PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910458

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910458

Probiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

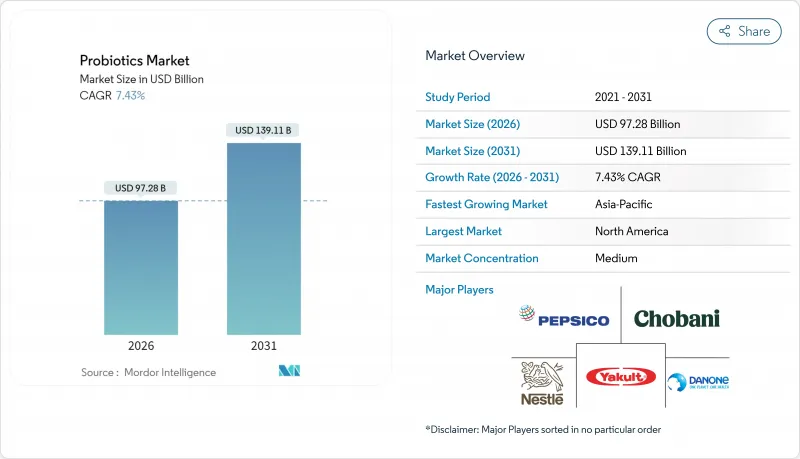

The probiotics market was valued at USD 90.56 billion in 2025 and estimated to grow from USD 97.28 billion in 2026 to reach USD 139.11 billion by 2031, at a CAGR of 7.43% during the forecast period (2026-2031).

Heightened consumer focus on preventive health, the FDA's 2024 qualified health claim for yogurt, and rapid advances in precision microbiome research are propelling adoption across food, supplement, and clinical channels. Manufacturers are shifting investment toward strain-specific R&D, AI-enabled personalization platforms, and e-commerce fulfillment efficiencies to capture premium margins. Multinational consolidation, led by the Chr Hansen-Novozymes merger, is reshaping competitive structures and accelerating technology diffusion. Regionally, North America benefits from progressive regulatory signals, while Asia-Pacific's 9.23% CAGR reflects rising middle-class spending and regulatory harmonization. Strategic opportunities center on next-generation therapeutic formats, organic and non-GMO certification, and livestock antibiotic-reduction policies that widen the probiotics market addressable base.

Global Probiotics Market Trends and Insights

Rising demand for functional foods and beverages

The rise in "food-as-medicine" preferences has prompted fermentation companies to integrate spore-forming probiotic strains into non-dairy products, resulting in shelf-stable offerings across cereals, snacks, and sports beverages. Studies mapping gut microbiome patterns show that specialized probiotic formulations can achieve premium pricing. This development has fostered collaborations between consumer packaged goods (CPG) companies and research institutions for product development. According to market surveys, 85% of U.S. consumers favor probiotic foods over supplements, prompting retailers to expand shelf space for functional products. The increasing prevalence of lactose intolerance and vegan preferences has driven manufacturers to explore plant-based carriers. These innovations in functional foods continue to support the growth of the probiotics market.

Growing Incidence of Digestive Disorders Drives Market Growth

The increasing occurrence of gastrointestinal conditions, inflammatory bowel diseases, and antibiotic-associated complications has expanded the therapeutic applications for probiotics across different age groups. Clinical trials have shown improved efficacy, with multicenter studies demonstrating that high-dose probiotic combinations prevent antibiotic-associated diarrhea in adults, addressing a significant healthcare concern affecting millions of patients each year. In pediatric applications, the combination of omeprazole and probiotics has reduced inflammatory markers and improved symptom scores in children with functional dyspepsia compared to using pharmaceutical treatments alone. The adoption of preventive probiotic treatments has increased due to healthcare cost considerations, as clinical evidence shows their effectiveness in lowering hospitalization rates and reducing dependence on pharmaceuticals for chronic gastrointestinal conditions.

High cost of research and development

The development of probiotic products requires substantial investments in clinical trials, regulatory compliance, and strain characterization, creating significant barriers for smaller companies. Established companies with robust R&D capabilities and financial resources maintain a competitive advantage. The capital requirements for comprehensive safety evaluations, including toxicological testing and self-GRAS pathway approvals, typically exceed USD 10 million for novel strain development and validation. Microbiome research demands sophisticated analytical capabilities, specialized equipment, and multidisciplinary expertise in microbiology, immunology, and clinical research. Companies without established research infrastructure face significant operational challenges. The varying regulatory requirements across jurisdictions necessitate multiple studies and separate documentation systems for different markets, increasing development costs and extending time-to-market. Additionally, the complex patent landscape in probiotic applications requires extensive intellectual property research and potential licensing agreements, resulting in additional legal costs and strategic limitations for product development.

Other drivers and restraints analyzed in the detailed report include:

- Demand for natural, organic, and non-GMO probiotics

- Growing Research and Clinical Validation

- Regulatory challenges and product claims restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Probiotic foods dominated revenue with a 53.88% share in 2025, validating consumer desire for health benefits embedded in everyday diets, while supplements are scaling fastest at an 7.99% CAGR. The category's yogurt cornerstone gained further traction after the FDA diabetes-risk claim, spurring line extensions into low-sugar and plant-based variants. Drinks are diversifying: kefir, kombucha, and oat-based smoothies now incorporate Bacillus spores stable at ambient temperatures, opening non-refrigerated distribution. Supplements ride precision-dose appeal; time-release capsules and spore-based blends attract athletes and seniors seeking targeted outcomes.

The animal nutrition niche, buoyed by EU antibiotic bans, adds incremental volume as poultry and aquaculture producers adopt multi-strain feed additives to improve feed conversion and disease resistance. Collectively, expanding formats underpin resilience of the probiotics market. Functional snacking also rises: chocolate-coated probiotics, shelf-stable baked goods, and chewy gummies serve impulse occasions while delivering viable counts through protective microencapsulation. Private-label innovation in supermarkets puts price pressure on legacy brands yet expands category footprint. In parallel, pharmaceutical-grade synbiotic medical foods enter hospital channels for oncology and critical-care patients requiring microbiome support, further broadening the probiotics market size.

The Probiotics Market Report is Segmented by Product Type (Probiotic Foods, Probiotic Drinks, and More), Function (Digestive and Gut Health, Immunity Enhancement, Mental Health and Mood, Sports and Metabolic Performance, Others), Distribution Channels (Supermarket/Hypermarkets, Pharmacies and Drug Stores, Convenience/Grocery Stores, Online Stores, Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 34.55% of the global probiotics market in 2025, underpinned by sophisticated regulatory frameworks, informed consumers, and sustained healthcare provider endorsements. The region sustains growth through high-end product positioning and diversified functional applications. The FDA's recent developments, particularly the March 2024 approval linking yogurt consumption to reduced diabetes risk, strengthen North American manufacturers' competitive position and encourage research investment. The United States maintains market dominance through substantial health-related consumer spending, extensive retail distribution, and established research capabilities. Canada contributes through progressive regulations and growing functional food acceptance, while Mexico emerges as a promising market driven by increased health consciousness and middle-class expansion.

Europe retains substantial market presence despite regulatory restrictions, employing strategic marketing initiatives and product modifications across Germany, United Kingdom, France, and Italy. EFSA's rigorous health claim requirements demand extensive clinical research investment while restricting marketing flexibility compared to other regions. Nordic countries exhibit strong functional food and probiotic acceptance, reinforced by health-oriented cultural values. Mediterranean markets demonstrate growing interest in digestive health solutions. The ongoing European Ombudsman examination of probiotic classification indicates potential regulatory adjustments that could remove existing market barriers.

Asia-Pacific exhibits the strongest growth trajectory at 9.02% CAGR through 2031, fueled by expanding middle-class populations, heightened health awareness, and regulatory standardization across China, India, Japan, and Southeast Asian markets. China offers substantial growth potential, illustrated by Cell Biotech's 12-year leadership in Korean probiotic exports and market penetration into Thailand and Philippines through technological excellence and premium positioning. Japan's comprehensive functional food regulations, including the Foods with Function Claims framework, facilitate evidence-based probiotic development. India's market expands through its substantial population base and rising disposable income, despite infrastructure challenges. South America and Middle East & Africa demonstrate growth potential but require investments in consumer education, distribution networks, and regulatory alignment.

- Danone SA

- Nestle SA

- Yakult Honsha Co. Ltd

- Gujarat Cooperative Milk Marketing Federation Limited (Amul)

- Bio-K Plus International

- Bright Dairy & Food Co., Ltd

- Fonterra Co-op Group Ltd

- Suja Life LLC

- Harmless Harvest

- Lifeway Foods Inc.

- Chobani LLC

- PepsiCo Inc.

- Morinaga Milk Industry Co. Ltd

- Now Foods

- NextFoods, Inc (Good Belly)

- Evonik Industries

- BioGaia AB

- Church & Dwight Co. Inc

- Amway Corp.

- Archer Daniels Midland Company (Bio-Kult)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional foods and beverages

- 4.2.2 Growing Incidence of Digestive Disorders Drives Market Growth

- 4.2.3 Demand for natural, organic, and non-GMO probiotics

- 4.2.4 Expansion of retail and e-commerce distribution

- 4.2.5 Growing Research and Clinical Validation

- 4.2.6 Microbiome-based personalised nutrition programs

- 4.3 Market Restraints

- 4.3.1 High cost of research and development

- 4.3.2 Competition from Alternative Health Products

- 4.3.3 Lack of consumer awareness in some regions

- 4.3.4 Regulatory challenges and product claims restrictions

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Product Type

- 5.1.1 Probiotic Foods

- 5.1.1.1 Yogurt

- 5.1.1.2 Bakery & Breakfast Cereals

- 5.1.1.3 Infant Formula & Baby Foods

- 5.1.1.4 Snacks & Confectionery

- 5.1.2 Probiotic Drinks

- 5.1.2.1 Dairy-based

- 5.1.2.2 Non-dairy

- 5.1.3 Dietary Supplements

- 5.1.4 Animal Feed and Nutrition

- 5.1.1 Probiotic Foods

- 5.2 By Function

- 5.2.1 Digestive & Gut Health

- 5.2.2 Immunity Enhancement

- 5.2.3 Mental Health & Mood (Gut-brain axis)

- 5.2.4 Sports & Metabolic Performance

- 5.2.5 Others

- 5.3 By Distribution Channels

- 5.3.1 Supermarket/Hypermarkets

- 5.3.2 Pharmacies and Drug Stores

- 5.3.3 Convinience/Grocery Stores

- 5.3.4 Online Stores

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 Yakult Honsha Co. Ltd

- 6.4.4 Gujarat Cooperative Milk Marketing Federation Limited (Amul)

- 6.4.5 Bio-K Plus International

- 6.4.6 Bright Dairy & Food Co., Ltd

- 6.4.7 Fonterra Co-op Group Ltd

- 6.4.8 Suja Life LLC

- 6.4.9 Harmless Harvest

- 6.4.10 Lifeway Foods Inc.

- 6.4.11 Chobani LLC

- 6.4.12 PepsiCo Inc.

- 6.4.13 Morinaga Milk Industry Co. Ltd

- 6.4.14 Now Foods

- 6.4.15 NextFoods, Inc (Good Belly)

- 6.4.16 Evonik Industries

- 6.4.17 BioGaia AB

- 6.4.18 Church & Dwight Co. Inc

- 6.4.19 Amway Corp.

- 6.4.20 Archer Daniels Midland Company (Bio-Kult)

7 MARKET OPPORTUNITITES AND FUTURE OUTLOOK