PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906946

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906946

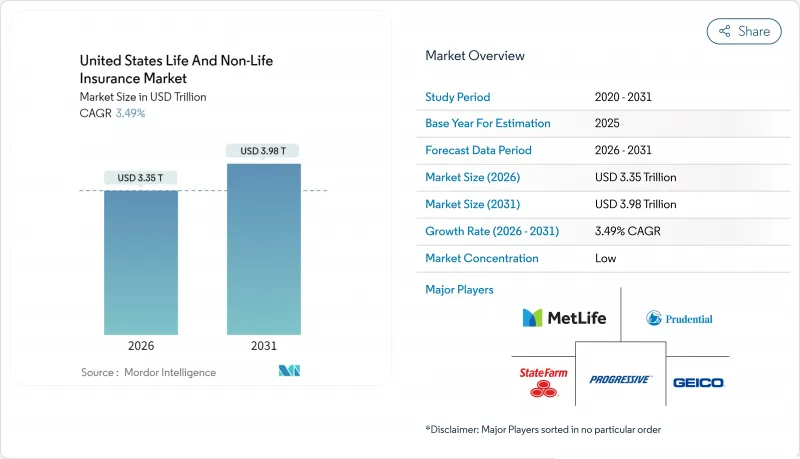

United States Life And Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States life and non-life insurance market was valued at USD 3.239 trillion in 2025 and estimated to grow from USD 3.35 trillion in 2026 to reach USD 3.98 trillion by 2031, at a CAGR of 3.49% during the forecast period (2026-2031).

The measured expansion comes from population aging, digital distribution adoption, and product innovation that collectively offset catastrophe-loss volatility. Non-life coverage holds a dominant position because of widespread property and liability exposures, yet life insurance is expanding faster as retirement-income gaps widen. Digitalization compresses operating costs and allows direct-to-consumer platforms to win share without sacrificing underwriting discipline. Carriers that combine telematics, embedded protection, and advanced climate modeling are positioned to capture incremental demand while maintaining prudent capital buffers.

United States Life And Non-Life Insurance Market Trends and Insights

Aging Population & Retirement-Savings Gap

The convergence of a rising median age and inadequate nest eggs fuels stronger demand for annuities and permanent life policies. Employee Benefit Research Institute reported that 57% of workers held under USD 25,000 in retirement savings in 2025, underscoring a sizable income shortfall. Roughly 10,000 citizens turn 65 each day, and many seek guaranteed lifetime income products that life insurers already manufacture at scale. The passage of the SECURE Act 2.0 allows employers to embed annuities in defined-contribution plans, broadening workplace distribution. Younger savers also show interest in private solutions as trust in Social Security benefits continues to fall, reinforcing the long runway for life coverage growth.

Escalating Healthcare Costs & Privatization

Medical spending and premium growth have exceeded overall inflation for several years. Medicare Advantage enrollment surpassed half of all eligible beneficiaries during 2025, pushing more public healthcare dollars through private insurers. Medicaid managed-care contracts now govern benefits for nearly three-quarters of recipients, delivering predictable fee streams to carriers. Employers react to cost pressure by shifting workers into high-deductible plans paired with supplemental insurance, prompting new product development around gap coverage. Collectively, these factors expand the addressable opportunity for both life and non-life writers that can combine health, disability, and long-term care solutions.

Catastrophe-Loss Volatility & Reinsurance Inflation

The National Oceanic and Atmospheric Administration recorded 27 weather events with at least USD 1.0 billion in damage during 2024, the second-highest tally on record. Higher frequency of secondary perils led to double-digit price hikes at the January 2025 reinsurance renewals. Several Florida property carriers entered rehabilitation due to surplus erosion and hinged on state-backed reinsurance facilities to remain solvent. Primary insurers hold more risk on balance sheets following a capacity pullback, which constrains new policy issuance in high-hazard ZIP codes. Rate adequacy remains uncertain because loss experience has begun to outpace historical models.

Other drivers and restraints analyzed in the detailed report include:

- Usage-Based & Telematics Motor Insurance

- Accelerated Digital Distribution & Insurtech

- Persistently Low Real Interest Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The United States life and non-life insurance market size for life products is projected to climb at a 5.16% CAGR, whereas non-life maintains a larger premium base. Life expansion comes from annuities placed in workplace plans and individual policies designed to close the retirement-income gap. Deferred income annuities with guaranteed withdrawal benefits attract aging baby boomers who seek stable cash flows. Younger families increasingly choose simplified-issue term policies sold through mobile applications, reducing underwriting cycle times. Meanwhile, non-life performance relies on sound pricing discipline in property, auto, and liability lines amid catastrophe cost pressure.

In non-life, motor remains the biggest contributor but faces premium erosion once autonomous features reduce accident frequency. Property insurers implement deductibles and coverage caps in wildfire-exposed regions, which shifts certain risks to policyholders. Cyber liability premiums rise sharply as ransomware attacks plague businesses of all sizes. Health premiums advance in lockstep with medical cost inflation and the expansion of Medicare Advantage enrollment. Liability coverage benefits from heightened litigation intensity that pushes demand for higher limits across corporate buyers.

The United States Life and Non-Life Insurance Market Report is Segmented by Insurance Type (Life Insurance, Non-Life Insurance), Customer Segment (Retail, Corporate), Distribution Channel (Brokers, Agents, Banks, Direct Sales, Other Channels), and Geography (Northeast, Midwest, South, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MetLife

- Prudential Financial

- New York Life

- Northwestern Mutual

- MassMutual

- State Farm

- Allstate

- Progressive

- GEICO (Berkshire Hathaway)

- USAA

- Liberty Mutual

- Travelers

- Chubb

- AIG

- Nationwide

- Farmers Insurance

- Guardian Life

- Principal Financial

- Lincoln National

- UnitedHealth Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging population & retirement-savings gap

- 4.2.2 Escalating healthcare costs & privatization

- 4.2.3 Usage-based & telematics motor insurance

- 4.2.4 Accelerated digital distribution & insurtech

- 4.2.5 Climate-risk modeling enables new property products

- 4.2.6 Embedded insurance via fintech & e-commerce

- 4.3 Market Restraints

- 4.3.1 Catastrophe-loss volatility & reinsurance inflation

- 4.3.2 Persistently low real interest rates

- 4.3.3 Capital strain from LDTI accounting changes

- 4.3.4 Actuarial & data-science talent shortages

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.2 Non-Life Insurance

- 5.1.2.1 Motor Insurance

- 5.1.2.2 Health Insurance

- 5.1.2.3 Property Insurance

- 5.1.2.4 Liability Insurance

- 5.1.2.5 Other Insurance

- 5.2 By Customer Segment

- 5.2.1 Retail

- 5.2.2 Corporate

- 5.3 By Distribution Channel

- 5.3.1 Brokers

- 5.3.2 Agents

- 5.3.3 Banks

- 5.3.4 Direct Sales

- 5.3.5 Other Channels

- 5.4 By Region

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 South

- 5.4.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 MetLife

- 6.4.2 Prudential Financial

- 6.4.3 New York Life

- 6.4.4 Northwestern Mutual

- 6.4.5 MassMutual

- 6.4.6 State Farm

- 6.4.7 Allstate

- 6.4.8 Progressive

- 6.4.9 GEICO (Berkshire Hathaway)

- 6.4.10 USAA

- 6.4.11 Liberty Mutual

- 6.4.12 Travelers

- 6.4.13 Chubb

- 6.4.14 AIG

- 6.4.15 Nationwide

- 6.4.16 Farmers Insurance

- 6.4.17 Guardian Life

- 6.4.18 Principal Financial

- 6.4.19 Lincoln National

- 6.4.20 UnitedHealth Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment