PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910438

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910438

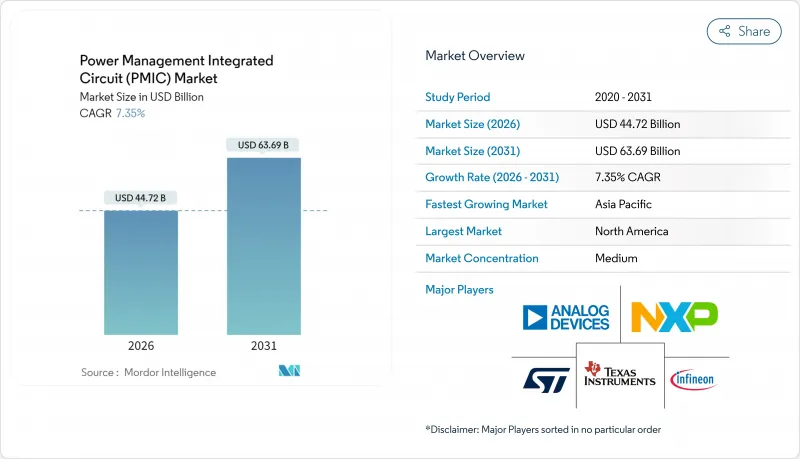

Power Management Integrated Circuit (PMIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The power management integrated circuit market size in 2026 is estimated at USD 44.72 billion, growing from 2025 value of USD 41.66 billion with 2031 projections showing USD 63.69 billion, growing at 7.35% CAGR over 2026-2031.

An expanding pool of electric vehicles, flagship smartphones, and ultra-low-power IoT devices is boosting demand for highly efficient conversion topologies, tighter voltage tolerances, and advanced process nodes. Battery management ICs remain the cornerstone of the power management integrated circuit market, while wireless-charging PMICs, wide-bandgap power stages, and sub-20 nm designs are emerging as pivotal growth catalysts. The competitive landscape is shaped by analog stalwarts defending share through proprietary IP and by processor vendors developing captive solutions for vertical integration. Foundry capacity, thermal constraints in ultra-thin devices, and counterfeit-component infiltration continue to pose tangible risks to overall market momentum.

Global Power Management Integrated Circuit (PMIC) Market Trends and Insights

Rapid EV and xEV Penetration Elevating Demand for High-Current, High-Efficiency PMICs

Electric-vehicle architecture is reshaping specifications for the power management integrated circuit market. Tesla's 4680 battery cell demands PMICs that handle up to 500 A continuous current while remaining below 125°C junction temperature, prompting silicon-carbide power stages and advanced thermal packaging. BYD's distributed battery-management design delivers 10C fast-charge capability, illustrating the need for granular cell-level PMIC control. Infineon's CoolSiC modules reach 98.5% efficiency in 800 V on-board chargers, and fleet operators now prioritize PMIC diagnostics to enable predictive maintenance. These requirements spur integration of sensor interfaces and wireless links, transforming PMICs into smart subsystems rather than isolated regulators.

Shrinking Process Nodes Enabling Higher On-Chip Power Density

Sub-20 nm migration allows multiple power rails and control logics on a single die, shrinking board footprints and limiting parasitics. TSMC's 16 nm FinFET platform achieves power densities above 1 W/mm2 versus 0.3 W/mm2 at 65 nm while safeguarding thermal profiles through engineered substrates. MediaTek's Dimensity 9400 integrates 12 independent power domains managed by an on-die PMIC that performs sub-microsecond voltage scaling for AI workloads. Yet quantum effects boost leakage variance, forcing adoption of compensation algorithms and heralding gate-all-around structures in 2 nm nodes targeting 30% power drop relative to current 3 nm.

Supply-Chain Cyclicality of Foundry Capacity for Analog and Mixed-Signal Nodes

Analog production lags digital capacity expansion, reaching 95% utilization at TSMC's specialty lines in late 2024 and elongating PMIC lead times to 16 weeks from a historical 8 weeks. GlobalFoundries' strategy shift toward mature nodes leaves fewer suppliers for automotive-qualified lots, raising exposure to geopolitical events. With automotive programs locking five-year commitments, consumer electronics vie for shrinking slots, intensifying allocation risk.

Other drivers and restraints analyzed in the detailed report include:

- Flagship Smartphone Adoption of Advanced Battery-Health PMICs

- Government Energy-Efficiency Mandates for Consumer and Industrial Electronics

- Rising Design Complexity Driving NRE Costs Beyond Reach of Smaller OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery management ICs accounted for 33.15% of the power management integrated circuit market size in 2025, underscoring their indispensability in electric-vehicle packs and stationary storage. Wireless-charging PMICs, however, are expected to log an 8.32% CAGR through 2031 as Qi2 magnetic alignment boosts 15 W transmit efficiency to 85% and as MagSafe-like ecosystems proliferate.

Demand within the power management integrated circuit market pivots around safety diagnostics, cell-balancing accuracy, and thermal orchestration for battery management ICs, whereas foreign-object detection and adaptive resonance control differentiate wireless-charging PMICs. DC-DC converter PMICs still serve data-center and notebook rails, linear regulators reserve niches that need <10 µV noise floors, and motor-driver PMICs ride factory-automation growth. Voltage-reference and supervisor ICs remain a stable revenue bedrock, mandated by automotive functional-safety norms.

Consumer electronics generated 42.25% of 2025 revenue for the power management integrated circuit market share, reflecting smartphones, notebooks, and tablets that integrate upwards of 15 regulated rails per device. Automotive and e-mobility, supported by 800 V drivetrains and ADAS compute clusters, is forecast to post an 8.55% CAGR, outpacing all other verticals.

Industrial and robotics use cases require torque-accurate motor drives, whereas 5 G infrastructure calls for high-voltage PMICs handling 48 V direct feeds. Healthcare devices, especially implants, prioritize <1 µA standby current, and IoT endpoints adopt energy-harvesting PMICs capable of starting at 380 mV. Each vertical calibrates its PMIC specs around reliability, regulation voltage, and telemetry sophistication, fragmenting supplier roadmaps across the power management integrated circuit market.

The Power Management Integrated Circuit (PMIC) Market Report is Segmented by Type (Linear Regulator PMIC, DC-DC Converter PMIC, and More), Application (Consumer Electronics, Automotive and E-Mobility, and More), Wafer Node (Greater Than or Equal To 65 Nm, 40-65 Nm, and More), Power Range (Low Power PMICs, Medium Power PMICs, High Power PMICs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.85% of global revenue in 2025, propelled by Tesla battery-management orders and Apple's emphasis on custom PMIC silicon. The region benefits from deep design-service ecosystems and a robust EV infrastructure build-out.

Asia-Pacific, home to leading foundries and consumer-electronics assembly, is projected to post a 10.21% CAGR through 2031. China's EV scale-up and South Korea's memory lines fuel PMIC volume, while proximity to fabs shortens iteration cycles.

Europe combines automotive electrification, where German OEMs adopt 800 V systems, with strict eco-design rules, sustaining steady demand. Nordic renewables deploy grid-tie inverter PMICs optimizing maximum-power-point tracking. Growth pockets in the Middle East and Africa arise from solar mini-grids, whereas South America leverages Brazilian EV incentives and Argentine lithium resources for localized battery supply chains.

- Texas Instruments Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- Qualcomm Incorporated

- Broadcom Inc.

- Skyworks Solutions, Inc.

- Dialog Semiconductor (Renesas)

- Rohm Co., Ltd.

- Maxim Integrated (ADI)

- Toshiba Electronic Devices and Storage Corp.

- MediaTek Inc.

- Power Integrations, Inc.

- Silicon Laboratories Inc.

- Monolithic Power Systems, Inc.

- Vishay Intertechnology, Inc.

- Littelfuse, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid EV and xEV penetration elevating demand for high-current, high-efficiency PMICs

- 4.2.2 Shrinking process nodes (Less than 20 nm) enabling higher on-chip power density

- 4.2.3 Flagship smartphone adoption of advanced battery-health PMICs

- 4.2.4 Government energy-efficiency mandates for consumer and industrial electronics

- 4.2.5 Edge-AI/IoT proliferation requiring ultra-low-quiescent-current PMICs

- 4.2.6 Adoption of wide-bandgap (GaN/SiC) power stages in fast chargers

- 4.3 Market Restraints

- 4.3.1 Supply-chain cyclicality of foundry capacity for analog and mixed-signal nodes

- 4.3.2 Rising design complexity driving NRE costs beyond reach of smaller OEMs

- 4.3.3 Thermal-management limits in ultra-thin consumer devices

- 4.3.4 Increasing counterfeit PMIC influx affecting reliability perceptions

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers/Consumers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (USD BILLION)

- 5.1 By IC Type

- 5.1.1 Linear Regulator PMIC

- 5.1.2 DC-DC Converter PMIC

- 5.1.3 Battery Management IC

- 5.1.4 Voltage Reference and Supervisor IC

- 5.1.5 Motor-Control and Driver PMIC

- 5.1.6 Wireless-Charging PMIC

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and e-Mobility

- 5.2.3 Industrial and Robotics

- 5.2.4 Telecommunications and Networking

- 5.2.5 Healthcare and Medical Devices

- 5.2.6 IoT and Edge Devices

- 5.3 By Wafer Node

- 5.3.1 Greater than and Equal to 65 nm

- 5.3.2 40 - 65 nm

- 5.3.3 20 - 40 nm

- 5.3.4 Less than 20 nm

- 5.4 By Power Range

- 5.4.1 Low Power PMICs

- 5.4.2 Medium Power PMICs

- 5.4.3 High Power PMICs

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Analog Devices, Inc.

- 6.4.3 Infineon Technologies AG

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 STMicroelectronics N.V.

- 6.4.6 ON Semiconductor Corporation

- 6.4.7 Renesas Electronics Corporation

- 6.4.8 Qualcomm Incorporated

- 6.4.9 Broadcom Inc.

- 6.4.10 Skyworks Solutions, Inc.

- 6.4.11 Dialog Semiconductor (Renesas)

- 6.4.12 Rohm Co., Ltd.

- 6.4.13 Maxim Integrated (ADI)

- 6.4.14 Toshiba Electronic Devices and Storage Corp.

- 6.4.15 MediaTek Inc.

- 6.4.16 Power Integrations, Inc.

- 6.4.17 Silicon Laboratories Inc.

- 6.4.18 Monolithic Power Systems, Inc.

- 6.4.19 Vishay Intertechnology, Inc.

- 6.4.20 Littelfuse, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment