PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906929

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906929

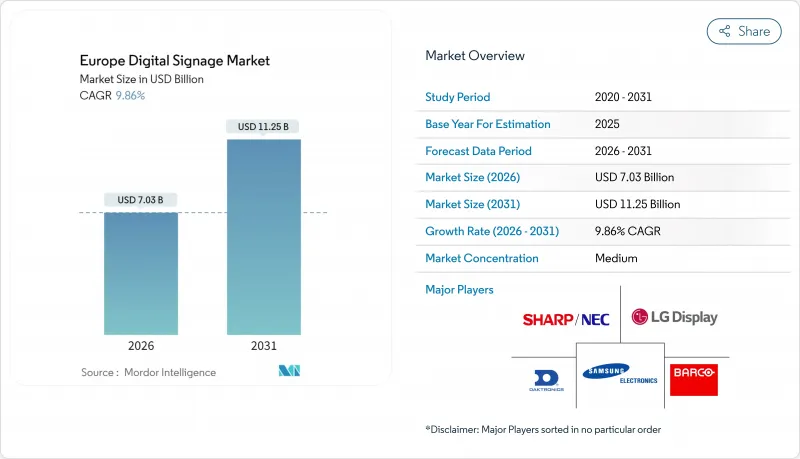

Europe Digital Signage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe digital signage market size in 2026 is estimated at USD 7.03 billion, growing from 2025 value of USD 6.4 billion with 2031 projections showing USD 11.25 billion, growing at 9.86% CAGR over 2026-2031.

Growth accelerates as retailers upgrade video walls to 4K and 8K resolution, transportation authorities digitize passenger information systems, and programmatic digital-out-of-home (DOOH) platforms democratize automated buying for small and mid-sized brands. The Europe digital signage market benefits from EU eco-design rules that discourage single-use print media and incentivize energy-efficient displays. Hardware vendors respond with lower-power microLED and flip-chip displays, while software providers embed AI to personalize content in near real time. At the same time, mergers involving STRATACACHE, ZetaDisplay, Vertiseit, and others are reshaping supply dynamics and creating continental service networks able to support complex, multi-country deployments.

Europe Digital Signage Market Trends and Insights

Steady increase in DOOH ad spend

Programmatic DOOH is gaining share rapidly as advertisers migrate budgets from static posters to data-driven screens that support conditional triggers such as weather or audience movement. Clear Channel generated USD 662 million across Northern Europe in 2024, half of which already came from digital panels, while CPM premiums on programmatic transactions reached 30%-300% over loop-based sales. The Nordic cluster acts as a bellwether because its high smartphone penetration and open data policies foster real-time bidding environments. Higher media yields finance additional screen rollouts, reinforcing a feedback loop that underpins the Europe digital signage market.

Evolution of turnkey solutions

Enterprises increasingly favor single-vendor contracts that bundle displays, media players, content management, analytics, and on-site services. Samsung's VXT cloud CMS, hosted in Frankfurt and certified for GDPR compliance, illustrates how vendors position integrated offers that reduce complexity and ensure data sovereignty. LG's collaboration with BrightSign packages system-on-chip media players directly inside professional panels, eliminating bulky external hardware. Turnkey models shorten deployment cycles, a decisive factor for airports and rail operators migrating from paper timetables to dynamic displays. They also lower lifetime costs by sharing risk between integrators and end clients, encouraging mid-sized enterprises to join the Europe digital signage industry.

Concerns over customer privacy

GDPR imposes strict consent rules on facial recognition, demographic analytics, and video analytics, forcing operators to anonymize data immediately or avoid collection altogether. Retailers that deploy cameras for audience metrics must install visible notices and offer opt-out mechanisms, adding capital and legal costs. These obligations slow the rollout of AI-driven targeting despite proven engagement benefits, dampening near-term revenue opportunities for the Europe digital signage market.

Other drivers and restraints analyzed in the detailed report include:

- Retail demand for 4K / 8K video walls

- Dynamic pricing via POS integration

- High CAPEX and OPEX of large networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 65.78% of Europe digital signage market share in 2025, underscoring the capital intensity of screen infrastructure. LCD and LED panels dominate orders, with transportation projects such as the Elizabeth line adopting 55-inch, 700-nit boards for multi-lingual passenger alerts. OLED displays gain favor in premium boutiques where deep blacks and wide angles justify higher pricing, while microLED moves from prototype to limited production and signals future displacement of tiled LED. Media players transition to ARM-based, fanless designs that withstand 24/7 cycles, further reinforcing hardware as the bedrock of the Europe digital signage market.

Software is poised for an 10.88% CAGR through 2031 as advertisers pivot to programmatic bidding and AI-driven creative optimization. Open APIs enable cross-platform orchestration of kiosks, mobile apps, and web storefronts, creating omnichannel journeys. Investment vehicles targeting CMS suppliers, as seen in the Navori Labs sale, reveal confidence that recurring license income will outpace one-off hardware margins. Services round out solutions through design, installation, and managed operations, offering vendors a hedge against hardware price compression while meeting enterprise demand for turnkey contracts.

Retail commanded 35.62% of Europe digital signage market in 2025, driven by immersive storytelling and dynamic price labeling. Apparel chains use 3D product renders on in-store LED portals to amplify social media trends and drive immediacy. Grocery stores adopt electronic shelf labels that synchronize with loyalty databases to push individualized offers. These innovations keep physical outlets relevant in an e-commerce era and sustain the Europe digital signage market as a core pillar of omnichannel strategies.

Transportation projects are expanding at an 10.95% CAGR, making them the fastest-growing vertical through 2031. Airports like Frankfurt retrofit departure halls with dual-purpose displays that alternate between flight data and programmatic ads linked to passenger demographic data. Rail operators deploy ruggedized 2.5-millimeter-pixel LED ribbons along platforms for real-time service alerts. Such investments diversify revenue streams via advertising concessions, reinforcing the Europe digital signage market's appeal to infrastructure owners.

The Europe Digital Signage Market Report is Segmented by Type (Hardware, Software, and Services), End-User Vertical (Retail, Transportation, Hospitality, Corporate, and More), Distribution Channel (Direct and System Integrators), and Application (Indoor Digital Signage, Outdoor Digital Signage, Interactive Digital Signage, Video Walls, and Digital Posters/Kiosks). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Samsung Electronics Co. Ltd (Display Solutions)

- LG Display Co. Ltd

- Sharp NEC Display Solutions Ltd

- Barco NV

- Daktronics Inc.

- Leyard Europe Srl

- Innolux Corp.

- Sony Group Corp.

- Planar Systems Inc.

- BrightSign LLC

- Stratacache Inc. (Scala)

- ZetaDisplay AB

- Broadsign International LLC

- Mvix (USA) Inc.

- Unilumin Group Co. Ltd

- Absen Optoelectronic Co. Ltd

- AOPEN Inc.

- 22Miles Inc.

- Navori Labs SA

- FocusNeo AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Steady increase in DOOH ad spend

- 4.2.2 Evolution of turnkey solutions

- 4.2.3 Retail demand for 4K/8K video walls

- 4.2.4 Dynamic pricing via POS integration

- 4.2.5 EU eco-design rules replacing print media

- 4.2.6 Programmatic DOOH access for SMBs

- 4.3 Market Restraints

- 4.3.1 Concerns over customer privacy

- 4.3.2 High CAPEX and OPEX of large networks

- 4.3.3 CMS compatibility fragmentation

- 4.3.4 Semiconductor supply volatility

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 LCD / LED Displays

- 5.1.1.2 OLED Displays

- 5.1.1.3 Media Players

- 5.1.1.4 Projectors / Screens

- 5.1.1.5 Other Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By End-User Vertical

- 5.2.1 Retail

- 5.2.2 Transportation

- 5.2.3 Hospitality

- 5.2.4 Corporate

- 5.2.5 Education

- 5.2.6 Government

- 5.2.7 Other End-User Verticals

- 5.3 By Distribution Channel

- 5.3.1 Direct

- 5.3.2 System Integrators

- 5.4 By Application

- 5.4.1 Indoor Digital Signage

- 5.4.2 Outdoor Digital Signage

- 5.4.3 Interactive Digital Signage

- 5.4.4 Video Walls

- 5.4.5 Digital Posters / Kiosks

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd (Display Solutions)

- 6.4.2 LG Display Co. Ltd

- 6.4.3 Sharp NEC Display Solutions Ltd

- 6.4.4 Barco NV

- 6.4.5 Daktronics Inc.

- 6.4.6 Leyard Europe Srl

- 6.4.7 Innolux Corp.

- 6.4.8 Sony Group Corp.

- 6.4.9 Planar Systems Inc.

- 6.4.10 BrightSign LLC

- 6.4.11 Stratacache Inc. (Scala)

- 6.4.12 ZetaDisplay AB

- 6.4.13 Broadsign International LLC

- 6.4.14 Mvix (USA) Inc.

- 6.4.15 Unilumin Group Co. Ltd

- 6.4.16 Absen Optoelectronic Co. Ltd

- 6.4.17 AOPEN Inc.

- 6.4.18 22Miles Inc.

- 6.4.19 Navori Labs SA

- 6.4.20 FocusNeo AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment