PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910452

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910452

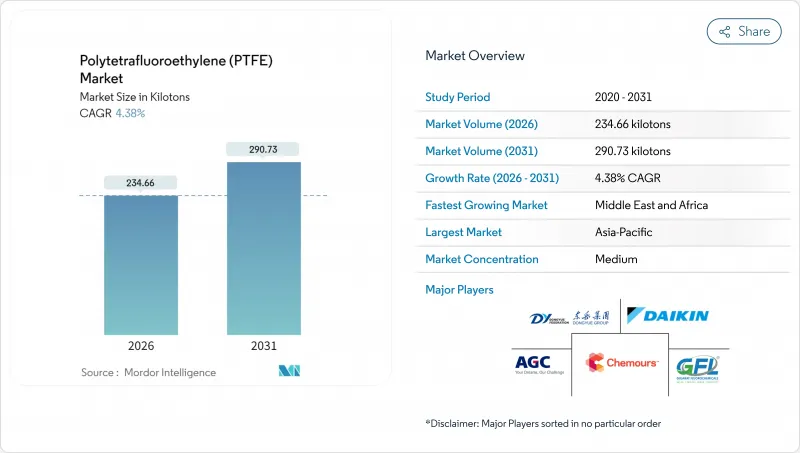

Polytetrafluoroethylene (PTFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Polytetrafluoroethylene market is expected to grow from 224.82 kilotons in 2025 to 234.66 kilotons in 2026 and is forecast to reach 290.73 kilotons by 2031 at 4.38% CAGR over 2026-2031.

This growth reflects the material's entrenched position in demanding industrial environments, where chemical inertness, low friction, and thermal stability remain hard to substitute. Continuous capacity additions in semiconductor fabrication, petrochemical processing, and electric-vehicle (EV) infrastructure sustain baseline consumption even as potential PFAS restrictions intensify qualification procedures for new applications. The PTFE market also benefits from design shifts toward higher-voltage, lighter-weight wire harnesses, solid-state battery membranes, and additive-manufactured machine parts, all of which require the polymer's unique combination of dielectric strength and temperature resistance. Competitive strategies increasingly revolve around vertical integration of fluorspar supply, development of PFAS-compliant product lines, and geographic proximity to electronics clusters.

Global Polytetrafluoroethylene (PTFE) Market Trends and Insights

Rapid Expansion of Electronics Manufacturing in Asia

Wave after wave of new wafer-fab lines across mainland China, Taiwan, South Korea and Singapore require ultrapure PTFE valves, liners and wafer-processing components to manage aggressive chemistries. Large-scale investments in 3 nm and 2 nm logic nodes elevate demand for plasma-resistant fluoropolymer parts that cannot be economically replaced with commodity plastics. Close clustering of chip foundries, outsourced assembly plants and display makers acts as a demand magnet, pulling the PTFE market toward regional suppliers that can deliver tight-tolerance parts on accelerated build schedules. Equipment suppliers, in turn, lock in multi-year contracts for granular PTFE feedstock to ensure clean-room qualification continuity. These linkages consolidate Asia-Pacific's role as the consumption epicenter of the global PTFE market.

Growth in Global Chemical-Processing Capacity

Hydrocarbon producers in Saudi Arabia, the United Arab Emirates, and India continue to sanction integrated refinery-petrochemical complexes with increasingly severe operating envelopes. Reactors, heat exchangers, and piping in these plants confront acids, superheated steam, and high-velocity particulates, environments that reinforce PTFE's dominance in gaskets, valve seats, and linings. Concurrent debottlenecking in specialty chemicals calls for larger volumes of molded billets and isostatic blocks. Because chemical parks favor long service life and low downtime, procurement departments often specify PTFE grades in blanket purchase agreements, stabilizing offtake across economic cycles. Resultant volume commitments underpin the PTFE market's steady baseline growth trajectory.

Environmental Scrutiny on PFAS and PTFE

The European Chemicals Agency's 2025 draft restriction on PFAS threatens broad classes of fluoropolymers unless exemptions for essential uses are retained. Major processors respond by launching PFAS-compliant or PFAS-free product lines; Avient introduced a PTFE-free LubriOne range for precision gears and bushings in early 2024. Smaller players unable to amortize compliance testing are exiting the category, as reflected in Micro Powders' notice to wind down PTFE operations by late 2025 (company press release, 2024). End-users in consumer cookware and apparel accelerate dual-sourcing with silicon-coated or sol-gel alternatives, blunting incremental demand in these segments and tightening the PTFE market's addressable base.

Other drivers and restraints analyzed in the detailed report include:

- EV-Driven Demand for Lightweight Wire and Cable Insulation

- Surging PTFE Use in Non-Stick Cookware

- Geopolitical Risk to Fluorspar Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Granular and molded grades constituted 56.74% of the PTFE market share in 2025, supported by well-established compression-molding infrastructure across gasket, valve, and bearing manufacturers. Typical batch sizes run into metric tons, ensuring scale economies that anchor competitive pricing. The segment delivers stable baseline revenue for integrated producers because its physical-property envelope fits a wide range of industrial equipment standards. Tier-one chemical processors often codify specific granular PTFE resins into plant-wide approved-materials lists, further reinforcing demand in maintenance, repair, and overhaul cycles.

Micronized powder, while starting from a smaller base, is forecast to post a 5.82% CAGR through 2031, the fastest among all forms. Particles under 10 µm unlock friction-reduction additives for high-performance greases, laser-sintered 3-D-printed gears, and texture-control agents for aerospace coatings. Producers invest in jet-milling systems and in-line classification to deliver narrow particle-size distributions, a capability that commands premium pricing. Growth in additive manufacturing accentuates this trend, as designers specify PTFE micropowders to enhance surface release and dimensional accuracy in complex geometries. The PTFE market size for micronized grades is therefore projected to expand both in value and in volume terms at rates exceeding the overall PTFE market.

The Polytetrafluoroethylene (PTFE) Report is Segmented by Product Form (Granular/Molded PTFE, Fine Powder/Dispersion PTFE, and More), End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, and More), and Geography (Asia-Pacific, North America, Europe, South America, and More). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific dominated with 52.28% of PTFE market share in 2025 and is projected to keep its lead through 2031 as new wafer-fab and battery-material plants come online. China hosts integrated value chains stretching from fluorspar mining to finished cable extrusion, enabling local suppliers to quote shorter lead times and aggressive pricing. Government incentives under China's 14th Five-Year Plan funnel capital into fluorochemicals, catalyzing internal resin demand. India follows with refinery-petrochemical joint ventures that require corrosion-resistant linings, while South Korea and Japan focus on high-precision fluoropolymer components for metrology and medical devices.

The Middle East and Africa, although accounting for a smaller baseline, is forecast to log a 5.72% CAGR to 2031-outpacing all other regions. Mega-projects in Saudi Arabia's NEOM and ADNOC's downstream expansion in the UAE embed PTFE components in sulfuric acid, chlorine, and lithium-processing units. Local cable makers pivot toward PTFE jacketing to meet IEC 62893 fire-retardant standards for photovoltaic wiring in desert climates.

North America and Europe reflect mature demand profiles, yet regulatory and technological factors reshape consumption patterns. The U.S. Department of Commerce's 4.70-4.89% countervailing duties on granular PTFE imports from Gujarat Fluorochemicals Limited encourage reshoring dialogues among domestic converters.

Meanwhile, the European Union's evolving PFAS roadmap compels equipment OEMs to document essential-use justifications, a hurdle that may slow order cycles but also raises barriers to entry for less-prepared suppliers. Aerospace primes, however, continue to specify PTFE for hydraulic seals that function from -55 °C to +200 °C, ensuring a resilient high-value niche.

- 3M

- AGC Inc.

- Arkema

- Daikin Industries, Ltd.

- Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- HaloPolymer, OJSC

- Saint-Gobain

- Shanghai Huayi 3F New Materials Co., Ltd.

- Sinochem Holdings

- Syensqo

- The Chemours Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of electricals and electronics manufacturing in Asia

- 4.2.2 Growth in global chemical processing capacity

- 4.2.3 EV-driven demand for lightweight wire and cable insulation

- 4.2.4 Surging PTFE use in non-stick cookware markets

- 4.2.5 Adoption of PTFE membranes in solid-state batteries

- 4.3 Market Restraints

- 4.3.1 Environmental scrutiny on PFAS and PTFE

- 4.3.2 Geopolitical risk to fluorspar supply

- 4.3.3 Engineering-plastic substitutes for 5G hardware

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Import and Export Trends

- 4.7 Form Trends

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Australia

- 4.8.3 Brazil

- 4.8.4 Canada

- 4.8.5 China

- 4.8.6 European Union

- 4.8.7 India

- 4.8.8 Japan

- 4.8.9 Malaysia

- 4.8.10 Mexico

- 4.8.11 Nigeria

- 4.8.12 Russia

- 4.8.13 Saudi Arabia

- 4.8.14 South Africa

- 4.8.15 South Korea

- 4.8.16 United Arab Emirates

- 4.8.17 United Kingdom

- 4.8.18 United States

- 4.9 End-use Sector Trends

- 4.9.1 Aerospace (Aerospace Component Production Revenue)

- 4.9.2 Automotive (Automobile Production)

- 4.9.3 Building and Construction (New Construction Floor Area)

- 4.9.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.9.5 Packaging(Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Form

- 5.1.1 Granular/Molded PTFE

- 5.1.2 Fine Powder/Dispersion PTFE

- 5.1.3 Micronized Powder PTFE

- 5.1.4 Aqueous Dispersion PTFE

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Machinery

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 United Kingdom

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Daikin Industries, Ltd.

- 6.4.5 Dongyue Group

- 6.4.6 Gujarat Fluorochemicals Limited (GFL)

- 6.4.7 HaloPolymer, OJSC

- 6.4.8 Saint-Gobain

- 6.4.9 Shanghai Huayi 3F New Materials Co., Ltd.

- 6.4.10 Sinochem Holdings

- 6.4.11 Syensqo

- 6.4.12 The Chemours Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs