PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907230

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907230

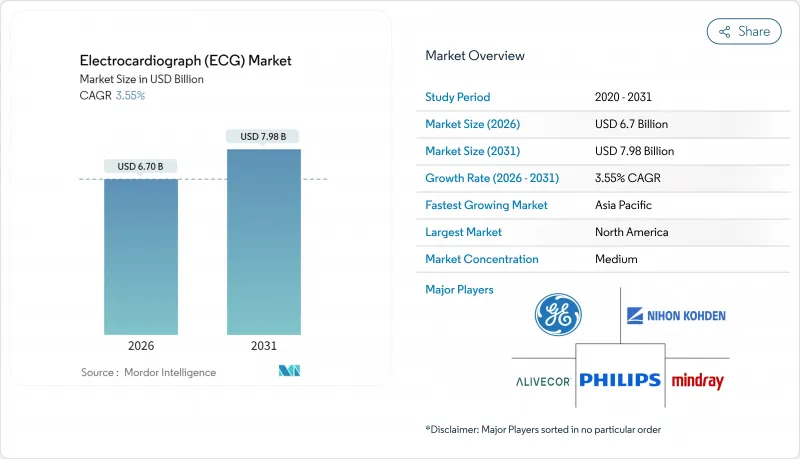

Electrocardiograph (ECG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Electrocardiograph market size in 2026 is estimated at USD 6.7 billion, growing from 2025 value of USD 6.47 billion with 2031 projections showing USD 7.98 billion, growing at 3.55% CAGR over 2026-2031.

Momentum reflects the sector's shift toward AI-driven analytics, cloud connectivity and consumer-grade wearables that now deliver clinical-grade accuracy. Digital devices already transmit ECG waveforms in real time, giving physicians a continuous view of cardiac status and enabling earlier intervention. Home monitoring accelerates as Medicare and other payers reimburse remote ECG services, while government-funded mass screening programs extend access to systematic risk assessment. Together these levers keep competitive pressure high and open sizable opportunities in software-centric care pathways.

Global Electrocardiograph (ECG) Market Trends and Insights

Rising Cardiovascular Disease Prevalence

Cardiovascular disease remains the principal mortality driver worldwide, and aging populations place persistent demand on diagnostic capacity. Routine ECG screening is increasingly recognized as cost-effective frontline prevention. Evidence from the American Heart Association shows AI-assisted ECG interpretation improves early detection of left ventricular dysfunction, a key predictor of heart failure, and supports proactive disease management . Health systems are integrating ECG checks into primary care workflows to curb downstream treatment costs, while employers and insurers promote annual heart health programs to reduce absenteeism.

Rapid Adoption of AI-Enabled ECG Devices

Deep-learning models now achieve 98.6% sensitivity in identifying critical arrhythmias, significantly outperforming manual interpretation . Hospitals facing technician shortages deploy cloud algorithms that auto-interpret waveforms and push structured reports directly to electronic medical records. Vendors bundle AI analytics with subscription services, creating recurring revenue streams and differentiating beyond hardware. Regulatory bodies encourage transparency by mandating explainability features, spurring investment in bias-mitigation tools that calibrate performance across gender and skin-tone variations.

Fragmented Reimbursement in Emerging Markets

Hospitals in Latin America and parts of Southeast Asia face patchwork policies that often exclude remote interpretation fees. A Europe-wide survey of implantable-device monitoring showed more than 80% of centers delayed deployment due to lack of reimbursement. Unpredictable funding cycles deter distributors from holding inventory and slow technology refresh rates, thereby constraining the Electrocardiograph market in cost-sensitive geographies. Multilateral lenders are beginning to fund outcome-based pilots, but scaled adoption hinges on harmonized payer frameworks.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Shift to Remote & Home Cardiac Monitoring

- Government-Funded Mass Screening Programs

- Shortage of ECG-Trained Technicians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Resting ECG carts accounted for 45.18% of 2025 revenue as clinicians continue to rely on 12-lead snapshots for baseline diagnostics. Yet wearable and patch devices deliver the fastest 3.95% CAGR, a clear signal that continuous data capture complements episodic testing. The Electrocardiograph market size for wearable solutions is projected to widen as consumer electronics brands enhance battery life and waterproofing. Hospitals maintain procurement of stress testing systems for exercise-induced ischemia, while Holter monitors remain indispensable for multi-day arrhythmia detection. Software assumes center stage: integration engines aggregate waveforms from diverse hardware and leverage AI to flag anomalies, positioning analytics rather than electrodes as the next competitive frontier.

Ecosystem players illustrate the shift. Resting-system stalwarts embed secure Wi-Fi modules that push data to cardiology information systems, adding software subscription revenue on top of capital sales. Patch-centric firms focus on user adhesion comfort and single-use simplicity to boost patient compliance. This duality underscores the Electrocardiograph market evolution from pure hardware toward hybrid device-and-data services that embed ECG insights into longitudinal care pathways.

The 12-lead configuration retained 59.68% share in 2025 thanks to its unrivaled diagnostic scope, especially for myocardial infarction localization. Single-lead wireless wearables, however, are climbing at 4.21% CAGR as consumers value effortless, on-wrist rhythm checks. The Electrocardiograph market size attached to single-lead devices could exceed USD 1.08 billion by 2031 if current penetration trajectories hold. Mid-range 3-6-lead systems offer portability gains for ambulatory monitoring and emergency transport, striking a balance between signal fidelity and patient comfort. Advanced 15/18-lead setups, though niche, deliver incremental accuracy for posterior infarcts in tertiary centers.

Regulatory reviews increasingly focus on AI augmentation that reconstructs virtual 12-lead waveforms from fewer electrodes, a development that may converge today's bifurcated segments. As software-enhanced reconstruction matures, lead-count differentiation may dwindle, making analytics and cloud workflow the primary purchasing criteria.

The Electrocardiograph Market Report is Segmented by Product Type (Resting ECG Systems, Stress ECG Systems, Holter Monitors, Event Recorders, and More), Lead Type (Single-Lead, 3-6 Lead, and More), End User (Hospitals & Clinics, Ambulatory Surgical Centers, and More), Technology (Analog, Digital/Cloud-connected), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.62% of 2025 revenue, buoyed by Medicare coverage and high cardiovascular incidence. U.S. hospitals standardize remote rhythm management programs that bill under recently created CPT codes, ensuring predictable reimbursement cash flows. Canada mirrors adoption via universal insurance schemes that reimburse primary-care ECG screening, while Mexico accelerates device imports as public hospitals modernize cardiology wards.

Asia-Pacific posts the swiftest 5.48% CAGR to 2031. Japan's compulsory annual ECG screening for adults aged >= 35 normalizes preventive testing and stabilizes equipment demand across prefectures . China invests in digital health under its Healthy China 2030 plan, subsidizing cloud ECG platforms for county hospitals. India broadens access through the Ayushman Bharat insurance expansion, which reimburses primary-health-center ECG tests. South Korea's fee schedule for wearable ECG monitors further underscores the region's pivot to mobile diagnostics. Europe maintains steady growth anchored by robust health systems in Germany, France and the Nordics. National e-health records facilitate remote ECG uploads, though reimbursement for at-home services varies by member state. The Middle East and Africa trail but show promising tenders in the Gulf Cooperation Council, where cardiac disease prevalence rises alongside sedentary lifestyles. South America records moderate uptake, led by Brazil's private-sector investment in tele-cardiology networks. Regional disparities underline the need for adaptable business models that bridge premium digital solutions with cost-sensitive analog alternatives.

- Abbott (BioTelemetry)

- AliveCor

- BIOTRONIK

- BPL

- Cardiac Insight Inc.

- CardioComm Solutions

- Compumed Inc.

- EDAN Instruments

- Fukuda Denshi Co.

- GE Healthcare

- Hillrom (Baxter)

- iRhythm Technologies

- Medtronic

- Mindray

- Nihon Kohden

- OSI Systems (Spacelabs)

- Koninklijke Philips

- Schiller

- Shenzhen Creative

- Welch Allyn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising cardiovascular-disease prevalence

- 4.2.2 Rapid adoption of AI-enabled ECG devices

- 4.2.3 Accelerating shift to remote & home cardiac monitoring

- 4.2.4 Government-funded mass screening programs

- 4.2.5 ECG integration into consumer wearable ecosystems (smartwatches, earbuds)

- 4.2.6 Insurer-led preventive-care reimbursement models

- 4.3 Market Restraints

- 4.3.1 Fragmented reimbursement in emerging markets

- 4.3.2 Shortage of ECG-trained technicians

- 4.3.3 Cyber-security & data-privacy risks in cloud ECG platforms

- 4.3.4 Algorithm bias affecting signal accuracy for women & dark-skin populations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Resting ECG Systems

- 5.1.2 Stress ECG Systems

- 5.1.3 Holter Monitors

- 5.1.4 Event Recorders

- 5.1.5 Wearable / Patch ECG Devices

- 5.1.6 ECG Management Software

- 5.2 By Lead Type

- 5.2.1 Single-Lead ECG

- 5.2.2 3-6 Lead ECG

- 5.2.3 12-Lead ECG

- 5.2.4 15/18-Lead Advanced ECG

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home Settings / Remote Patients

- 5.3.4 Diagnostic Labs & Cardiac Centers

- 5.4 By Technology

- 5.4.1 Analog ECG Devices

- 5.4.2 Digital / Cloud-connected ECG Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott (BioTelemetry)

- 6.4.2 AliveCor Inc.

- 6.4.3 Biotronik SE & Co. KG

- 6.4.4 BPL Medical Technologies

- 6.4.5 Cardiac Insight Inc.

- 6.4.6 CardioComm Solutions

- 6.4.7 Compumed Inc.

- 6.4.8 EDAN Instruments

- 6.4.9 Fukuda Denshi Co.

- 6.4.10 GE Healthcare

- 6.4.11 Hillrom (Baxter)

- 6.4.12 iRhythm Technologies

- 6.4.13 Medtronic plc

- 6.4.14 Mindray Medical International

- 6.4.15 Nihon Kohden Corporation

- 6.4.16 OSI Systems (Spacelabs)

- 6.4.17 Philips Healthcare

- 6.4.18 Schiller AG

- 6.4.19 Shenzhen Creative

- 6.4.20 Welch Allyn

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment