PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906998

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906998

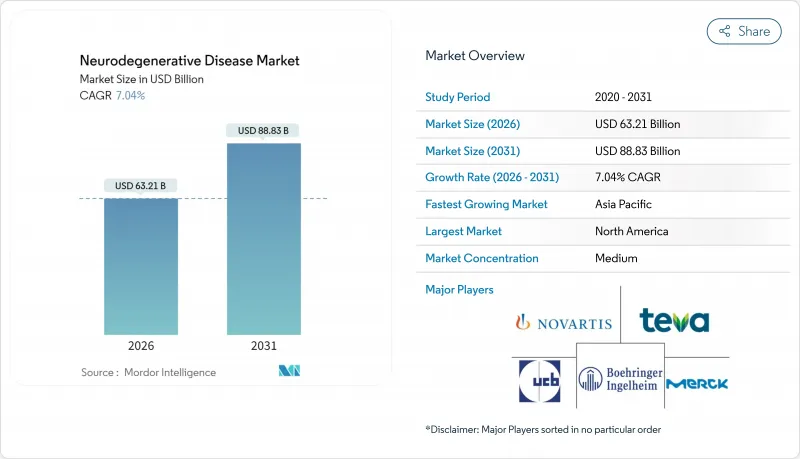

Neurodegenerative Disease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The neurodegenerative disease market was valued at USD 59.06 billion in 2025 and estimated to grow from USD 63.21 billion in 2026 to reach USD 88.83 billion by 2031, at a CAGR of 7.04% during the forecast period (2026-2031).

Robust demand is fuelled by an aging global population, fresh approvals for disease-modifying biologics, and sharper diagnostic tools that enable earlier intervention. Competitive pressure intensifies as incumbents defend blockbuster franchises while biotechnology newcomers push gene and RNA therapies toward late-stage trials. Payer appetite for premium pricing remains intact in the United States, yet parallel generic erosion in symptomatic drugs reshapes revenue mixes. Taken together, these forces put the neurodegenerative disease market on a durable growth path that balances near-term stability with long-term innovation.

Global Neurodegenerative Disease Market Trends and Insights

Escalating Disease Burden Among Aging Populations

Rising longevity pushes prevalence curves higher, doubling Alzheimer's incidence roughly every five years past age 65. Health systems in the United States, Canada, Western Europe, Japan, and South Korea, therefore, pivot toward disease-modifying regimens that promise delayed institutionalization and lower long-run care costs. Policy makers incorporate dementia plans into national agendas, spurring reimbursement for biomarker screening and incentivizing early diagnosis. Pharmaceutical firms respond by aligning trial designs with mild-cognitive-impairment cohorts, expanding addressable patient pools. In parallel, caregiver advocacy accelerates clinical uptake, particularly in markets with robust long-term-care insurance. Collectively, these elements underpin sustained volume growth for the Neurodegenerative disease market even as unit pricing pressures rise.

Launch Of Disease-Modifying Therapies

The 2024 approvals of donanemab and subcutaneous lecanemab shifted commercial narratives from symptom relief to disease alteration. Their launch proved payers will reimburse high-cost biologics when evidence shows amyloid plaque clearance and cognitive stabilization. More than 15 additional anti-amyloid or anti-tau antibodies now populate Phase III pipelines, signaling a therapeutic arms race. Biogen, Roche, and Johnson & Johnson deploy adaptive trial designs and fluid biomarker surrogate endpoints to shorten development timelines. Investor confidence surges, with neuroscience IPO proceeds rising despite macro uncertainty. Over the medium term, combination regimens pairing antibodies with small-molecule anti-inflammatories are expected to widen clinical benefit windows, further enlarging revenue opportunities across the neurodegenerative disease market.

Patent Expirations of Key Neurology Brands

Aricept's loss of exclusivity in 2026 erases USD 2.8 billion in branded revenue, triggering price compression across generic donepezil competitors. Similar erosion hits Namzaric by 2029, overlapping with premium launches of antibodies and gene therapies. Portfolio managers hedge by layering life-cycle extensions-fixed-dose combos, new delivery systems, and OTC switches-but margin dilution remains inevitable. Emerging markets, where intellectual-property enforcement lags, see even steeper price drops, challenging multinational revenue recapture strategies. This constraint suppresses near-term top-line growth yet nudges firms to accelerate higher-value innovation, indirectly sustaining the broader neurodegenerative disease market.

Other drivers and restraints analyzed in the detailed report include:

- Advancements In Neuroimaging and Biomarker Diagnostics

- Expansion Of Neuroscience R&D Investments

- High Attrition Rates in Late-Stage Clinical Trials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alzheimer's disease commanded 41.72% neurodegenerative disease market share in 2025, buoyed by high prevalence and multiple labeled therapies. The 2025 surge in Leqembi revenue, topping JPY 23.1 billion (USD 154 million), reaffirmed commercial headroom for disease-modifying antibodies. Parkinson's and multiple sclerosis sustain volume through entrenched dopaminergic and immunomodulatory regimens, yet incremental innovation remains slower. ALS, albeit small, posts a 9.36% CAGR, supported by gene-silencing candidates and expanded newborn-screening programs. Huntington's benefits from Pridopidine's European nod, adding a tangible disease-modifying option for the first time. Over the forecast, Alzheimer's still anchors the neurodegenerative disease market, but diversified revenue flow from rare indications mitigates concentration risk.

A second layer of growth emerges as regulators widen accelerated-approval eligibility to lysosomal storage diseases with neurodegenerative components. Denali's tividenofusp alfa breakthrough tag illustrates this trend, channelling capital toward previously neglected orphan indications. Collectively, these shifts broaden the therapeutic canvas, raising the ceiling for total neurodegenerative disease market size and creating cross-segment synergies in biomarker standardization.

Cholinesterase inhibitors generated 27.98% of the neurodegenerative disease market size in 2025, reflecting entrenched first-line use. Yet pipeline velocity now favors gene and cell therapies, which are set to grow 9.21% annually as vector design and manufacturing scale improve. Solid Biosciences' SGT-212 clearance for Friedreich ataxia validates systemic AAV delivery for neuro-cardiac phenotypes, opening paths to adjacent forms of ataxia. Meanwhile, monoclonal antibodies extend beyond amyloid to target alpha-synuclein and TDP-43, supported by learnings in dosing optimization. NMDA antagonists and dopamine agonists remain staples but face generic exposure; sponsors defend share through long-acting injectables and digital adherence tools. RNA therapeutics occupy a strategic middle ground with lower COGS than biologics and higher specificity than small molecules, further fragmenting drug-class leadership within the neurodegenerative disease market.

Clinical data transparency enhances class-switch dynamics, as real-world evidence highlights heterogeneity in response to antibodies versus modulators. Physicians increasingly adopt multi-mechanism strategies, combining symptomatic relief with disease modification, which expands overall prescription volumes even if class shares fluctuate. Consequently, competitive intensity rises, but the aggregate neurodegenerative disease market size continues to climb.

The Neurodegenerative Disease Market Report is Segmented by Indication (Parkinson's Disease, and More), Drug Class (NMDA Receptor Antagonists, and More), Molecule Type (Small-Molecule Drugs, and More), Route of Administration (Oral, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.96% of worldwide revenue in 2025 as the FDA's accelerated-approval pathway and Medicare reimbursement powers the quick uptake of novel biologics. Breakthrough tags for posdinemab and tividenofusp alfa in January 2025 exemplify regulatory agility. Venture capital funnels toward Boston and San Francisco hubs, while Roche's USD 50 billion U.S. expansion secures domestic biologics capacity. Canada broadens early-access programs, and Mexico leverages near-shoring to attract packaging operations, creating a contiguous North American supply ecosystem that boosts the neurodegenerative disease market.

Asia-Pacific holds the fastest 8.31% CAGR outlook through 2031. Japan's rapid Leqembi adoption set a regional precedent for reimbursing expensive antibodies despite budget scrutiny. China accelerates NDA reviews under its priority-review channel, with local firms co-developing biosimilars and RNA therapies that lower entry prices. South Korea funds AI-guided screening tools, and Australia integrates genomic testing into public health benefits. Collectively, infrastructure expansion and policy harmonization expand patient access and diversify revenue drivers within the neurodegenerative disease market.

Europe posts steady growth anchored by EMA's centralized procedures that balance risk and access. The agency's Pridopidine reversal signals an openness to re-evaluation based on post-hoc analyses. Germany, France, and the United Kingdom remain premium markets but negotiate outcome-based rebates to contain spending. Southern Europe increases deployment of regional dementia plans co-funded by EU cohesion funds, supporting earlier diagnosis and slowing disease progression. While differing national HTA assessments fragment launch sequencing, collective purchasing through EU4 consortia mitigates pricing gaps and sustains continental contribution to the neurodegenerative disease market size.

- Abbvie

- Amneal Pharmaceuticals

- Boehringer Ingelheim

- Roche

- Merck

- Novartis

- Pfizer

- Teva Pharmaceutical Industries

- UCB

- Biogen

- Johnson & Johnson

- Sanofi

- Eli Lilly and Company

- Eisai

- Lundbeck

- Denali Therapeutics

- AC Immune

- Alector

- Ionis Pharmaceuticals

- Neurocrine Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Disease Burden Among Aging Populations

- 4.2.2 Launch of Disease-Modifying Therapies

- 4.2.3 Advancements in Neuroimaging and Biomarker Diagnostics

- 4.2.4 Expansion of Neuroscience R&D Investments

- 4.2.5 Integration of Artificial Intelligence in Drug Discovery

- 4.2.6 Emergence of Novel Brain-Targeted Delivery Platforms

- 4.3 Market Restraints

- 4.3.1 Patent Expirations of Key Neurology Brands

- 4.3.2 High Attrition Rates in Late-Stage Clinical Trials

- 4.3.3 Premium Pricing of Advanced Biologics and Gene Therapies

- 4.3.4 Limited Diagnostic Infrastructure in Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Indication

- 5.1.1 Parkinson-s Disease

- 5.1.2 Alzheimer-s Disease

- 5.1.3 Amyotrophic Lateral Sclerosis (ALS)

- 5.1.4 Multiple Sclerosis

- 5.1.5 Huntington Disease

- 5.1.6 Other Indications

- 5.2 By Drug Class

- 5.2.1 NMDA Receptor Antagonists

- 5.2.2 Cholinesterase Inhibitors

- 5.2.3 Dopamine Agonists

- 5.2.4 Immunomodulators / MAbs

- 5.2.5 Gene & Cell Therapies

- 5.2.6 Other Drug Classess

- 5.3 By Molecule Type

- 5.3.1 Small-Molecule Drugs

- 5.3.2 Biologics & Monoclonal Antibodies

- 5.3.3 RNA-based Therapeutics

- 5.4 By Route of Administration

- 5.4.1 Oral

- 5.4.2 Parenteral (IV/SC)

- 5.4.3 Transdermal / Intranasal

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacies

- 5.5.2 Retail & Specialty Pharmacies

- 5.5.3 Online Pharmacies

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 AbbVie

- 6.3.2 Amneal Pharmaceuticals

- 6.3.3 Boehringer Ingelheim International GmbH

- 6.3.4 F. Hoffmann-La Roche

- 6.3.5 Merck & Co Inc.

- 6.3.6 Novartis

- 6.3.7 Pfizer

- 6.3.8 Teva Pharmaceuticals, Inc.

- 6.3.9 UCB SA

- 6.3.10 Biogen

- 6.3.11 Johnson & Johnson (Janssen)

- 6.3.12 Sanofi

- 6.3.13 Eli Lilly

- 6.3.14 Eisai

- 6.3.15 Lundbeck

- 6.3.16 Denali Therapeutics

- 6.3.17 AC Immune

- 6.3.18 Alector

- 6.3.19 Ionis Pharmaceuticals

- 6.3.20 Neurocrine Biosciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment