PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910449

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910449

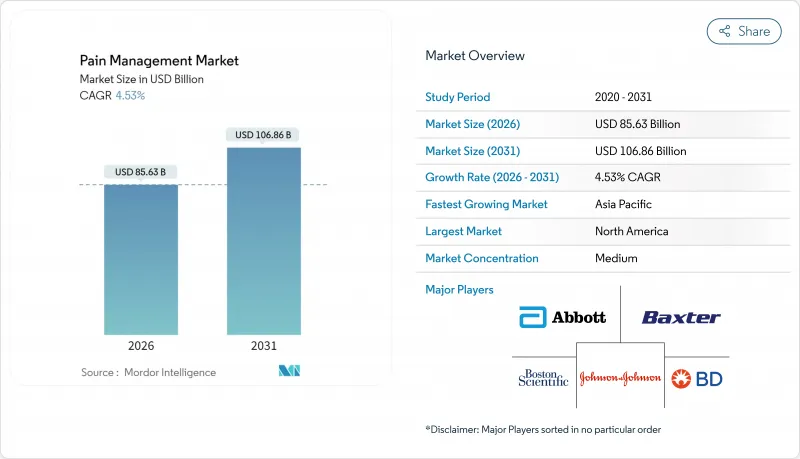

Pain Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

pain management market size in 2026 is estimated at USD 85.63 billion, growing from 2025 value of USD 81.92 billion with 2031 projections showing USD 106.86 billion, growing at 4.53% CAGR over 2026-2031.

Greater life expectancy, stringent opioid regulations and expanding use of connected neuromodulation platforms anchor this growth trajectory. Clinicians now favor multimodal regimens that blend non-opioid pharmacology with device-based therapies, a shift reinforced by payer incentives rewarding durable outcomes over pill counts. Digital health integration improves longitudinal monitoring, aligning treatment intensity with real-time patient-reported pain scores while curbing hospital readmissions. Heightened ESG scrutiny of legacy opioid makers meanwhile accelerates capital flows toward developers of non-addictive alternatives and AI-driven dosing algorithms.

Global Pain Management Market Trends and Insights

Ageing-Related Rise in Chronic Pain Prevalence

Growing cohorts aged >= 45 now represent the highest incidence of chronic musculoskeletal and neuropathic complaints. In 2024, 24.3% of U.S. adults reported chronic pain, with prevalence peaking in the 65+ group. European meta-analysis places adult prevalence at 21.45%, propelled by diabetes, arthritis, and postsurgical syndromes. Patients living with persistent pain incur double the healthcare expenditure of age-matched peers and lose USD 12,167 annually in productivity within high-income countries. Payers, therefore, channel funds toward longitudinal programs combining pharmaceutical, device, and behavioral elements. Recognition of chronic pain as a standalone disease entity further unlocks dedicated reimbursement codes and specialty clinic capacity worldwide.

Clinical Validation of Neuromodulation Efficacy

Landmark cost-utility studies show spinal cord stimulation paired with best medical therapy remains cost-effective over 10 years, outperforming pharmacologic management at typical willingness-to-pay thresholds. Dorsal root ganglion technology delivers even higher quality-adjusted life years for focal neuropathic syndromes, despite steeper upfront costs. Closed-loop platforms now auto-adjust amplitude based on evoked compound action potentials, sustaining analgesia as physiologic states shift. Regulatory bodies accelerate market entry through Breakthrough Device designations, trimming review times and incentivizing venture investment. Expanded reimbursement in select EU member states confirms recognition of durable neuromodulation value, increasing hospital purchasing confidence and physician adoption rates.

High CAPEX/OPEX for Implantable Devices

Implantable pulse generators priced between USD 20,000 - 50,000 per patient exceed many public-sector budgets in emerging economies. Replacement surgeries every 4-7 years add anesthesia and hospitalization charges, straining payer tolerance. Health technology assessment agencies now demand ten-year real-world evidence before approving high-cost neuromodulation reimbursement lines. Manufacturers react by migrating to rechargeable batteries and automated programming that lower clinician touchpoints. Leasing models and outcome-based contracts have begun surfacing, yet capital intensity remains a gating factor across low- and middle-income settings.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Opioid-Sparing Multimodal Protocols

- Rapid ASC Adoption for Pain Procedures

- Limited Reimbursement in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drugs retained 68.92% of pain management market share in 2025, anchored by NSAIDs, anticonvulsants and selective antidepressants used for neuropathic indications. Non-opioid innovations, including sodium-channel blockers, sustain momentum as guideline authors promote opioid-sparing regimens. In value terms, the drugs segment added USD 3.2 billion year-over-year, supported by strong generic uptake in Asia-Pacific and Latin America. Devices are set to outpace pharmaceuticals at a 9.99% CAGR, adding roughly USD 11 billion to the pain management market size by 2031.

Closed-loop spinal cord stimulators and dorsal root ganglion systems headline this surge, leveraging real-time physiologic feedback to fine-tune amplitude and pulse width. Analgesic infusion pumps shrink in form factor while gaining Bluetooth-enabled dosage logs that feed clinician dashboards. FDA Breakthrough Device designations granted in 2024 and 2025 shave six to nine months from review cycles, accelerating commercial rollout. As value-based procurement spreads, hospital buyers increasingly weigh total cost of ownership, a metric favoring rechargeable stimulators with extended battery life.

The Pain Management Market Report is Segmented by Mode of Pain Management (Drugs [Opioids and Non-Narcotic Analgesics] and Devices [Neuro-Modulation Devices and More]), Application (Neuropathic Pain, Cancer Pain, Facial Pain & Migraine and More), Setting of Care (Hospitals, Ambulatory Surgical Centers and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.10% revenue in 2025, supported by mature reimbursement, extensive ASC networks and swift FDA clearance pathways. Continued litigation over opioid marketing drives diversification toward non-addictive modalities, inflating demand for neuromodulation and non-opioid analgesics. Medicaid expansion in additional U.S. states during 2025 further widens patient pools for comprehensive pain management programs.

Europe displays balanced maturation; Western states sustain incremental gains while Eastern markets accelerate device adoption under EU cohesion funding. The European Medicines Agency's rolling review procedures shortened average approval times for biosimilars and novel analgesics by 15% in 2025. National health technology assessment bodies increasingly recognize quality-of-life outcomes, prompting broader reimbursement for validated neuromodulation indications.

Asia-Pacific delivers the fastest regional CAGR at 10.55% through 2031. China's Healthy 2030 blueprint earmarks chronic pain as a priority, enabling tier-two hospitals to establish specialty pain clinics. India's telemedicine guidelines passed in 2025 legitimize e-prescriptions of non-schedule drugs, spurring digital consultation platforms. However, uneven insurance penetration and fragmented provider markets still limit uptake of high-cost implantables, constraining absolute market size relative to demographic potential.

- Abbott Laboratories

- Baxter

- Beckton Dickinson

- Boston Scientific

- Endo International

- Fresenius

- Grunenthal GmbH

- Hikma Pharmaceuticals

- Hisamitsu Pharmaceutical

- Insulet

- Johnson & Johnson (DePuy Synthes, Ethicon)

- Medtronic

- Nevro

- Novartis

- OMRON

- Pfizer

- Smiths Group

- Stryker

- Terumo

- Teva Pharmaceutical Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing-Related Rise in Chronic Pain Prevalence

- 4.2.2 Clinical Validation of Neuro-Modulation Efficacy

- 4.2.3 Shift Toward Opioid-Sparing Multimodal Protocols

- 4.2.4 Rapid ASC Adoption for Pain Procedures

- 4.2.5 Venture Funding for Closed-Loop Stimulation Platforms

- 4.2.6 AI-Driven, Patient-Specific Dosing Algorithms

- 4.3 Market Restraints

- 4.3.1 High CAPEX/OPEX for Implantable Devices

- 4.3.2 Limited Reimbursement in Emerging Markets

- 4.3.3 Cyber-Security Risks in Connected Pumps

- 4.3.4 ESG Scrutiny on Opioid Manufacturers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Mode of Pain Management

- 5.1.1 Drugs

- 5.1.1.1 Opioids

- 5.1.1.2 Non-narcotic Analgesics

- 5.1.1.2.1 NSAIDs

- 5.1.1.2.2 Anesthetics

- 5.1.1.2.3 Anticonvulsants

- 5.1.1.2.4 Antidepressants

- 5.1.2 Devices

- 5.1.2.1 Neuro-modulation Devices

- 5.1.2.1.1 TENS

- 5.1.2.1.2 Spinal Cord Stimulation (SCS)

- 5.1.2.1.3 Dorsal Root Ganglion (DRG)

- 5.1.2.1.4 Vagus & Peripheral Nerve Stimulators

- 5.1.2.2 Analgesic Infusion Pumps

- 5.1.2.2.1 Intrathecal Pumps

- 5.1.2.2.2 External PCA Pumps

- 5.1.2.3 Radio-frequency Ablation Systems

- 5.1.2.1 Neuro-modulation Devices

- 5.1.1 Drugs

- 5.2 By Application

- 5.2.1 Neuropathic Pain

- 5.2.2 Cancer Pain

- 5.2.3 Musculoskeletal Pain

- 5.2.4 Facial Pain & Migraine

- 5.2.5 Post-operative & Acute Pain

- 5.3 By Setting of Care

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home-care & Remote Monitoring

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Baxter International Inc.

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 Boston Scientific Corporation

- 6.3.5 Endo International plc

- 6.3.6 Fresenius SE & Co. KGaA

- 6.3.7 Grunenthal GmbH

- 6.3.8 Hikma Pharmaceuticals

- 6.3.9 Hisamitsu Pharmaceutical

- 6.3.10 Insulet Corporation

- 6.3.11 Johnson & Johnson (DePuy Synthes, Ethicon)

- 6.3.12 Medtronic plc

- 6.3.13 Nevro Corp.

- 6.3.14 Novartis AG

- 6.3.15 Omron Healthcare

- 6.3.16 Pfizer Inc.

- 6.3.17 Smiths Medical (ICU Medical)

- 6.3.18 Stryker Corporation

- 6.3.19 Terumo Corporation

- 6.3.20 Teva Pharmaceutical Industries

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment