PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906284

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906284

Europe Passive Electronic Components In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

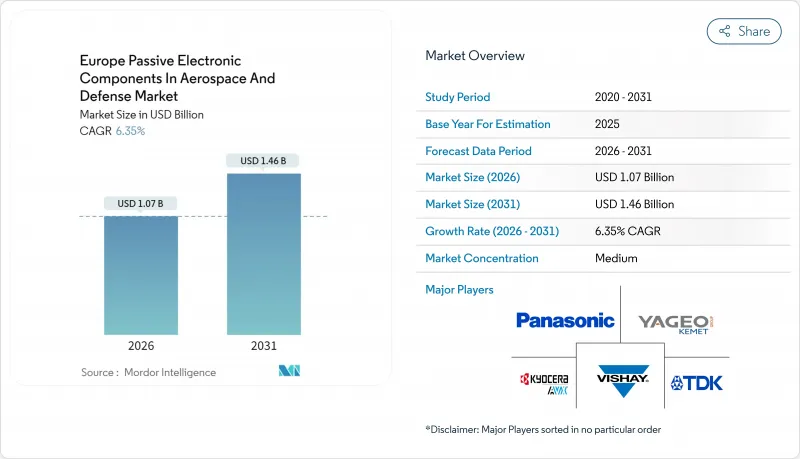

The Europe passive electronic components in aerospace and defense market was valued at USD 1.01 billion in 2025 and estimated to grow from USD 1.07 billion in 2026 to reach USD 1.46 billion by 2031, at a CAGR of 6.35% during the forecast period (2026-2031).

Rising defense modernization programmes, expanding small-satellite constellations, and the transition toward More-Electric-Aircraft architectures are intensifying demand for rugged, high-reliability passive parts. Supply-side momentum also stems from the European Commission's ReArm Europe initiative, which will mobilize up to EUR 800 billion for defense capability enhancement, opening wider opportunities for component suppliers that can meet stringent EU localization rules. At platform level, commercial fixed-wing aircraft still dominate spend, yet satellites and spacecraft now post the fastest unit growth as European governments and private operators scale orbital assets for observation, connectivity, and military surveillance. Meanwhile, policy-driven localization, GaN power research, and anti-drone requirements are reshaping the competitive playbook, compelling vendors to deepen regional manufacturing footprints and accelerate material innovation.

Europe Passive Electronic Components In Aerospace And Defense Market Trends and Insights

Surge in European defense-electronics modernization programmes

Record defense allocations of EUR 326 billion in 2024 accelerated procurement of cutting-edge avionics, radars, and EW suites that consume dense arrays of capacitors, inductors, and filters. New armaments spending jumped from EUR 59 billion in 2021 to EUR 102 billion in 2024, channeling larger volumes of qualified passives into tactical radios, active-electronically-scanned-array radars, and digital flight computers. The European Defence Fund's EUR 1.065 billion 2025 Work Programme earmarks sizable grants for collaborative sensor and EW R&D, giving European vendors a head-start on early design-in opportunities. In parallel, a policy mandate that 50% of defense procurement budgets flow to EU suppliers by 2030 incentivizes primes to deepen ties with regional passive specialists, reinforcing the Europe passive electronic components in aerospace and defense market's structural growth path.

Demand spike from small-sat and launch-service build-up

Europe's pivot toward constellations of micro and nano-satellites multiplies the number of radiation-tolerant passives required per launch. The European Space Agency set aside EUR 8.5 million for NewAthena and EUR 1.3 million for M7 mission candidates in 2024, underscoring a steady pipeline of science and security payloads. Component makers are responding with miniaturized, hermetic designs such as Exxelia's Trademarked MML film capacitors tailored to LEO constellations. Dual-use satellites that combine civil and defense imagery further expand total available market, positioning the Europe passive electronic components in aerospace and defense market for sustained upside as both governments and commercial operators pursue resilient space infrastructures.

Geopolitical volatility of tantalum and ferrite supply

Tantalum ore often originates from politically unstable regions, while ferrite raw materials depend heavily on Chinese processing capacity. Heightened tension around export controls raises spot prices and lengthens lead times. European firms must divert capital toward safety stock and explore alternate chemistries, squeezing margins within the Europe passive electronic components in aerospace and defense market. The EU's Critical Raw Materials Act aims to localize 10% of extraction and 40% of processing by 2030, yet interim volatility remains a drag on growth.

Other drivers and restraints analyzed in the detailed report include:

- More-Electric-Aircraft architectures driving high-temp passives

- EU-backed GaN power R&D catalysing advanced passives integration

- Cost burden of REACH-compliant lead-free redesigns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe passive electronic components in aerospace and defense market size for capacitors reached USD 0.48 billion in 2025, translating to a dominant 47.15% share. Ceramic MLCCs underpin power-integrity and decoupling functions across flight controls, radar, and missile seekers. Their volumetric efficiency and radiation tolerance keep them entrenched despite price swings. Inductors, however, are scaling faster at a 7.05% CAGR as high-density power converters and EMI filters proliferate in MEA subsystems. Thin-film and molded power inductors gain traction inside GaN-based converters, while toroidal chokes secure avionics signal lines against interference.

Integrated Passive Devices (IPDs) are blurring categorical lines by co-locating resistive and capacitive elements onto alumina substrates, shrinking size and boosting reliability. Emerging RF filter assemblies for AESA radar merge resonators and capacitors within monolithic modules to expedite qualification. Resistors, transformers, and RF filters sustain niche but critical roles, particularly in electronic warfare pods where precision impedance matching is essential. The aggregate dynamism across categories confirms a steady diversification path underpinning the broader Europe passive electronic components in aerospace and defense market.

Ceramic technology captured 53.10% of the Europe passive electronic components in aerospace and defense market share in 2025 thanks to its wide utility across MLCCs, resonators, and substrates. Advanced barium-titanate formulations deliver stable dielectric constants across military-temperature ranges, while high-temperature cofired ceramics support embedded passives. Tantalum's superior volumetric capacitance positions it for fastest growth at 6.56% CAGR, particularly within point-of-load converters on satellites and missiles where volumetric efficiency and surge reliability outweigh cost premiums.

Aluminum electrolytics remain indispensable for bulk energy storage inside airborne radar processors, though life-time derating above 125 °C limits their use in engine bays. Film capacitors leveraging PPS and PTFE films cater to pulse-power coils in directed-energy research and space propulsion. Ferrite materials underpin toroidal inductors and broadband transformers in EW receivers, yet supply risk forces vendors to qualify manganese-zinc substitutes. Consequently, material diversity acts as a hedge against geopolitical volatility, sustaining momentum for the Europe passive electronic components in aerospace and defense market.

The Europe Passive Electronic Components in Aerospace and Defense Market Report is Segmented by Type (Capacitors, Resistors, Inductors, and More), Material (Ceramic, Tantalum, Aluminum Electrolytic, Film, Ferrite, and More), Platform (Commercial Fixed-Wing Aircraft, Military Fixed-Wing Aircraft, Rotorcraft and More), End-User (OEM Production Lines, and MRO), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KEMET (Yageo)

- Panasonic Corp.

- TDK Corp.

- Vishay Intertechnology Inc.

- AVX (Kyocera)

- Taiyo Yuden Co., Ltd.

- WIMA GmbH and Co. KG

- Cornell Dubilier Electronics Inc.

- API Delevan (Regal Rexnord)

- Bourns Inc.

- TE Connectivity plc

- Eaton plc

- TT Electronics plc

- Ohmite Manufacturing Co.

- Honeywell International Inc.

- Murata Manufacturing Co. Ltd.

- Exxelia Group

- Knowles Precision Devices

- Wurth Elektronik

- Smiths Interconnect

- NIC Components Corp.

- AVX Czech Republic s.r.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in European defense-electronics modernization programmes

- 4.2.2 Demand spike from small-sat and launch-service build-up in United Kingdom, France and Germany

- 4.2.3 More-Electric-Aircraft (MEA) architectures driving high-temp passives

- 4.2.4 EU-backed GaN power R&D catalysing advanced passives integration

- 4.2.5 Offset and localisation mandates favouring regional passive suppliers

- 4.2.6 Rapid anti-drone and precision-munition deployment post-Ukraine conflict

- 4.3 Market Restraints

- 4.3.1 Geopolitical volatility of tantalum and ferrite supply

- 4.3.2 Cost burden of REACH-compliant lead-free redesigns

- 4.3.3 Limited EU ceramic-capacitor fab capacity lengthening lead-times

- 4.3.4 Integration of SiP solutions reducing discrete passive counts

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Defense Spending Analysis - European Countries

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Capacitors

- 5.1.2 Resistors

- 5.1.3 Inductors

- 5.1.4 Transformers

- 5.1.5 RF and Microwave Filters

- 5.1.6 Others (Varistors, Thermistors, Quartz)

- 5.2 By Material

- 5.2.1 Ceramic

- 5.2.2 Tantalum

- 5.2.3 Aluminum Electrolytic

- 5.2.4 Film

- 5.2.5 Ferrite

- 5.2.6 Carbon Composition and Thick Film

- 5.3 By Platform

- 5.3.1 Commercial Fixed-Wing Aircraft

- 5.3.2 Military Fixed-Wing Aircraft

- 5.3.3 Rotorcraft

- 5.3.4 Unmanned Aerial Vehicles (UAVs)

- 5.3.5 Missiles and Precision Munitions

- 5.3.6 Spacecraft and Satellites

- 5.4 By End-User

- 5.4.1 OEM Production Lines

- 5.4.2 Maintenance, Repair and Overhaul (MRO)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Nordics (Sweden, Finland, Norway, Denmark)

- 5.5.7 Rest of Europe (Poland, Netherlands, Belgium and Others)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Partnerships, M&A, CapEx)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 KEMET (Yageo)

- 6.4.2 Panasonic Corp.

- 6.4.3 TDK Corp.

- 6.4.4 Vishay Intertechnology Inc.

- 6.4.5 AVX (Kyocera)

- 6.4.6 Taiyo Yuden Co., Ltd.

- 6.4.7 WIMA GmbH and Co. KG

- 6.4.8 Cornell Dubilier Electronics Inc.

- 6.4.9 API Delevan (Regal Rexnord)

- 6.4.10 Bourns Inc.

- 6.4.11 TE Connectivity plc

- 6.4.12 Eaton plc

- 6.4.13 TT Electronics plc

- 6.4.14 Ohmite Manufacturing Co.

- 6.4.15 Honeywell International Inc.

- 6.4.16 Murata Manufacturing Co. Ltd.

- 6.4.17 Exxelia Group

- 6.4.18 Knowles Precision Devices

- 6.4.19 Wurth Elektronik

- 6.4.20 Smiths Interconnect

- 6.4.21 NIC Components Corp.

- 6.4.22 AVX Czech Republic s.r.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment