PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906873

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906873

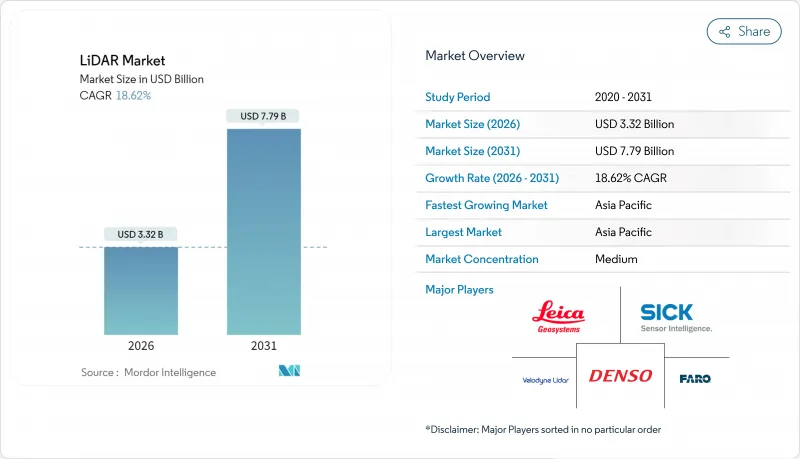

LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The LiDAR market is expected to grow from USD 2.8 billion in 2025 to USD 3.32 billion in 2026 and is forecast to reach USD 7.79 billion by 2031 at 18.62% CAGR over 2026-2031.

Cost-optimized vertical-cavity surface-emitting lasers (VCSELs), maturing single-photon avalanche diode (SPAD) arrays, and automotive-grade system-on-chips are lowering entry costs for mass-production vehicles while extending detection range and reliability. Regulation UN R-157 has removed optionality from sensor choice by specifying depth perception capabilities that radar-camera suites alone cannot satisfy, giving the LiDAR market a durable compliance tail-wind . Federal spending-such as the USD 830 million PROTECT grants and the expanding USGS 3D Elevation Program-anchors the corridor-mapping demand base across North America . Meanwhile, Chinese suppliers leverage complete domestic supply chains and state incentives to compress prices globally, intensifying competitive pressure but simultaneously expanding the LiDAR market by lowering adoption thresholds.

Global LiDAR Market Trends and Insights

Rapid cost compression in VCSEL emitters and stacked SPAD receivers has pushed complete automotive-grade sensor modules below USD 500 without sacrificing 300 m detection range or 5 cm depth resolution . Hesai's plan to halve list prices again in 2025 signals a price-elastic expansion toward mid-tier models rather than premium flagships, propelling near-term design-win volumes across more than 23 global OEMs . European automakers are synchronizing launch cycles to exploit the improved cost-performance curve, shortening validation timelines because solid-state architecture eliminates mechanical actuators.

Autonomous-Driving Regulation UN R-157 Triggering L3 LiDAR Ramp-ups

UN R-157 enforces minimum depth-perception, field-of-view, and redundancy benchmarks that camera-radar combinations cannot satisfy in highway automation, effectively hard-coding LiDAR into every homologated Level 3 stack. The regulation's early EU implementation, mirrored by China's forthcoming GB/T 45500-2025, enables global platform commonality, cutting OEM re-engineering costs and accelerating rollout schedules. Industry-wide collaboration through ISO/PWI 13228 chaired by Hesai is standardizing test protocols, reducing certification friction.

EU Eye-Safety Rules Hindering 1550 nm Long-Range Automotive LiDAR

IEC 60825-1 Class 1 limits severely restrict permissible laser power at 1550 nm in passenger vehicles, curbing practical detection ranges below the 200 m required for highway autonomy. OEMs therefore pivot to 905 nm or multi-sensor fusion, adding cost and architectural complexity while capping the potential of otherwise superior atmospheric-penetration wavelengths.

Other drivers and restraints analyzed in the detailed report include:

- US Infrastructure Bill Funding Corridor & Climate-Resilience LiDAR Mapping

- Drone-based Topographical Surveys for Utility-Scale Renewables in Africa & South America

- 4D Imaging Radar Price-Pressure on Short-Range ADAS Sensors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aerial platforms retained 37.45% of 2025 LiDAR market share as large-area surveys for flood-risk mitigation, offshore-wind siting, and precision agriculture drove sustained flight-hour demand. Single-photon instruments now capture 14 million points per second, cutting mission time and boosting return-on-investment for agencies mapping corridor assets at national scales.

Mobile terrestrial units, however, are expanding at 23.1% CAGR, propelled by smart-city and vehicle-mounted road-asset inventories that integrate seamlessly with HD map generation. As autonomous-ready highways proliferate, data-collection frequency rises, positioning mobile platforms to rival aerial share by the decade's end. Continued cost drops in inertial measurement units and real-time kinematic corrections reinforce growth momentum across urban regions.

Solid-state sensors accounted for 82.95% of 2025 revenues, reflecting OEM preference for vibration-proof architectures and simplified assembly that enable long-term reliability targets. The LiDAR market size for solid-state modules is on track to exceed USD 6.15 billion by 2031 at segment-leading 18.4% CAGR.

Frequency-modulated continuous-wave designs measure Doppler velocity alongside range, enriching perception stacks with instantaneous motion cues that traditional time-of-flight lacks. Immune to crosstalk and external illumination, FMCW unlocks high-density urban deployment where many vehicles operate concurrent sensors. Mechanical scanning persists in niche ultra-resolution use-cases, yet declining unit volumes suggest an inevitable transition as wafer-scale beam-steering matures.

The LiDAR Market Report is Segmented by Product/Technology (Mechanical and More), Component (Laser Scanner and More), by Range (Short (<100 M) and More), Application (Robotic Vehicle, ADAS, and Morel), Type (Aerial and Terrestrial), End-User Industry (Automotive and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led in growth with a 25.1% regional CAGR in 2025, driven by Chinese OEM production that now integrates LiDAR on mid-tier EVs after high-profile camera failures highlighted depth-perception gaps. Hesai and RoboSense leverage vertically integrated supply chains and provincial subsidies to offer sensors at price points that undercut global averages by up to 40%, broadening domestic adoption and setting aggressive benchmarks abroad. National standard GB/T 45500-2025 establishes performance floors that ripple across global homologation programs and incentivize export-oriented hardware conformity.

North America maintains sizable share anchored by federal infrastructure outlays and strong venture capital backing for autonomous-driving startups. The PROTECT grants allocate USD 830 million toward LiDAR-enabled climate resilience mapping, ensuring recurring demand beyond automotive verticals. Advanced space-borne programs such as NASA's GEDI continue to stretch technical frontiers and funnel spin-off components into commercial channels. Canada's offshore technology push, exemplified by Kraken's acquisition of 3D at Depth, expands underwater-survey capabilities and diversifies revenue streams.

Europe balances strong regulatory pull with stringent laser-safety limitations. Type-approval Regulation (EU) 2019/2144 compels ADAS fitment, elevating LiDAR procurement, yet IEC 60825-1 hampers 1550 nm automotive adoption, forcing platform developers to juggle eye-safety and range needs. High offshore-wind build-rates in the North Sea drive bathymetric LiDAR campaigns, while single-photon airborne sensors shorten survey windows for cross-border rail corridors. Emerging markets in Latin America and Africa increasingly deploy drone-based LiDAR to accelerate renewable-energy siting and mining exploration, benefitting from falling per-flight costs and expanding cellular backhaul coverage.

- Hesai Technology

- RoboSense LiDAR

- Velodyne Lidar Inc.

- Innoviz Technologies Ltd

- Valeo SA

- Leica Geosystems AG (Hexagon AB)

- Sick AG

- Teledyne Optech

- FARO Technologies Inc.

- Topcon Corporation

- Luminar Technologies Inc.

- Ouster Inc.

- Continental AG

- Valeo Schalter und Sensoren GmbH

- DENSO Corporation

- Aeva Technologies

- Neptec Technologies Corp. (MDA)

- Argo LiDAR (Argo AI)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Breakthrough <USD 500 Solid-State Sensors Accelerating Automotive Design-wins in China and EU

- 4.2.2 Autonomous-Driving Regulation UN R-157 Triggering L3 LiDAR Ramp-ups

- 4.2.3 US Infrastructure Bill Funding Corridor and Climate-Resilience LiDAR Mapping

- 4.2.4 Drone-based Topographical Surveys for Utility-Scale Renewables in Africa and South America

- 4.2.5 Offshore Wind Bathymetric LiDAR Campaigns in North Sea and East Asia

- 4.2.6 Perception-Fusion Demand for Dark-Warehouse Robotics

- 4.3 Market Restraints

- 4.3.1 EU Eye-Safety Rules Hindering 1550 nm Long-Range Automotive LiDAR

- 4.3.2 4D Imaging Radar Price-Pressure on Short-Range ADAS Sensors

- 4.3.3 Scarcity of Space-Grade Components for Orbital LiDAR Missions

- 4.3.4 Point-Cloud Data Deluge Overloading National Mapping Agencies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

- 4.8 Technology Snapshot

- 4.8.1 Measurement Process Options

- 4.8.2 Laser Options

- 4.8.3 Beam-Steering Options

- 4.8.4 Photodetector Options

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Aerial

- 5.1.1.1 Topographic

- 5.1.1.2 Bathymetric

- 5.1.2 Terrestrial

- 5.1.2.1 Mobile

- 5.1.2.2 Static

- 5.1.1 Aerial

- 5.2 By Product/Technology

- 5.2.1 Mechanical

- 5.2.2 Solid-State (MEMS)

- 5.3 By Component

- 5.3.1 Laser Scanner

- 5.3.2 Navigation and Positioning (IMU / GNSS)

- 5.3.3 Beam-Steering and MEMS Mirrors

- 5.3.4 Photodetector / Receiver

- 5.3.5 Software and Services

- 5.4 By Range

- 5.4.1 Short (<100 m)

- 5.4.2 Medium (100-200 m)

- 5.4.3 Long (>200 m)

- 5.5 By Application

- 5.5.1 Advanced Driver-Assistance Systems (ADAS)

- 5.5.2 Robotic and Autonomous Vehicles

- 5.5.2.1 Delivery

- 5.5.3 Corridor and Topographic Mapping

- 5.5.4 Environmental and Forestry Monitoring

- 5.5.5 Urban Planning and Smart Infrastructure

- 5.5.6 Marine and Bathymetric Survey

- 5.6 By End-User Industry

- 5.6.1 Automotive

- 5.6.2 Aerospace and Defense

- 5.6.3 Civil Engineering and Construction

- 5.6.4 Energy and Utilities

- 5.6.5 Agriculture

- 5.6.6 Oil and Gas

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 Australia

- 5.7.4.6 Indonesia

- 5.7.4.7 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 South Africa

- 5.7.5.3 Saudi Arabia

- 5.7.5.4 Nigeria

- 5.7.5.5 Kenya

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Hesai Technology

- 6.4.2 RoboSense LiDAR

- 6.4.3 Velodyne Lidar Inc.

- 6.4.4 Innoviz Technologies Ltd

- 6.4.5 Valeo SA

- 6.4.6 Leica Geosystems AG (Hexagon AB)

- 6.4.7 Sick AG

- 6.4.8 Teledyne Optech

- 6.4.9 FARO Technologies Inc.

- 6.4.10 Topcon Corporation

- 6.4.11 Luminar Technologies Inc.

- 6.4.12 Ouster Inc.

- 6.4.13 Continental AG

- 6.4.14 Valeo Schalter und Sensoren GmbH

- 6.4.15 DENSO Corporation

- 6.4.16 Aeva Technologies

- 6.4.17 Neptec Technologies Corp. (MDA)

- 6.4.18 Argo LiDAR (Argo AI)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment