PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910437

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910437

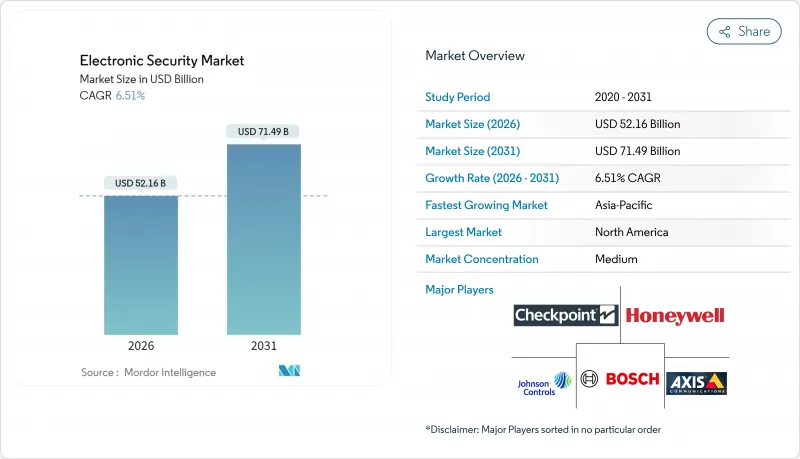

Electronic Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The electronic security market is expected to grow from USD 48.97 billion in 2025 to USD 52.16 billion in 2026 and is forecast to reach USD 71.49 billion by 2031 at 6.51% CAGR over 2026-2031.

Continued migration from analog systems, rising AI video analytics penetration, and tighter critical-infrastructure protection rules underpin this growth. Integrated cloud platforms reduce ownership costs and speed deployments, while edge processing curbs bandwidth needs and boosts real-time decision making. Vendor consolidation unlocks end-to-end offerings that combine surveillance, access, and alarms, yet also raises entry barriers for niche specialists. Governments sustain procurement budgets, smart-home adoption broadens the customer base, and expanding cyber-physical threats keep security investment top of mind across industries.

Global Electronic Security Market Trends and Insights

Proliferation of AI-Enabled Video Analytics

AI analytics turns cameras into proactive sensors that cut false alarms by 95% and support retail traffic insights. Edge inference chips process footage locally, letting operators act within seconds at airports and power plants. Vendors monetize analytics licenses, while integrators upskill to manage algorithm training. Early adopters in North America and Europe validate performance benchmarks that spur global rollouts. Rising accuracy and declining compute costs keep this driver potent through the medium term.

Migration from Analog to IP-Based Systems

IP networks let firms monitor multiple sites remotely, integrate access control, and tap cloud storage. Subscription models shift spending from capital to operating budgets, drawing small and medium enterprises into the electronic security market. However, open network exposure mandates encryption and segmentation that add set-up complexity. Asia Pacific leapfrogs legacy cabling, installing IP in new malls and industrial parks, anchoring long-term growth.

Fragmented Compliance Standards Across Regions

The European NIS2 rules mandate controls that differ from U.S. frameworks, forcing vendors to re-engineer firmware and file extra documentation. Certification costs climb and product launches slip, straining smaller suppliers. Multinationals juggle parallel system builds to satisfy data-residency clauses, raising deployment expenses and slowing electronic security market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Integrated Cloud-Driven Platforms

- Rise in Smart and Connected Infrastructure

- High Total Cost of Ownership for SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surveillance equipment captured 41.38% of electronic security market size in 2025 on the strength of AI-capable cameras and line-crossing analytics. Access and control products are climbing at a 7.05% CAGR, aided by biometric readers and mobile credentials. Vendors bundle thermal imaging and multi-sensor units to extend detection into low-light and harsh weather, while convergence with access logs enriches forensic evidence. Edge processing curtails backhaul costs, maintaining surveillance relevance even where bandwidth is scarce.

The proliferation of AI modules within cameras creates adjacent use cases such as queue management and industrial safety. Enterprise buyers view unified dashboards that marry video feeds with badge activity, positioning surveillance as the digital spine of next-generation facilities. As hardware commoditizes, differentiation shifts to software stacks and cybersecurity hardening, reinforcing the premium on integrated offerings within the electronic security market.

Monitoring services held 37.55% revenue in 2025, supplying always-on oversight that enterprises and local governments deem essential. Cloud monitoring's 7.18% CAGR rides mobile apps and browser-based portals that let managers verify alarms on the go. Predictive maintenance algorithms schedule field visits before device failure, cutting downtime and truck rolls. Consulting engagements around compliance and cyber fortification rise as physical systems sit on corporate networks, cementing service providers as strategic partners.

Subscription economics attract investors seeking annuity returns, prompting acquisitions of regional monitoring centers. As do-it-yourself residential packages proliferate, professional monitoring upgrades become an upsell lever, broadening the electronic security market beyond commercial complexes. Top operators invest in AI triage tools that prioritize genuine alerts, preserving service levels even as camera volumes surge.

The Electronic Security Market Report is Segmented by Product Type (Surveillance Security System, Alarm System, Access and Control System, and More), Service Type (Installation and Integration, Monitoring, and More), Deployment Mode (On-Premise, and Cloud), End-User Vertical (Government, Transportation, Industrial, Hospitality, Retail Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 33.21% of 2025 revenue, propelled by USD 27.5 billion in federal cybersecurity outlays and TSA's USD 10.8 billion multiyear plan for advanced screening. Early AI adoption and mature cloud acceptance speed platform upgrades, though semiconductor shortages elongate lead times. State grants encourage school safety retrofits, sustaining a robust project pipeline across the United States and Canada.

Asia Pacific is advancing at a 7.12% CAGR through 2031, bolstered by smart-city blueprints in China, India, and Southeast Asia. Local manufacturers supply cost-effective cameras, while 5G rollouts underpin cloud surveillance pilots. Government stimulus packages earmark funds for digital infrastructure, and a growing middle class embraces connected doorbells and motion sensors. Supply-chain geopolitics and export controls inject risk, yet rising urban density ensures recurring demand across commercial towers and industrial parks.

Europe's outlook remains steady as the NIS2 Directive drives cyber-physical convergence spending. Germany and the United Kingdom modernize rail and energy assets with AI video and biometric gates, while GDPR steers vendors toward privacy-preserving analytics. The Middle East and Africa allocate USD 169 billion in IT spend by 2026, with security layers woven into megaprojects like smart districts and transport corridors. Latin America adopts cloud monitoring to offset skilled-labor gaps, though currency volatility tempers import plans. Collectively, these regional dynamics sustain the electronic security market growth arc.

- Axis Communications AB

- Robert Bosch GmbH

- Honeywell International Inc.

- Johnson Controls International plc

- Checkpoint Systems Inc.

- Teledyne FLIR LLC

- ADT Inc.

- Siemens AG

- International Business Machines Corporation

- Hangzhou Hikvision Digital Technology Co., Ltd.

- MOBOTIX AG

- Allegion plc

- Zhejiang Dahua Technology Co., Ltd.

- ASSA ABLOY AB

- Genetec Inc.

- Hanwha Vision Co., Ltd.

- Avigilon Corporation

- Aiphone Co., Ltd.

- Gallagher Group Limited

- Secom Co., Ltd.

- NAPCO Security Technologies, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Impact of Macroeconomic Factors

- 4.6 Market Drivers

- 4.6.1 Proliferation of AI-enabled Video Analytics

- 4.6.2 Migration from Analog to IP-based Systems

- 4.6.3 Demand for Integrated Cloud-driven Platforms

- 4.6.4 Rise in Smart and Connected Infrastructure

- 4.6.5 Increasing Physical-Cyber Convergence Needs

- 4.6.6 Surge in Edge Computing for Real-Time Security

- 4.7 Market Restraints

- 4.7.1 Fragmented Compliance Standards across Regions

- 4.7.2 High Total Cost of Ownership for SMEs

- 4.7.3 Privacy Concerns around Facial Recognition

- 4.7.4 Supply Chain Disruptions for Critical Components

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Surveillance Security System

- 5.1.2 Alarm System

- 5.1.3 Access and Control System

- 5.1.4 Other Product Types

- 5.2 By Service Type

- 5.2.1 Installation and Integration

- 5.2.2 Monitoring

- 5.2.3 Maintenance and Support

- 5.2.4 Consulting

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By End-user Vertical

- 5.4.1 Government

- 5.4.2 Transportation

- 5.4.3 Industrial

- 5.4.4 Banking, Financial Services and Insurance (BFSI)

- 5.4.5 Hospitality

- 5.4.6 Retail Stores

- 5.4.7 Residential

- 5.4.8 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Axis Communications AB

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Honeywell International Inc.

- 6.4.4 Johnson Controls International plc

- 6.4.5 Checkpoint Systems Inc.

- 6.4.6 Teledyne FLIR LLC

- 6.4.7 ADT Inc.

- 6.4.8 Siemens AG

- 6.4.9 International Business Machines Corporation

- 6.4.10 Hangzhou Hikvision Digital Technology Co., Ltd.

- 6.4.11 MOBOTIX AG

- 6.4.12 Allegion plc

- 6.4.13 Zhejiang Dahua Technology Co., Ltd.

- 6.4.14 ASSA ABLOY AB

- 6.4.15 Genetec Inc.

- 6.4.16 Hanwha Vision Co., Ltd.

- 6.4.17 Avigilon Corporation

- 6.4.18 Aiphone Co., Ltd.

- 6.4.19 Gallagher Group Limited

- 6.4.20 Secom Co., Ltd.

- 6.4.21 NAPCO Security Technologies, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment