PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906281

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906281

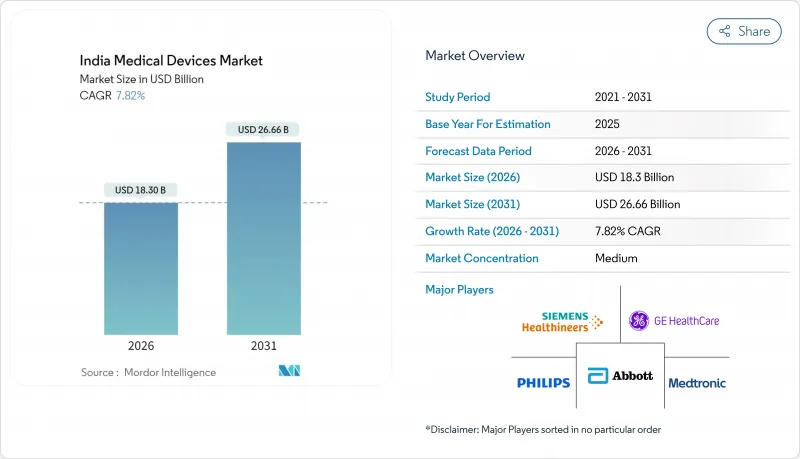

India Medical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Medical Devices Market was valued at USD 16.97 billion in 2025 and estimated to grow from USD 18.3 billion in 2026 to reach USD 26.66 billion by 2031, at a CAGR of 7.82% during the forecast period (2026-2031).

Robust policy support, the country's demographic shift toward chronic-disease prevalence, and private-sector investments are the central forces sustaining this trajectory. Domestic manufacturing incentives are gradually lowering India's historic 80-85% import dependence, while demand for cost-effective, technology-enabled care settings is broadening the customer base for both conventional and connected devices. Regional growth patterns are uneven: South India leads by revenue, yet East & North-East India grows fastest, showing how infrastructure roll-outs are redefining addressable pockets of the India medical devices market. Competitive intensity remains high because fragmented after-sales ecosystems and unpredictable approval timelines are nudging some producers toward Southeast Asian locations, even as the Production-Linked Incentive (PLI) scheme lures fresh investments back to Indian soil.

India Medical Devices Market Trends and Insights

Rising Prevalence of Chronic & Lifestyle Diseases

Non-communicable disorders now dominate India's disease burden, creating a continuous pull for sophisticated equipment to detect, monitor, and treat long-term conditions. Diabetes cases are projected to jump from 77 million in 2025 to 134.2 million by 2045, magnifying demand for glucose monitors, insulin pumps, and remote telemetry solutions. Incidence of cardiovascular conditions is likewise increasing, encouraging wider deployment of high-throughput diagnostic imaging systems and interventional cardiology products. Urban lifestyles-marked by sedentary habits and dietary shifts-are accelerating obesity, hypertension, and related morbidities, all of which call for continuous vital-sign tracking outside hospital walls. At the same time, an aging demographic is lengthening care cycles, making durable home-care devices commercially attractive. These trends collectively extend the growth runway for the India medical devices market well past typical health-spending cycles, reinforcing broader momentum in the india medical devices market.

Government Production-Linked Incentive Scheme

The PLI scheme earmarks INR 3,420 crore for medical devices from 2020-21 to 2027-28, supporting 32 approved projects that collectively bring INR 1.46 lakh crore investment into local manufacturing of 39 device categories. Thirteen new greenfield plants already produce complex products such as MRI and CT systems, once fully imported, reducing supply-chain risk from currency swings and geopolitical tensions. Technology transfer agreements under the program are localizing high-value components, shrinking lead times for Indian buyers and widening the domestic talent base in advanced manufacturing. As cost savings flow through purchasing budgets of hospital groups, procurement policies increasingly favor "Made in India" offerings, accelerating penetration for homegrown brands across the India medical devices market.

Stringent Regulatory Approval Timelines

Central Drugs Standard Control Organisation (CDSCO) reviews for Class C and Class D devices can extend to 12 months, introducing launch uncertainty that deters smaller innovators. Lengthy queries and additional dossier requests inflate compliance costs, prompting certain manufacturers to shift final assembly to Vietnam or Malaysia, where approvals are faster. While digitization initiatives aim to streamline filings, the current lag constrains speed-to-market and slows capital rotation, clipping near-term growth of the India medical devices market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Private Hospital Networks

- Domestic Med-Tech Start-Ups Leveraging Frugal Innovation

- Price-Cap Regulations on Stents & Implants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic devices generated 35.21% of 2025 revenue, emphasizing India's treatment-oriented care model, where hospitals direct capital budgets toward devices that deliver immediate interventions. Revenue concentration aligns with reimbursement practices that favor procedure-linked billing over preventive screening. Monitoring devices, in contrast, post an 8.18% CAGR as remote patient management programs expand in response to chronic disease loads. Diagnostic imaging maintains a stable uptick, reflecting private-hospital competition to offer multi-modality radiology suites beyond metros.

The leadership of therapeutic devices in the India medical devices market hinges on a pipeline of high-end imports gradually giving way to local production under PLI. Indigenous MRI prototypes developed at AIIMS illustrate how academic-industry collaboration can repatriate spending from imports to domestic suppliers. Meanwhile, niche areas like dental and endoscopy continue steady but smaller-scale adoption, aided by rising insurance coverage and medical tourism inflows seeking specialty services.

Cost-effective electro-mechanical and disposable devices account for 61.88% of 2025 sales, highlighting hospitals' prioritization of reliability and low maintenance. Yet augmented/virtual-reality training simulators and intra-operative overlays are scaling quickly at 9.92% CAGR as surgical departments aim for higher precision. Wearables and remote sensors resonate with chronic-care pathways that shift monitoring to patients' homes, pushing connected-device penetration deeper into the India medical devices market.

Robotic surgery systems exemplify premium-tech adoption that accelerates when public hospitals like the Regional Cancer Centre install flagship units. Parallel growth in tele-health platforms, supported by the Ayushman Bharat Digital Mission, expands addressable endpoints for mHealth peripherals. Although 3D-printed implants and nanotech remain embryonic, research pilots in orthopedic trauma indicate long-term disruptive potential.

The India Medical Devices Market Report is Segmented by Device Type (Diagnostic Imaging, Therapeutic, and More), Technology Platform (Conventional Electro-Mechanical & Disposable, Wearable & Remote Monitoring, and More), Therapeutic Application (Cardiology, Orthopedics, and More), End-User (Hospitals, Clinics, and More), and Geography (North India, South India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Allengers Medical Systems

- Boston Scientific

- BPL

- Cardinal Health

- Roche

- GE Healthcare

- Hindustan Syringes & Medical Devices

- Johnson & Johnson

- Koninklijke Philips

- Medtronic

- OMRON

- Opto Circuits (India) Ltd.

- Poly Medicure Ltd.

- Sahajanand Medical Technologies

- Siemens Healthineers

- Smiths Group

- Solventum Corporation

- Stryker

- Trivitron Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic & Lifestyle Diseases

- 4.2.2 Government Production-Linked Incentive Scheme

- 4.2.3 Expansion of Private Hospital Networks

- 4.2.4 Domestic Med-Tech Start-Ups Leveraging Frugal Innovation

- 4.2.5 Surge in Home-Based Diagnostic Testing Demand Post-Covid

- 4.2.6 Growing Medical Tourism Demand for High-End Devices

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Approval Timelines

- 4.3.2 Price-Cap Regulations on Stents & Implants

- 4.3.3 Limited Component-Level Supply Chain within India

- 4.3.4 Fragmented After-Sales Service Infrastructure

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Segmentation (Value)

- 5.1 By Device Type

- 5.1.1 Diagnostic Imaging Devices

- 5.1.2 Therapeutic Devices

- 5.1.3 Surgical Devices

- 5.1.4 Monitoring Devices

- 5.1.5 In-Vitro Diagnostics

- 5.1.6 Assistive & Mobility Aids

- 5.1.7 Dental Devices

- 5.1.8 Endoscopy Devices

- 5.1.9 Other Devices

- 5.2 By Technology Platform

- 5.2.1 Conventional Electro-mechanical & Disposable Devices

- 5.2.2 Wearable & Remote Monitoring

- 5.2.3 Telehealth & mHealth

- 5.2.4 Robotic Surgery

- 5.2.5 3D Printing

- 5.2.6 Augmented / Virtual Reality (AR / VR)

- 5.2.7 Nanotechnology

- 5.2.8 Others

- 5.3 By Therapeutic Application

- 5.3.1 Cardiology

- 5.3.2 Orthopedics

- 5.3.3 Neurology

- 5.3.4 Ophthalmology

- 5.3.5 General Surgery

- 5.3.6 Others

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Clinics

- 5.4.3 Home-Care Settings

- 5.4.4 Other End-Users

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 South India

- 5.5.3 West & Central India

- 5.5.4 East & North-East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Allengers Medical Systems

- 6.3.3 Boston Scientific Corporation

- 6.3.4 BPL Medical Technologies

- 6.3.5 Cardinal Health

- 6.3.6 F. Hoffmann-La Roche Ltd.

- 6.3.7 GE Healthcare

- 6.3.8 Hindustan Syringes & Medical Devices

- 6.3.9 Johnson & Johnson

- 6.3.10 Koninklijke Philips N.V.

- 6.3.11 Medtronic plc

- 6.3.12 Omron Corporation

- 6.3.13 Opto Circuits (India) Ltd.

- 6.3.14 Poly Medicure Ltd.

- 6.3.15 Sahajanand Medical Technologies

- 6.3.16 Siemens Healthineers

- 6.3.17 Smith & Nephew

- 6.3.18 Solventum Corporation

- 6.3.19 Stryker Corporation

- 6.3.20 Trivitron Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment