PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907218

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907218

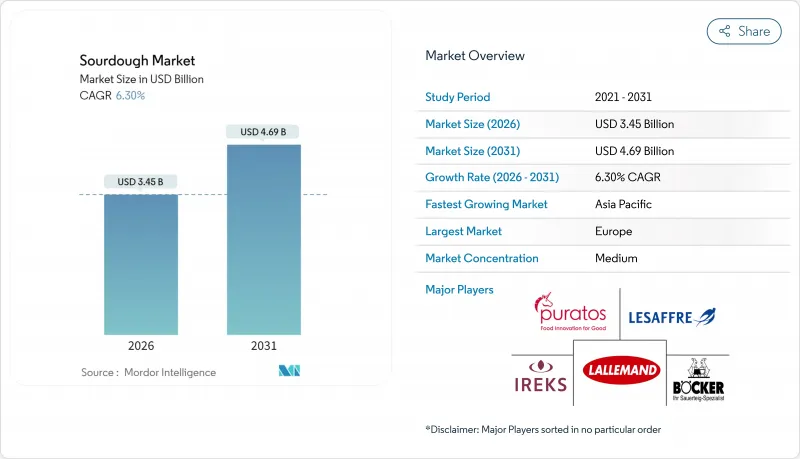

Sourdough - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

sourdough market size in 2026 is estimated at USD 3.45 billion, growing from 2025 value of USD 3.25 billion with 2031 projections showing USD 4.69 billion, growing at 6.3% CAGR over 2026-2031.

This growth is driven by increasing consumer preference for clean-label baked goods, growing scientific evidence supporting sourdough's benefits in managing blood sugar levels, and its rising popularity in foodservice channels. Industrial bakers are expanding production by using freeze-dried starter technologies, while retail in-store bakeries are capitalizing on sourdough's premium appeal to boost profit margins. Ingredient suppliers are focusing on research and development to improve fermentation techniques, particularly for gluten-free and functional food applications, which is creating new opportunities in the specialty nutrition segment. The global market remains moderately consolidated as leading multinational companies invest in fermentation expertise and technical support teams to strengthen their market position.

Global Sourdough Market Trends and Insights

Growing lower glycemic index appeal

Consumer interest in sourdough bread is growing due to its potential health benefits, particularly its lower glycemic index. Research has shown that sourdough bread can help manage blood sugar levels more effectively compared to regular yeast bread. For instance, a 2023 study by PubMed Central found that whole wheat sourdough bread resulted in 45.5% less insulin secretion and 9.6% lower post-meal blood sugar levels compared to whole wheat yeast bread in both healthy pregnant women and those with gestational diabetes. These benefits are attributed to the fermentation process used in making sourdough, which alters the bread's nutritional profile. As a result, sourdough is becoming increasingly popular among health-conscious consumers and is now featured in premium supermarket offerings and hospital cafeteria menus. Retailers in areas with high rates of metabolic disorders are also expanding shelf space for certified sourdough products, reflecting the growing demand for foods that promote better health outcomes.

Influence of home baking trends

The increasing trend of home baking is significantly influencing consumer preferences and boosting the sourdough market. According to a 2024 survey by the Agriculture and Horticulture Development Board (AHDB), 11% of people bake at least once a week, and 20% bake at least once a month, showing that home baking remains a popular activity. Many individuals are now investing in specialty flours and fermentation tools to create sourdough bread at home. To meet this growing demand, Essential launched a certified organic, bake-at-home sourdough bread in 2024, made with a 140-year-old starter. This product makes it easier for consumers to enjoy the authentic taste of sourdough without the complexities of traditional baking. The continued interest in home baking has also led to more knowledgeable consumers who now focus on details such as fermentation time, the age of the starter culture, and the source of the flour. Commercial bakers are increasingly sharing this information on their sourdough products, which was previously kept as proprietary knowledge.

Competition from mass-produced yeast breads

Competition from mass-produced yeast breads continues to challenge the growth of the sourdough market. Large-scale bakeries use automated processes to produce yeast bread in just a few hours, allowing them to offer affordable options with widespread availability through nationwide distribution networks. These companies also invest heavily in promotions, which often limits shelf space for premium sourdough products in mainstream retail outlets. To address this challenge, sourdough producers are targeting niche markets such as specialty grocery stores, farmers' markets, and direct-to-consumer subscription services. In these channels, the focus is on highlighting the authenticity, craftsmanship, and unique qualities of sourdough, which appeal to consumers willing to pay a premium. However, in regions where consumers are more price-sensitive due to economic constraints, the lower cost of mass-produced yeast bread continues to make it a more attractive option, limiting the potential for sourdough to gain a larger market share.

Other drivers and restraints analyzed in the detailed report include:

- Popularity of artisanal and premium bakery

- Innovation in gluten-free sourdough

- Emergence of ingredient sourcing regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dry Mix and Premix formats led the sourdough market in 2025, accounting for 60.98% of the segment. These formats are popular among industrial and foodservice bakers because they are easy to store, reduce fermentation risks, and ensure consistent product quality. Their longer shelf life and convenience make them ideal for large-scale operations where efficiency and reliability are essential. Premix solutions also help bakers maintain consistent recipes across different locations, ensuring uniform flavor and texture in commercial production. The popularity of dry mix and premix formats highlights the industry's focus on efficiency while preserving the artisanal qualities of sourdough.

Ready-to-use liquid starters are becoming more popular and are expected to grow at a 7.2% CAGR between 2026 and 2031. This growth is supported by the expansion of cold-chain distribution systems, which help deliver perishable liquid starters to more bakers while keeping them fresh and active. Liquid starters allow bakers to create unique sourdough flavors, appealing to consumers who value authenticity and variety. They are also easy to use in production lines without requiring much preparation, making them suitable for both industrial and premium bakery settings. As demand for flavor, authenticity, and convenience grows, Ready-to-Use Liquid starters are expected to play a bigger role in the sourdough market's future.

Type III (Powder) sourdough cultures were the most popular in 2025, accounting for 43.10% of the market. These cultures, made using spray- and freeze-drying methods, are highly stable and can be easily rehydrated when needed. This makes them ideal for large-scale bakeries, as they ensure consistent fermentation and flavor without slowing down production. Their long shelf life and easy storage also help reduce waste and simplify inventory management. The popularity of Type III cultures shows the focus on efficiency and reliability in industrial sourdough production.

Type II (Dried) sourdough cultures are expected to grow at a 7.55% CAGR through 2031, as mid-size bakeries look for options that balance authentic flavor with longer shelf life. These pelletized cultures last longer while still maintaining the unique flavors of sourdough, making them a good fit for artisanal and semi-industrial bakeries. They are easier to handle than liquid starters but still offer the traditional taste of sourdough, appealing to bakeries that value both quality and convenience. The growth of Type II cultures highlights the demand for solutions that combine great flavor with practical use.

The Sourdough Market Report is Segmented by Form (Ready-To-Use Liquid and Dry Mix/Premix), Processing Type (Type I (Fresh), Type II (Dried), and More), Ingredient Source (Wheat, Rye, and More), Application (Breads and Buns, and More), Distribution Channel (Retail, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe contributed 34.40% of total revenue in 2025, maintaining its position as a leader in the sourdough market due to its long-standing baking traditions, strict quality standards, and strong export capabilities. European sourdough products are highly regarded for their authenticity, with Germany being a key player in producing rye blends that hold protected geographical indication (PGI) status. These premium products are particularly sought after in Asian markets, where they are perceived as high-quality imports. European Union policies that protect traditional fermentation methods and support rural bakery apprenticeships ensure the preservation of artisanal baking skills, further strengthening the region's dominance.

The Asia-Pacific region is projected to grow at a strong 8.60% CAGR through 2031, driven by urbanization, rising disposable incomes, and the increasing adoption of Western-style baked goods. In China, the bakery market remained popular, with sourdough baguettes becoming a popular choice in convenience stores located near urban hubs. Similarly, Japanese companies are integrating sourdough starters into packaged bread products, making them more accessible to a broader audience. In India, sourdough is gaining popularity in major cities as consumers shift towards healthier eating habits and look for alternatives to traditional carbohydrate-heavy diets. This growing demand highlights the region's potential for sourdough market expansion.

North America showcases a mature sourdough market with opportunities for further premiumization. Artisan bakeries in states like California and New York are flourishing, offering high-quality sourdough products that cater to local communities. At the same time, large bakery chains are adopting centralized production models to maintain consistent quality while delivering the signature tangy flavor of sourdough. The Food and Drug Administration's evolving guidelines on natural product claims are influencing labeling practices, but consumer trust in the quality of fermented bread remains strong. Additionally, Canadian mills are exporting wheat-based sourdough mixes to Southeast Asia, demonstrating the interconnected trade flows that support the sourdough market.

- Puratos Group

- Lesaffre International

- Lallemand Inc.

- IREKS GmbH

- Ernst Bocker GmbH

- Leipnik-Lundenburger Invest Beteilungs AG

- Emu AG

- Philibert Savours

- Semifreddi's Bakery

- Alpha Baking Company Inc.

- Forklift Brands, Inc.

- Truckee Sourdough Company

- Bread SRSLY

- Peak Rock Capital (Gold Coast Bakery)

- Morabito Baking Company Inc.

- Mimansa Industries Private Limited (Baker's Dozen)

- Seven Stars Bakery

- Dr. Otto Suwelack Nachf. GmbH & Co. KG's

- The Health Factory

- Backaldrin International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing lower glycemic index appeal

- 4.2.2 Clean-label and minimal ingredient preference

- 4.2.3 Innovation in gluten-free sourdough

- 4.2.4 Influence of home baking trends

- 4.2.5 Popularity of artisanal and premium bakery

- 4.2.6 Gut health and probiotic/prebiotic benefits

- 4.3 Market Restraints

- 4.3.1 Stringent clean-label compliance

- 4.3.2 Competition from mass-produced yeast breads

- 4.3.3 High production costs

- 4.3.4 Emergence of ingredient sourcing regulations

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Ready-to-Use Liquid

- 5.1.2 Dry Mix/Premix

- 5.2 By Processing Type

- 5.2.1 Type I (Fresh)

- 5.2.2 Type II (Dried)

- 5.2.3 Type III (Powder)

- 5.3 By Ingredient Source

- 5.3.1 Wheat

- 5.3.2 Rye

- 5.3.3 Barley

- 5.3.4 Others (Oats, etc.)

- 5.4 By Application

- 5.4.1 Bread and Buns

- 5.4.2 Cakes and Pastries

- 5.4.3 Pizza Crust

- 5.4.4 Cookies and Crackers

- 5.4.5 Others

- 5.5 By Distribution Channel

- 5.5.1 Food Processing Industry

- 5.5.2 Foodservice

- 5.5.3 Retail

- 5.5.3.1 Supermarkets/Hypermarkets

- 5.5.3.2 Online Retail Stores

- 5.5.3.3 Other Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Colombia

- 5.6.2.3 Chile

- 5.6.2.4 Peru

- 5.6.2.5 Argentina

- 5.6.2.6 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Poland

- 5.6.3.7 Belgium

- 5.6.3.8 Sweden

- 5.6.3.9 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 Australia

- 5.6.4.5 Indonesia

- 5.6.4.6 South Korea

- 5.6.4.7 Thailand

- 5.6.4.8 Singapore

- 5.6.4.9 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Puratos Group

- 6.4.2 Lesaffre International

- 6.4.3 Lallemand Inc.

- 6.4.4 IREKS GmbH

- 6.4.5 Ernst Bocker GmbH

- 6.4.6 Leipnik-Lundenburger Invest Beteilungs AG

- 6.4.7 Emu AG

- 6.4.8 Philibert Savours

- 6.4.9 Semifreddi's Bakery

- 6.4.10 Alpha Baking Company Inc.

- 6.4.11 Forklift Brands, Inc.

- 6.4.12 Truckee Sourdough Company

- 6.4.13 Bread SRSLY

- 6.4.14 Peak Rock Capital (Gold Coast Bakery)

- 6.4.15 Morabito Baking Company Inc.

- 6.4.16 Mimansa Industries Private Limited (Baker's Dozen)

- 6.4.17 Seven Stars Bakery

- 6.4.18 Dr. Otto Suwelack Nachf. GmbH & Co. KG's

- 6.4.19 The Health Factory

- 6.4.20 Backaldrin International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK