PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906280

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906280

Hardwood - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

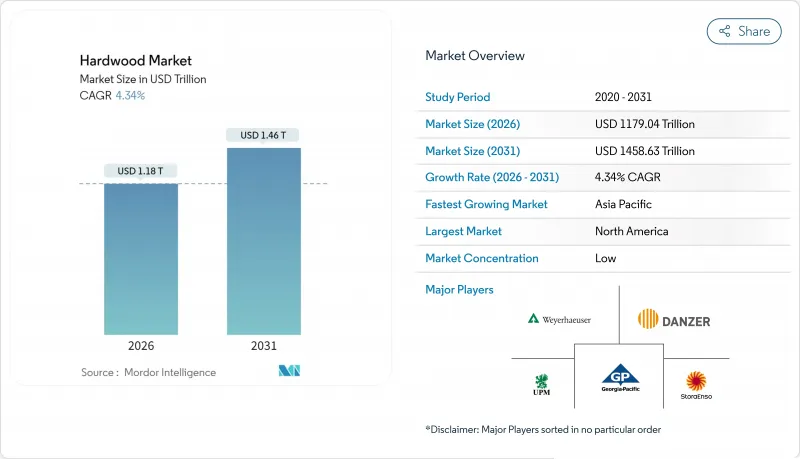

The Hardwood Market was valued at USD 1130 billion in 2025 and estimated to grow from USD 1179.04 billion in 2026 to reach USD 1458.63 billion by 2031, at a CAGR of 4.34% during the forecast period (2026-2031).

Growth is underpinned by tightening sustainability regulations-most notably the European Union Deforestation Regulation (EUDR)-and by resilient end-use demand in construction, flooring, and high-end furniture. Market leaders are funding vertically integrated supply chains to de-risk raw-material availability, while tighter global enforcement against illegal logging is raising compliance costs yet reinforcing the premium for certified wood. Asia-Pacific's pace, buoyed by ongoing urbanization and rising middle-class spending, balances the cooler but still sizable consumption base in North America and Europe. On the supply side, efficiency-boosting sawmill automation, wider deployment of digital traceability, and U.S. policy moves to accelerate domestic harvesting all point to an era of disciplined, productivity-led growth.

Global Hardwood Market Trends and Insights

Rising Demand for Certified Sustainable Hardwood in Global Green Building Projects

Roughly 280 million hectares of forests carried either PEFC (Programme for the Endorsement of Forest Certification systems) or Forest Stewardship Council (FSC) certification in 2025, turning third-party validation into an entry requirement rather than a marketing add-on . The EU Deforestation Regulation (EUDR), effective December 2024, forces exporters to present geolocation data for every shipment, pushing suppliers to retrofit digital traceability across fragmented operations. FSC reacted with a dedicated "Regulatory Module" to ease compliance . The certification premium is migrating beyond Europe, as importers in East and South-East Asia increasingly ask for verified provenance to protect their downstream access to Organisation for Economic Co-operation and Development (OECD) markets. Bureau Veritas confirms a marked rise in multi-scheme audits that bundle FSC, PEFC, and legality checks into one field mission, thereby trimming compliance overlap costs.

Expanding Middle-Class Expenditure on Premium Hardwood Furniture Worldwide

Income gains across Asia-Pacific have reset aspirations toward solid-wood furniture, yet short-term sales fluctuate with housing turnover. An assessment by William Blair shows a tight correlation between existing-home transactions and furniture receipts, explaining subdued volumes despite intact long-term fundamentals. Freight rates and deflationary price trends continue to squeeze margins, though demographic tailwinds-such as remote-work configurations that elevate home-office quality-anchor a 4%-6% steady-state growth band. Early-2024 U.S. hardwood exports to India reached USD 2.87 million, led by white oak, hickory, and red oak, underscoring the gap between India's low import base and its latent appetite for premium hardwood species.

Supply Volatility Due to Stricter International Anti-Illegal Logging Regulations (EUDR, Lacey Act)

Stringent rules, including the EU Deforestation Regulation and the U.S. Lacey Act, now demand end-to-end tracking for every load of hardwood that crosses a border, adding layers of paperwork and verification to each transaction. The extra scrutiny raises costs for importers and exporters alike and has already pushed some buyers to scale back orders from regions where proving a legal harvest is difficult. The European Commission's April 2025 guidance allows annual due diligence filings but still demands shipment-level geodata, raising fixed costs for suppliers handling diverse sourcing pools.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Engineered Wood Manufacturing Utilizing Hardwood Veneers

- Increasing Adoption of Hardwood Flooring in Residential Renovations Globally

- Price Pressure from Cheaper Softwood and Composite Substitutes in Global Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oak controlled 27.74% of 2025 consumption, giving it the single-largest slice of the hardwood market. Pennsylvania and Missouri stumpage reports reveal impressive ceiling prices for white oak veneer, yet mixed sawlog averages settled near USD 260 per thousand board feet, spotlighting widening value bands across grades. Walnut, propelled by luxury furniture and acoustic-panel applications, is set to capture an outsized wallet share as its 5.71% CAGR outstrips overall hardwood market growth. Mahogany remains capacity-constrained under CITES (Convention on International Trade in Endangered Species) listing, while cherry treaded water after fashion cycles cooled. Secondary species, including tulipwood and beech, ride certification premiums into niche project specifications but lack the scale of oak or walnut. Diversified species portfolios allow integrated firms to exploit regional price differentials, smoothing earnings and hedging against climate-induced shifts in species distribution.

Consumers increasingly choose species not only for aesthetics but also for transparency credentials, amplifying the strategic value of traceable supply chains. That virtuous loop rewards forest owners investing in Forest Stewardship Council or Programme for the Endorsement of Forest Certification audits, sustaining a price delta that compensates for audit and chain-of-custody costs.

The Hardwood Market is Segmented by Species (Oak, Maple, and More), Application (Flooring, Furniture, and More), Distribution Channel (Direct Sales, Distributors/Wholesalers, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.55% of 2025 turnover thanks to expansive forest inventories, mature infrastructure, and a regulatory environment conducive to certified forestry. The March 2025 U.S. executive order to expand harvesting aims to fortify wildfire mitigation and reduce import reliance, although sawmill closures such as Canfor's South Carolina operations-which will remove 350 million board feet of capacity-underscore how market cycles can still override policy intent. Canada's role as a top U.S. supplier remains pivotal; potential countervailing duties could reshape cross-border trade flows and influence project economics across the Midwest and Northeast. Mexico leverages USMCA tariff-free access but lacks processing scale, limiting its upside to regional furniture clusters near the U.S. border.

The Asia-Pacific corridor, growing at 5.42% CAGR, is the hardwood market's chief momentum engine. China imported 9.98 million m3 of hardwood logs in 2024 at an average USD 277 per m3, pivoting toward premium species despite overall tepid construction activity. India's hardwood market remains under-indexed; U.S. lumber constitutes just 5% of its import mix, leaving significant runway for species diversification once logistics and tariff frictions ease. Southeast Asian exporters-Vietnam, particularly-are filling global furniture orders, yet Indonesia's plywood segment wrestles with demand slumps, pointing to heterogeneous performance across the region.

Europe delivers stable, certification-led demand but is rewriting supply chains through the EUDR filter, effectively favoring domestic and Nordic producers with robust chain-of-custody records. Germany's softwood import collapse (-34% in 2024) hints at structural substitution into engineered products, likely to spill over into hardwood patterns. The Middle East and Africa pool gains from sovereign mega-projects; however, volatile logistics and limited kiln-dry capacity restrict near-term hardwood roll-outs, while long-term visibility remains promising as local standards embrace carbon-positive building materials.

- Weyerhaeuser Company

- Georgia-Pacific LLC

- Danzer Group

- Baillie Lumber Co.

- Stora Enso Oyj

- UPM-Kymmene Oyj

- Mohawk Industries, Inc.

- Armstrong Flooring, Inc.

- Rougier Afrique International

- Samling Group

- Greenply Industries Ltd.

- Arauco

- Sumitomo Forestry Co., Ltd.

- Dongwha International

- Columbia Forest Products

- Century Plyboards Ltd.

- Norbord Inc.

- Kronospan Limited

- Mannington Mills, Inc.

- Roseburg Forest Products

- Holzindustrie Schweighofer (HS Timber Group)

- Stella-Jones Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Certified Sustainable Hardwood in Global Green Building Projects

- 4.2.2 Expanding Middle-Class Expenditure on Premium Hardwood Furniture Worldwide

- 4.2.3 Growth of Engineered Wood Manufacturing Utilizing Hardwood Veneers

- 4.2.4 Increasing Adoption of Hardwood Flooring in Residential Renovations Globally

- 4.2.5 Technological Advancements in Harvesting & Sawmilling Enhancing Yield and Supply Efficiency

- 4.3 Market Restraints

- 4.3.1 Supply Volatility Due to Stricter International Anti-Illegal Logging Regulations (EUDR, Lacey Act)

- 4.3.2 Price Pressure from Cheaper Softwood and Composite Substitutes in Global Markets

- 4.3.3 Trade Disruptions and Tariff Uncertainties Impacting Hardwood Export Flows

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value)

- 5.1 By Species

- 5.1.1 Oak

- 5.1.2 Maple

- 5.1.3 Cherry

- 5.1.4 Walnut

- 5.1.5 Mahogany

- 5.1.6 Others

- 5.2 By Application

- 5.2.1 Flooring

- 5.2.2 Furniture

- 5.2.3 Construction

- 5.2.4 Interior Design & Decoration

- 5.2.5 Industrial Packaging & Pallets

- 5.2.6 Millwork

- 5.2.7 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Direct Sales

- 5.3.2 Distributors/Wholesalers

- 5.3.3 Retailers (offline and online)

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East And Africa

- 5.4.5.1 United Arab of Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East And Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Weyerhaeuser Company

- 6.4.2 Georgia-Pacific LLC

- 6.4.3 Danzer Group

- 6.4.4 Baillie Lumber Co.

- 6.4.5 Stora Enso Oyj

- 6.4.6 UPM-Kymmene Oyj

- 6.4.7 Mohawk Industries, Inc.

- 6.4.8 Armstrong Flooring, Inc.

- 6.4.9 Rougier Afrique International

- 6.4.10 Samling Group

- 6.4.11 Greenply Industries Ltd.

- 6.4.12 Arauco

- 6.4.13 Sumitomo Forestry Co., Ltd.

- 6.4.14 Dongwha International

- 6.4.15 Columbia Forest Products

- 6.4.16 Century Plyboards Ltd.

- 6.4.17 Norbord Inc.

- 6.4.18 Kronospan Limited

- 6.4.19 Mannington Mills, Inc.

- 6.4.20 Roseburg Forest Products

- 6.4.21 Holzindustrie Schweighofer (HS Timber Group)

- 6.4.22 Stella-Jones Inc.

7 Market Opportunities & Future Outlook

- 7.1 Demand for Sustainable and Certified Hardwood

- 7.1.1 Custom and Modular Furniture Trends