PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906977

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906977

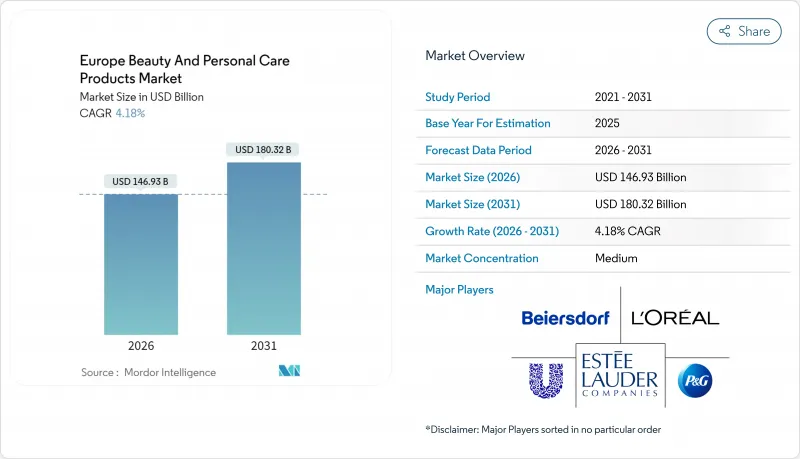

Europe Beauty And Personal Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe beauty and personal care products market is expected to grow from USD 141.03 billion in 2025 to USD 146.93 billion in 2026 and is forecast to reach USD 180.32 billion by 2031 at 4.18% CAGR over 2026-2031.

As online retail leverages data-driven personalization to boost margins, trends like premiumisation, natural-ingredient reformulations, and stringent sustainability laws are redefining value creation. Germany commands a substantial 15.83% share of the revenue pie, driven by its strong consumer base, robust infrastructure, and established market players. The United Kingdom also reflects its evolving market dynamics, increased focus on innovation, and adaptation to post-Brexit challenges. With a microplastics ban set to roll out by 2029, clean-label claims are gaining traction, steering brands towards vegetable-oil-based actives and promoting refillable packaging to meet consumer demand for sustainable and eco-friendly solutions. Annual losses of EUR 3 billion from counterfeits are significantly eroding consumer trust, prompting industry players to adopt advanced technologies like blockchain tagging and QR-based tracking. These measures aim to enhance supply chain transparency, ensure product authenticity, and rebuild consumer confidence in the market.

Europe Beauty And Personal Care Products Market Trends and Insights

Premiumization outpacing mass-market growth

In Europe, premium beauty and personal care lines are outpacing the overall market growth nearly twofold. Consumers now view high-performance formulations as everyday essentials rather than mere indulgences, driven by a growing preference for products that deliver tangible results. Products with dermatological validation and wellness-oriented claims command a higher price, as they align with the increasing consumer focus on health and self-care. This trend is exemplified by Beiersdorf's record sales of EUR 9.9 billion in 2024, largely fueled by innovations in its Eucerin skincare line, which combines scientific research with advanced formulations. Major multinationals are shifting their focus and capital towards prestige portfolios to capitalize on this demand. A case in point is Unilever's acquisition of Dr. Squatch, coupled with its ambition to elevate the premium segment's contribution to the group's turnover to 50%. Furthermore, brand equity, bolstered by clinical data and unique delivery systems, remains robust even amidst the prevailing cost-of-living challenges, as consumers prioritize quality and efficacy over cost.

Surge in online D2C and marketplaces

In 2024, 77% of EU residents shopped online, with cosmetics accounting for 20% of those purchases. The Netherlands leads with a 94% penetration rate, highlighting the country's swift embrace of digital beauty trends driven by high internet penetration, advanced e-commerce infrastructure, and consumer preference for convenience. Direct-to-consumer (D2C) platforms empower brands to gather zero-party data, such as customer preferences, purchase behavior, and feedback, enabling them to adjust product assortments on the fly, launch targeted marketing campaigns, and maintain gross margins that were once surrendered to brick-and-mortar retailers. Additionally, AI-driven shade-matching and virtual try-on features not only minimize returns by helping customers make more accurate selections but also enhance the overall shopping experience. These tools build consumer confidence in online purchases, ultimately driving higher sales conversions, fostering brand loyalty, and positioning brands to better compete in an increasingly digital marketplace.

Counterfeit and grey-market channels

In 2023, EU customs confiscated 152 million counterfeit items, collectively valued at a staggering EUR 3.4 billion. Notably, beauty and personal care products ranked among the top five categories affected, highlighting the vulnerability of this market to counterfeit activities. France bore a significant brunt, witnessing an EUR 800 million dip in legitimate cosmetics turnover. This substantial loss has not only impacted the nation's economy but also eroded consumer confidence in e-commerce platforms, where product authentication processes remain inadequate and opaque. The prevalence of counterfeit goods in online marketplaces has made it increasingly difficult for consumers to distinguish genuine products from fake ones, further exacerbating the issue. Furthermore, premium stock-keeping units (SKUs) have become prime targets for counterfeiters due to their higher profit margins, jeopardizing brand equity, inflating warranty expenses, and forcing companies to allocate additional resources to combat counterfeiting activities.

Other drivers and restraints analyzed in the detailed report include:

- Preference for clean and microbiome-friendly formulations

- Age-inclusive "skinification" of hair-care

- Retailer private-label price pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, personal care dominated Europe's beauty and personal care landscape, accounting for 86.72% of total sales. This segment maintained a forward CAGR, demonstrating resilience as hygiene staples remain non-discretionary even during economic slowdowns. Within personal care, skin care emerged as the largest subcategory, valued at EUR 27.7 billion, fueled by rising demand for anti-aging solutions, treatments for hyperpigmentation, and products supporting barrier repair. Hair care followed closely, generating EUR 16.8 billion in revenue, supported by innovations such as scalp serums and sulfate-free cleansing bars. Oral care also benefited from a growing preventive-health mindset, further reinforcing personal care's dominance. Mass-priced bath and shower products continued to secure steady baseline volumes, while sustainable packaging formats like refillable pouches and solid bars helped improve margins without sacrificing accessibility.

Within cosmetics, the segment recorded the fastest CAGR of 5.07%, driven by strong consumer demand for makeup and color cosmetics innovations. This growth reflects rising interest in premium formulations, multifunctional products, and inclusive shade ranges catering to diverse skin tones. Fragrance lines and color cosmetics benefited from trend-driven launches, social media influence, and increased digital engagement, further accelerating adoption. The momentum is also supported by targeted innovations in skincare-infused makeup and long-lasting formulations, creating opportunities for brands to capture value while meeting evolving consumer preferences.

In 2025, mass beauty and personal care products dominated the European market, accounting for 66.20% of total turnover. These offerings cater to a broad consumer base with accessible price points while maintaining strong quality standards, ensuring they remain staples in daily routines. Mass skin care, hair care, and bath and shower products continued to secure steady volumes, driven by demand for essential hygiene and grooming solutions. Brands are increasingly leveraging value packs, multi-use products, and sustainable packaging formats such as refillable pouches and solid bars to combine affordability with functionality.

Despite their already significant presence, premium products are set to be the market's fastest-growing segment, boasting a projected CAGR of 5.03% through 2031. This growth trajectory positions premium lines to account for half of all incremental industry revenue during this period, underscoring their pivotal role in market expansion. This surge is driven by consumers opting for performance-driven formulations and long-term benefits in essential skin care, even as they navigate cost-of-living challenges. While shoppers economize in certain beauty categories, they remain committed to high-efficacy premium skin-care items. Furthermore, luxury fragrance refill initiatives not only resonate with sustainability trends but also fortify brand loyalty, fostering an emotional bond that fuels growth. As mass-market segments wane either due to cautious spending or a shift to upgraded supermarket options, premium's innovation-led approach positions it for a swift ascent, outpacing all other market segments.

The Europe Beauty and Personal Care Market Report is Segmented by Product Type (Personal Care, Cosmetics/Makeup Products), Category (Premium Products, Mass Products), Ingredient Type (Natural and Organic, Conventional/Synthetic), Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, and More), and Geography (Germany, United Kingdom, France, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal S.A.

- Unilever PLC

- The Procter & Gamble Co.

- Estee Lauder Companies Inc.

- Beiersdorf AG

- Shiseido Co. Ltd.

- Natura & Co.

- Colgate-Palmolive Co.

- Coty Inc.

- Henkel AG & Co. KGaA

- LVMH Mot Hennessy Louis Vuitton SE

- Johnson & Johnson Consumer Health

- KAO Corp.

- L'Occitane International SA

- Puig SL

- Oriflame Holding AG

- Wella Professionals

- Interparfums SA

- Amway Corp

- Groupe Clarins

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumisation outpacing mass-market growth

- 4.2.2 Surge in online D2C and marketplaces

- 4.2.3 Preference for clean and micro-biome-friendly formulations

- 4.2.4 Age-inclusive skinification" of hair-care (under-the-radar)"

- 4.2.5 AI-powered hyper-personalisation tools (under-the-radar)

- 4.2.6 Increased awareness about oral hygiene among consumers

- 4.3 Market Restraints

- 4.3.1 Counterfeit and grey-market channels

- 4.3.2 Retailer private-label price pressure

- 4.3.3 Fragmented eco-label regulations (under-the-radar)

- 4.3.4 High manufacturing costs and raw material expenses limit market

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Personal Care

- 5.1.1.1 Hair Care

- 5.1.1.1.1 Shampoo

- 5.1.1.1.2 Conditioner

- 5.1.1.1.3 Hair Colorant

- 5.1.1.1.4 Hair Styling Products

- 5.1.1.1.5 Others

- 5.1.1.2 Skin Care

- 5.1.1.2.1 Facial Care Products

- 5.1.1.2.2 Body Care Products

- 5.1.1.2.3 Lip and Nail Care Products

- 5.1.1.3 Bath and Shower

- 5.1.1.3.1 Shower Gels

- 5.1.1.3.2 Soaps

- 5.1.1.3.3 Others

- 5.1.1.4 Oral Care

- 5.1.1.4.1 Toothbrush

- 5.1.1.4.2 Toothpaste

- 5.1.1.4.3 Mouthwashes and Rinses

- 5.1.1.4.4 Others

- 5.1.1.5 Men's Grooming Products

- 5.1.1.6 Deodorants and Antiperspirants

- 5.1.1.7 Perfumes and Fragrances

- 5.1.1.1 Hair Care

- 5.1.2 Cosmetics/Makeup Products

- 5.1.2.1 Facial Cosmetics

- 5.1.2.2 Eye Cosmetics

- 5.1.2.3 Lip and Nail Makeup Products

- 5.1.1 Personal Care

- 5.2 Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 Ingredient Type

- 5.3.1 Natural and Organic

- 5.3.2 Conventional/Synthetic

- 5.4 Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Pharmacies/Drug Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Channels

- 5.5 By Geography

- 5.5.1 Europe

- 5.5.1.1 Germany

- 5.5.1.2 United Kingdom

- 5.5.1.3 France

- 5.5.1.4 Italy

- 5.5.1.5 Spain

- 5.5.1.6 Russia

- 5.5.1.7 Netherlands

- 5.5.1.8 Poland

- 5.5.1.9 Belgium

- 5.5.1.10 Sweden

- 5.5.1.11 Rest of Europe

- 5.5.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Unilever PLC

- 6.4.3 The Procter & Gamble Co.

- 6.4.4 Estee Lauder Companies Inc.

- 6.4.5 Beiersdorf AG

- 6.4.6 Shiseido Co. Ltd.

- 6.4.7 Natura & Co.

- 6.4.8 Colgate-Palmolive Co.

- 6.4.9 Coty Inc.

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 LVMH Mot Hennessy Louis Vuitton SE

- 6.4.12 Johnson & Johnson Consumer Health

- 6.4.13 KAO Corp.

- 6.4.14 L'Occitane International SA

- 6.4.15 Puig SL

- 6.4.16 Oriflame Holding AG

- 6.4.17 Wella Professionals

- 6.4.18 Interparfums SA

- 6.4.19 Amway Corp

- 6.4.20 Groupe Clarins

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK