PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906277

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906277

Food Trays And Bowls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

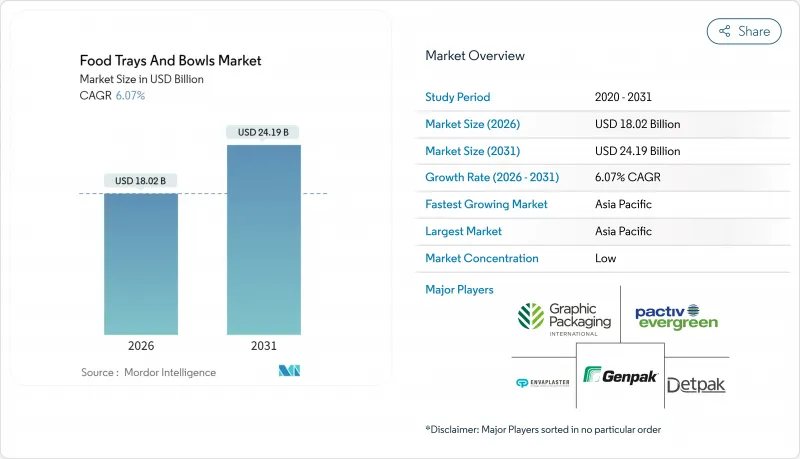

The food trays and bowls market was valued at USD 16.99 billion in 2025 and estimated to grow from USD 18.02 billion in 2026 to reach USD 24.19 billion by 2031, at a CAGR of 6.07% during the forecast period (2026-2031).

This robust outlook underscores the sector's ability to adapt as consumer lifestyles shift, packaging regulations tighten, and new barrier technologies gain traction. Online meal-ordering platforms now account for a growing share of foodservice spending, forcing suppliers to engineer containers that can withstand longer journeys and multiple handling events without leakage. Governments in the European Union, Australia, and parts of the United States have enacted single-use plastic bans that fast-track fiber and mono-material solutions, while artificial-intelligence labeling improves freshness tracking and consumer trust. Producers are also grappling with pulp price swings, yet corporate sustainability commitments continue to favor recyclable and compostable substrates, sustaining positive volume momentum across retail and foodservice channels.

Global Food Trays And Bowls Market Trends and Insights

Government Bans on Single-Use Plastics Accelerate Product Redesign

Regulators across the European Union and Australia have enacted prohibitions on select disposable formats, compelling manufacturers to re-engineer designs for circularity. Foodservice operators that once favored expanded polystyrene are now shifting toward molded fiber or coated paperboard that meets recyclability or compostability thresholds set by local authorities. The mandates impose strict recyclability criteria that have prompted design-for-recycling programs and lightweighting targets of up to 15% without compromising stiffness. Brand owners that adopt compliant trays and bowls report faster approvals in municipal waste schemes, which cuts compliance costs and accelerates shelf access. This environment reinforces investments in mono-material barriers and aqueous coatings that facilitate fiber recovery while maintaining grease and moisture resistance.

Surging Penetration of Online Food Delivery Platforms

Third-party delivery intermediaries have transformed last-mile logistics, tripling average touchpoints compared with dine-in or grocery channels. Containers must withstand vibration, stacking, and temperature fluctuations in vehicles and rider bags. Many suppliers now offer tamper-evident lids and multi-compartment bowls that retain textural integrity for sauces and broths, enabling premium menu expansion. Restaurants willing to pay for higher-spec formats report lower leakage claims and greater consumer satisfaction, supporting premium pricing tiers that offset cost inflation. Governments in major cities are starting to reference delivery conditions in food-safety codes, nudging packaging standards toward stronger seals and real-time temperature indicators.

Volatile Prices of Sustainable Raw Materials

Pulpwood prices in Europe have risen sharply as construction, textile, and energy sectors compete for certified fiber, squeezing converter margins. Limited supplier diversity restricts hedging options, forcing companies to sign long-term contracts that can cap near-term flexibility. High-grade recycled plastic pellets fetch premiums that fluctuate with oil markets and collection yields, complicating cost forecasting for thin-margin foodservice operators. Manufacturers offset spikes by lightweighting or blending alternative fibers, yet extensive reformulation can slow commercialization and delay regulatory submissions. Buyers are increasingly adopting index-linked pricing clauses to share cost volatility across the chain.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Sustainability Commitments Drive Fiber-Based Packaging

- Expansion of Global Quick Service Restaurant Chains

- Stringent Food-Contact Compliance Testing Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Trays dominated the food trays and bowls market with a 74.12% share in 2025, underlining their role as the default carrier for burgers, entrees, and combo meals in institutional and QSR settings. Standardized footprints fit existing sealing equipment, and stackability maximizes distribution efficiency across commissaries and distribution centers, preserving the food trays and bowls market size leadership of the format. Yet bowls are registering a 7.05% CAGR to 2031 and are redefining premium positioning as healthier, ingredient-forward meals like grain or poke bowls gain mainstream acceptance. The rising share of soup-based meal kits in supermarkets is pushing retailers to source deeper, leak-resistant cavity designs that safeguard broths during curbside pickup runs. Producers are refining nesting ratios to cut freight cube while retaining microwave tolerance, demonstrating how engineering refinements sustain growth momentum.

Multi-compartment trays now integrate flex-film lids that enable venting and maintain crisp textures during on-demand delivery that often exceeds 30 minutes. In contrast, bowls increasingly feature hinged or press-fit lids with tamper loops that satisfy third-party courier protocols. Across both formats, brand owners are testing aqueous dispersions that achieve mineral oil barrier equivalence without plastic lamination, supporting recyclability claims under European Aticelca assessments. As a result, both trays and bowls anchor strategies aimed at satisfying evolving meal repertoires, but bowls hold the potential to reach parity in revenue contribution over the long term if consumer affinity for spoonable and mixed-texture dishes persists.

Rigid plastic retained 36.95% of 2025 revenue, demonstrating entrenched capital deployments that favor polypropylene and PET lines configured for high-speed thermoforming. Its durability and clarity continue to earn placements in bakery and produce applications where shelf appeal drives impulse purchases. Paperboard, however, is forecasting an 7.89% CAGR through 2031, the fastest of any substrate group inside the food trays and bowls market. Foodservice operators increasingly choose coated board for on-premise dining bans on plastic and for brand storytelling around recyclability, lifting the food trays and bowls market share of fiber while narrowing the performance gap. EPS foam faces outright bans in jurisdictions such as South Australia, accelerating substitution with molded fiber that promises curbside compostability where infrastructure exists.

Hybrid innovations illustrate a transitional phase where thin barrier layers deliver moisture and grease defense while reducing polymer mass by up to 80%. Amcor's AmFiber Performance Paper is emblematic, earning patent protection for a structure that processes at commercial form-fill-seal speeds and passes standard paper recycling protocols. WestRock's EnShield technology eliminates intentionally added PFAS while hitting oil-resistance metrics required for fried fare. Converters view such advances as essential stepping-stones while biopolymer costs and composting capacity scale.

The Food Trays and Bowls Market Report is Segmented by Product Type (Trays, and Bowls), Material Type (Rigid Plastic, Plastic Foam (EPS), Paperboard, and Molded Fiber), Application (Meat, Poultry, and Seafood, Prepared Food, Baked Goods, and More), End-User (Quick Service Restaurants, Institutional Catering, Supermarket and Hypermarket, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 40.05% of 2025 sales, and its 7.41% CAGR to 2031 outpaces all other regions. Rapid urban migration, widening middle-class disposable income, and smartphone-enabled delivery services converge to amplify unit demand for performance packaging. China's GB 4806.15-2024 adhesive regulation, effective February 2025, compels suppliers to validate food-contact safety across multilayer laminates, rewarding converters with proven compliance credentials. Japan's proposed elimination of 138 PFOA-related substances, combined with tighter migration test schedules, elevates scrutiny on barrier chemistries, steering material selection toward PFAS-free platforms. India is circulating draft plastic-suitability revisions, and Indonesia has enacted new paper and cardboard standards, signaling regional harmonization with global best practices.

North America benefits from an entrenched delivery culture, advanced logistics, and early mainstreaming of recycled content mandates. California's Safer Food Packaging Act is poised to restrict certain bisphenols beginning January 2027, prompting proactive substitution among multilayer tray suppliers. Canada's national grocers have rolled out coated board bowls as default carriers for rotisserie chickens and hot sides, demonstrating consumer acceptance of fiber even for greasy items. While the United States hosts about 5,000 composting facilities, most accept only yard trimmings, limiting widespread adoption of compostable molded fiber, yet pilot programs in Washington and Minnesota illustrate momentum.

Europe's February 2025 Packaging and Packaging Waste Regulation imposes recycled-content thresholds and design-for-recycling standards, reshaping innovation pipelines and stimulating investments in fiber-capacity expansion. Germany, France, Italy, Spain, and the United Kingdom account for the bulk of regional volume, each promoting circular economy incentives that accelerate the adoption of mono-material designs.

South America and the Middle East & Africa represent high-potential growth corridors as modern retail footprints widen. Brazil and Argentina leverage agri-food export channels to justify upgrades in chilled protein packaging lines, while Gulf states invest in quick-service and delivery aggregators that replicate Western models. African urban centers see rising convenience-store penetration, driving demand for single-serve bowls that fit smaller refrigeration units. Infrastructure gaps and fragmented regulatory oversight temper near-term volume, yet population growth and rising incomes signal long-run upside for the food trays and bowls market.

- Amcor plc

- Sonoco Products Company

- EasyPak LLC

- Envaplaster S.A.

- Form Plastics Company Inc.

- Genpak LLC

- Graphic Packaging Holding Company

- Huhtamaki Oyj

- Mondi plc

- Novolex Holdings LLC

- Pactiv Evergreen Inc.

- PaperTech Inc.

- Sealed Air Corporation

- International Paper Company

- Stora Enso Oyj

- Winpak Ltd.

- Detpak Australia (Detmold Group)

- GM Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Penetration of Online Food Delivery Platforms

- 4.2.2 Expansion of Global Quick Service Restaurant Chains

- 4.2.3 Corporate Sustainability Commitments Driving Fiber-Based Packaging

- 4.2.4 Rising Demand for Ready-to-Eat Meals Among Working Population

- 4.2.5 Government Bans on Single-Use Plastics Accelerating Product Redesign

- 4.2.6 AI-Enabled Smart Labelling for Real-Time Freshness Tracking

- 4.3 Market Restraints

- 4.3.1 Volatile Prices of Sustainable Raw Materials

- 4.3.2 Stringent Food-Contact Compliance Testing Costs

- 4.3.3 Infrastructure Gaps in Commercial Composting Facilities

- 4.3.4 Supply Chain Disruptions From Geopolitical Tensions

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape, Compliances and Standards

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Threat of Substitutes

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Key Industry Trends and Developments

- 4.9.1 Lightweighting and Material Downgauging

- 4.9.2 Integration of NFC and QR for Product Authenticity

- 4.9.3 Convenience Innovations Driven by Food Aggregator Apps

- 4.10 Relevant Case Studies

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Trays

- 5.1.2 Bowls

- 5.2 By Material Type

- 5.2.1 Rigid Plastic

- 5.2.2 Plastic Foam (EPS)

- 5.2.3 Paperboard

- 5.2.4 Molded Fiber

- 5.3 By Application

- 5.3.1 Meat, Poultry, and Seafood

- 5.3.2 Prepared Food

- 5.3.3 Baked Goods

- 5.3.4 Fresh Produce

- 5.3.5 Other Food Applications

- 5.4 By End-User

- 5.4.1 Quick Service Restaurants

- 5.4.2 Institutional Catering

- 5.4.3 Supermarket and Hypermarket

- 5.4.4 Convenience Stores

- 5.4.5 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Thailand

- 5.5.3.7 Malaysia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sonoco Products Company

- 6.4.3 EasyPak LLC

- 6.4.4 Envaplaster S.A.

- 6.4.5 Form Plastics Company Inc.

- 6.4.6 Genpak LLC

- 6.4.7 Graphic Packaging Holding Company

- 6.4.8 Huhtamaki Oyj

- 6.4.9 Mondi plc

- 6.4.10 Novolex Holdings LLC

- 6.4.11 Pactiv Evergreen Inc.

- 6.4.12 PaperTech Inc.

- 6.4.13 Sealed Air Corporation

- 6.4.14 International Paper Company

- 6.4.15 Stora Enso Oyj

- 6.4.16 Winpak Ltd.

- 6.4.17 Detpak Australia (Detmold Group)

- 6.4.18 GM Packaging

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet Need Assessment