PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910431

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910431

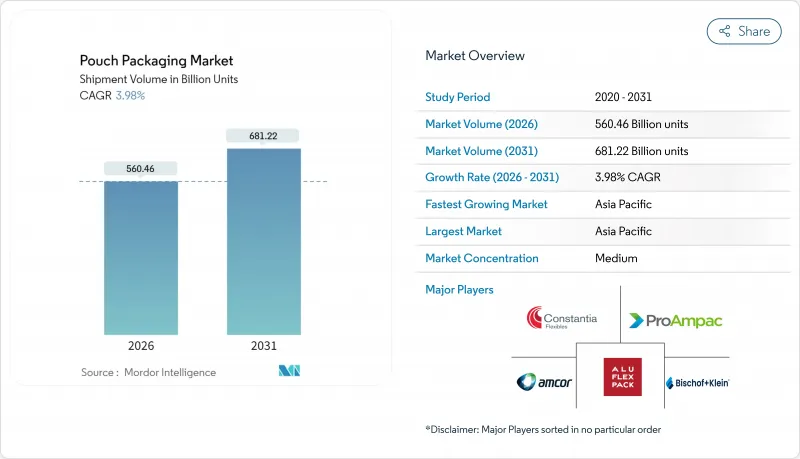

Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pouch packaging market was valued at USD 539.01 billion in 2025 and estimated to grow from USD 560.46 billion in 2026 to reach USD 681.22 billion by 2031, at a CAGR of 3.98% during the forecast period (2026-2031).

This steady trajectory underscores the pouch packaging market's transition from rapid early-stage growth to a more measured expansion supported by e-commerce logistics, convenience food trends, and tightening sustainability regulations. Brand owners continue to favor material-efficient flexible packs over rigid formats, while regulatory bodies endorse lightweight solutions that cut transport emissions. Technology investments now prioritize mono-material barrier films and recyclability compliance, shifting competitive advantage away from pure scale economics.

Global Pouch Packaging Market Trends and Insights

Rising Demand for Cost-Effective Packaging and Brand Differentiation

Inflationary pressure on consumer goods margins intensifies the search for packaging formats that cut material usage without compromising shelf appeal. Pouches typically use 70% less substrate than comparable rigid packs and provide a larger printable surface that supports high-resolution graphics. ProAmpac's 2024 report shows curbside-recyclable pouches delivering 15-20% material cost savings for brand owners. Smaller brands leverage these economics to match the visual impact of multinationals, fostering market fragmentation and stimulating additional unit volumes across price-sensitive categories.

Surge in Convenience and Ready-to-Eat Food Consumption

Rising urbanization and smaller household sizes translate into greater reliance on single-serve, microwave-ready meals best suited to flexible formats. USDA data indicates 12% annual growth in ready meals across China's tier-2 cities, with pouches gaining share due to uniform heating and steam venting capabilities. Premium baby-food players such as Once Upon a Farm capitalize on spouted pouches that extend shelf life and justify price premiums through superior functionality.

Escalating Environmental and Recycling Challenges

Flexible-film recycling infrastructure lags far behind that of PET bottles or metal cans, exposing brands to Extended Producer Responsibility fees. The Flexible Packaging Association notes only 4% of flexible films are mechanically recycled in the United States, leaving converters to fund costly take-back schemes. Meanwhile, proposed PFAS bans threaten barrier chemistries vital for food safety, creating uncertainty that slows capital spending on new lines.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-Driven Shift Toward Lightweight Flexible Packs

- Acceleration of E-Commerce and Direct-to-Consumer Logistics

- Volatility in Plastic-Resin Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics retained a 60.72% pouch packaging market share in 2025, anchored by the affordability and processability of polyethylene and polypropylene. Yet bio-based and compostable materials are gaining a 6.05% CAGR foothold as regulators signal a future where end-of-life solutions trump historic cost-performance ratios. Leading converters integrate plant-derived resins with barrier coatings based on nanofibrillated cellulose that rival EVOH in oxygen-blocking capacity.

The pouch packaging market rewards mono-material breakthroughs that ensure recyclability while maintaining product protection. Patent filings for simplified structures rose 40% in 2024, demonstrating a material-science arms race. Converters investing in compatibilizers and solvent-free lamination position themselves to meet EU recyclability quotas ahead of the 2030 deadline. Meanwhile, aluminum foil usage holds steady in premium applications that demand near-zero oxygen ingress, though downgauging efforts continue.

Flat formats still constitute 36.33% of the pouch packaging market size, reflecting entrenched applications in dry goods. Stand-up pouches, however, outpace at a 5.43% CAGR as retailers reward the vertical billboard effect on crowded shelves. Brands exploit gusseted bases and photo-realistic printing to signal premium value, even in commoditized categories such as snack nuts or pet treats.

Function-specific variants proliferate. Retort pouches enable shelf-stable ready meals, aseptic laminates chase beverage opportunities, and stick packs dominate single-serve nutraceuticals. Integrated rollstock-to-fill workflows deliver cost advantages for high-volume SKUs, whereas premade formats suit small batch runs. Gualapack's integrated laminate, injection, and filling solution in Brazil exemplifies how end-to-end control lowers failure rates while accelerating time to market.

The Pouch Packaging Market Report is Segmented by Material (Plastics, Paper, Aluminum Foil, Bio-degradable/Compostable), Product Type (Flat, Stand-Up, Spouted, Retort, Aseptic, Stick-Pack/Sachet, Rollstock/Premade Pouch), Closure Type (Zipper, Spout and Cap, and More), End-User Industry (Food, Beverage, Medical and Pharmaceutical, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

Geography Analysis

Asia-Pacific led with 39.54% of the pouch packaging market share in 2025 and is forecast to record a 6.74% CAGR to 2031. China's rapid shift toward packaged foods, propelled by organized retail and stringent food-safety laws, keeps demand buoyant. India's modern trade expansion drives volume gains, while South Korea's K-Beauty ecosystem exports flexible cosmetic packs worldwide. Regional converters benefit from proximity to virgin resin suppliers and cost-competitive labor, reinforcing localized supply chains even as multinational brand owners demand global harmonization of pack specifications.

North America exhibits a mature demand profile focused on premiumization and e-commerce readiness. Lightweight designs translate into shipping cost savings under dimensional-weight tariffs, pushing retailers toward house-brand pouch adoption. Europe's regulatory drive toward recyclability accelerates mono-material rollouts, positioning flexible packs ahead of rigid glass and multilayer cartons on lifecycle metrics. Scandinavian markets pilot deposit schemes for flexible films, providing data for broader EU implementation.

South America and the Middle East, and Africa collectively offer emerging upside. Brazil's dairy sector adopts spouted pouches for yogurt drinks, citing cold-chain energy savings. Gulf Cooperation Council nations import pouch-packed ready meals that withstand desert logistics, and African megacities rely on small-sachet formats for affordable daily necessities. Infrastructure hurdles remain, yet demographic momentum and rising disposable incomes will progressively close the gap with developed regions.

- Amcor plc

- Mondi plc

- ProAmpac Intermediate, Inc.

- Constantia Flexibles Group GmbH

- Huhtamaki Oyj

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Management GmbH

- Bischof + Klein SE and Co. KG

- FlexPak Services, LLC

- Goglio SpA

- Scholle IPN Corporation

- Gualapack SpA

- Aluflexpack AG

- Flair Flexible Packaging Corporation

- Hood Packaging Corporation

- Toppan Printing Co., Ltd.

- Winpak Ltd.

- Glenroy, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for cost-effective packaging and brand differentiation

- 4.2.2 Surge in convenience and ready-to-eat food consumption

- 4.2.3 Sustainability-driven shift toward lightweight flexible packs

- 4.2.4 Acceleration of e-commerce and direct-to-consumer logistics

- 4.2.5 Expansion of spouted pouches in industrial bulk applications

- 4.2.6 High-barrier mono-material film breakthroughs enabling recyclability

- 4.3 Market Restraints

- 4.3.1 Escalating environmental and recycling challenges

- 4.3.2 Volatility in plastic-resin feedstock prices

- 4.3.3 Competition from emerging fiber-based flexible formats

- 4.3.4 Supply constraints for bio-based high-barrier resins

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 The Impact of Macroeconomic Factors on the Market

- 4.9 Recycling and Sustainability Landscape

5 MARKET SIZE AND GROWTH FORECASTS(VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyethylene Terephthalate (PET)

- 5.1.1.4 Polyvinyl Chloride resin (PVC)

- 5.1.1.5 Other Plastics

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Bio-degradable/Compostable

- 5.1.1 Plastics

- 5.2 By Product Type

- 5.2.1 Flat (Pillow and Side-Seal)

- 5.2.2 Stand-Up

- 5.2.3 Spouted

- 5.2.4 Retort

- 5.2.5 Aseptic

- 5.2.6 Stick-Pack / Sachet

- 5.2.7 Rollstock / Premade Pouch

- 5.3 By Closure Type

- 5.3.1 Zipper

- 5.3.2 Spout and Cap

- 5.3.3 Tear-Notch

- 5.3.4 Slider

- 5.3.5 Other Closure Type

- 5.4 By End-User Industry

- 5.4.1 Food

- 5.4.1.1 Candy and Confectionery

- 5.4.1.2 Frozen Foods

- 5.4.1.3 Fresh Produce

- 5.4.1.4 Dairy Products

- 5.4.1.5 Dry Foods and Cereals

- 5.4.1.6 Meat, Poultry and Seafood

- 5.4.1.7 Pet Food

- 5.4.1.8 Other Foods (Sauces, Condiments, Spreads)

- 5.4.2 Beverage

- 5.4.2.1 Alcoholic

- 5.4.2.2 Non-Alcoholic

- 5.4.3 Medical and Pharmaceutical

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Home Care and Household

- 5.4.6 Other End-User Industry

- 5.4.1 Food

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Mondi plc

- 6.4.3 ProAmpac Intermediate, Inc.

- 6.4.4 Constantia Flexibles Group GmbH

- 6.4.5 Huhtamaki Oyj

- 6.4.6 Sealed Air Corporation

- 6.4.7 Sonoco Products Company

- 6.4.8 Coveris Management GmbH

- 6.4.9 Bischof + Klein SE and Co. KG

- 6.4.10 FlexPak Services, LLC

- 6.4.11 Goglio SpA

- 6.4.12 Scholle IPN Corporation

- 6.4.13 Gualapack SpA

- 6.4.14 Aluflexpack AG

- 6.4.15 Flair Flexible Packaging Corporation

- 6.4.16 Hood Packaging Corporation

- 6.4.17 Toppan Printing Co., Ltd.

- 6.4.18 Winpak Ltd.

- 6.4.19 Glenroy, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment