PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906992

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906992

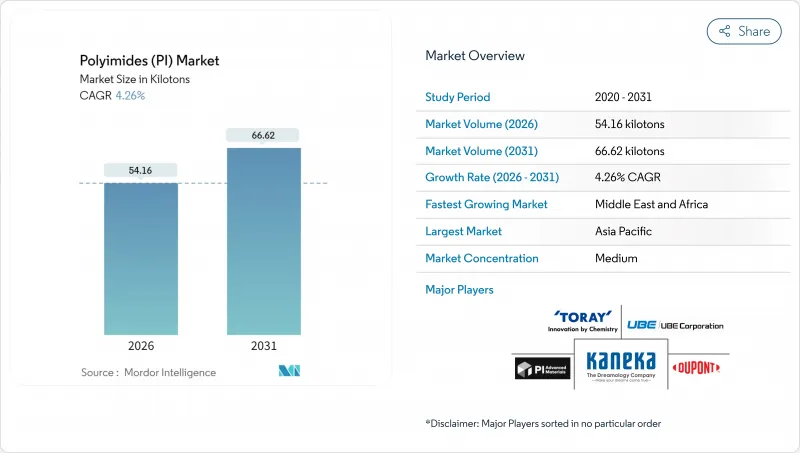

Polyimides (PI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Polyimides market is expected to grow from 51.95 kilotons in 2025 to 54.16 kilotons in 2026 and is forecast to reach 66.62 kilotons by 2031 at 4.26% CAGR over 2026-2031.

Persistent demand from high-performance applications underpins this trajectory. Advanced semiconductor packaging, notably high-bandwidth memory stacks and heterogeneous integration, keeps polyimide films at the center of interlayer dielectric and stress-buffer designs. Electric-vehicle power-train electrification is widening the customer base as 800 V systems favor polyimide dielectrics for insulation stability. Adoption in 5G and early 6G infrastructure is accelerating because low-loss tangent values preserve signal integrity at millimeter-wave frequencies. Space-sector commercialization adds another growth vector as lightweight thermal blankets specify polyimides for durability under extreme temperatures.

Global Polyimides (PI) Market Trends and Insights

Electronics Miniaturization and Foldable-Display Boom

Demand for thinner, lighter portable devices has made polyimide substrates indispensable for next-generation flexible circuits and foldable displays. Samsung testing shows films survive more than 200,000 folds at radii down to 1.4 mm without optical distortion. Automotive cockpits are adopting curved OLED panels that operate safely between -40 °C and 150 °C, again relying on polyimide flexibility. Chiplet-based semiconductor packages likewise benefit because the material's low coefficient of thermal expansion absorbs mechanical stresses that would crack brittle dielectrics. As form-factor innovation continues, the polyimides market gains resilient demand from designers that cannot compromise on thermal or dimensional stability.

EV High-Voltage Insulation Demand Surge

Electric-vehicle platforms now operate above 800 V, pushing traditional insulation materials beyond safe limits. Polyimide films provide dielectric strengths exceeding 250 kV mm-1 and retain that integrity after 1,000 thermal cycles between -40 °C and 200 °C. Tesla integrates polyimide-wrapped copper windings to mitigate partial-discharge failures in traction motors. The shift to silicon-carbide inverters, which run hotter than silicon, further entrenches the need for high-temperature polymer packaging. As battery capacities scale, thermal runaway containment systems also specify polyimide barriers, enhancing long-term growth prospects for the polyimides market.

VOC-Emission Compliance Costs for Solvent Casting

Industrial Emissions Directive thresholds in Europe and SCAQMD rules in California cap volatile organic compound emissions at 20 mg m-3. Solvent-cast polyimide lines using N-methyl-2-pyrrolidone must therefore install regenerative thermal oxidizers costing several million dollars per line. Payback stretches beyond five years, prompting a shift toward water-based imide chemistries. However, production yields remain lower, restraining rapid adoption despite environmental urgency.

Other drivers and restraints analyzed in the detailed report include:

- 5G/6G High-Frequency PCB Adoption

- Space-Sector Lightweight Thermal Shielding Expansion

- Processing Skill Gap Outside East Asia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electrical and electronics applications commanded 36.42% of the polyimides market share in 2025, underscoring the material's historical role in flexible printed circuits and semiconductor packaging. Revenues here will keep expanding as chiplet architectures multiply interconnect layers that rely on thin films. Automotive follows, propelled by electric-vehicle motor insulation and battery thermal barriers. Industrial machinery values chemical resistance in high-temperature seals, while aerospace relies on radiation-resistant laminates.

Other end-user industries accounted for a smaller but faster-growing slice, posting a 5.18% CAGR that will push their contribution to the polyimides market size above 15.6 kilotons by 2031. Building-construction codes specifying flame-retardant facade systems and medical-device makers adopting sterilization-resistant polymers are two visible frontiers. As these applications mature, dependency on consumer electronics will dilute, lowering cyclical risk for the wider polyimides market.

The Polyimides Report is Segmented by End User Industry (Automotive, Electrical and Electronics, Packaging, Industrial and Machinery, Aerospace, Building and Construction, and Other End-User Industries), Form (Film, Resin, Fiber, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific anchored 40.55% of global demand in 2025 and remains the epicenter of flexible-PCB fabrication and foldable-display assembly. China contributes scale, while Japan perfects ultra-low-defect chemistries that feed semiconductor back-end packaging houses. South Korea's display giants sustain large captive consumption. Southeast Asian nations such as Malaysia are absorbing relocation investment from multinational electronics groups, strengthening the regional cluster that underwrites the polyimides market.

North America shows steady but less spectacular volume growth. The region excels in aerospace and defense projects, where flight-qualified films priced at triple commodity levels are commonplace. High-speed network deployments are stimulating local laminate demand. Federal incentives for domestic semiconductor fabs should spur incremental resin off-take, yet talent shortages in specialty polymer processing temper rapid expansion.

Europe's outlook mirrors that of North America. Automotive electrification and offshore wind-turbine inverters adopt polyimide insulation, yet energy prices and stringent VOC rules raise conversion costs. Policymakers are weighing supply-chain autonomy measures that could subsidize new capacity, but near-term reliance on imports persists.

The Middle East and Africa, presently small in absolute tonnage, advances at a 6.05% CAGR as Gulf states diversify into high-tech manufacturing. Large-scale data centers and 5G rollouts demand high-frequency PCBs that favor polyimide cores, and infrastructure modernization pushes cable manufacturers to specify higher-temperature insulations. Investment frameworks remain nascent, so most material is imported, though joint ventures with Asian chemical groups are under negotiation. Over the forecast horizon, the polyimides market may see pilot lines established to tap regional demand.

- Arakawa Chemical Industries,Ltd.

- Arkema

- China Wanda Group

- DUNMORE

- DuPont

- JIAOZUO TIANYI TECHNOLOGY CO.,LTD

- Kaneka Corporation

- Kolon Industries Inc.

- Mitsui Chemicals Inc.

- PI Advanced Materials Co., Ltd.

- Shenzhen Ruihuatai Film Technology Co., Ltd.

- SKC

- Taimide Tech. Inc.

- Toray Industries Inc

- UBE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electronics miniaturisation and foldable-display boom

- 4.2.2 EV high-voltage insulation demand surge

- 4.2.3 5 G/6 G high-frequency PCB adoption

- 4.2.4 Space-sector lightweight thermal shielding expansion

- 4.2.5 China-led capacity additions lowering price barriers

- 4.3 Market Restraints

- 4.3.1 Volatile dianhydride and diamine feedstock pricing

- 4.3.2 VOC-emission compliance costs for solvent casting

- 4.3.3 Processing skill gap outside East Asia

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Regulatory Framework

- 4.6.1 Argentina

- 4.6.2 Australia

- 4.6.3 Brazil

- 4.6.4 Canada

- 4.6.5 China

- 4.6.6 European Union

- 4.6.7 India

- 4.6.8 Japan

- 4.6.9 Malaysia

- 4.6.10 Mexico

- 4.6.11 Nigeria

- 4.6.12 Russia

- 4.6.13 Saudi Arabia

- 4.6.14 South Africa

- 4.6.15 South Korea

- 4.6.16 United Arab Emirates

- 4.6.17 United Kingdom

- 4.6.18 United States

- 4.7 End-use Sector Trends

- 4.7.1 Aerospace (Aerospace Component Production Revenue)

- 4.7.2 Automotive (Automobile Production)

- 4.7.3 Building and Construction (New Construction Floor Area)

- 4.7.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.7.5 Packaging(Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By End User Industry

- 5.1.1 Automotive

- 5.1.2 Electrical and Electronics

- 5.1.3 Packaging

- 5.1.4 Industrial and Machinery

- 5.1.5 Aerospace

- 5.1.6 Building and Construction

- 5.1.7 Other End-user Industries

- 5.2 By Form

- 5.2.1 Film

- 5.2.2 Resin

- 5.2.3 Fiber

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Arakawa Chemical Industries,Ltd.

- 6.4.2 Arkema

- 6.4.3 China Wanda Group

- 6.4.4 DUNMORE

- 6.4.5 DuPont

- 6.4.6 JIAOZUO TIANYI TECHNOLOGY CO.,LTD

- 6.4.7 Kaneka Corporation

- 6.4.8 Kolon Industries Inc.

- 6.4.9 Mitsui Chemicals Inc.

- 6.4.10 PI Advanced Materials Co., Ltd.

- 6.4.11 Shenzhen Ruihuatai Film Technology Co., Ltd.

- 6.4.12 SKC

- 6.4.13 Taimide Tech. Inc.

- 6.4.14 Toray Industries Inc

- 6.4.15 UBE Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs