PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906990

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906990

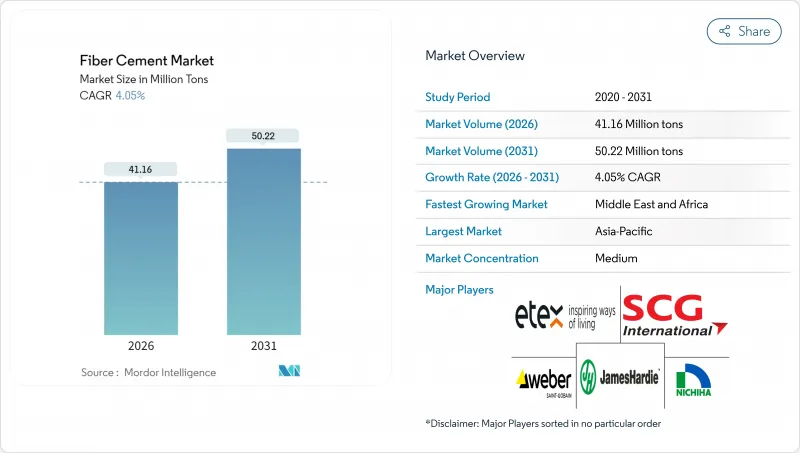

Fiber Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Fiber Cement Market size in 2026 is estimated at 41.16 Million tons, growing from 2025 value of 39.56 Million tons with 2031 projections showing 50.22 Million tons, growing at 4.05% CAGR over 2026-2031.

Robust demand stems from the material's non-combustible nature that eases compliance with stricter fire codes, its superior weather resistance that lowers life-cycle replacement outlays, and design flexibility that satisfies both single-family renovators and large-scale commercial developers. Supply chain partners also recognize fiber cement's ability to bridge the performance gap between wood siding and synthetic substitutes, a factor that underpins resilient volume growth even when broader construction cycles moderate. Building owners favor the product's four-decade service life, while insurers reward non-combustible facades with lower premiums, reinforcing adoption intent in wildfire-prone regions. On the competitive front, leading manufacturers accelerate direct builder agreements that tighten channel control, whereas mid-tier players focus on synthetic fiber innovation and carbon-negative formulations to defend margins.

Global Fiber Cement Market Trends and Insights

Rapid Urbanization and Residential Construction Rebound in Asia-Pacific

Government housing mandates and mega-infrastructure programs stimulate steady fiber cement market demand across China, India, and ASEAN nations. China posted a 66.2% urbanization rate in 2024, adding 14 million urban residents each year, while India is expected to integrate 416 million city dwellers by 2050. Construction permit issuances in Indonesia rose 8.3% during 2024 and Thailand forecasts 4.2% sector growth in 2025 under the Eastern Economic Corridor framework. Harmonized ASEAN fire-safety standards that classify fiber cement as a non-combustible facade option further solidify regional usage. The confluence of demographic shifts, pro-housing policies, and stricter codes secures a multi-year demand runway for the fiber cement market.

Stringent Fire and Acoustic-Performance Building Codes

California's 2024 update to Title 24 now requires Class A exteriors in Wildland-Urban Interface zones covering 4.5 million structures, while Australia's National Construction Code revision applies comparable mandates to 2.8 million dwellings. The 2024 International Building Code tightens acoustic performance benchmarks for multifamily projects, driving adoption of dense facades that limit sound transfer. North Carolina fire-test data show fiber cement exhibits 73% lower ignition probability than wood siding and achieves an 18-decibel noise reduction without extra layers. These regulations elevate fiber cement from premium option to compliance necessity across an expanding set of jurisdictions.

High Initial Installation Cost Versus Vinyl Alternatives

Fiber cement requires USD 8-12 per square foot installed, a 60-100% price premium over vinyl. Labor scarcity in many regions inflates the gap because installers need specialized dust-management tools that add 25-35% to man-hours. Tariff scenarios could raise imported input costs another 6-14%, widening the delta for first-time homebuyers who already represent 32% of 2024 purchases. Cost headwinds are most acute in multifamily projects where developers monetize properties before maintenance bills accrue, reducing willingness to pay for longer-life facades.

Other drivers and restraints analyzed in the detailed report include:

- Lifecycle Cost Advantage Over Wood and Vinyl Siding

- Adoption of Panelized Prefab Facades in Mid-Rise Buildings

- Availability of Substitutes Such as Engineered Wood Siding

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Siding retained 34.75% of 2025 volume, reflecting long-standing use in detached housing and renovation projects where fiber cement's wood-like grain patterns satisfy aesthetic norms. Replacement demand from an aging housing stock cushions volume against cyclical new-build fluctuations, and wide installer familiarity fortifies channel stability. Cladding, however, is set to outpace siding with a 4.52% CAGR through 2031, propelled by stringent fire codes for mid-rise and high-rise structures and the rapid embrace of panelized construction systems. Data center builds and infrastructure megaprojects frequently select non-combustible facades, prompting architects to specify thicker fiber cement cladding panels that withstand extreme temperature swings. Roofing, moulding, and trimming components continue to deliver steady supplemental demand, offering manufacturers cross-selling opportunities that leverage existing color-coating assets. Collectively, this evolving application mix underpins balanced growth drivers across the fiber cement market.

The expansion of cladding narrows the historical gap with siding and encourages suppliers to broaden color palettes and surface textures compatible with contemporary mixed-material aesthetics. Regulatory clarity within the latest International Building Code strengthens this trajectory by codifying performance requirements that favor non-combustible exterior wall assemblies. As developers evaluate total cost and regulatory compliance holistically, fiber cement's rising profile in commercial facades becomes a pivotal growth avenue within the fiber cement market.

The Fiber Cement Market Report is Segmented by Application (Siding, Cladding, Moulding and Trimming, Roofing and Other Applications), End-User Sector (Residential, Commercial, Industrial and Institutional, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 42.45% of 2025 volume thanks to rapid urbanization, supportive housing policies, and region-wide adoption of stricter fire-safety codes. China continues to add 14 million urban residents annually, and India's metro expansions underpin robust permit pipelines. Indonesia's building permits rose 8.3% in 2024, while Thailand projects 4.2% construction growth for 2025 under Eastern Economic Corridor investments exceeding THB 1.7 trillion (USD 47.2 billion). Proximity to cellulose feedstock and developed cement infrastructure yields cost advantages that attract capacity investments throughout the fiber cement market.

North America represents a mature but stable arena where code-driven replacement activity sustains volume. Extensive wildfire exposure in the western United States accelerates siding upgrades to non-combustible alternatives, and insurance incentives bolster homeowner interest. In Canada, a resilient renovation segment offsets moderation in multifamily starts, while Mexico's emerging middle class drives incremental demand for durable facades in mid-rise housing. Continued innovation in prefabricated panels and direct builder contracting further supports North American volume, keeping the region central to global strategy within the fiber cement industry.

Middle East and Africa is set to achieve the fastest regional CAGR of 4.38% through 2031. Saudi Arabia's Vision 2030 megaprojects, including NEOM and The Line, add more than USD 500 billion of construction value, all subject to stringent facade performance criteria. The UAE and Qatar continue infrastructure build-outs, and fire-safety regulations in high-rise clusters favor non-combustible cladding. Climatic extremes in the Gulf place a premium on weather-resistant materials, amplifying fiber cement's appeal. Limited local production capacity may constrain near-term supply, yet joint ventures and plant expansions already announced are aimed at mitigating bottlenecks in this promising slice of the fiber cement market.

- Allura

- American Fiber Cement.

- CSR Limited

- ElEMENTIA MATERIALS, SAB DE CV

- Eterno Ivica S.r.l.

- Etex Group

- Everest

- HIL Limited

- James Hardie Building Products Inc.

- KMEW Co., Ltd.

- Mahaphant Fibre-Cement (South Asia) Pvt. Ltd

- Maxitile Inc.

- NICHIHA

- Ramco Industries Limited

- Renaatus Group

- Saint-Gobain (Weber & Eternit)

- SCG International Corporation

- SHERA Public Company Limited

- Swisspearl Group AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Rapid Urbanisation and Residential Construction Rebound in Asia-Pacific

- 4.1.2 Stringent Fire and Acoustic-Performance Building Codes

- 4.1.3 Lifecycle Cost Advantage Over Wood and Vinyl Siding

- 4.1.4 Adoption of Panelised Prefab Facades in Mid-Rise Buildings

- 4.1.5 Carbon-Negative Cement Formulations Using Cellulose Nanofibers

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Cost Versus Vinyl Alternatives

- 4.2.2 Availability of Substitutes Such as Engineered Wood Siding

- 4.2.3 Fibre-Sourcing Risk Amid Global Pulp-Price Volatility

- 4.3 Value Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 End Use Sector Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Siding

- 5.1.2 Cladding

- 5.1.3 Moulding and Trimming

- 5.1.4 Roofing

- 5.1.5 Other Applications

- 5.2 By End-User Sector

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial and Institutional

- 5.2.4 Infrastructure

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Allura

- 6.4.2 American Fiber Cement.

- 6.4.3 CSR Limited

- 6.4.4 ElEMENTIA MATERIALS, SAB DE CV

- 6.4.5 Eterno Ivica S.r.l.

- 6.4.6 Etex Group

- 6.4.7 Everest

- 6.4.8 HIL Limited

- 6.4.9 James Hardie Building Products Inc.

- 6.4.10 KMEW Co., Ltd.

- 6.4.11 Mahaphant Fibre-Cement (South Asia) Pvt. Ltd

- 6.4.12 Maxitile Inc.

- 6.4.13 NICHIHA

- 6.4.14 Ramco Industries Limited

- 6.4.15 Renaatus Group

- 6.4.16 Saint-Gobain (Weber & Eternit)

- 6.4.17 SCG International Corporation

- 6.4.18 SHERA Public Company Limited

- 6.4.19 Swisspearl Group AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs