PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910451

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910451

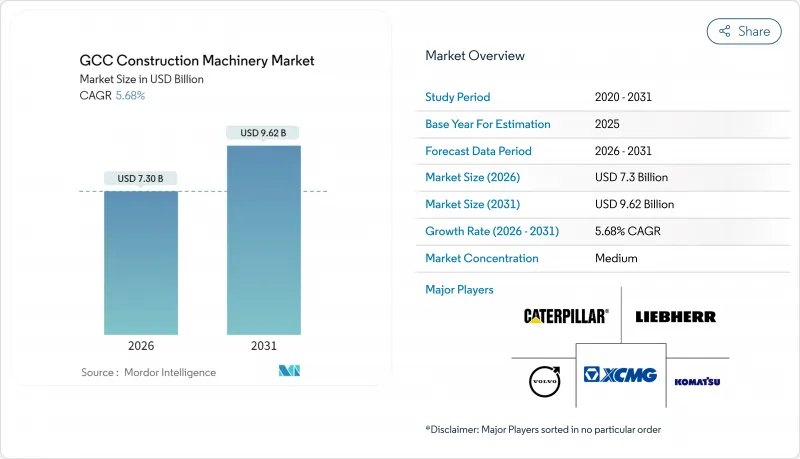

GCC Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC construction machinery market is expected to grow from USD 6.91 billion in 2025 to USD 7.3 billion in 2026 and is forecast to reach USD 9.62 billion by 2031 at 5.68% CAGR over 2026-2031.

This sustained advance aligns with sovereign wealth fund deployments, rapidly diversifying economies, and an unprecedented pipeline of infrastructure megaprojects that now dominate public-sector capital-expenditure agendas across all six Gulf nations. Sovereign strategies such as Saudi Arabia's Vision 2030, the UAE's federal growth program, Qatar National Vision 2030, and Oman Vision 2040 continue to convert hydrocarbon proceeds into long-cycle construction spending, lifting procurement of heavy machinery for urban expansion, industrial corridors, and green-energy installations. Equipment demand remains elastic to demographic growth, with Gulf urban populations climbing 2.1% annually and creating material shortfalls in housing, transit, and utilities. Competitive dynamics are intensifying as Chinese original-equipment manufacturers (OEMs) localize final assembly in Saudi Arabia and the UAE, while incumbents Caterpillar, Komatsu, and Volvo Construction Equipment defend share by scaling digital service platforms and flexible financing. Even with near-term oil-price volatility and a fast-growing rental market tempering fresh unit sales, the long-term trajectory of the GCC construction equipment market is supported by evolving local-content rules, green-hydrogen build-outs, and mandatory digital-engineering standards that collectively necessitate larger, more technologically sophisticated fleets .

GCC Construction Machinery Market Trends and Insights

Vision-2030 Megaproject Pipeline Sustains Equipment Demand

Saudi Arabia's USD 500 billion NEOM initiative alone requires specialized excavators, telematics-enabled bulldozers, and desert-rated cranes for its 170 km linear city and 26,500 km2 development zone. Procurement for mega LNG, rail, and tourism clusters extends average fleet-replacement cycles beyond five years, compelling OEMs to embed longer-tenor maintenance contracts and localized parts depots. The geographic concentration of work in the kingdom's northwest also forces distributors to realign service hubs nearer to project sites .

Rapid Urban Population Growth Intensifies Infrastructure Spend

The rapid urbanization of Gulf cities is creating significant demand for infrastructure development. The annual influx of millions of new residents has resulted in substantial gaps in transport, utilities, and housing infrastructure, leading to increased investment in these sectors. Housing shortages in regions such as Saudi Arabia's Eastern Province and the UAE's Northern Emirates have necessitated large-scale community development projects that require extensive earth-moving and concrete equipment.

The increasing urban density is transforming equipment requirements in the construction sector. The demand for compact excavators and vertical-reach machinery is increasing, especially in confined construction areas. This transition indicates a broader movement toward specialized equipment that can operate efficiently in densely populated urban environments.

Oil-Price Volatility Curbs Public-Sector Capex Cycles

Oil price movements influence fiscal planning and infrastructure development across the Gulf region. Declining crude oil prices reduce government revenues, leading to project rescheduling and delays in equipment procurement. In Saudi Arabia, project awards have decreased as ministries focus on high-priority initiatives instead of optional upgrades.

While large-scale projects maintain dedicated funding, smaller municipal projects face budget constraints. This funding pattern demonstrates a strategic spending approach, where investments target projects delivering measurable economic or social benefits during periods of fiscal uncertainty.

Other drivers and restraints analyzed in the detailed report include:

- Electrification Mandates in Flagship Smart-city Projects

- Mandatory BIM Adoption Boosts Demand for Connected Machinery

- Equipment-Rental Boom Suppresses New-unit Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators captured 54.10% of the GCC construction equipment market share in 2025 on foundation, grading, and trenching tasks woven through every megaproject. A pipeline of high-detail earthworks, from NEOM's trench-based infrastructure spine to dual-carriageway expansions in Abu Dhabi, keeps 30-35-ton models in constant rotation. In the future, motor graders are slated for a 7.35% CAGR through 2031 as Saudi Arabia and Oman push 1,900 km of new highways and smart-city roadway grids that demand precision finish grading.

The increasing digitalization is transforming the machinery composition, with the adoption of telematics in crawler excavators driving market demand, enabling fuel-burn optimization and predictive maintenance routines that cut downtime. Meanwhile, rough-terrain cranes have found a niche in the industrial build-out phase; the single-order purchase of 100 Tadano GR-800EX units by AMHEC illustrates the heightened scale of fleet aggregation on complex job sites. Specialized quarry equipment has experienced an upswing after the Saudi Ministry of Industry shortlisted 30 firms for 22 new quarry licenses, guaranteeing fresh demand for rock breakers and surface-drilling rigs across Tabuk and Eastern Province clusters.

Internal combustion engines commanded 98.05% of the GCC construction equipment market size in 2025. Reliability in 50 °C ambient temperatures, easy refueling logistics, and proven residual values keep ICE the standard for desert and remote-area projects. However, electric and hybrid equipment is pacing at a 26.2% CAGR through 2031, albeit from a low base. Early adoption focuses on compact excavators, telehandlers, and light towers in enclosed or emissions-sensitive environments such as hospital extensions and subterranean metro stations.

Infrastructure gaps remain the primary brake on wider decarbonization. Even so, Dubai and Riyadh municipal codes now stipulate electric-ready job sites for flagship developments; equipment financiers are responding with operating-lease structures that spread higher capital costs over eight-year terms. Atlas Copco's launch of containerized 1 MWh energy-storage systems is another sign of ecosystem maturity, providing off-grid fast-charge capabilities for daytime peak operations.

The GCC Construction Machinery Market Report is Segmented by Machinery Type (Cranes, Excavators, Loaders and Backhoes, and More), Propulsion Type (Internal Combustion Engine and Electric/Hybrid), Application Type (Concrete Construction Equipment, Road Construction Equipment, and More), End-User (Infrastructure, Commercial, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd

- AB Volvo (Volvo Construction Equipment)

- XCMG Construction Machinery Co. Ltd

- Liebherr International AG

- Hitachi Construction Machinery Co. Ltd.

- Hyundai Construction Equipment Co.,Ltd.

- J.C. Bamford Excavators Ltd (JCB)

- Sany Heavy Industry Co. Ltd

- Deere & Company

- CNH Industrial N.V.(Case Construction)

- Kobelco Construction Machinery Co. Ltd

- Sumitomo Construction Machinery

- Doosan Bobcat (Develon)

- Terex Corporation

- Manitou Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd

- Yanmar Holdings Co. Ltd

- Wacker Neuson SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Vision-2030 Megaproject Pipeline Sustains Equipment Demand

- 4.2.2 Rapid Urban Population Growth Intensifies Infrastructure Spend

- 4.2.3 Electrification Mandates in Flagship Smart-City Projects (e.g., NEOM)

- 4.2.4 Mandatory BIM Adoption Boosts Demand for Connected Machinery

- 4.2.5 Localization Incentives Spur Regional Assembly Investments

- 4.2.6 Green Hydrogen Build-Out Drives Specialized Heavy-Lift Needs

- 4.3 Market Restraints

- 4.3.1 Oil-Price Volatility Curbs Public Sector Capex Cycles

- 4.3.2 Equipment-Rental Boom Suppresses New-Unit Sales

- 4.3.3 Stringent Water-Use Regulations Raise Operating Costs

- 4.3.4 Skilled-Operator Shortage Delays Fleet Expansions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Excavators

- 5.1.3 Loaders and Backhoes

- 5.1.4 Motor Graders

- 5.1.5 Telescopic Handlers

- 5.1.6 Other Machinery

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Electric / Hybrid

- 5.3 By Application Type

- 5.3.1 Concrete Construction Equipment

- 5.3.2 Road Construction Equipment

- 5.3.3 Earth-Moving Equipment

- 5.3.4 Material Handling Equipment

- 5.4 By End-User

- 5.4.1 Infrastructure

- 5.4.2 Commercial

- 5.4.3 Residential

- 5.4.4 Industrial

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Kuwait

- 5.5.4 Qatar

- 5.5.5 Oman

- 5.5.6 Bahrain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd

- 6.4.3 AB Volvo (Volvo Construction Equipment)

- 6.4.4 XCMG Construction Machinery Co. Ltd

- 6.4.5 Liebherr International AG

- 6.4.6 Hitachi Construction Machinery Co. Ltd.

- 6.4.7 Hyundai Construction Equipment Co.,Ltd.

- 6.4.8 J.C. Bamford Excavators Ltd (JCB)

- 6.4.9 Sany Heavy Industry Co. Ltd

- 6.4.10 Deere & Company

- 6.4.11 CNH Industrial N.V.(Case Construction)

- 6.4.12 Kobelco Construction Machinery Co. Ltd

- 6.4.13 Sumitomo Construction Machinery

- 6.4.14 Doosan Bobcat (Develon)

- 6.4.15 Terex Corporation

- 6.4.16 Manitou Group

- 6.4.17 Zoomlion Heavy Industry Science and Technology Co., Ltd

- 6.4.18 Yanmar Holdings Co. Ltd

- 6.4.19 Wacker Neuson SE

7 Market Opportunities & Future Outlook