PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906878

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906878

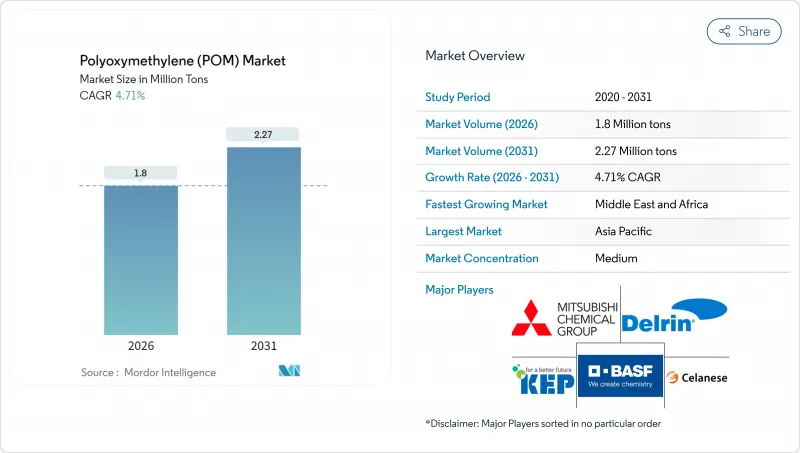

Polyoxymethylene (POM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Polyoxymethylene market size in 2026 is estimated at 1.80 million tons, growing from 2025 value of 1.72 million tons with 2031 projections showing 2.27 million tons, growing at 4.71% CAGR over 2026-2031.

Elevated demand stems from automotive lightweighting programs, electronics miniaturization, and the shift from metal to plastic in precision machinery. The implementation of tighter vehicle emission rules in the European Union, China, and the United States favors the broader adoption of dimensionally stable engineering resins. Original equipment manufacturers (OEMs) are designing single-material modules to reduce part counts and simplify recycling, an approach that reinforces the selection of acetal copolymers. Meanwhile, sustainability initiatives encourage producers to launch low-formaldehyde and recycled-content grades that meet regulatory thresholds without sacrificing mechanical integrity. On the competitive front, integrated Asian producers leverage captive methanol supply and proximity to downstream converters to reinforce cost advantages, while Western suppliers differentiate through specialty formulations aimed at electric vehicle (EV) interiors and semiconductor tooling.

Global Polyoxymethylene (POM) Market Trends and Insights

Automotive Lightweighting Boom

Carmakers specify acetal copolymers to reduce vehicle mass while retaining structural stiffness, particularly in fuel modules, door latches, and transmission components. The average automobile incorporated 8-10 lb of POM in 2024, a figure that increases with every new battery-electric model. EV thermal-management systems enhance the resin's creep resistance and chemical inertness, allowing for thinner-walled parts that withstand under-hood heat cycling. Sliding assemblies, such as window regulators, adopt POM gears to meet lifetime noise, vibration, and harshness (NVH) targets. Automakers also bundle several sub-functions-such as guide rails, seals, and hinge pins-into single, injection-molded modules, maximizing weight savings while simplifying end-of-life disassembly. The 31.05% slice of 2024 demand tied to automotive underlines the polymer's entrenched role in next-generation mobility solutions.

Miniaturization in Electrical and Electronics

Component scaling in smartphones, wearables, and 5G infrastructure intensifies demand for dimensionally stable plastics that hold micron-level tolerances. POM's low moisture uptake prevents swelling in humid environments, safeguarding precision in fine-pitch connectors and micro-gears. Static-dissipative grades mitigate electrostatic discharge risks in chip-handling fixtures, while high-flow variants enable thin-wall molding down to 0.25 mm for camera modules. Consumer device makers capitalize on the resin's easy machinability to rapidly prototype new actuator designs, thereby shortening the time-to-market. The surge of IoT nodes-each requiring dozens of miniature moving parts-further broadens the addressable base for acetal copolymers across Asia-Pacific contract manufacturing hubs.

Competition from Bio-based and High-Performance Plastics

Sustainability goals prompt OEMs to experiment with cellulose-reinforced acetal and fully bio-derived polyamides, which reduce life-cycle emissions by double-digit percentages. Aerospace suppliers are weighing the substitution of polyetheretherketone (PEEK) for hot-section parts operating above POM's 100 °C ceiling, despite the associated cost premium. In European consumer goods markets, regulators reward carbon-negative formulations through lower eco-taxes, thereby tilting sourcing decisions. Some medical-device firms are pivoting to sterilization-stable chemistries to withstand repeated steam cycles, thereby eroding the share of POM in precision pump components. Although the incumbent polymer retains a cost-performance sweet spot, rising environmental disclosure obligations threaten demand in applications where drop-in greener alternatives exist.

Other drivers and restraints analyzed in the detailed report include:

- Metal-to-Plastic Shift in Industrial Machinery

- Manufacturing Expansion in Asia-Pacific

- Raw-Material Price Volatility and Trade Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The sheet category accounted for 64.78% of global consumption in 2025, reflecting its widespread use in automotive door modules, electronics housings, and industrial covers. The segment is also projected to pace a 5.05% CAGR through 2031. Extrusion advances now yield sheet thickness tolerances of +-3%, allowing for direct machining into complex three-dimensional parts without the need for secondary planing. Converters appreciate the material's uniform crystalline morphology, which resists warp during thermoforming of large panels.

Rod and tube forms serve high-precision niches, such as gears, thrust washers, and fluid-handling manifolds, where dimensional drift cannot exceed 0.05 mm over the service temperature range. Hybrid powertrain assemblies and factory automation equipment drive modest but steady growth. The "others" bucket-principally injection-molded near-net-shapes-attracts design engineers seeking weight parity with aluminum at one-third the cost. The ASTM D6100 specification unifies tolerance benchmarks across all form factors, providing global OEMs with confidence in multi-regional sourcing. Although sheet will remain dominant, the proliferation of additive-manufacturing feedstock pellets could gradually elevate the "others" sub-segment after 2027.

The Polyoxymethylene (POM) Market Report is Segmented by Form Type (Sheet, Rod and Tube, and Others), End-User Industry (Aerospace, Automotive, Electrical and Electronics, Industrial and Machinery, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific contributed 66.70% of 2025 shipments, buoyed by vertically integrated supply chains and surging demand from Chinese, Indian, and Southeast Asian OEMs. Japanese producers continue supplying high-crystallinity copolymers favored in precision gears, while Korean suppliers push electro-conductive grades for semiconductor tooling. Clusters around Ho Chi Minh City and Pune accelerate the conversion of off-the-shelf sheet into automotive assemblies, reinforcing regional self-sufficiency.

The Middle-East and Africa exhibit the fastest trajectory at 5.90% CAGR through 2031. Mega-sites like SABIC's Petrokemya integrate methanol, formaldehyde, and downstream polymer units, conferring feedstock stability and energy efficiency. Aerospace parts makers in the United Arab Emirates diversify away from aluminum, sourcing POM locally to support Gulf carrier fleet expansion plans. The region's location between Asian and European consumer bases helps exporters minimize freight costs, a factor amplified by Red Sea shipping bottlenecks.

North America and Europe maintain technology leadership, nurturing research and development pipelines for low-formaldehyde and recycled-content variants. Automotive Tier-1 suppliers in Michigan and Bavaria collaborate with resin producers on cradle-to-gate life-cycle assessments, advocating for narrower specification windows that ensure compatibility with the circular economy. South American markets remain nascent but benefit from manufacturing investments in Brazil's automotive corridor, where acetal demand aligns with localized fuel system production. Overall, the Asia-Pacific region appears poised to maintain its dominance, given its concentration of both methanol feedstock and finished goods assembly lines.

- Celanese Corporation

- China BlueChemical Ltd.

- Delrin USA, LLC

- Henan Energy and Chemical Group Co., Ltd.

- Kolon BASF innoPOM, Inc.

- Korea Engineering Plastics Co., Ltd.

- LG Chem

- Mitsubishi Chemical Group Corporation

- Polyplastics Co., Ltd. (Daicel Group)

- SABIC

- Yuntianhua Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive Lightweighting Boom

- 4.2.2 Miniaturisation in Electrical and Electronics

- 4.2.3 Metal-to-plastic Shift in Industrial Machinery

- 4.2.4 Manufacturing Expansion in Asia-Pacific

- 4.2.5 Low-VOC POM Grades for EV Interiors

- 4.3 Market Restraints

- 4.3.1 Competition from Bio-based and High-performance Plastics

- 4.3.2 Raw-material Price Volatility and Trade Barriers

- 4.3.3 Methanol Diversion to SAF Value-chain

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Import and Export Analysis

- 4.7 Price Trends

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of Substitutes

- 4.8.4 Competitive Rivalry

- 4.8.5 Threat of New Entrants

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging (Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Form Type

- 5.1.1 Sheet

- 5.1.2 Rod and Tube

- 5.1.3 Others

- 5.2 By End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Industrial and Machinery

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Celanese Corporation

- 6.4.2 China BlueChemical Ltd.

- 6.4.3 Delrin USA, LLC

- 6.4.4 Henan Energy and Chemical Group Co., Ltd.

- 6.4.5 Kolon BASF innoPOM, Inc.

- 6.4.6 Korea Engineering Plastics Co., Ltd.

- 6.4.7 LG Chem

- 6.4.8 Mitsubishi Chemical Group Corporation

- 6.4.9 Polyplastics Co., Ltd. (Daicel Group)

- 6.4.10 SABIC

- 6.4.11 Yuntianhua Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs