PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910455

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910455

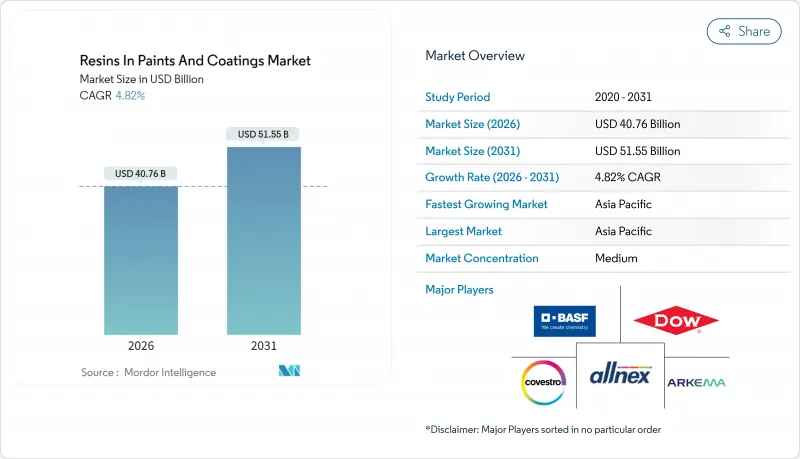

Resins In Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Resins In Paints And Coatings market size in 2026 is estimated at USD 40.76 billion, growing from 2025 value of USD 38.89 billion with 2031 projections showing USD 51.55 billion, growing at 4.82% CAGR over 2026-2031.

Although the headline growth rate appears measured, policy-driven shifts away from solvent-borne chemistries are forcing formulators to retool their portfolios around waterborne acrylic, polyurethane dispersion, and other biocircular technologies. Governments on three continents tightened volatile-organic-compound (VOC) ceilings in 2024-2025, accelerating the transition timeline. The Asia-Pacific region continues to dominate value creation, thanks to infrastructure spending. However, North America and Europe are staging multi-year renovation programs that favor premium, low-VOC resins. Competitive intensity is rising as incumbents integrate renewable feedstocks, build regional dispersion plants, and deploy digital formulation platforms to compress product-development cycles.

Global Resins In Paints And Coatings Market Trends and Insights

Construction Boom Across the Asia-Pacific

Public-sector infrastructure pipelines remain the single largest demand engine for architectural and protective coatings. India's National Infrastructure Pipeline alone targets USD 1.4 trillion in cumulative capital outlays through 2025, generating a multi-year pull-through for epoxy- and polyurethane-rich bridge, port, and rail coatings. Singapore's Building and Construction Authority now requires Green Mark Platinum performance on all new public housing projects from 2025, effectively mandating water-based acrylic or polyurethane chemistries for factory-applied panels. The Philippines allocated PHP 1.1 trillion (approximately USD 20 billion) to its Build Better More program in 2024, which includes industrial coating-intensive airports, roads, and energy assets. Across the region, state-owned developers are bundling low-VOC specifications into tender documents, accelerating the adoption of dispersion technology. Resin suppliers have responded by announcing the establishment of dispersion reactors in Indonesia and Vietnam, aiming to shorten lead times and reduce freight emissions. These moves provide global incumbents with a volume hedge while enabling regional formulators to localize their supply.

Tightening VOC-Emission Regulations

The compliance window for high-solvent resins is narrowing rapidly. In January 2025 the U.S. Environmental Protection Agency capped aerosol-coating VOC content at 25% by weight-down from prior category ceilings of 45%-forcing an immediate shift in binder selection. Georgia followed with Rule 391-3-1-.02(7)(c), effective July 2025, limiting flat architectural finishes to 50 grams per liter. Europe raised the bar again when the European Commission published draft Ecolabel criteria in October 2024 that impose a 30 grams-per-liter ceiling for interior paints, achievable only with high-solids acrylic or hybrid systems. China mirrored the EU thresholds in its GB 18582-2024 standard, signaling that the world's largest construction market can no longer serve as a VOC-light haven. Resin suppliers with ready-to-scale waterborne portfolios-especially acrylic- and polyurethane-based dispersions-are winning share as formulators scramble to meet the cliff.

Feedstock Price Volatility

Price swings for propylene, benzene, and ethylene remain a significant headwind. ICIS Chemical Business reported that Asian contract propylene prices increased by 25% quarter-on-quarter in Q2 2024, following three unplanned cracker outages. Similar squeezes in Europe turned ethylene-derivative margins negative, compelling smaller epoxy producers to idle plants. Resin makers without upstream petrochemical integration face 60- to 90-day pass-through lags in the price-sensitive architectural channel. Partial insulation is emerging; Covestro has disclosed bio-circular polyols derived from waste vegetable oils that reached price parity with fossil feedstock by 2024, thereby trimming exposure to naphtha volatility. Still, the commodity link will limit margins until bio-feedstock adoption scales.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Output Revival Post-2024

- Refurbishment Wave in OECD Housing

- Shift Toward Powder-Only Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic resins commanded 30.02% of the 2025 resins in paints and coatings market share, supported by their superior fit in low-VOC waterborne systems. Coupled with a 5.28% CAGR, they anchor value migration as regulators tighten emission ceilings. Epoxy resins are used in high-stress applications, such as those in the marine and wind-turbine industries; Hexion noted robust orders from turbine OEMs in its 2024 report. Polyurethane dispersions benefit from EV battery use cases. Polyester, a workhorse for powder coatings, faces margin compression as buyers mix polyester-epoxy hybrids that cure at lower temperatures. Alkyds, long the backbone of solvent-borne architectural paints, retain a niche in premium wood finishes but fade in mainstream wall-coating lines due to their slower dry time and higher VOC. ISO 14040 life-cycle assessments are now mandatory in Scandinavian public tenders, funneling share toward resins with verified environmental declarations.

Acrylic's dispersion superiority also underpins factory-applied panel lines for modular housing. Prefabrication sites prefer quick-dry, single-pass coatings to meet tight takt times, making waterborne acrylic a natural choice. Epoxy suppliers are responding with nano-modified systems that cut bake curves, while polyurethane vendors push humidity-cure versions that eliminate forced-air ovens. Across the resins in paints and coatings market, supplier innovation is converging on CO2-reduced feedstocks, evidenced by BASF's pledge to integrate renewable propylene into its acrylic value chain by 2026. This feedstock strategy aligns with European public-procurement rules granting price premiums to materials with >=20% bio-content.

The Resins in Paints and Coatings Market Report is Segmented by Type (Epoxy, Acrylic, Polyurethane, Polyester, Polypropylene, Alkyd, Other Types), End-User Industry (Industrial, Architectural, Automotive, Packaging, Other End-Users), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for a 44.12% share of the resins in paints and coatings market in 2025 and is growing fastest at a 5.33% CAGR, propelled by China's construction recovery and India's megaproject pipelines. China's residential completions rebounded in 2024 as municipal authorities eased credit, translating into higher drawdowns. India's National Infrastructure Pipeline drives protective-coating resin consumption for bridges and railways, while the IKN Nusantara capital-city buildout in Indonesia and the Philippines' Build Better More program lift regional baseline volumes. Japan's seismic-retrofit subsidy and South Korea's Green New Deal mandate low-VOC coatings in public procurement, driving the use of acrylic and polyurethane dispersions through local converting channels.

North America's momentum rests on remodeling spending that hit USD 485 billion in 2024, with energy-efficient exteriors and siding replacements at the top of the wallet. The EPA's 2025 VOC rule accelerates waterborne adoption, and Sherwin-Williams has flagged premium pricing on low-odor emulsions as margin-accretive. Canada's carbon price reached CAD 80 per metric ton in 2024 and is nudging building owners toward retrofit packages that include high-albedo roof coatings to cut cooling loads.

Europe advances at a mid-single-digit pace led by the Renovation Wave and the Industrial Emission Directive, both of which prioritize low-solvent or powder chemistries. Nordic municipalities now require product-specific environmental product declarations in tenders, advantaging suppliers with fully audited dispersion lines. South America and the Middle East and Africa collectively account for a smaller share of coating resins market size but offer pocket-growth linked to oil-and-gas, mining, and stadium construction in Brazil, Saudi Arabia, and the United Arab Emirates.

- Allnex GmbH

- Arkema

- BASF SE

- Covestro AG

- Dow

- Evonik Industries AG

- Hexion

- Huntsman International LLC

- Kangnam Chemical

- KANSAI HELIOS

- Mitsubishi Shoji Chemical Corporation

- Mitsui Chemicals Inc.

- Olin Corporation.

- Reichhold LLC 2

- Solvay

- Synthomer plc

- Uniform Synthetics

- Vil Resins

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction boom across Asia-Pacific

- 4.2.2 Tightening (VOC)-emission regulations

- 4.2.3 Automotive output revival post-2024

- 4.2.4 Refurbishment wave in OECD housing

- 4.2.5 On-site 3-D printing repair resins

- 4.3 Market Restraints

- 4.3.1 Feed-stock price volatility

- 4.3.2 Shift toward powder-only systems

- 4.3.3 Micro-plastic phase-out rules

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Polyester

- 5.1.5 Polypropylene

- 5.1.6 Alkyd

- 5.1.7 Other Types

- 5.2 By End-user Industry

- 5.2.1 Industrial

- 5.2.2 Architectural

- 5.2.3 Automotive

- 5.2.4 Packaging

- 5.2.5 Other End-users

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Allnex GmbH

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 Covestro AG

- 6.4.5 Dow

- 6.4.6 Evonik Industries AG

- 6.4.7 Hexion

- 6.4.8 Huntsman International LLC

- 6.4.9 Kangnam Chemical

- 6.4.10 KANSAI HELIOS

- 6.4.11 Mitsubishi Shoji Chemical Corporation

- 6.4.12 Mitsui Chemicals Inc.

- 6.4.13 Olin Corporation.

- 6.4.14 Reichhold LLC 2

- 6.4.15 Solvay

- 6.4.16 Synthomer plc

- 6.4.17 Uniform Synthetics

- 6.4.18 Vil Resins

- 6.4.19 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment