PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907337

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907337

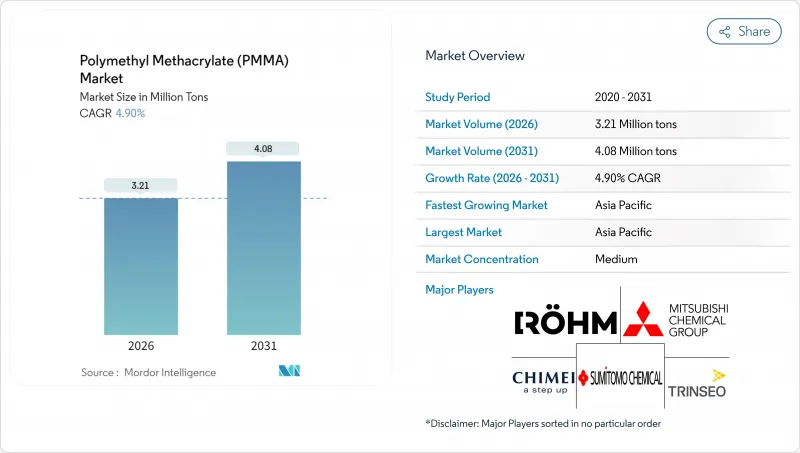

Polymethyl Methacrylate (PMMA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Polymethyl Methacrylate (PMMA) market size in 2026 is estimated at 3.21 Million tons, growing from 2025 value of 3.06 Million tons with 2031 projections showing 4.08 Million tons, growing at 4.90% CAGR over 2026-2031.

Solid demand from automotive lightweighting, architectural glazing, and LED displays sustains growth even as methyl methacrylate (MMA) feedstock costs remain volatile. PMMA's optical clarity, UV stability, and straightforward processing differentiate it from competing polymers, shielding volumes from substitution pressure in many core uses. Regional overcapacity-especially in China-keeps pricing competitive, while breakthrough chemical-recycling pilots open a pathway to circular production models. Producers prioritize vertical integration and specialty-grade development as defensive strategies in the PMMA market.

Global Polymethyl Methacrylate (PMMA) Market Trends and Insights

Automotive lightweight and lighting demand

Electric-vehicle makers specify PMMA for panoramic sunroofs, tail-lamp covers, and sensor housings because the polymer weighs 50% less than glass yet offers high optical quality. The technology shift toward adaptive LED systems amplifies demand for Rohm's light-management grades that shape precise beam patterns. Additional pull comes from autonomous-vehicle LiDAR lenses requiring low birefringence. Despite new impact-resistant polycarbonate (PC) copolymers, PMMA market resilience persists where cost and UV durability outweigh marginal toughness gains.

Architectural Glazing and Facade Adoption

Smart-building envelopes now integrate PMMA sheets embedded with sensors and heating elements that manage daylight, condensation, and self-cleaning functions. PMMA transmits 92-93% visible light versus 86-89% for PC, supporting energy-efficiency credits under European building codes. Digital printing on PMMA panels enables complex facade designs without multi-material assemblies, reducing installation time. Fire-code restrictions in high-rise projects still cap penetration, yet long-term warranties and UV resistance keep PMMA competitive where clarity and aesthetics dominate.

Volatile MMA Feedstock Pricing

MMA price swings mirror petrochemical feedstock trends, magnified by energy-intensive processes. Trinseo raised European PMMA prices by EUR 250 / t in March 2025 after propylene costs surged, compressing converter margins. Import-dependent regions such as Europe remain exposed until bio-based or recycled MMA scales commercially. Asian producers with back-integrated acetone routes gain cost advantage, exacerbating global price disparities.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of LED Signage & Display Industry

- Growth in Medical & Dental PMMA Use

- Substitution Threat from Polycarbonate and Glass

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sheets captured 38.19% of PMMA market share in 2025 and will expand at a 5.36% CAGR through 2031, underpinning USD-denominated sales growth proportionate with the overall PMMA market size for this category. Thinner-gauge extrusion lines now deliver robust mechanical stability that satisfies automotive sunroof load requirements, enabling vehicle makers to shave weight without sacrificing safety margins. Cast-acrylic sheets retain premium positioning-especially in LED edge-lit panels-thanks to tighter thickness tolerances that minimize optical defects.

Beads and pellets follow as the workhorse feedstocks for injection-molded lenses, appliance knobs, and medical parts. Formulators increasingly incorporate impact modifiers and UV absorbers at the compounding stage, trading some transparency for higher durability in outdoor signage. Granules tailored for laser engraving open niche revenue streams in trophy and giftware segments. Although growth lags the sheet category, resin compounds support consistent PMMA market demand by serving a wider span of short-run customized products.

The PMMA Market Report is Segmented by Product Form (Sheets, Beads and Pellets, Resin Compounds and Granules), End-User Industry (Automotive, Building and Construction, Electrical and Electronics, Aerospace, Industrial Machinery and Equipment, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific accounted for 50.30% of PMMA market share in 2025 on the strength of China's large converter base and India's infrastructure build-out. However, Chinese overcapacity compresses margins, pushing domestic players toward specialty exports and prompting new capacity curtailments. India's commitment of USD 1.1 billion to an integrated MMA-PMMA complex aims to cut import reliance and seize regional share by 2027. Japan and South Korea anchor high-value niches tied to electronics and optics, mitigating price erosion seen in commodity grades.

North America remains a mature but lucrative arena where sustainability attributes command premiums. LG Chem's 2025 bio-acrylic acid launch positions North American converters to offer renewable-content PMMA products in cosmetics packaging. Aerospace recovery and electric-vehicle investments bolster baseline volumes despite imported sheet competition.

Europe focuses on circularity; chemical-recycling pilots in Germany and the Netherlands receive policy support and generate early commercial lots that meet recycled-content quotas. Nevertheless, exposure to imported MMA feedstocks leaves European PMMA producers vulnerable to energy-driven cost spikes. South American and Middle-Eastern markets remain small but promising as infrastructure megaprojects demand transparent noise barriers and large-format signage.

- Asahi Kasei Corporation

- CHIMEI

- Kuraray Co., Ltd.

- LOTTE MCC Corp.

- Lucite International Alpha B.V.

- LX MMA (LX Group)

- Mitsubishi Chemical Corporation

- Rohm GmbH

- Sanors

- Sumitomo Chemical Co., Ltd.

- Suzhou Double Elephant Optical Materials Co., Ltd.

- Trinseo

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive lightweight and lighting demand

- 4.2.2 Architectural glazing and facade adoption

- 4.2.3 Expansion of LED signage and display industry

- 4.2.4 Growth in medical and dental PMMA use

- 4.2.5 Breakthroughs in PMMA chemical-recycling economics

- 4.3 Market Restraints

- 4.3.1 Volatile MMA feedstock pricing

- 4.3.2 Substitution threat from polycarbonate and glass

- 4.3.3 Stringent single-use plastics regulation

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Import and Export Trends

- 4.7 Pricing Trends

- 4.8 Regulatory Landscape

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging(Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Form

- 5.1.1 Sheets

- 5.1.2 Beads and Pellets

- 5.1.3 Resin Compounds and Granules

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Electrical and Electronics

- 5.2.4 Aerospace

- 5.2.5 Industrial Machinery and Equipment

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 CHIMEI

- 6.4.3 Kuraray Co., Ltd.

- 6.4.4 LOTTE MCC Corp.

- 6.4.5 Lucite International Alpha B.V.

- 6.4.6 LX MMA (LX Group)

- 6.4.7 Mitsubishi Chemical Corporation

- 6.4.8 Rohm GmbH

- 6.4.9 Sanors

- 6.4.10 Sumitomo Chemical Co., Ltd.

- 6.4.11 Suzhou Double Elephant Optical Materials Co., Ltd.

- 6.4.12 Trinseo

- 6.4.13 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs