PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906905

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906905

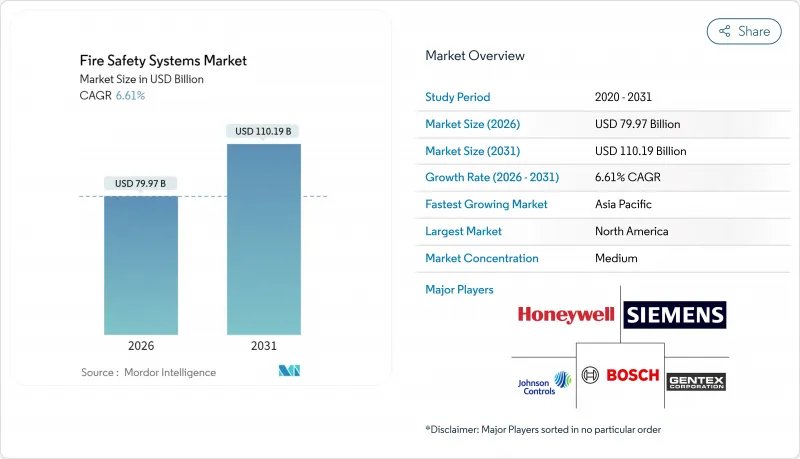

Fire Safety Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Fire Safety Systems market size in 2026 is estimated at USD 79.97 billion, growing from 2025 value of USD 75.01 billion with 2031 projections showing USD 110.19 billion, growing at 6.61% CAGR over 2026-2031.

Tightening code enforcement, rapid urbanization in Asia Pacific, and the shift toward wireless IoT-enabled detection shape this expansion. Active suppression and detection platforms are displacing passive-only barriers as insurers reward monitored systems with premium discounts. Wireless architectures cut retrofit labor by up to 60%, unlocking underserved heritage and occupied-building segments. Supply shortages in microcontrollers push integrators to stockpile parts, while data-center operators accelerate gas-suppression rollouts to protect high-value racks. Competitive pressure from regional specialists remains intense, yet platform ecosystems from large incumbents deepen customer lock-in.

Global Fire Safety Systems Market Trends and Insights

Stringent Government Fire-Safety Mandates

The 2025 edition of NFPA 72 mandates cloud-connected monitoring for commercial panels, prompting legacy upgrades and penalizing noncompliant owners during occupancy renewals. The 2024 International Fire Code now requires automatic suppression in assembly occupancies above 300 persons, expanding coverage to mid-sized venues previously exempt. China requires sprinklers in residential towers over 100 meters, sparking retrofit activity in tier-one cities. Japan extended inspection cycles for addressable systems from three to five years, raising demand for higher-reliability components that offset maintenance visits. The UAE adopted performance-based design, permitting CFD modeling but adding certification costs and lengthening project timelines. Publicly posted violation lists intensify reputational risk, nudging voluntary compliance beyond statutory minimums.

Rapid Urbanization and High-Rise Construction Boom

The United Nations forecasts that urban residency will rise to 68% by 2030, concentrating fire risk in taller structures. Asia Pacific represents more than half of new high-rise starts, with India and Indonesia contributing the bulk of units. Built-up area in the region's megacities expanded 12% between 2020 and 2024, while fire-station density increased only 3%, elevating reliance on on-site suppression. Mixed-use towers in Dubai and Riyadh include zones that require distinct code compliance, complicating integration and raising system costs. OECD analysis notes that infrastructure lag in sub-Saharan Africa widens protection gaps, prompting insurers to flag fire safety in underwriting. Underground facilities such as transit stations introduce further complexity, demanding premium smoke-extraction and heat-detection arrays.

High Installation and Maintenance Costs

Addressable panels with network connectivity cost AUD 15,000-45,000 (USD 9,800-29,400) for mid-sized Australian buildings, stretching facility budgets. Wireless detectors list at USD 180-320 each triple wired units posing adoption hurdles where insurance offsets are absent. Annual service contracts run 8-12% of installed cost because certified technicians are needed for firmware updates. Retrofitting older buildings often requires new conduit or compromise on device density, inflating capex. Enforcement gaps in lower-income regions limit compliance pressure, further slowing upgrades. Rural areas face 30-50% higher labor rates owing to scarce contractors, worsening affordability.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Wireless IoT-Enabled Detection Systems

- Expansion of Data Centers Requiring Specialized Suppression

- Supply-Chain Volatility in Electronic Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Active systems captured 62.58% of 2025 revenue and are set to expand at 7.69% through 2031, reflecting owners' preference for automatic mitigation that curbs loss events by up to 80%. Passive measures remain essential for compartmentation but surrender share as insurers insist on monitored suppression for premium relief. Integrated installations in high-rise residences pair fire-rated shafts with pressurization fans, exemplifying the combined approach. Hybrid deployments preserve barrier integrity by using wireless detectors that avoid drilling through rated walls, boosting retrofit rates in older stock. The International Building Code now obliges suppression in atriums taller than three stories, broadening the Fire Safety Systems market.

Active platforms increasingly embed analytics that predict hazard escalation, differentiating vendors on software prowess. Battery-powered sprays for lithium-ion battery rooms illustrate specialized niches within the Fire Safety Systems market. Passive providers respond with smarter materials, such as intumescent coatings that signal end-of-life status through color change. Yet funding gravitates toward active portfolios because service contracts yield recurring cash flows, an attraction for integrators pursuing annuity revenue. The migration from passive-only designs elevates the Fire Safety Systems market size tied to active solutions throughout the forecast.

Fire detection remained the chief revenue driver at 47.78% in 2025, anchored by addressable panels that pinpoint alarm origin and speed first-responder action. Wireless detectors, posting an 7.97% CAGR, outpace the broader Fire Safety Systems market as mesh networks trim installation labor in occupied spaces. Gas suppression dominates sensitive environments like museums and data halls where water presents unacceptable damage risk. Foam systems retain leadership in petrochemical sites yet grapple with fluorine-free transitions demanded by environmental rules.

The convergence of detection and suppression data within unified dashboards fosters predictive maintenance, a feature that cuts nuisance alarms by 30% in pilot offices. Voice-evacuation alarms, now demanded in properties exceeding 75,000 square feet, improve occupant guidance during incidents. Detectors integrating smoke, heat, and CO inputs reduce false positives in high-particulate plants, enhancing management confidence. These advances enlarge the Fire Safety Systems market size attached to premium detection gear and reinforce vendor differentiation on software sophistication.

The Fire Safety Systems Market Report is Segmented by Technology (Passive Fire Safety Systems, and Active Fire Safety Systems), Product (Fire Suppression With Gas, Foam, and More), End-User (Commercial, Industrial, and More), Connectivity (Wired Systems, and Wireless Systems), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.68% of 2025 revenue, reflecting the impact of rigorous NFPA updates and insurance incentives that reduced premiums by up to 20% for monitored suppression. High-rise construction along U.S. coasts, and wildfire retrofits in California, sustain orders. Canada's performance-based building code accelerates the adoption of water-mist systems in dense residential towers. Nearshoring in Mexico fuels demand for addressable panels in new industrial hubs.

Asia Pacific is set for the fastest 8.55% CAGR through 2031 on urbanization and high-rise proliferation. Chinese codes require sprinklers in towers above 100 meters, igniting retrofit cycles in Beijing and Shanghai. India mandates addressable detection in residential blocks over 15 meters, although enforcement varies. Japan rewards reliable components with extended inspection intervals, lifting upfront system spend. Australia's 2025 code demands interlinked smoke alarms, stimulating wireless detector uptake. South Korea enforces sprinklers in apartments taller than 11 stories, compelling wet-pipe adoption despite freeze-protection costs.

Europe shows fragmented standards that benefit local integrators. Germany's DGNB certification awards credits for advanced protection, nudging voluntary upgrades. The Middle East experiences brisk demand from mega-projects that embed performance-based design in master plans, with UAE regulations endorsing CFD modeling. Africa's adoption remains uneven, with South Africa and Kenya leading but limited penetration elsewhere due to contractor shortages.

- Johnson Controls International PLC

- Honeywell International Inc.

- Siemens AG

- Bosch Sicherheitssysteme GmbH

- Gentex Corporation

- Halma PLC

- Hochiki America Corporation

- Viking Group Inc.

- Victaulic Company

- Fike Corporation

- Securiton AG

- Carrier Global Corporation

- Nittan Company Limited

- Apollo Fire Detectors Limited

- Advanced Electronics Limited

- Minimax GmbH

- Robertshaw Controls Company

- Ravel Electronics Private Limited

- Panasonic Corporation

- Edwards Fire Safety (Carrier)

- Tyco Fire Protection Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Impact of Macroeconomic Factors on the Market

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Market Drivers

- 4.7.1 Stringent Government Fire-Safety Mandates

- 4.7.2 Rapid Urbanization and High-Rise Construction Boom

- 4.7.3 Surge in Insurance Premium Discounts for Compliant Buildings

- 4.7.4 Growing Adoption of Wireless IoT-Enabled Detection Systems

- 4.7.5 Expansion of Data Centers Requiring Specialized Suppression

- 4.7.6 Emergence of ESG-Linked Facility Management Budgets

- 4.8 Market Restraints

- 4.8.1 High Installation and Maintenance Costs

- 4.8.2 Supply-Chain Volatility in Electronic Components

- 4.8.3 Limited Skilled Workforce for System Integration

- 4.8.4 Slow Retrofit Cycles in Price-Sensitive Emerging Markets

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Passive Fire Safety Systems

- 5.1.2 Active Fire Safety Systems

- 5.2 By Product

- 5.2.1 Fire Detector

- 5.2.1.1 Detectors

- 5.2.1.2 Alarms

- 5.2.2 Fire Suppression

- 5.2.2.1 Gas

- 5.2.2.2 Foam

- 5.2.2.3 Other Fire Suppression Products

- 5.2.1 Fire Detector

- 5.3 By End-User

- 5.3.1 Commercial

- 5.3.2 Industrial

- 5.3.3 Government

- 5.3.4 Other End-Users

- 5.4 By Connectivity

- 5.4.1 Wired Systems

- 5.4.2 Wireless Systems

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Honeywell International Inc.

- 6.4.3 Siemens AG

- 6.4.4 Bosch Sicherheitssysteme GmbH

- 6.4.5 Gentex Corporation

- 6.4.6 Halma PLC

- 6.4.7 Hochiki America Corporation

- 6.4.8 Viking Group Inc.

- 6.4.9 Victaulic Company

- 6.4.10 Fike Corporation

- 6.4.11 Securiton AG

- 6.4.12 Carrier Global Corporation

- 6.4.13 Nittan Company Limited

- 6.4.14 Apollo Fire Detectors Limited

- 6.4.15 Advanced Electronics Limited

- 6.4.16 Minimax GmbH

- 6.4.17 Robertshaw Controls Company

- 6.4.18 Ravel Electronics Private Limited

- 6.4.19 Panasonic Corporation

- 6.4.20 Edwards Fire Safety (Carrier)

- 6.4.21 Tyco Fire Protection Products

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment