Industrial Group (Saudi Paper Converting Co.)

- 6.4.4 Gulf Carton Factory Company

- 6.4.5 Obeikan Folding Carton Company L.L.C.

- 6.4.6 United Carton Industries Company (UCI)

- 6.4.7 Napco National Packaging Company L.L.C.

- 6.4.8 Al Kifah Paper Products Company

- 6.4.9 Noor Carton & Packaging Industry L.L.C.

- 6.4.10 Queenex Corrugated Carton Factory L.L.C.

- 6.4.11 Majan Printing & Packaging Company S.A.O.G.

- 6.4.12 Al Rashed International Shipping Co. Packaging Division

- 6.4.13 Saudi Printing & Packaging Company

- 6.4.14 Emirates Printing Press L.L.C.

- 6.4.15 First Paper Company FPC (Saudia)

- 6.4.16 Sharjah Packaging Industries L.L.C.

- 6.4.17 Petropack Packaging L.L.C.

- 6.4.18 Printpack Middle East FZE

- 6.4.19 Rotopack Printing & Packaging Industry L.L.C.

- 6.4.20 Saudi Paper Manufacturing Co. (Folding Carton Unit)

- 6.4.21 Interplast Co. L.L.C. - Packaging Division

7 MARKET OPPORTUNITIES AN FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment