PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906924

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906924

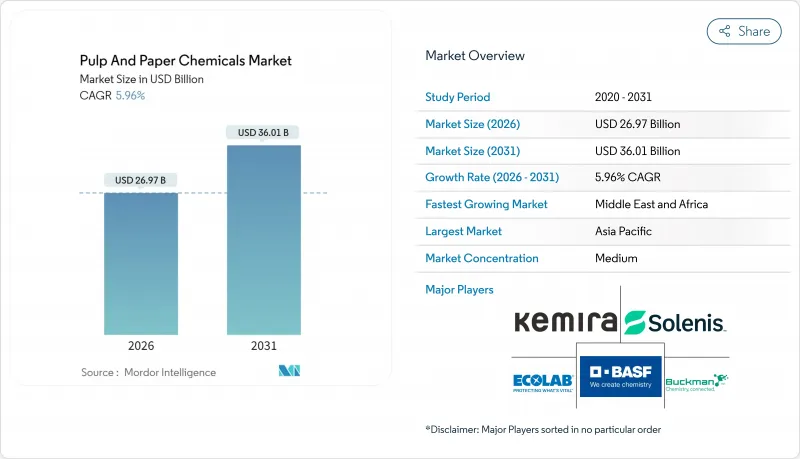

Pulp And Paper Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Pulp & Paper Chemicals market is expected to grow from USD 25.45 billion in 2025 to USD 26.97 billion in 2026 and is forecast to reach USD 36.01 billion by 2031 at 5.96% CAGR over 2026-2031.

The rising demand for packaging-grade paper, rapid technological upgrades in bleaching and sizing, and intensifying sustainability mandates are combining to create persistent growth headwinds and tailwinds. Capacity additions in the Asia-Pacific region, continued e-commerce expansion, and a pronounced shift toward recycled fiber have all contributed to an increase in the consumption of specialty chemistries that enhance brightness, improve strength, and reduce freshwater use. At the same time, tightening discharge rules, volatile input prices, and energy-intensive legacy processes compel suppliers to innovate around enzymatic, bio-based, and closed-loop solutions. Competitive differentiation hinges on bundled programs that optimize retention, drainage, and barrier performance while helping mills meet carbon and effluent targets. Industry incumbents, therefore, focus on targeted acquisitions, regional production footprints, and digital service models that reduce downtime and chemical over-feed.

Global Pulp And Paper Chemicals Market Trends and Insights

Expansion of Packaging-Grade Paper Capacity in Asia

Massive capital projects such as Green Bay Packaging's USD 1 billion facility and Suzano's R$1.66 billion investment have triggered unprecedented downstream demand for retention aids, drainage chemistries, and surface sizing tailored for high-speed machines. These mega-mills prefer local chemical sourcing to avoid freight penalties, prompting suppliers to deploy regional plants and service labs. Capacity additions also tighten global fiber balances, indirectly boosting additive consumption in export-oriented mills elsewhere. Suppliers that align technical teams with end-user start-up schedules capture early-cycle volume and long-term supply contracts. Finally, regional overcapacity risks heighten the need for cost-optimizing programs, favoring vendors that can bundle chemistries with real-time analytics.

Surge in Recycled-Fiber Furnish Adoption

Circular-economy mandates and brand owner commitments push average recycled-content ratios higher, especially in Europe and North America. Increased contaminants, stickies, and ink residues in secondary fiber prompt mills to employ advanced flotation reagents, enzyme-based de-inking, and high-charge microparticles that preserve brightness and tensile strength. Integrated "full-line" chemical packages simplify procurement, while data-rich monitoring cuts additive overdosing. Opportunities grow fastest in containerboard and tissue mills adopting 100% recycled furnish.

Tightening AOX and COD Discharge Norms

EU and US regulators are lowering allowable AOX and COD baselines, compelling mills to redesign bleach sequences or install high-capex tertiary treatment. Compliance adds 15-20% to annual operating costs for smaller sites that lack economies of scale. Chemical suppliers respond with low-AOX brightening agents, sludge de-watering aids, and online sensors that prove performance to auditors.

Other drivers and restraints analyzed in the detailed report include:

- Water-Free Enzymatic Bleaching Breakthroughs

- Carbon-Negative Bio-Based Sizing Agents

- High Energy Intensity Vis-a-Vis Alternative Substrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bleaching agents dominated the pulp and paper chemicals market, accounting for a 32.45% share in 2025. The segment's primacy stems from its indispensable role in brightness targets and its ongoing migration from chlorine dioxide toward hydrogen peroxide and oxygen sequences. This shift is reinforced by regulatory curbs on AOX and consumer scrutiny of chlorinated residues. Suppliers invest in stabilized peroxide grades, high-efficacy activators, and dispersants that lower total chemical oxygen demand.

Sizing agents, although smaller in absolute dollar terms, represent the fastest-growing segment with a 6.31% CAGR through 2031. Bio-based and enzymatic sizing gives converters the balance of ink hold-out, grease resistance, and carbon reduction they need for food-service and e-commerce packaging. Pulping chemicals maintain a steady baseline tied to integrated kraft mills, while fillers such as GCC and PCC benefit from lightweighting trends that call for higher opacity per gram. Binders, particularly wet-strength resins used in recycled tissue and towel grades, show moderate gains as hygiene product demand remains defensive.

The Pulp and Paper Chemicals Market Report is Segmented by Type (Binders, Bleaching Agents, Fillers, Pulping Chemicals, Sizing Agents, and More), Application (Newsprint, Packaging and Industrial Papers, Printing and Writing Papers, Pulp Mills and Water Treatment, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region commanded a 46.85% share of the pulp and paper chemicals market in 2025, driven by robust capital investment and rising per-capita packaging consumption. China's latest five-year plan earmarks containerboard and specialty tissue as strategic segments, spurring subsidies for energy-efficient chemical packages. India's tissue boom intensifies demand for soft-strength resins and fragrance-incorporation technologies. Southeast Asia benefits from supply-chain diversification, with Vietnam and Indonesia courting foreign investment for kraft liner mills.

North America registers stable demand grounded in lightweight containerboard conversions and progressive recycled-fiber mandates in states such as California. Mills invest in oxygen delignification retrofits and carbon-capture pilots to align with corporate net-zero commitments. Europe leads the adoption of bio-based sizing agents and PFAS-free barrier coatings, driven by the Green Deal and strict packaging directives.

The Middle East and Africa region is projected to grow at a 6.05% CAGR through 2031, supported by infrastructure build-out and the localization of food and beverage packaging. New tissue machines in Saudi Arabia and Egypt fuel additive demand, while Oman's SOHAR petrochemical investments improve regional sourcing of fatty-acid derivatives. South America enjoys steady gains anchored by Brazil's pulp capacity expansions, with chemical suppliers integrating upstream to secure wood-derived feedstocks.

- Arkema

- Ashland Inc.

- BASF

- Buckman

- Cargill Incorporated

- Celanese

- Chemours

- Clariant

- Ecolab

- ERCO Worldwide

- Georgia-Pacific

- Imerys S.A.

- Kemira

- Nouryon

- Omya International AG

- Solenis

- Solvay

- Stora Enso

- UPM

- Valmet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of packaging-grade paper capacity in Asia

- 4.2.2 Surge in recycled-fiber furnish adoption

- 4.2.3 Water-free enzymatic bleaching breakthroughs

- 4.2.4 Carbon-negative bio-based sizing agents

- 4.2.5 E-commerce led SKU proliferation driving speciality chemicals

- 4.3 Market Restraints

- 4.3.1 Tightening AOX and COD discharge norms

- 4.3.2 High energy intensity vis-a-vis alternative substrates

- 4.3.3 Volatility in elemental chlorine prices

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Binders

- 5.1.2 Bleaching Agents

- 5.1.3 Fillers

- 5.1.4 Pulping Chemicals

- 5.1.5 Sizing Agents

- 5.1.6 Other Types

- 5.2 By Application

- 5.2.1 Newsprint

- 5.2.2 Packaging and Industrial Papers

- 5.2.3 Printing and Writing Papers

- 5.2.4 Pulp Mills and Water Treatment

- 5.2.5 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 UAE

- 5.3.5.3 Turkey

- 5.3.5.4 South Africa

- 5.3.5.5 Egypt

- 5.3.5.6 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core segments, Financials, Strategic info, Market rank/share, Products & Services, Recent developments)

- 6.4.1 Arkema

- 6.4.2 Ashland Inc.

- 6.4.3 BASF

- 6.4.4 Buckman

- 6.4.5 Cargill Incorporated

- 6.4.6 Celanese

- 6.4.7 Chemours

- 6.4.8 Clariant

- 6.4.9 Ecolab

- 6.4.10 ERCO Worldwide

- 6.4.11 Georgia-Pacific

- 6.4.12 Imerys S.A.

- 6.4.13 Kemira

- 6.4.14 Nouryon

- 6.4.15 Omya International AG

- 6.4.16 Solenis

- 6.4.17 Solvay

- 6.4.18 Stora Enso

- 6.4.19 UPM

- 6.4.20 Valmet

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-Need Assessment