PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910445

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910445

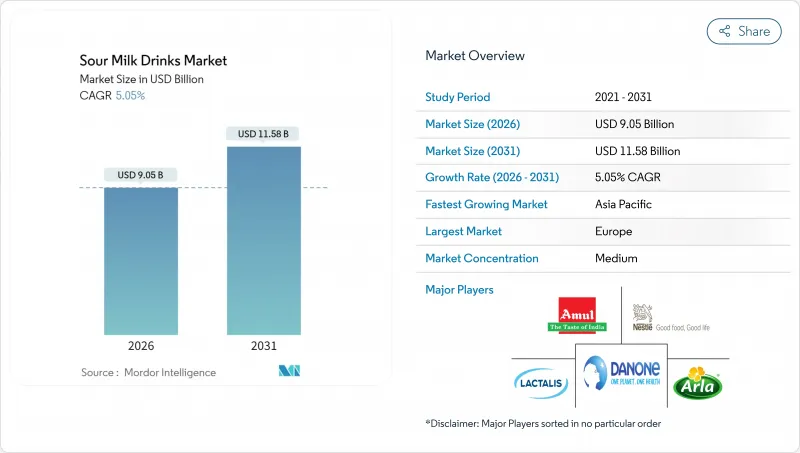

Sour Milk Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The sour milk drinks market was valued at USD 8.61 billion in 2025 and estimated to grow from USD 9.05 billion in 2026 to reach USD 11.58 billion by 2031, at a CAGR of 5.05% during the forecast period (2026-2031).

The market expansion is driven by increasing consumer awareness of health benefits, particularly regarding gut health and probiotic-rich beverages. Consumer demand for natural, minimally processed, and functional beverages that support digestive health, immunity, and overall well-being contributes to market growth, reflecting the broader trend toward clean labels and transparent ingredient sourcing. Sour milk drinks have emerged as a preferred choice among health-conscious consumers due to their probiotic content and nutritional profile, including essential vitamins, minerals, and bioactive compounds such as calcium, potassium, and phosphorus. The increasing prevalence of lactose intolerance and food sensitivities in key markets strengthens the demand for fermented dairy products that offer improved digestibility. Product innovation, including fortified and flavored variants, enhances consumer appeal through diverse options. The market's growth is further supported by expanded distribution through both traditional and modern retail channels.

Global Sour Milk Drinks Market Trends and Insights

Health and wellness trends

The growth of the global sour milk drinks market is fundamentally driven by transformative health and wellness trends sweeping across consumer demographics. Heightened consumer awareness about gut health and digestive well-being has substantially increased the demand for probiotic-rich beverages like kefir, buttermilk, and other cultured dairy drinks. These products deliver comprehensive natural health benefits, including enhanced digestive function, reinforced immune system performance, and maximized nutrient absorption, which seamlessly align with evolving consumer preferences for minimally processed, health-enhancing foods. According to the Food Standards Agency, approximately 12% of people in England, Wales, and Northern Ireland experienced food intolerance in 2024 . This significant prevalence of food intolerances and digestive disorders has dramatically increased the appeal of sour milk drinks as a powerful natural digestive aid, contributing substantially to their accelerated adoption and sustained growth across diverse global markets.

Advancements in fermentation technologies

Fermentation technology advancements are fundamentally revolutionizing the sour milk drinks market through innovative processing methods and enhanced production capabilities. High-pressure processing (HPP), sophisticated culturing techniques, and advanced fermentation control systems have significantly elevated product quality, safety standards, and shelf life performance. These technological improvements enable manufacturers to develop premium products with maximized probiotic content, exceptional taste profiles, and superior shelf stability, effectively addressing the expanding consumer demand for functional health beverages. Modern fermentation methods have also unlocked possibilities for developing specialized probiotic strains and breakthrough functional ingredients. For instance, in November 2024, Lifeway Foods launched a probiotic smoothie with kefir cultures and collagen, containing 25-30 billion beneficial CFUs and 5 grams of collagen per serving. These technological advancements have dramatically enhanced nutritional value and sensory characteristics while meeting the intensifying consumer focus on comprehensive health and wellness benefits.

Short shelf Life and refrigeration dependency

Short shelf life and refrigeration dependency constrain the global sour milk drinks market growth. These beverages require continuous cold storage to maintain product safety, freshness, and probiotic viability due to their live probiotic cultures. The perishable nature of sour milk drinks restricts their distribution to regions with reliable cold chain infrastructure, limiting market expansion in areas lacking adequate refrigeration facilities. The short shelf life increases product wastage during transportation and retail, affecting manufacturer profitability and increasing costs. Consumers must consume these drinks within a limited timeframe after opening, which impacts convenience and repeat purchases. The requirement for consistent refrigeration from production to consumption increases energy consumption and logistics complexity, raising environmental concerns and operational costs. While ultra-pasteurization and aseptic packaging offer extended shelf life, these processes can alter taste and reduce beneficial live cultures, affecting the primary health benefits of sour milk drinks. The refrigeration requirement also limits online retail and export opportunities due to cold chain maintenance costs.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in flavors and formulations

- Sustainability and environmental consciousness

- Competition from plant-Based alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kefir continues to maintain its dominant position in the sour milk drinks market, holding approximately 36.22% share in 2025. This leadership stems from kefir's rich probiotic profile, making it the most probiotic-dense option among sour milk drinks, appealing to health-conscious consumers seeking improved gut health and immunity. The growing understanding of probiotics' benefits for digestive health, immunity, and overall well-being drives kefir's popularity. For instance, in March 2025, Danone's Activia expanded its kefir range by incorporating 4 billion live cultures and authentic kefir grains, resulting in 16 different strains of live cultures to support gut health. The market growth is supported by kefir's versatility and the introduction of flavored variants, accommodating diverse consumer preferences.

Probiotic drinks represent the fastest-growing segment in the global sour milk drinks market, with a CAGR of approximately 7.05% through 2031. This growth results from increased consumer awareness and demand for gut health-enhancing products that provide functional benefits, including improved digestion, stronger immunity, and overall wellness. Probiotic drinks containing live beneficial bacteria attract health-conscious consumers seeking natural dietary solutions. Product innovations, including dairy-based and plant-based options, address various dietary requirements, such as vegan and lactose-free alternatives. The segment's expansion is enhanced by digital marketing initiatives and increased availability through online retail channels, improving consumer accessibility and education.

Flavored probiotic drinks command a significant 63.92% market share in 2025, solidifying their dominance in the functional beverage category. The popularity of flavored variants stems from their ability to deliver gut health benefits while meeting consumer taste preferences. Flavors such as fruit punch, berry mixes, mango, and tropical blends make probiotic consumption more appealing, particularly for younger consumers who might avoid unflavored, sour-tasting options. In July 2025, Good Enough Brands launched Good Enough Probiotics Reds Mix, a fruit punch-flavored drink mix containing the probiotic strain Anaerostipes caccae CLB101 for gut health support. This product demonstrates the market's focus on combining appealing flavor profiles with scientifically backed health benefits, expanding the consumer base for probiotic drinks.

Unflavored sour milk drink products are demonstrating growth momentum, with a projected CAGR of 6.05% through 2031. This growth comes from consumers seeking natural, clean-label options without added sugars, artificial flavors, or preservatives. Health-conscious individuals and those with dietary restrictions prefer unflavored products for their minimal processing. These variants serve as base ingredients in smoothies, culinary applications, or home combinations with fresh fruits and natural sweeteners, increasing their demand in retail and foodservice sectors. The segment's expansion aligns with consumer preferences for transparent product labeling and ingredient sourcing in the functional beverages market.

The Sour Milk Drinks Market is Segmented by Product Type (Kefir, Buttermilk, Lassi, Probiotic Drinks, and Others), Flavor (Flavored and Unflavored), Packaging Type (Bottles, Cartons, Pouches, and Others), Distribution Channel (On-Trade and Off-Trade), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Europe holds 48.35% market share in 2025, supported by established consumption patterns and advanced cold chain infrastructure that enables premium product distribution across national markets. Germany dominates European consumption through traditional kefir consumption and health-focused consumer preferences, while France and the Netherlands contribute through traditional production methods and organic offerings. The European Food Safety Authority (EFSA) framework provides guidelines for probiotic health claims, allowing manufacturers to communicate benefits while maintaining consumer trust through safety standards. The mature market status has led established companies to focus on premium offerings and sustainable packaging to maintain their market position.

Asia-Pacific demonstrates the highest growth rate at 7.02% CAGR through 2031, fueled by urbanization, increased disposable incomes, and growing probiotic health awareness among middle-class consumers. China and India present significant opportunities, with traditional fermented beverages gaining commercial success through modern production and distribution systems. Japan drives innovation in product formulations and packaging, while Southeast Asian markets expand through increased health awareness and Western dietary influences. The region successfully combines traditional fermentation practices with commercial production, creating products that appeal to local preferences while meeting international standards.

North America shows consistent growth through established wellness trends, with the United States leading kefir and probiotic drink consumption among health-conscious consumers. The region benefits from developed retail systems, marketing infrastructure, and consumers willing to pay for validated health benefits. Regulatory support for probiotic health claims provides market validation, while major dairy companies ensure product availability and quality. South America, and Middle East, and Africa show growth potential as traditional consumption patterns combine with improving retail infrastructure, indicating expansion opportunities as economic development and cold chain capabilities advance.

- Danone S.A.

- Gujarat Co-operative Milk Marketing Federation Ltd (Amul)

- Nestle S.A.

- Lactalis Group

- Dairy Farmers of America Inc.

- Arla Foods amba

- Lifeway Foods Inc.

- PepsiCo, Inc. (Kevita)

- Britannia Industries Ltd.

- Hiland Dairy Foods Company LLC

- Green Valley Creamery

- Producers Dairy Foods Inc.

- Yakult Honsha Co. Ltd.

- Valio Ltd.

- Muller Group

- Mengniu Dairy Co.

- Morinaga Milk Industry Co., Ltd.

- Sutaa Dairy Products Inc.

- Ehrmann SE

- Grupo Lala S.A.B. de C.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health and wellness trends

- 4.2.2 Advancements in fermentation technologies

- 4.2.3 Innovation in flavors and formulations

- 4.2.4 Sustainability and environmental consciousness

- 4.2.5 Celebrity and influencer endorsements

- 4.2.6 Cultural and traditional consumption

- 4.3 Market Restraints

- 4.3.1 Short shelf life and refrigeration dependency

- 4.3.2 Competition from plant-based alternatives

- 4.3.3 Stringent regulatory standards

- 4.3.4 High production and storage costs

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Kefir

- 5.1.2 Buttermilk

- 5.1.3 Lassi

- 5.1.4 Probiotic Drinks

- 5.1.5 Others

- 5.2 By Flavor

- 5.2.1 Flavored

- 5.2.2 Unflavored

- 5.3 By Packaging Type

- 5.3.1 Bottles

- 5.3.2 Cartons

- 5.3.3 Pouches

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/ Grocery Stores

- 5.4.2.3 Online Retail Stores

- 5.4.2.4 Specialist Retailers

- 5.4.2.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Danone S.A.

- 6.4.2 Gujarat Co-operative Milk Marketing Federation Ltd (Amul)

- 6.4.3 Nestle S.A.

- 6.4.4 Lactalis Group

- 6.4.5 Dairy Farmers of America Inc.

- 6.4.6 Arla Foods amba

- 6.4.7 Lifeway Foods Inc.

- 6.4.8 PepsiCo, Inc. (Kevita)

- 6.4.9 Britannia Industries Ltd.

- 6.4.10 Hiland Dairy Foods Company LLC

- 6.4.11 Green Valley Creamery

- 6.4.12 Producers Dairy Foods Inc.

- 6.4.13 Yakult Honsha Co. Ltd.

- 6.4.14 Valio Ltd.

- 6.4.15 Muller Group

- 6.4.16 Mengniu Dairy Co.

- 6.4.17 Morinaga Milk Industry Co., Ltd.

- 6.4.18 Sutaa Dairy Products Inc.

- 6.4.19 Ehrmann SE

- 6.4.20 Grupo Lala S.A.B. de C.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK