PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906972

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906972

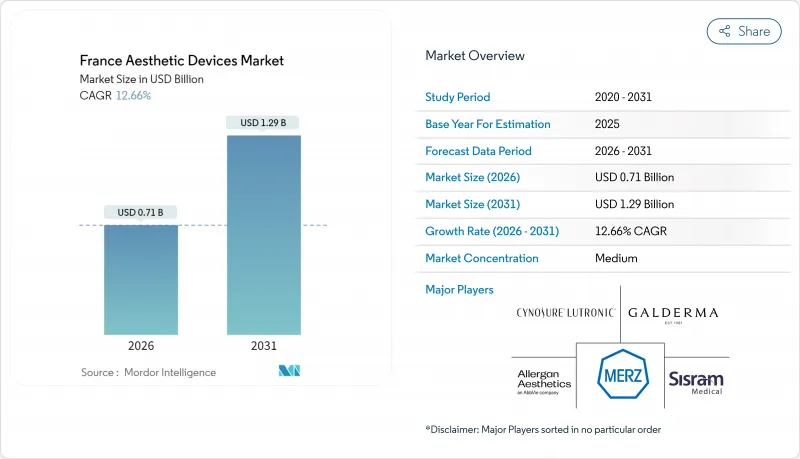

France Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

France Aesthetic Devices Market size in 2026 is estimated at USD 0.71 billion, growing from 2025 value of USD 0.63 billion with 2031 projections showing USD 1.29 billion, growing at 12.66% CAGR over 2026-2031.

That pace reflects the convergence of demographic shifts toward younger consumers, rapid device innovation and strong demand for minimally invasive procedures. Robust purchasing by clinics, backed by French millennials' willingness to pay for subtle "tweakments," is reinforcing premium pricing power. At the same time, the migration of multi-modal platforms, radiofrequency, ultrasound, and photobiomodulation in a single console enables providers to boost utilization while managing capital budgets. Home-use LEDs and low-level laser systems are scaling quickly as consumers adopt maintenance routines between clinic visits. Regulatory vigilance by ANSM and the newly added Afnor Certification notified body has increased the cost of compliance, but also elevated clinical confidence among patients and payers.

France Aesthetic Devices Market Trends and Insights

Rising Popularity of Minimally Invasive Injectables Among French Millennials

Disposable income and social-media transparency have aligned to propel injectables uptake among 15- to 34-year-olds, a group showing a 56% procedure surge between 2019 and 2023. ANSM's 2024 data confirm that botulinum toxin and hyaluronic acid fillers remain the first choice for natural-looking corrections, especially in Paris, Lyon and Marseille. Clinic chains respond with curated "tweakment" packages that align with the French preference for subtle enhancements. Providers also report higher follow-up compliance when patients view injectables as routine self-care. The generational shift sustains high visit frequency and lifts overall France aesthetic devices market adoption.

Expansion of Advanced Combination Devices in Aesthetic Clinics

Clinics increasingly prefer platforms that merge radiofrequency, ultrasound and LED modules into one cart. The Genesis SmartDrivity system, for instance, offers 44 preset programs for skin tightening and body contouring, reducing device downtime while expanding the menu of procedures. BTL's Exion Face Body delivers synchronized RF and ultrasound to stimulate collagen and hyaluronic acid with results lasting up to one year, making it a popular upsell in premium practices. Such versatility is crucial in a market where each dermatologist must maximize throughput amid workforce shortages. Combination consoles also future-proof capital investments against fast-moving technology cycles.

Escalating Litigation Risk Over Filler Complications

ANSM recorded eight severe botulism cases linked to illegal botulinum toxin injections between August and September 2024, prompting mandatory prescriptions for hyaluronic acid fillers from July 2024. Systematic reviews show 37% of nonpermanent filler adverse events are severe, often involving vascular occlusion in high-risk zones such as the glabella. Litigation costs and reputational damage deter some practitioners from expanding injectable services. Clinics respond by adopting ultrasound-guided injection protocols and securing higher malpractice coverage, adding overhead that tempers growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Social-Media Influence on Facial Aesthetics

- AI-Based Skin Analysis Tools Driving Clinic Conversion

- Inflation-Led Cut in Discretionary Beauty Spending

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-energy systems accounted for 51.48% of the 2025 France aesthetic devices market, propelled by sustained demand for neuromodulators and cross-linked dermal fillers that deliver subtle, natural-looking outcomes. Botulinum toxin remains the gold standard, with AbbVie's Botox capturing roughly 60% of segment revenue, while Galderma and Merz accelerate share gains via novel peptide-stabilized formulas. Chemical peels and mesotherapy kits also rebounded as clinics diversified beyond injectables to combat service commoditization.

Radiofrequency consoles represent the fastest-growing energy category, projected to post a 18.92% CAGR through 2031. Hands-free applicators embedded with thermoregulation sensors minimize operator fatigue and ensure uniform heating, driving provider confidence in predictable outcomes. Laser and IPL systems continue to serve hair-removal and pigmentation niches but face competitive pricing pressure. Meanwhile, ultrasound-based lipolysis and cryolipolysis devices occupy emerging slots in clinic menus, aided by improved safety certifications under EU MDR 2017/745.

The France Aesthetic Devices Market Report is Segmented by Device Type (Energy-Based Devices, Non-Energy-Based Devices), Application (Skin Resurfacing & Tightening, Body Contouring & Cellulite Reduction, Hair Removal, Tattoo & Pigmentation Removal, Breast Augmentation, Acne & Scar Treatment, and More), and End User (Hospitals, Aesthetic Clinics, Other End Users). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbvie

- Ipsen

- Galderma

- Merz Pharma

- Sinclair Pharma

- Teoxane Laboratories

- Bioxis Pharmaceuticals

- Dermaceutic Laboratoire

- Laboratoires Expanscience

- Johnson & Johnson (Mentor/Neostrata)

- Croma Pharma GmbH

- Laboratoires Vivacy

- Cutera

- Candela Medical

- Cynosure LLC

- Venus Concept Inc.

- BTL

- Alma Lasers (Sisram Medical)

- L'Oreal Group (Active Cosmetics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Popularity of Minimally-Invasive Injectables Among French Millennials

- 4.2.2 Expansion of Advanced Combination Devices in Aesthetic Clinics

- 4.2.3 Growing Social-Media Influence on Facial Aesthetics

- 4.2.4 EU Medical-Tourism Inflow for Cost-Effective Treatments

- 4.2.5 Surge In Demand for "Tweakments" Aligned with Discreet French Aesthetics

- 4.2.6 AI-Based Skin Analysis Tools Driving Clinic Conversion

- 4.3 Market Restraints

- 4.3.1 Lengthy ANSM Approval Cycles for New Fillers & Toxins

- 4.3.2 Escalating Litigation Risk Over Filler Complications

- 4.3.3 Inflation-Led Cut in Discretionary Beauty Spending

- 4.3.4 Retirement-Driven Shortage of Cosmetic Dermatologists

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Device Type

- 5.1.1 Energy-based Devices

- 5.1.1.1 Laser-based

- 5.1.1.2 Light-based (IPL)

- 5.1.1.3 Radio-frequency-based

- 5.1.1.4 Ultrasound-based

- 5.1.1.5 Cryolipolysis & Plasma-based

- 5.1.2 Non-energy-based Devices

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers & Threads

- 5.1.2.3 Chemical Peels

- 5.1.2.4 Microdermabrasion

- 5.1.2.5 Implants

- 5.1.2.6 Mesotherapy & Others

- 5.1.1 Energy-based Devices

- 5.2 By Application

- 5.2.1 Skin Resurfacing & Tightening

- 5.2.2 Body Contouring & Cellulite Reduction

- 5.2.3 Hair Removal

- 5.2.4 Tattoo & Pigmentation Removal

- 5.2.5 Breast Augmentation

- 5.2.6 Acne & Scar Treatment

- 5.2.7 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Aesthetic Clinics

- 5.3.3 Home-use Settings

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 AbbVie Inc. (Allergan Aesthetics)

- 6.3.2 Ipsen Pharma

- 6.3.3 Galderma SA

- 6.3.4 Merz Pharma GmbH & Co. KGaA

- 6.3.5 Sinclair Pharma PLC

- 6.3.6 Teoxane Laboratories

- 6.3.7 Bioxis Pharmaceuticals

- 6.3.8 Dermaceutic Laboratoire

- 6.3.9 Laboratoires Filorga

- 6.3.10 Johnson & Johnson (Mentor/Neostrata)

- 6.3.11 Croma Pharma GmbH

- 6.3.12 Laboratoires Vivacy

- 6.3.13 Cutera Inc.

- 6.3.14 Candela Medical

- 6.3.15 Cynosure LLC

- 6.3.16 Venus Concept Inc.

- 6.3.17 BTL Industries

- 6.3.18 Alma Lasers (Sisram Medical)

- 6.3.19 L'Oreal Group (Active Cosmetics)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment