PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907220

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907220

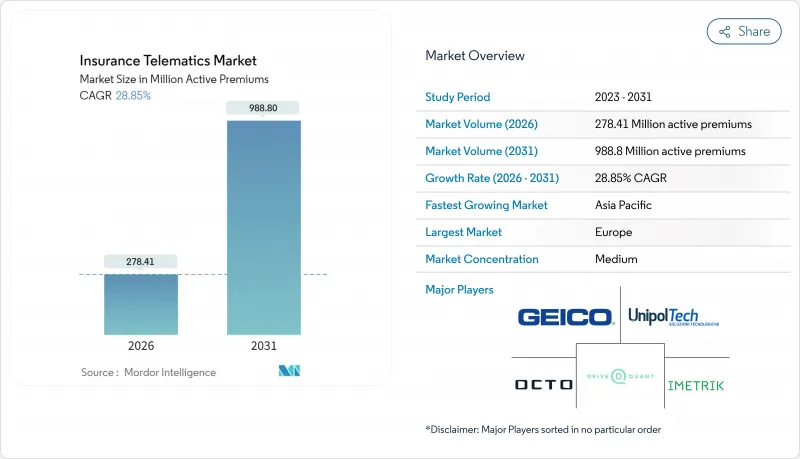

Insurance Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Telematics insurance market size in 2026 is estimated at 278.41 million active premiums, growing from 2025 value of 216.07 million active premiums with 2031 projections showing 988.8 million active premiums, growing at 28.85% CAGR over 2026-2031.

The market size expansion reflects insurers' rapid adoption of data-driven pricing models that rely on real-time driving analytics, automotive connectivity upgrades, and AI-enabled fraud scoring. European carriers maintain an early-mover advantage, while Asia-Pacific shows the steepest adoption curve on the back of regulatory mandates and rising smartphone penetration. Competitive dynamics favour technology-savvy insurers and OEM captive programs that leverage proprietary vehicle data. Headwinds stem from data-privacy compliance costs and cybersecurity risks tied to aftermarket dongles, yet momentum persists as smartphone-centric platforms lower deployment friction and widen addressable customer pools.

Global Insurance Telematics Market Trends and Insights

Rapid Insurer Shift to Usage-Based Insurance Models

Direct Assurance grew its YouDrive book 27% in 2024 and cut average premiums by EUR 200 (USD 213) per customer, underlining how real-time behavioural data outperforms static demographics for risk pricing. Progressive reported USD 74.4 billion in net written premiums for 2024, up 21%, with telematics programs the chief growth lever. Data velocity rather than volume drives competitive gains, as seen in Cambridge Mobile Telematics' expansion to 1 million Japanese drivers in 2025. As pay-how-you-drive products proliferate, incumbents risk share erosion unless they integrate mobile telematics swiftly.

Automotive Connectivity Innovations Drive Infrastructure Transformation

5G and eSIM technology are converting vehicles into always-on data hubs. BMW's iX platform, developed with Deutsche Telekom, showcases dual-SIM connectivity that separates telematics from infotainment traffic for resilient data streams. G+D's dual-active SIM architecture further secures over-the-air updates and ensures global roaming continuity. Ericsson's IoT Accelerator lets automakers orchestrate remote SIM provisioning at scale. Embedded connectivity removes aftermarket hardware dependencies, boosts data fidelity, and paves the way for instant crash notification, elevating insurer value propositions from reactive claims settlement to proactive risk prevention.

Data Privacy Regulations Create Implementation Complexity

The European Data Protection Board mandates explicit consent, granular purpose limitation, and user revocation rights for in-car data, lengthening onboarding cycles and raising compliance costs. China obliges local data storage plus security assessments before cross-border transfer, fragmenting global platforms and inflating architecture expense. Smaller insurers often lack the resources for continuous privacy audits, nudging market share toward larger carriers that can spread compliance overhead across broader portfolios.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Fraud Detection Revolutionizes Claims Processing

- OEM API Monetization Creates New Revenue Streams

- Cybersecurity Vulnerabilities Threaten Market Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manage-how-you-drive products are climbing at a 31.28% CAGR, outpacing the telematics insurance market average as insurers reward safe acceleration, braking, and cornering. India's 2025 regulation requires carriers to list pay-as-you-drive as a standard motor option, catalysing broader UBI uptake. PAYD retains volume leadership yet faces saturation, while pay-how-you-drive hybrids bridge mileage and behaviour for nuanced risk scores. Cambridge Mobile Telematics' DriveWell platform demonstrates 20% claim-frequency reduction by gamifying feedback loops, validating MHYD economics.

Adoption barriers center on driver privacy perceptions and sensor calibration, but smartphone telematics' passive data capture eases these frictions. As regulators promote eco-driving incentives, MHYD aligns closely with urban emissions goals, positioning it as a cornerstone of next-generation mobility insurance.

OBD-II dongles controlled 38.66% of policies in 2025 but face a decline as smartphone apps grow at a 32.62% CAGR. Smartcar notes dongles incur logistics, tampering, and accuracy costs that erode insurer ROI. Conversely, smartphone sensors plus cloud AI deliver comparable event resolution without hardware overhead. OEM-embedded modules command premium positioning for high-end vehicles, offering secure boot chains and high-rate CAN data, but depend on data-sharing agreements. Black-box devices retain relevance in jurisdictions mandating sealed hardware for legal traceability.

Transition success hinges on battery optimization and motion-co-processing to ensure reliable data while preserving user experience. Zendrive's mobile SDK shows 98% trip-detection accuracy, proving smartphone viability.

The Telematics Insurance Report is Segmented by Usage Type (PAYD, PHYD, MHYD), Technology Platform (OBD-II Dongle, Embedded OEM Module, Smartphone-Centric, Black-box/Hardwired), Vehicle Type (Passenger Cars, Light CV, Heavy CV), End-User (Personal Lines, Commercial Lines, and More), Distribution Channel (Direct-To-Consumer, Broker/Agent, and More), and Geography. Market Forecasts are Provided in Terms of Value (Active Premiums).

Geography Analysis

Europe led with 32.41% market share in 2025 on the strength of GDPR-backed consumer trust and stringent road-safety policies. An EIOPA survey found 17% of carriers already market telematics products, and the forthcoming EU Data Act is expected to raise adoption by formalizing data-sharing rights. Subsidies in congestion-priced cities, notably London and Milan, further magnify pay-per-mile program uptake.

Asia-Pacific is forecast to chart a 32.47% CAGR to 2031 as India mandates AIS-140 location trackers and China standardizes automotive data security. China's regulator promotes telematics for new-energy vehicle safety analytics, unlocking premium discounts for EV drivers. Japan's solvency reforms reward capital relief for tech-enabled risk mitigation, incentivizing carriers to allocate budget toward telematics infrastructure.

North America continues to experience steady growth. Progressive's telematics penetration reached 45% of new auto business in 2024, underpinning its 68% combined ratio outperformance. Data-privacy patchwork and higher litigation risk temper acceleration, but high smartphone adoption sustains momentum.

Middle East, Africa, and South America remain nascent yet promising. Government digitization agendas and rising motorization rates lay groundwork for telematics pilots, with importers keen to embed connectivity to differentiate offerings.

- Berkshire Hathaway Inc. - GEICO

- Unipol Gruppo SpA - UnipolTech

- Octo Telematics SpA

- DriveQuant SAS

- IMS (Global) Ltd.

- AXA SA

- The Floow Ltd.

- LexisNexis Risk Solutions (RELX PLC)

- Vodafone Group PLC - Vodafone Automotive SpA

- Viasat Group SpA

- Targa Telematics SpA

- Cambridge Mobile Telematics Inc.

- Allstate Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mainstream - Rapid insurer shift to Usage-Based Insurance (UBI)

- 4.2.2 Mainstream - Automotive connectivity innovations (5G, eSIM)

- 4.2.3 Mainstream - Stricter road-safety and CO? regulations

- 4.2.4 Under-the-radar - OEM API monetisation mandates

- 4.2.5 Under-the-radar - Pay-per-mile subsidies from city congestion schemes

- 4.2.6 Under-the-radar - AI-driven fraud scoring lowering loss ratios

- 4.3 Market Restraints

- 4.3.1 Mainstream - Data-privacy and consent hurdles (GDPR, CPRA)

- 4.3.2 Mainstream - Device/data-quality interoperability gaps

- 4.3.3 Under-the-radar - Rising CAN-bus cyber-attacks on aftermarket dongles

- 4.3.4 Under-the-radar - Adverse selection as low-risk drivers exit pools

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Usage Type

- 5.1.1 Pay-as-you-drive (PAYD)

- 5.1.2 Pay-how-you-drive (PHYD)

- 5.1.3 Manage-how-you-drive (MHYD)

- 5.2 By Technology Platform

- 5.2.1 OBD-II Dongle

- 5.2.2 Embedded OEM Module

- 5.2.3 Smartphone-centric

- 5.2.4 Black-box/Hardwired

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.4 By End-User

- 5.4.1 Personal Lines Insurers

- 5.4.2 Commercial Lines Insurers

- 5.4.3 Automotive OEM Captives

- 5.4.4 Fleet-management Service Providers

- 5.5 By Distribution Channel

- 5.5.1 Direct-to-Consumer

- 5.5.2 Broker/Agent-Mediated

- 5.5.3 OEM/Dealer Bundle

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Berkshire Hathaway Inc. - GEICO

- 6.4.2 Unipol Gruppo SpA - UnipolTech

- 6.4.3 Octo Telematics SpA

- 6.4.4 DriveQuant SAS

- 6.4.5 IMS (Global) Ltd.

- 6.4.6 AXA SA

- 6.4.7 The Floow Ltd.

- 6.4.8 LexisNexis Risk Solutions (RELX PLC)

- 6.4.9 Vodafone Group PLC - Vodafone Automotive SpA

- 6.4.10 Viasat Group SpA

- 6.4.11 Targa Telematics SpA

- 6.4.12 Cambridge Mobile Telematics Inc.

- 6.4.13 Allstate Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment

- 7.2 51993