PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906932

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906932

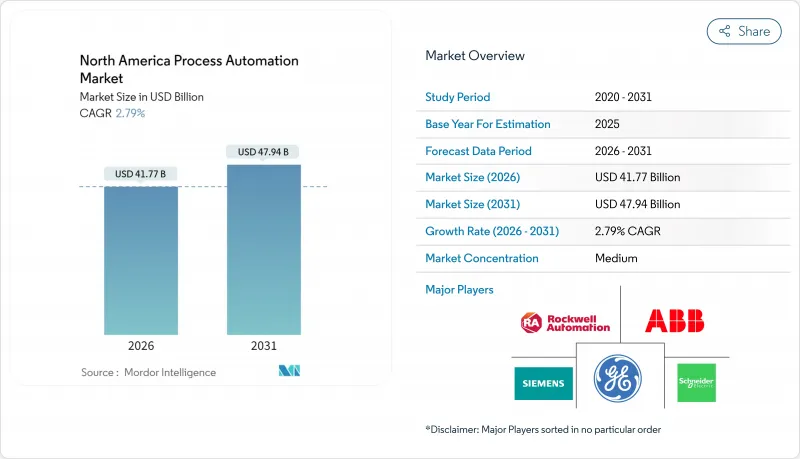

North America Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America process automation market is expected to grow from USD 40.64 billion in 2025 to USD 41.77 billion in 2026 and is forecast to reach USD 47.94 billion by 2031 at 2.79% CAGR over 2026-2031.

Moderate growth stems from a large installed base, incremental efficiency initiatives, and stricter environmental mandates. Oil and gas operators remain the principal adopters, while pharmaceutical manufacturers post the fastest expansion as continuous manufacturing gains U.S. Food and Drug Administration support. Wired protocols still dominate control-room links, yet wireless networks post the highest growth as ISA100 and WirelessHART mature. Cloud and edge deployments accelerate as manufacturers monetize operational data through predictive analytics while keeping safety-critical logic on-premises.

North America Process Automation Market Trends and Insights

Rising Focus on Energy-Efficiency and OPEX Reduction

Escalating electricity and fuel prices make real-time energy optimization a board-level priority. Heidelberg Materials cut kiln energy use by 15% and saved USD 2.8 million annually after installing advanced process control software that fine-tunes combustion in response to load swings. Similar initiatives in Great Lakes steel mills reduce natural-gas intensity during winter price spikes. Demand response programs reward plants that shift power-intensive steps to off-peak hours, creating quick payback on sensor retrofits. Continuous monitoring uncovers hidden losses such as compressed-air leaks, which often consume 20-30% of a plant's electricity bill. Once initial pilots validate savings, corporate finance teams release larger multiyear budgets, sustaining the process automation market momentum.

Heightened Demand for Safety-Instrumented Systems

Industrial incidents have tightened regulatory scrutiny, accelerating safety-system upgrades. ISA-84 now obliges refineries to verify safety integrity levels at five-year intervals. Emerson's DeltaV SIS integrates logic solvers with process control, trimming engineering hours and reducing test downtime. Chevron invested USD 45 million in redundant logic platforms after new state mandates, slashing trip-related lost-production events. Vendors bundle diagnostics that flag valve stiction and sensor drift before trips occur. Together, these changes lift demand for certified hardware, validation tools, and lifecycle service contracts that underpin the process automation market.

High Upfront CAPEX and Integration Complexity

Retrofitting a multi-vendor plant can push integration costs to 60% of project value. Technicians must map proprietary tags, develop middleware, and stage cutovers during short turnarounds, inflating total installed cost. Payback lengthens when downtime overruns occur. Financing hurdles magnify in commodity-price-sensitive sectors like chemicals, where margins fluctuate. Vendors now bundle energy-savings guarantees, yet CFOs still insist on under-three-year returns, limiting near-term process automation market uptake.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Industrial IoT Platforms

- Shift Toward Predictive and Prescriptive Maintenance Analytics

- Operational Cybersecurity Talent Deficit

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired networks secured 69.25% of 2025 revenue thanks to deterministic performance that safeguards safety-critical loops. That dominance translates to the largest process automation market size contribution within connectivity categories. Yet wireless protocols are gaining credibility as mesh topologies deliver 99.9% availability in corrosive or explosive zones. ExxonMobil's success at Baytown proves wireless deployment can slash installation budgets by 40%. Emerging private 5G spurs interest in mobile asset tracking and untethered robotics, foreshadowing double-digit sensor counts per asset. Manufacturers now pilot hybrid architectures that pair Ethernet-based controllers with WirelessHART field instruments, striking a balance between uptime and flexibility.

First adopters quantify quick wins in temporary monitoring projects that would never clear the capital committee under traditional cabling assumptions. Service contractors appreciate faster commissioning, especially on turnarounds with compressed schedules. Reliability teams confirm that advanced diagnostics embedded in gateways pinpoint signal degradation before it imperils control loops. Parallel growth in industrial cybersecurity frameworks such as ISA/IEC 62443 calms worries over radio attack surfaces. As test use cases mature into permanent installations, wireless will narrow its gap, sustaining incremental gains in the process automation market.

Hardware systems retained a 26.88% share of the process automation market size in 2025, reflecting the enduring need for PLCs, distributed control systems, and safety logic solvers. However, plant managers increasingly view algorithms, not enclosures, as the source of competitive edge. Software platforms post a 3.92% CAGR as advanced control, manufacturing execution, and analytics tools mine untapped data. Schneider Electric's EcoStruxure blends SCADA with cloud micro-services, letting engineers act on insights in near real time.

Software gains momentum wherever regulators demand digital batch records or energy-intensity audits. Pharmaceutical firms embed inline spectroscopy and model-predictive control to satisfy FDA quality-by-design mandates, lifting software penetration. Meanwhile, open-source historians and container orchestration reduce vendor lock-in fears. Hardware still matters for determinism, but differentiation now hinges on how adeptly software extracts value. This pivot enlarges service and subscription revenue, reinforcing the long-term expansion of the process automation market.

The North America Process Automation Market Report is Segmented by Communication Protocol (Wired, Wireless), System Type (Hardware, Software), Component (Hardware, Software, Services), Deployment Mode (On-Premises, Cloud and Edge), End-User Industry (Chemical and Petrochemical, Power and Utilities, Water and Wastewater, Food and Beverage, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Omron Corporation

- Fuji Electric Co., Ltd.

- Delta Electronics, Inc.

- Yokogawa Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Bosch Rexroth AG

- Beckhoff Automation GmbH & Co. KG

- Festo SE & Co. KG

- Endress+Hauser Group Services AG

- Aspen Technology, Inc.

- AVEVA Group plc

- Azbil Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising focus on energy-efficiency and OPEX reduction

- 4.2.2 Heightened demand for safety-instrumented systems

- 4.2.3 Proliferation of Industrial IoT platforms

- 4.2.4 Shift toward predictive and prescriptive maintenance analytics

- 4.2.5 Carbon-intensity penalties accelerating digital process control

- 4.2.6 Aging skilled workforce driving remote and autonomous operations

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and integration complexity

- 4.3.2 Brown-field interoperability challenges

- 4.3.3 Operational cybersecurity talent deficit

- 4.3.4 Long-term service-contract lock-ins limiting vendor switch

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Industrial-Automation Hot-Spots Analysis (US and Canada)

- 4.9 Macroeconomic Trend Impact (inflation-linked capex, reshoring)

- 4.10 Pandemic Recovery Themes (V-shape / Mid-range / Slump)

- 4.11 US - Base-Variable End-user Performance

- 4.12 Canada - Base-Variable End-user Performance

- 4.13 Supply-related Challenges and Policy Stimulus

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Protocol

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By System Type

- 5.2.1 Hardware

- 5.2.1.1 SCADA

- 5.2.1.2 Distributed Control System (DCS)

- 5.2.1.3 Programmable Logic Controller (PLC)

- 5.2.1.4 Human-Machine Interface (HMI)

- 5.2.1.5 Process Safety Systems

- 5.2.1.6 Valves and Actuators

- 5.2.1.7 Electric Motors

- 5.2.1.8 Sensors and Transmitters

- 5.2.2 Software

- 5.2.2.1 Advanced Process Control (ARC, MVC, Inferential)

- 5.2.2.2 Data Analytics and Reporting

- 5.2.2.3 Manufacturing Execution Systems (MES)

- 5.2.2.4 Other Software

- 5.2.1 Hardware

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Mode

- 5.4.1 On-Premises

- 5.4.2 Cloud and Edge

- 5.5 By End-user Industry

- 5.5.1 Oil and Gas

- 5.5.2 Chemical and Petrochemical

- 5.5.3 Power and Utilities

- 5.5.4 Water and Wastewater

- 5.5.5 Food and Beverage

- 5.5.6 Pulp and Paper

- 5.5.7 Pharmaceutical

- 5.5.8 Other End-user Industry

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market overview, core segments, financials, strategy, market share, products and services, recent developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 Schneider Electric SE

- 6.4.4 General Electric Company

- 6.4.5 Rockwell Automation, Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Honeywell International Inc.

- 6.4.9 Omron Corporation

- 6.4.10 Fuji Electric Co., Ltd.

- 6.4.11 Delta Electronics, Inc.

- 6.4.12 Yokogawa Electric Corporation

- 6.4.13 Phoenix Contact GmbH & Co. KG

- 6.4.14 Bosch Rexroth AG

- 6.4.15 Beckhoff Automation GmbH & Co. KG

- 6.4.16 Festo SE & Co. KG

- 6.4.17 Endress+Hauser Group Services AG

- 6.4.18 Aspen Technology, Inc.

- 6.4.19 AVEVA Group plc

- 6.4.20 Azbil Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Investment Analysis