PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906884

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906884

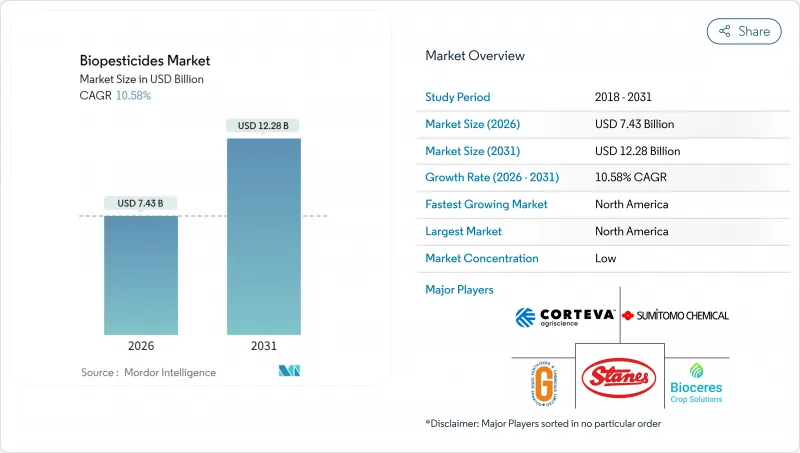

Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The biopesticides market size in 2026 is estimated at USD 7.43 billion, growing from 2025 value of USD 6.72 billion with 2031 projections showing USD 12.28 billion, growing at 10.58% CAGR over 2026-2031.

Heightened regulatory scrutiny of synthetic chemistries, rapid expansion of organic farmland, and the emergence of fermentation-as-a-service platforms are converging to accelerate the commercialization of microbial-based solutions. Brazil's unified bioinputs law, effective December 2024, has already shortened approval timelines for biological products, providing momentum that other emerging markets are beginning to emulate. At the same time, North American growers lead global adoption because of a mature controlled-environment agriculture infrastructure and streamlined reviews under the reformed United States Coordinated Framework. Intensifying insecticide resistance, especially in lepidopteran pests, is steering both row-crop and horticultural producers toward biological modes of action that complement existing chemistries.

Global Biopesticides Market Trends and Insights

Stricter Global Curbs on Synthetic Pesticides

The European Union's Farm to Fork Strategy targets a 50% cut in chemical pesticide use by 2030, prompting a measurable substitution effect in favor of biologicals. Complementing this, the United States Environmental Protection Agency (EPA) cancelled several organophosphate registrations in 2024, which has increased biological awareness among 87% of surveyed row-crop growers. Brazil's streamlined approval process now takes significantly less time for biologicals compared to synthetics, creating a cost-of-delay advantage for biopesticide manufacturers. Thailand and other Southeast Asian nations are drafting comparable policies, illustrating the global reach of regulatory momentum. Across major export crops, residue-limit compliance has become a tangible business risk, so buyers are pressuring suppliers to reduce dependence on synthetic chemistries.

Expansion of Organic Farming Acreage

Certified organic farmland has been steadily increasing, supported by consistent annual growth across major producing regions. Since organic certification prohibits synthetic inputs, biologicals serve as the primary pest-management option in these systems, creating a reliable revenue base for biopesticide vendors. The premium retail pricing associated with organic products allows growers to manage higher per-hectare treatment costs while maintaining profitability. The expansion of controlled-environment agriculture (CEA) within organic supply chains further drives demand, as indoor farms adopt biological controls from the outset to meet residue-free branding requirements. Additionally, investment in regional organic research centers is enhancing extension support for biological products, boosting adoption confidence.

Higher Cost Versus Synthetic Pesticides

Per-hectare treatment costs for biologicals remain two to three times higher than conventional products, primarily because of lower active-ingredient density and more frequent application cycles. Commodity crop growers in Africa and parts of Asia hesitate to invest in premium inputs, even though premium export channels may cover those costs. Economic modeling that factors in resistance management and residue-testing savings can partially offset price gaps, but such analyses are not yet widely distributed through extension networks. Several governments now offer direct input subsidies to bridge the pricing differential, but program scope is still limited.

Other drivers and restraints analyzed in the detailed report include:

- Rising Resistance to Conventional Chemistries

- Government Biopesticide Incentives and Fast-Track Approvals

- Shorter Shelf Life and Cold-Chain Dependence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Biofungicides generated 46.92% of 2025 revenue and continue to anchor the biopesticides market size, reflecting proven field performance of Bacillus and Trichoderma strains across cereals, fruits, and protected vegetables. Innovation in wettable-powder and oil-dispersion formulations has improved shelf stability, which supports penetration in warmer climates. The segment's broad utility has built distributor confidence, encouraging wider shelf allocation in retail channels. Bioinsecticides trail in current share but are forecast to advance at a 11.86% CAGR, outpacing other categories. Adoption is rising as growers seek new modes of action to counter lepidopteran resistance. Recent regulatory submissions show a 35% rise in bioinsecticide dossiers in 2024, supplying a pipeline that will expand choices over the forecast window.

Second-generation bioherbicides remain niche but show commercial momentum as companies pair novel microbial isolates with adjuvants that improve host specificity. While limited acreage uptake keeps volume small, the category attracts venture capital because it offers a differentiated solution to herbicide-resistant weeds. Other biopesticides, including nematicides and molluscicides, target high-value specialty crops where yield preservation justifies higher inputs. Together, these diverse forms demonstrate the expanding technical scope of the biopesticides market.

The Biopesticides Market Report is Segmented by Form (Biofungicides, Bioherbicides, Bioinsecticides, and More), Crop Type (Cash Crops, Horticultural Crops, and More), and Geography (Africa, Asia-Pacific, Europe, Middle East, North America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America retained 39.12% revenue in 2025 and posted the fastest regional CAGR at 12.05%, underscoring its dual status as both the largest and fastest-growing territory for the biopesticides market. Streamlined EPA reviews, state-level incentive programs, and strong retailer commitments to residue-free sourcing combine to accelerate uptake. United States CEA operations integrate biological pest control in leafy greens, tomatoes, and strawberries, providing a steady baseline of demand. Canada's organic acreage expansion and Mexico's export-oriented horticulture further expand regional use.

Europe follows closely, propelled by the European Union's Farm to Fork Strategy. The European biocontrol market has grown significantly, representing a notable portion of total crop-protection sales. Stringent approval processes extend over several years, slowing product turnover but ensuring high-quality data packages that bolster grower trust. Northern member states emphasize residue reduction in cereals, while Mediterranean regions employ biologicals heavily in horticulture and viticulture.

South America delivers the most dynamic growth, led by Brazil's expanding market and favorable regulatory reforms that unify bioinput approvals. A significant portion of Brazilian growers now report routine biological use, and annual market expansion vastly outstrips the global average. Argentina's equivalency recognition and Chile's public research funding enhance regional momentum. Asia-Pacific registers strong potential tied to rising organic acreage and government sustainability mandates, yet progress is fragmented by variable regulatory timelines and limited technical extension. Africa and the Middle East represent early-stage markets where donor-funded programs and multinational demonstrations seed future demand.

- Bayer AG

- BASF SE

- Syngenta Group

- Corteva Agriscience

- FMC Corporation

- Valent BioSciences LLC (Sumitomo Chemical Co., Ltd.)

- Certis USA LLC (Mitsui and Co., Ltd.)

- Koppert B.V.

- Andermatt Group AG

- Marrone Bio Innovations Inc. (Bioceres Crop Solutions Corp.)

- Seipasa SA

- T.Stanes and Company Limited

- UPL Ltd.

- Atlantica Agricola

- Gujarat State Fertilizers and Chemicals Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 China

- 4.3.6 Egypt

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Iran

- 4.3.12 Italy

- 4.3.13 Japan

- 4.3.14 Mexico

- 4.3.15 Netherlands

- 4.3.16 Nigeria

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Turkey

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Stricter global curbs on synthetic pesticides

- 4.5.2 Expansion of organic farming acreage

- 4.5.3 Rising resistance to conventional chemistries

- 4.5.4 Government bio-pesticide incentives and fast-track approvals

- 4.5.5 Growth of controlled-environment agriculture (CEA)

- 4.5.6 Fermentation-as-a-service lowering scale-up barriers

- 4.6 Market Restraints

- 4.6.1 Higher cost versus synthetic pesticides

- 4.6.2 Shorter shelf life and cold-chain dependence

- 4.6.3 Feed-stock price volatility for microbial production

- 4.6.4 Absence of uniform field-performance KPIs

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Geography

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Nigeria

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest of Africa

- 5.3.1.1 By Country

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 Thailand

- 5.3.2.1.8 Vietnam

- 5.3.2.1.9 Rest of Asia-Pacific

- 5.3.2.1 By Country

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.3.1 By Country

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest of Middle East

- 5.3.4.1 By Country

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest of North America

- 5.3.5.1 By Country

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Rest of South America

- 5.3.6.1 By Country

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global-Level Overview, Market-Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 BASF SE

- 6.4.3 Syngenta Group

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Valent BioSciences LLC (Sumitomo Chemical Co., Ltd.)

- 6.4.7 Certis USA LLC (Mitsui and Co., Ltd.)

- 6.4.8 Koppert B.V.

- 6.4.9 Andermatt Group AG

- 6.4.10 Marrone Bio Innovations Inc. (Bioceres Crop Solutions Corp.)

- 6.4.11 Seipasa SA

- 6.4.12 T.Stanes and Company Limited

- 6.4.13 UPL Ltd.

- 6.4.14 Atlantica Agricola

- 6.4.15 Gujarat State Fertilizers and Chemicals Ltd.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS