PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907311

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907311

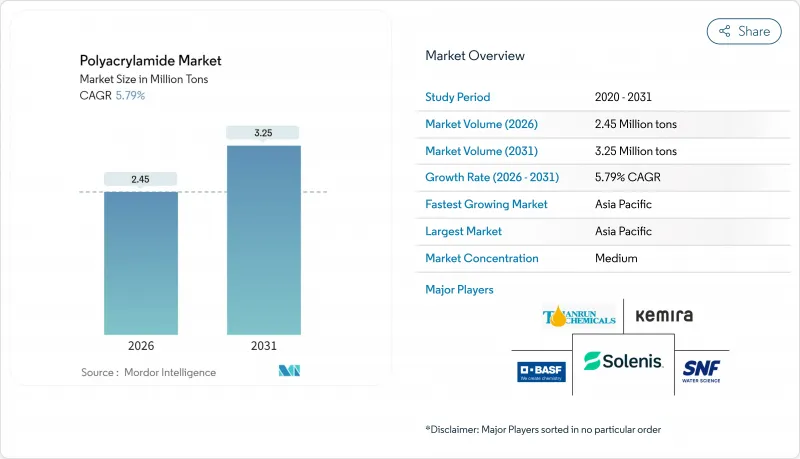

Polyacrylamide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Polyacrylamide market size in 2026 is estimated at 2.45 million tons, growing from 2025 value of 2.32 million tons with 2031 projections showing 3.25 million tons, growing at 5.79% CAGR over 2026-2031.

Rising demand for high-performance flocculants in municipal and industrial wastewater treatment, the rapid adoption of ultra-high-molecular-weight friction reducers in unconventional shale completions, and stricter zero-liquid-discharge mandates are the primary forces driving this expansion. Market players are also benefiting from China's multibillion-dollar investments in water infrastructure and BASF's large-scale capacity additions, which secure raw material availability and shorten supply chains.

Global Polyacrylamide Market Trends and Insights

Growing Utilization in Enhanced Oil Recovery (EOR)

Oil producers are replacing water-based flooding reagents with high-performance HPAM formulations that add 6%-27% incremental recovery, even in harsh reservoirs. Field results from North American shale plays confirm that ultra-high-molecular-weight polyacrylamide stabilizes viscosity under high salinity and 120 °C, cutting chemical top-ups and downtime. Graphene-oxide-reinforced HPAM further boosts thermal stability, unlocking tertiary recovery opportunities in deep, hot reservoirs. Market leaders are scaling dedicated research and development platforms to tailor polymer flooding packages to reservoir-specific chemistries, capturing value through service contracts and premium product pricing. As a result, enhanced oil recovery now represents the fastest-growing revenue stream within the polyacrylamide market.

Increasing Demand for Flocculants in Municipal and Industrial Wastewater Treatment

Utilities report up to 95% turbidity reduction with lower chemical consumption versus conventional coagulants. Industrial users in Asia-Pacific are migrating to advanced flocculant systems to meet EPA-style zero-discharge limits and recycle process water. New formulations that target heavy-metal removal address cadmium and chromium compliance gaps, broadening the addressable client base. These dynamics underpin the long-term expansion of the polyacrylamide market in water treatment.

Health and Carcinogenicity Concerns Over Residual Acrylamide Monomer

Regulators limit residual acrylamide to below 0.2% in food-contact materials and 0.1% in cosmetics, forcing producers to invest in tighter purification regimes. California's Proposition 65 classification and IARC's probable carcinogen status intensify labeling and monitoring obligations. Compliance raises production costs and slows product approvals in consumer-facing segments, trimming potential demand. Producers with advanced QA laboratories can turn the constraint into a competitive edge, but smaller firms risk market exit, softening overall polyacrylamide market growth.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Mining Activities Driving Demand for Sedimentation Aids

- Government Mandates on Zero-Liquid-Discharge and Sludge Reduction

- Rising Preference for Bio-Based Flocculants in Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The powder segment held a 43.78% share of the polyacrylamide market size in 2025, supported by ease of bulk handling and lower freight costs for high-volume municipal projects. However, liquid emulsions are gaining rapid traction, with a 6.10% CAGR forecast to 2031, because instant solubility and molecular-weight preservation reduce process downtime in shale completions and high-temperature industrial circuits.

Packaging shifts illustrate the trend: drum-to-IBC conversions are rising in North America to improve onsite dosing precision, while Chinese suppliers are expanding inverse-emulsion reactors that raise active-polymer content to 50%. Powder therefore retains its stronghold in cost-sensitive water utilities, but emulsions capture incremental value in performance-critical niches, underscoring the maturation of the polyacrylamide industry toward specialized chemistries.

The Polyacrylamide Report is Segmented by Physical Form (Powder, Liquid, and Emulsion/Dispersions), Application (Enhanced Oil Recovery, Flocculants for Water Treatment, Soil Conditioner, and More), End-User Industry (Water Treatment, Oil and Gas, Pulp and Paper, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific captured 49.92% of the global polyacrylamide market share in 2025 and is growing at a 6.20% CAGR, propelled by China's USD 45 billion water-treatment program. The region's self-reinforcing loop of capacity expansion and local demand insulates it from supply shocks and sustains pricing power. India's chemicals corridor and Japan's membrane-technology leadership add further impetus, while Southeast Asian states benefit from manufacturing relocations that demand advanced effluent solutions.

North America remains a powerhouse for high-margin EOR and friction-reducer grades, with shale activity extending product lifecycles and enabling suppliers like SNF to acquire complementary completion-fluid firms. EPA zero-discharge rules further underpin steady sales into industrial wastewater projects. Europe shows slower volume growth but is a bellwether for bio-based innovation; its green-procurement policies stimulate research and development in biodegradable flocculants, while specialty applications in chemicals and mining uphold baseline polymer demand.

The Middle East and Africa are emerging growth theaters, leveraging abundant oilfields and mining prospects to justify local capacity additions. South America's copper and lithium boom likewise drives sedimentation-aid uptake, while government projects to modernize water infrastructure broaden addressable demand. Geographic diversification therefore remains central to sustaining resilient expansion in the polyacrylamide market.

- AnHui JuCheng Fine Chemicals Co. Ltd

- Anhui Tianrun Chemical Industry Co. Ltd

- Ashland

- BASF

- Beijing Hengju Chemical Group Co. Ltd

- Beijing Xitao Technology Development Co. Ltd

- CHINAFLOC

- Envitech Chemical Specialities Pvt. Ltd

- Kemira

- Liaocheng Yongxing Environmental Protection Science & Technology Co. Ltd

- Qingdao Oubo Chemical Co. Ltd

- Shandong Tongli Chemical Co. Ltd

- SNF

- Solenis

- Syensqo

- Universal Fine Chemicals SPC

- Yixing Cleanwater Chemicals Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Utilization in Enhanced Oil Recovery (EOR)

- 4.2.2 Increasing Demand for Flocculants in Municipal and Industrial Wastewater Treatment

- 4.2.3 Expansion of Mining Activities Driving Demand for Sedimentation Aids

- 4.2.4 Government Mandates on Zero-Liquid-Discharge and Sludge Reduction

- 4.2.5 Shift Toward Ultra-High-Molecular-Weight Friction Reducers for Shale Completions

- 4.3 Market Restraints

- 4.3.1 Health And Carcinogenicity Concerns over Residual Acrylamide Monomer

- 4.3.2 Rising Preference for Bio-Based Flocculants in Europe

- 4.3.3 Supply-Chain Vulnerability of Acrylonitrile Feedstock in China and CIS

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Physical Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.1.3 Emulsion/Dispersions

- 5.2 By Application

- 5.2.1 Enhanced Oil Recovery

- 5.2.2 Flocculants for Water Treatment

- 5.2.3 Soil Conditioner

- 5.2.4 Binders and Stabilizers in Cosmetics

- 5.2.5 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Water Treatment

- 5.3.2 Oil and Gas

- 5.3.3 Pulp and Paper

- 5.3.4 Mining

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AnHui JuCheng Fine Chemicals Co. Ltd

- 6.4.2 Anhui Tianrun Chemical Industry Co. Ltd

- 6.4.3 Ashland

- 6.4.4 BASF

- 6.4.5 Beijing Hengju Chemical Group Co. Ltd

- 6.4.6 Beijing Xitao Technology Development Co. Ltd

- 6.4.7 CHINAFLOC

- 6.4.8 Envitech Chemical Specialities Pvt. Ltd

- 6.4.9 Kemira

- 6.4.10 Liaocheng Yongxing Environmental Protection Science & Technology Co. Ltd

- 6.4.11 Qingdao Oubo Chemical Co. Ltd

- 6.4.12 Shandong Tongli Chemical Co. Ltd

- 6.4.13 SNF

- 6.4.14 Solenis

- 6.4.15 Syensqo

- 6.4.16 Universal Fine Chemicals SPC

- 6.4.17 Yixing Cleanwater Chemicals Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment