PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910432

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910432

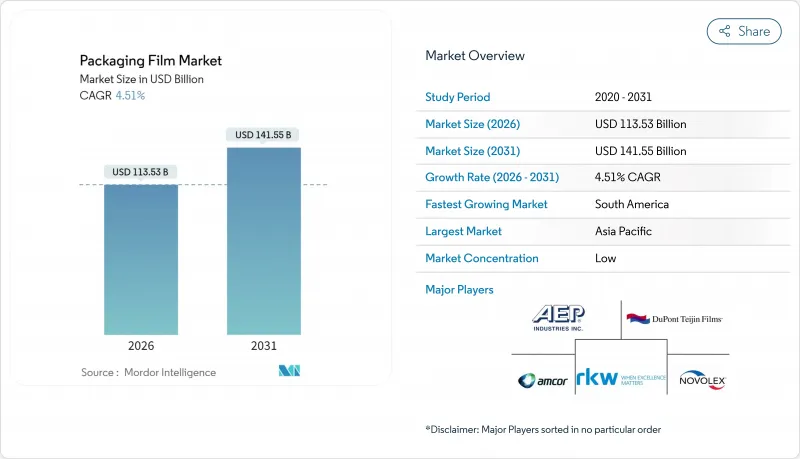

Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The packaging film market was valued at USD 108.63 billion in 2025 and estimated to grow from USD 113.53 billion in 2026 to reach USD 141.55 billion by 2031, at a CAGR of 4.51% during the forecast period (2026-2031).

Heightened demand for lightweight e-commerce shipping materials, stricter European recyclability rules, and rapid cold-chain expansion in emerging Asia-Pacific economies sustain steady momentum. Multilayer barrier innovations, antimicrobial masterbatches, and chemical-recycling feedstock agreements underpin premium growth niches, while strategic mergers accentuate scale advantages among the top global converters.

Global Packaging Film Market Trends and Insights

E-commerce Boom Driving Demand for Lightweight Shipping Films

Parcel-volume growth pushes brands to down-gauge shipping packs, trimming dimensional weight by up to 30% while preserving drop resistance. PAC Worldwide's Eco PAC jacket system automates mailer conversion and reduces labor at fulfillment centers, aligning cost efficiency with recyclability goals. Dual-seal courier bags support reverse-logistics programs that are integral to customer loyalty. Short-run graphics tap digital presses for thematic promotions that strengthen brand engagement and circumvent high plate charges. These factors collectively reinforce the packaging film market as a core beneficiary of global retail digitization.

EU Push for Mono-Material Recyclable Films

The Packaging and Packaging Waste Regulation obligates 30% recycled content in plastic food packs by 2030 and requires full recyclability, accelerating the shift toward polyolefin-only laminates. Mopack's certified structures with 80% rPE validate commercial readiness, while converters install de-inking and wash systems to secure compliance. Extended Producer Responsibility fees become a material cost lever that favors designs enabling closed-loop recovery. As compliance deadlines approach, the packaging film market adopts standardized design rules that harmonize performance with recyclability.

Plastic Bans/Taxes in North America and Europe

Single-use levies and PFAS prohibitions force rapid specification overhaul, stretching R&D budgets at mid-sized plants and lengthening customer qualification cycles. Fragmented policy rollouts complicate inventory planning as brands juggle differing regional cutoffs for legacy laminates.

Other drivers and restraints analyzed in the detailed report include:

- Cold-Chain Packaged Food Growth in Emerging Asia-Pacific

- Digital Printing Enabling Short-Run Personalised Packs

- Volatile Virgin-Resin Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene preserves 42.10% share of the packaging film market in 2025, riding its favorable price-performance profile and broad processability. High-density grades serve semi-rigid uses while LDPE and LLDPE underpin the bulk of blown-film applications. Bioplastics post a robust 7.75% CAGR through 2031 as policy signals and brand pledges intensify. The packaging film market size for bioplastic variants is projected to reach multi-billion USD territory by decade-end, provided feedstock scaling continues apace. Polypropylene's biaxially oriented formats compete on clarity and stiffness for premium confectionery. PET layers ensure dimensional stability in retort applications, often coupled with aluminum-oxide coatings for a high gas barrier. Chemical-recycling advances promise closed-loop PE that matches virgin properties, with titanosilicate catalysis now at pilot scale. Block-copolymerized PLA breakthroughs cut brittleness, offering an 80% bio-based alternative for fresh-produce pouches.

Polyethylene converters invest in metallocene catalysts that upgrade seal-through-contamination performance, an essential trait for high-speed form-fill-seal lines. The packaging film market thus balances cost efficiency against sustainability pulls, with incumbents safeguarding volume while specialty biopolymers address regulatory requirements and consumer preference shifts.

Multilayer constructions controlled 56.20% revenue in 2025 by optimizing mechanical, optical and barrier attributes through layer-specific functionality. Barrier stacks incorporating EVOH or AlOx layers are on course for 6.14% CAGR as pharma logistics and ready-meal sectors require longer shelf life. Monolayer films retain relevance where recovery streams demand simpler chemistries, notably for store drop-off recycling in North America.

Co-extruders add inline orientation units to produce machine-direction oriented PE laminates that satisfy recyclability while keeping puncture resistance. Nanoclay dispersions cut oxygen transmission by 60% at equivalent calipers, paving the way for further down-gauging. Layer-thickness scanners improve profile accuracy and minimize start-up scrap, delivering yield gains that feed directly into bottom-line improvement for participants within the packaging film market.

The Packaging Film Market Report is Segmented by Material Type (Polyethylene, Polypropylene, Polyester, and More), Film Structure (Monolayer, and More), Application (Food and Beverage, Pharmaceutical and Medical, Personal Care and Cosmetics, and More), End-Use Format (Bags and Pouches, Wraps and Lidding Films, Labels and Sleeves, and More ), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific sustained 37.00% share of the packaging film market in 2025, underpinned by abundant resin supply, competitive labor, and a vast consumer base. China's GB/T 31268-2024 rule on excessive packaging triggers demand for ultra-light pouches that meet parcel weight caps. Thailand and Indonesia implement harmonized food-contact controls that standardize test protocols and elevate local extrusion sophistication. Indian players such as JPFL Films add 60,000 tpa BOPP capacity to capture domestic and export opportunities. Japan and South Korea champion barrier-coating R&D, while Australia emphasizes post-consumer recycling content.

Europe faces transformative investment cycles to satisfy PPWR recyclability and recycled-content thresholds. Constantia Flexibles' acquisition of Aluflexpack consolidates foil competencies and bolsters Southeast-European footholds. Brands introduce QR-coded disposal instructions to guide consumers and to enhance collection purity. The UK and Germany pilot chemical-recycling drop-offs, driving rPE integration.

North America leverages mature e-commerce networks and rolling policy clarity. PFAS withdrawal deadlines steer converters toward metallized BOPP and AlOx PET, while Canada capitalizes on feedstock cost advantages to remain a major exporter. Mexican facilities supply both domestic snack markets and southern U.S. value chains.

South America records the fastest 7.60% CAGR through 2031, propelled by agricultural exports that require high-barrier films. Investments by OPP FILM COLOMBIA and GDM Plasticos expand BOPP and CPP footprints, while regional funding bodies support eco-design labs. The momentum positions the region as the new growth frontier in the packaging film market.

Middle East and Africa post solid double-digit volume gains fostered by urban retail expansion. Saudi Arabia and the UAE introduce mandates for recyclable plastics that guide procurement choices, and South Africa's established converters serve the broader continent with cost-optimized offerings.

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Jindal Poly Films Ltd

- Cosmo Films Ltd

- Uflex Ltd

- Huhtamaki Oyj

- ProAmpac Holdings

- Novolex Holdings

- AEP Industries

- RKW SE

- Toray Plastics

- Coveris Holdings

- Sigma Plastics Group

- SRF Limited

- Klockner Pentaplast

- Taghleef Industries

- Polyplex Corporation

- Transcontinental Inc.

- Dupont Teijin Films

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving demand for lightweight shipping films

- 4.2.2 EU push for mono-material recyclable films

- 4.2.3 Cold-chain packaged food growth in emerging Asia-Pacific

- 4.2.4 Digital printing enabling short-run personalised packs

- 4.2.5 Antimicrobial additive masterbatches for meat films

- 4.2.6 Chemical-recycling feedstock agreements for food-grade rPE

- 4.3 Market Restraints

- 4.3.1 Plastic bans / taxes in NA and Europe

- 4.3.2 Volatile virgin-resin prices

- 4.3.3 Barrier limits of bio-based films

- 4.3.4 Converter downtime from ultra-thin gauges

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Polyethylene

- 5.1.1.1 High-Density Polyethylene (HDPE)

- 5.1.1.2 Low-Density Polyethylene (LDPE)

- 5.1.1.3 Linear Low-Density Polyethylene (LLDPE)

- 5.1.2 Polypropylene

- 5.1.3 Polyester (BOPET)

- 5.1.4 Bioplastics

- 5.1.5 Other Material Types

- 5.1.1 Polyethylene

- 5.2 By Film Structure

- 5.2.1 Monolayer

- 5.2.2 Multilayer (2-3 layers)

- 5.2.3 Barrier multilayer (More than 3 layers)

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical and Medical

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Consumer Durables and Electronics

- 5.3.5 Industrial and Institutional

- 5.3.6 Agriculture and Horticulture

- 5.3.7 Other Application

- 5.4 By End-Use Format

- 5.4.1 Bags and Pouches

- 5.4.2 Wraps and Lidding Films

- 5.4.3 Labels and Sleeves

- 5.4.4 Blister and Sachets

- 5.4.5 Shrink and Stretch Wrap

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Sealed Air Corporation

- 6.4.3 Mondi plc

- 6.4.4 Jindal Poly Films Ltd

- 6.4.5 Cosmo Films Ltd

- 6.4.6 Uflex Ltd

- 6.4.7 Huhtamaki Oyj

- 6.4.8 ProAmpac Holdings

- 6.4.9 Novolex Holdings

- 6.4.10 AEP Industries

- 6.4.11 RKW SE

- 6.4.12 Toray Plastics

- 6.4.13 Coveris Holdings

- 6.4.14 Sigma Plastics Group

- 6.4.15 SRF Limited

- 6.4.16 Klockner Pentaplast

- 6.4.17 Taghleef Industries

- 6.4.18 Polyplex Corporation

- 6.4.19 Transcontinental Inc.

- 6.4.20 Dupont Teijin Films

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment