PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906933

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906933

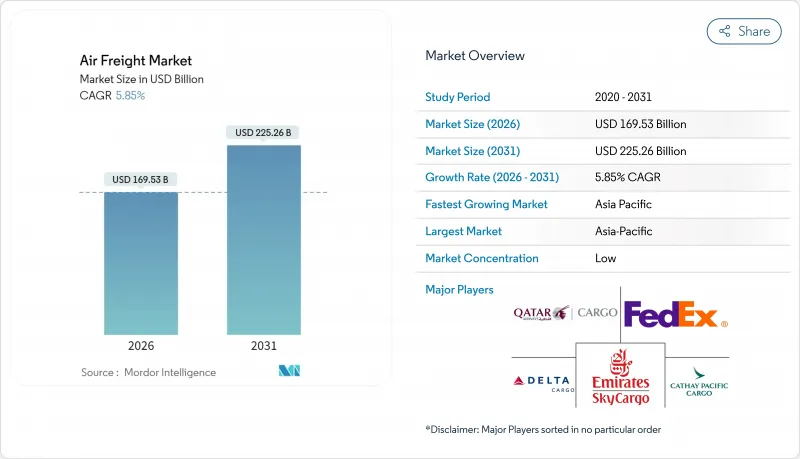

Air Freight - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Air Freight Market was valued at USD 160.17 billion in 2025 and estimated to grow from USD 169.53 billion in 2026 to reach USD 225.26 billion by 2031, at a CAGR of 5.85% during the forecast period (2026-2031).

Rising cross-border e-commerce volumes, ongoing supply-chain reconfiguration, and pharmaceutical cold-chain needs are the primary forces behind this expansion. Airlines are rebalancing capacity toward specialized cargo, while passenger-to-freighter conversions support additional lift. Regulatory momentum on sustainable aviation fuel and dynamic pricing adoption is reshaping cost structures, yet overall demand remains resilient. Consolidation among forwarders and integrators indicates that scale, network depth, and technology are critical to sustaining competitive advantage in the air freight market.

Global Air Freight Market Trends and Insights

Expanding Cross-Border E-Commerce Shipments

Cross-border online retail is accelerating smaller, more frequent shipments that favor air freight's speed advantage. Airlines are reconfiguring belly capacity and scheduling extra freighter frequencies to support marketplaces that promise three-to-five-day delivery. New trans-Pacific routes connecting production zones in Asia with fulfillment centers in Mexico and the United States have emerged, deepening network density and boosting load factors. Streamlined customs processes and electronic documentation shorten clearance times, protecting service reliability. Continuous retail promotion cycles create highly volatile but generally upward-trending demand that underpins the growth of the air freight market.

Accelerated Supply-Chain Needs for High-Tech Electronics

Semiconductor producers in Southeast Asia and Mexico now fly critical components to final assembly lines to support just-in-time manufacturing. Payloads often contain high-value microchips whose weight-to-value ratio justifies premium air charges. Airlines have introduced specialized handling protocols that mitigate static, vibration, and humidity risks, protecting product integrity. Near-shoring from China to Mexico creates shorter, higher-frequency lanes that reshape hub structures and favor narrow-body aircraft conversions. These dynamics reinforce the strategic role of the air freight market in electronics supply continuity.

Volatile Fuel Prices & Surcharges

Jet fuel accounts for more than 25% of operating costs. Airlines publish monthly surcharge tables pegged to spot kerosene prices, transferring volatility to shippers. Sustainable aviation fuel blends, mandated in the EU from 2025, cost two to three times traditional Jet-A-1 and add further upward pressure. Some carriers introduce route-specific "green" fees to recover incremental expenses, which can erode price-sensitive demand. Effective fuel hedging and energy-efficient fleet renewal are vital to protecting margins in the air freight market.

Other drivers and restraints analyzed in the detailed report include:

- Global Pharmaceutical Cold-Chain Demand

- Resumption of Trade & Near-Shoring Urgency

- Aviation-Emission Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Freight Forwarding 44.50% of 2025 revenue, reflecting complex multi-modal coordination needs, though its growth pace lags the broader air freight market at 3.74%. Many forwarders now offer digital booking portals and customs engines that deepen client retention. The Freight Transport sub-segment, covering dedicated cargo flights and courier-express-parcel lift, is growing at a 5.02% CAGR, outpacing forwarding as shippers seek direct carrier relationships. Market entrants leveraging asset-light virtual airlines and block-space agreements chip away at incumbent share, yet full-service forwarders maintain relevance through value-added visibility and insurance.

Digitalization blurs historic boundaries: integrated carriers expand brokerage desks, while forwarders charter freighters during capacity crunches. Larger shippers demand end-to-end control, pushing providers toward vertical integration. These shifts encourage competitive differentiation in technology, network reach, and specialized handling that underpins the sustained expansion of the air freight market.

International traffic represented 83.50% of 2025 tonnage, benefiting from global trade flows and wide-body aircraft economics. Long-haul lanes from Asia-Pacific to North America and Europe generate high load factors and premium yields. However, domestic air freight's 5.43% CAGR exceeds international growth as regionalization drives short-haul replenishment between near-shored factories and consumption centers. E-commerce same-day and next-day promises accelerate dedicated domestic freighter networks, particularly in China, India, and the United States.

Regulatory simplicity, predictable schedules, and rising express parcel penetration support domestic lanes. Airlines redeploy older narrow-body conversions to shuttle goods between secondary cities, improving aircraft utilization. The complementary nature of these flows supports balanced fleet strategies and cushions macro-volatility, reinforcing the broad-based health of the air freight market.

The Air Freight Market Report is Segmented by Service (Freight Transport, Freight Forwarding, and More), Destination (Domestic and International), Carrier Type (Belly Cargo and Freighter), Cargo Type (General Cargo and Special Cargo), End-User Industry (E-Commerce & Retail, Manufacturing & Automotive, and More), Geography (North America, Asia-Pacific, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated 2025 with 40.70% revenue and is expected to post a 5.72% CAGR (2026-2031), reflecting dense manufacturing ecosystems, rapid consumer spending growth, and expanding intra-regional express networks. Strategic hubs in Singapore, Hong Kong, and Incheon interlink secondary production centers, boosting connectivity and network redundancy. Government incentives for near-term capacity growth at Indian and Southeast Asian airports further elevate regional significance.

North America is a significant contributor, supported by resilient domestic parcel demand and Mexico-driven near-shoring. United States regulatory relief on slot usage amid staffing shortages safeguards service continuity at major gateways. Bilateral trade levels underpin balanced CTKs, enhancing structural utilization and supporting the long-term health of the air freight market.

Europe and the Middle East present contrasting outlooks. European carriers face cost pressure from carbon compliance but benefit from a high-value export mix and strong pharmaceutical flows. Middle Eastern hubs exploit geographic proximity among three continents, achieving robust transshipment traffic. Africa and South America remain smaller yet demonstrate opportunity in resource-driven demand and growing e-commerce penetration.

- FedEx Corporation

- Emirates SkyCargo

- Qatar Airways Cargo

- Delta Cargo

- Cathay Pacific Cargo

- DHL Supply Chain & Global Forwarding

- UPS Supply Chain Solutions

- Etihad Cargo

- All Nippon Airways Cargo

- Lufthansa Cargo

- Korean Air Cargo

- United Cargo

- American Airlines Cargo

- Kuehne + Nagel

- CEVA Logistics

- DSV

- Expeditors

- Sinotrans

- Hellmann Worldwide Logistics

- Kintetsu World Express

- AirBridgeCargo Airlines

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding cross-border e-commerce shipments

- 4.2.2 Accelerated supply-chain needs for high-tech electronics

- 4.2.3 Global pharmaceutical cold-chain demand

- 4.2.4 Resumption of trade & near-shoring urgency

- 4.2.5 Cargo-dedicated narrow-body conversions

- 4.2.6 AI-driven dynamic pricing adoption

- 4.3 Market Restraints

- 4.3.1 Volatile fuel prices & surcharges

- 4.3.2 Aviation-emission regulations

- 4.3.3 Airport slot constraints at secondary hubs

- 4.3.4 Shortage of certified ground-handling labour

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Air-Freight Rates Analysis

- 4.8 Heavy Cargo / Project-Logistics Spotlight

- 4.9 Ground-Handling Equipment Insights

- 4.10 Dangerous-Goods Safety Standards Review

- 4.11 Cold-Chain Logistics in Air Cargo

- 4.12 Porter's Five Forces

- 4.12.1 Threat of New Entrants

- 4.12.2 Bargaining Power of Buyers

- 4.12.3 Bargaining Power of Suppliers

- 4.12.4 Threat of Substitutes

- 4.12.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Freight Transport (Cargo/CEP)

- 5.1.2 Freight Forwarding

- 5.1.3 Other Value-Added Services (Customs brokerage, insurance, etc.)

- 5.2 By Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 By Carrier Type

- 5.3.1 Belly Cargo

- 5.3.2 Freighter

- 5.4 By Cargo Type

- 5.4.1 General Cargo

- 5.4.2 Special Cargo

- 5.5 By End-User Industry

- 5.5.1 E-commerce & Retail

- 5.5.2 Manufacturing & Automotive

- 5.5.3 Healthcare & Pharmaceuticals

- 5.5.4 Perishables & Fresh Produce

- 5.5.5 High-Tech & Electronics

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share, Products & Services, Recent Developments)

- 6.4.1 FedEx Corporation

- 6.4.2 Emirates SkyCargo

- 6.4.3 Qatar Airways Cargo

- 6.4.4 Delta Cargo

- 6.4.5 Cathay Pacific Cargo

- 6.4.6 DHL Supply Chain & Global Forwarding

- 6.4.7 UPS Supply Chain Solutions

- 6.4.8 Etihad Cargo

- 6.4.9 All Nippon Airways Cargo

- 6.4.10 Lufthansa Cargo

- 6.4.11 Korean Air Cargo

- 6.4.12 United Cargo

- 6.4.13 American Airlines Cargo

- 6.4.14 Kuehne + Nagel

- 6.4.15 CEVA Logistics

- 6.4.16 DSV

- 6.4.17 Expeditors

- 6.4.18 Sinotrans

- 6.4.19 Hellmann Worldwide Logistics

- 6.4.20 Kintetsu World Express

- 6.4.21 AirBridgeCargo Airlines

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment