PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907004

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907004

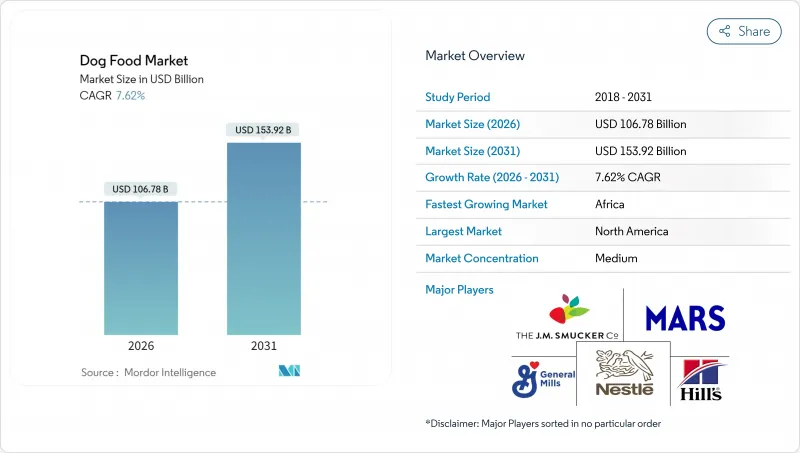

Dog Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Dog Food Market was valued at USD 99.22 billion in 2025 and estimated to grow from USD 106.78 billion in 2026 to reach USD 153.92 billion by 2031, at a CAGR of 7.62% during the forecast period (2026-2031).

Elevated pet humanization, the rapid migration toward premium and functional recipes, and the rise of e-commerce subscription services underpin the sector's robust growth momentum. Manufacturers continue to prioritize human-grade meat, novel proteins, and clean-label ingredients to secure price premiums while meeting transparency demands. Digital commerce reshapes route-to-market economics by lowering customer acquisition costs and enabling data-driven product personalization. Meanwhile, supply chain investments in upcycling and alternative proteins support both sustainability positioning and margin insulation against meat price swings. Competitive intensity remains high as global food conglomerates and venture-backed startups deploy acquisitions, direct-to-consumer models, and AI-enabled nutrition platforms to protect and expand their dog food market footprints.

Global Dog Food Market Trends and Insights

Premiumization of Dog Diets

Premium positioning constitutes the largest growth catalyst within the dog food market. Manufacturers leverage organic and ethically sourced proteins, superfood inclusions such as chia and kale, and recyclable packaging to justify double-digit price premiums. Retailers reinforce the trend by dedicating incremental shelf space to super-premium assortments and by curating in-store education programs that highlight nutrient density and provenance. Premiumization also filters into emerging markets where upper-income households replicate Western consumption patterns.

Adoption of Human-Grade Ingredients

Human-grade sourcing bolsters consumer confidence and underpins the shift from commodity kibble toward recognizable whole-food inclusions. Brands now publish supplier maps, run third-party audits, and obtain USDA or equivalent certification to validate claims. Blue Buffalo grew its United States market share by 7.5% in 2021 on the back of natural ingredient messaging. Post-pandemic health awareness persists, with 60% of supplement buyers reporting closer scrutiny of ingredient panels since 2020. The dog food market rewards transparency with loyalty, enabling premium price retention even during commodity inflation.

Volatility of Meat-Based Input Prices

Protein sourcing remains the largest cost line for most manufacturers. Drought, animal disease outbreaks, and geopolitical trade disruptions can lift poultry and red meat prices by double digits within quarters. Companies hedge exposure using futures contracts and diversify into insect or plant proteins, yet these tactics cannot eliminate margin compression when spot prices spike. The constraint weighs most heavily on premium meat-forward brands that lack formulation flexibility.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of E-commerce Private-Label Brands

- Functional and Fortified Recipes

- Regulatory Scrutiny on Sustainability Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The food category dominated the dog food market, accounting for a 65.14% revenue share in 2025, thanks to its wide household penetration and multipack convenience. Dry kibble alone captured about three-quarters of the category, supported by its shelf life and cost efficiency. Pet Veterinary Diets, although only a mid-single-digit slice of the overall dog food market, is projected to post an 8.41% CAGR outlook to 2031, as veterinarians increasingly advocate for nutrition therapy in addressing obesity, diabetes, and renal conditions. Functional treats and toppers extend these clinical solutions into between-meal occasions, reinforcing owner compliance.

Pet veterinary diets achieve price points two to three times higher than mainstream kibble because of research and clinical trial investment. Formulations incorporate enzymatically hydrolyzed proteins, precise omega-3 to omega-6 ratios, and soluble fiber blends that have been validated for their glycemic modulation effects. Hill's, Purina Pro Plan Veterinary, and Royal Canin lead this segment, leveraging global research centers and robust distribution through veterinary clinics. Smaller specialty brands partner with contract researchers to validate claims and secure distribution, often utilizing prescription-only models that secure professional endorsement. Growth tailwinds include rising canine lifespan, pet insurance coverage expansion, and increasing diagnosis rates due to affordable diagnostic imaging.

The Dog Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets, and More), by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and More), and by Geography (Africa, Asia-Pacific, Europe, North America, and South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America commanded 45.02% market share of the dog food market in 2025, owing to high dog ownership, premium purchasing behavior, and an established regulatory scaffold that bolsters consumer confidence. The United States remains the single largest national market, with high sales and robust per-capita spending supported by rising insurance adoption and premiumization. Continuous innovation in subscription models and functional snacks further fuels regional value growth. South America exhibits moderate growth anchored by Brazil and Argentina. Economic volatility tempers high-end trade-up, but domestic producers capitalize on favorable soybean and corn supply for cost-competitive formulations. Government programs encouraging local sourcing under sustainability agendas also influence procurement strategies.

Africa represents the fastest regional upside with a projected 9.18% CAGR to 2031. Rising disposable income, urban migration, and expanding modern retail fuel commercial dog food adoption, particularly in South Africa, Nigeria, and Kenya. The region attracts investment for local production facilities to circumvent import tariffs and currency volatility. Marketing focuses on education campaigns highlighting nutritional adequacy compared with table scraps. Although infrastructure gaps persist, smartphone penetration supports digital commerce leapfrogging, shortening the path to premium formats.

Europe maintains steady mid-single-digit expansion anchored by stringent labeling laws, sustainability leadership, and a consolidated private-label manufacturing base. German and French consumers display strong adoption of organic and insect-protein products, aligning with broader environmental priorities. Although pet ownership penetration still trails Western levels, rapid urbanization and one-child household structures drive incremental dog adoptions and premium spend.

Japan's aging dog population led to flat volumes, yet value gains continue as owners trade up to therapeutic and fresh formats. Emerging markets like Indonesia and India record double-digit volume growth but from low per-capita bases, presenting fertile grounds for mainstream and value brands.

- ADM

- Agroindustrias Baires

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Simmons Foods Inc.

- General Mills Inc.

- Mars, Incorporated

- Nestle S.A.(Purina)

- The J. M. Smucker Company

- Central Garden and Pet Company

- Sunshine Mills, Inc.

- heristo aktiengesellschaft

- PLB International

- Diamond Pet Foods (Schell and Kampeter, Inc.)

- Unicharm Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Premiumization of dog diets

- 5.5.2 Human-grade ingredient adoption

- 5.5.3 E-commerce private-label expansion

- 5.5.4 Functional and fortified recipes

- 5.5.5 Growth of subscription delivery models

- 5.5.6 Upcycling of food waste into kibble

- 5.6 Market Restraints

- 5.6.1 Volatility of meat-based input prices

- 5.6.2 Regulatory scrutiny on sustainability claims

- 5.6.3 Rising prevalence of canine allergies to grains

- 5.6.4 Competition from fresh home-cooked alternatives

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 By Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 By Distribution Channel

- 6.2.1 Convenience Stores

- 6.2.2 Online Channel

- 6.2.3 Specialty Stores

- 6.2.4 Supermarkets/Hypermarkets

- 6.2.5 Other Channels

- 6.3 By Geography

- 6.3.1 Africa

- 6.3.1.1 Country

- 6.3.1.1.1 South Africa

- 6.3.1.1.2 Rest of Africa

- 6.3.1.1 Country

- 6.3.2 Asia-Pacific

- 6.3.2.1 Country

- 6.3.2.1.1 Australia

- 6.3.2.1.2 China

- 6.3.2.1.3 India

- 6.3.2.1.4 Indonesia

- 6.3.2.1.5 Japan

- 6.3.2.1.6 Malaysia

- 6.3.2.1.7 Philippines

- 6.3.2.1.8 Taiwan

- 6.3.2.1.9 Thailand

- 6.3.2.1.10 Vietnam

- 6.3.2.1.11 Rest of Asia-Pacific

- 6.3.2.1 Country

- 6.3.3 Europe

- 6.3.3.1 Country

- 6.3.3.1.1 France

- 6.3.3.1.2 Germany

- 6.3.3.1.3 Italy

- 6.3.3.1.4 Netherlands

- 6.3.3.1.5 Poland

- 6.3.3.1.6 Russia

- 6.3.3.1.7 Spain

- 6.3.3.1.8 United Kingdom

- 6.3.3.1.9 Rest of Europe

- 6.3.3.1 Country

- 6.3.4 North America

- 6.3.4.1 Country

- 6.3.4.1.1 Canada

- 6.3.4.1.2 Mexico

- 6.3.4.1.3 United States

- 6.3.4.1.4 Rest of North America

- 6.3.4.1 Country

- 6.3.5 South America

- 6.3.5.1 Country

- 6.3.5.1.1 Argentina

- 6.3.5.1.2 Brazil

- 6.3.5.1.3 Rest of South America

- 6.3.5.1 Country

- 6.3.1 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 ADM

- 7.6.2 Agroindustrias Baires

- 7.6.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.5 Simmons Foods Inc.

- 7.6.6 General Mills Inc.

- 7.6.7 Mars, Incorporated

- 7.6.8 Nestle S.A.(Purina)

- 7.6.9 The J. M. Smucker Company

- 7.6.10 Central Garden and Pet Company

- 7.6.11 Sunshine Mills, Inc.

- 7.6.12 heristo aktiengesellschaft

- 7.6.13 PLB International

- 7.6.14 Diamond Pet Foods (Schell and Kampeter, Inc.)

- 7.6.15 Unicharm Corporation

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS