PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910463

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910463

Middle East And Africa Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

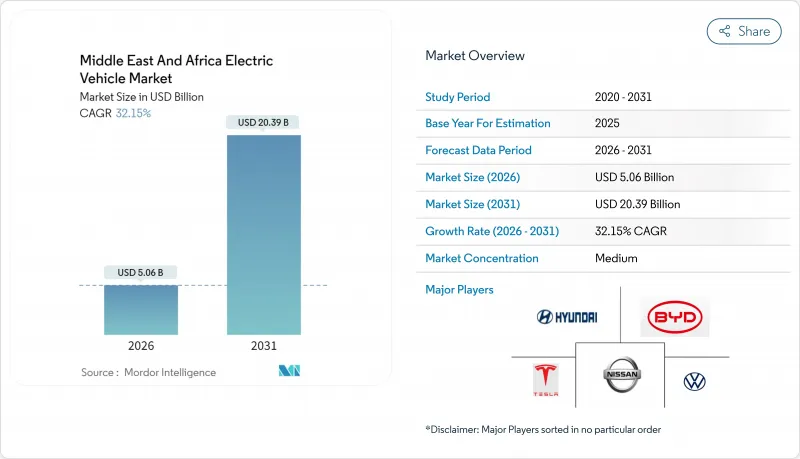

The electric vehicle market in the Middle East and Africa was valued at USD 3.83 billion in 2025 and estimated to grow from USD 5.06 billion in 2026 to reach USD 20.39 billion by 2031, at a CAGR of 32.15% during the forecast period (2026-2031).

Sovereign wealth funds are directing multibillion-dollar allocations toward domestic production ecosystems, and oil-exporting nations are leveraging abundant solar resources to lower charging costs and attract global original-equipment manufacturers (OEMs). Binding decarbonization mandates, falling battery costs, and the rollout of public fast-charging corridors reinforce demand momentum even as used internal-combustion-engine (ICE) imports remain a short-term headwind. Passenger cars retain the most extensive installed base, yet commercial fleets increasingly dominate incremental volume as oil-and-gas operators issue bulk electrification tenders. Strategic partnerships between energy majors and automakers and hot-climate battery-thermal innovations are positioning the region as a technical test bed for extreme-heat EV performance.

Middle East And Africa Electric Vehicle Market Trends and Insights

Government Decarbonization Mandates and ICE-Ban Targets

Gulf Cooperation Council (GCC) members have embedded electric-mobility quotas into national development agendas, creating demand floors that anchor OEM investment decisions. Saudi Arabia's Vision 2030 compels 30% of Riyadh's vehicles to be electric by 2030, while the UAE's federal strategy targets a 50% electric-vehicle mix by 2050. These directives funnel public-sector procurement toward zero-emission models, catalyze private-sector fleet conversions, and standardize certification under Gulf Standardization Organization (GSO) rules, which ease cross-border trade. Morocco's mandates 2,500 charging points by 2026, illustrating how firm policy anchors accelerate infrastructure scale-up. Binding targets dovetail with COP28 commitments, giving investors long-cycle visibility, compensating for initial demand volatility.

Rapid Rollout of Public DC Fast-Charging Corridors

Intercity fast-charging corridors convert EVs from urban runabouts into region-wide mobility options. EVIQ's flagship 150 kW site on the Riyadh-Qassim motorway demonstrates highway viability and signals forthcoming coverage of the kingdom's 10 busiest arterial routes. In parallel, the UAE plans 70,000 public chargers across Abu Dhabi by 2030, while Dubai targets 1,000 sites by 2025, effectively eliminating intra-emirate range anxiety. Morocco's plan links Casablanca, Rabat, and Tangier with green-energy-powered DC units that supply sub-30-minute stops. Nigeria's 2025 inauguration of West Africa's largest assembled charging hub widens the infrastructure map to frontier markets. Corridor density materially lifts commercial-vehicle uptime, unlocking electrification for freight operators serving ports such as Jebel Ali.

High Upfront Vehicle Price and Limited Consumer Financing

Purchase-price premiums continue to deter mass-market adoption in lower-income segments even as batteries cheapen. Egypt's EV share remains just 0.1% of new-car sales due to limited installment plans and hard-currency outlays that expose buyers to exchange-rate swings. Traditional lenders, accustomed to securitizing used imports, lack residual-value benchmarks for electric vehicle market loans, inflating interest spreads. In Sub-Saharan Africa, microfinance mechanisms target two-wheeler taxis rather than four-wheeler purchases, further stalling scale economics for OEMs.

Other drivers and restraints analyzed in the detailed report include:

- Day-Time Solar-PV Surplus Driving Ultra-Low-Cost Charging Tariffs

- Oil-and-Gas Fleet-Electrification Pledges Unlocking Bulk Orders

- Influx of Cheap Used ICE Imports Undermines EV Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery-electric vehicles (BEVs) commanded 78.64% of the electric vehicle market share in 2025, validating the region's preference for fully electric drivetrains and sidestepping the fuel-duty complexity of plug-in hybrids. BEV appeal stems from simpler maintenance and the rollout of destination chargers at malls, airports, and industrial parks. The segment's robust margin structure has enticed Tesla, BYD, and Geely to launch direct-to-consumer sales portals that bypass traditional dealerships.

Fleet operators adopt BEVs for depot-night charging, reducing daytime operational disruptions. Fuel-cell electric vehicles post a 35.90% CAGR through 2031 as Saudi Arabia scales green-hydrogen refueling nodes around its industrial corridors, underscoring their long-haul potential. Meanwhile, plug-in hybrids remain transitional, offering range security where grid reliability lags. The drive-type mix therefore mirrors infrastructure maturity, with BEVs prevailing in the urban Gulf and fuel-cells rising along desert freight links.

Passenger cars controlled 64.05% of 2025 revenue, yet medium and heavy commercial vehicles are forecast to outpace with a 35.05% CAGR to 2031, expanding the electric vehicle market size in corporate procurement channels. Oil-field service trucks and last-mile delivery vans accrue higher daily mileage, magnifying fuel savings and carbon audit benefits. Logistics firms in the Jeddah free zone now specify electric models in tenders to comply with port authority emissions limits. Bus electrification pilots in Cairo and Cape Town indicate growing public-transport appetite, while ride-hailing operators deploy small hatchback EVs to meet city-center clean-air mandates. OEMs are responding with region-tuned payload ratings, enhanced cabin HVAC, and reinforced suspensions for unpaved routes. As commercial volumes climb, supply-chain localization deepens because truck bodies, battery enclosures, and telematics services can all be sourced domestically.

The Middle East and Africa Electric Vehicle Market Report is Segmented by Drive Type (Battery-Electric, Plug-In Hybrid, and Fuel-Cell Electric), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Battery Chemistry (Lithium-Ion, Nickel-Metal Hydride, and Others), Charging Level (AC Below 7 KW, and More), and by Country. Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tesla Inc.

- BYD Co. Ltd.

- Hyundai Motor Co.

- Kia Corp.

- Volkswagen AG

- Nissan Motor Co. Ltd.

- BMW Group

- Toyota Motor Corp.

- Stellantis N.V.

- Mercedes-Benz Group AG

- Renault Group

- Jaguar Land Rover Ltd.

- Zhejiang Geely Holding

- Lucid Group

- Ceer Motors

- Togg A.S.

- General Motors Co.

- SAIC-MG Motor

- Ford Motor Co.

- Rivian Automotive Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Decarbonizations Mandates and ICE-Ban Targets

- 4.2.2 Subsidies And Zero-Customs Duties on EV Imports (GCC)

- 4.2.3 Rapid Rollout of Public DC Fast-Charging Corridors

- 4.2.4 Declining Battery Pack Prices and Longer Driving Range

- 4.2.5 Oil-and-Gas Fleet Electrification Pledges Unlocking Bulk Orders

- 4.2.6 Day-Time Solar-PV Surplus Driving Ultra-Low-Cost Charging Tariffs

- 4.3 Market Restraints

- 4.3.1 High Upfront Vehicle Price and Limited Consumer Financing

- 4.3.2 Restricted Hot-Climate Model Availability From OEMs

- 4.3.3 Grid Unreliability Curbing Charger Uptime (Sub-Saharan Sites)

- 4.3.4 Influx of Cheap Used ICE Imports Undermines EV Demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Million)

- 5.1 By Drive Type

- 5.1.1 Battery-Electric (BEV)

- 5.1.2 Plug-in Hybrid (PHEV)

- 5.1.3 Fuel-Cell Electric (FCEV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Buses and Coaches

- 5.2.5 Two and Three Wheelers

- 5.3 By Battery Chemistry

- 5.3.1 Lithium-ion (NMC / NCA / LFP)

- 5.3.2 Nickel-Metal Hydride

- 5.3.3 Others

- 5.4 By Charging Level

- 5.4.1 AC below 7 kW (Slow)

- 5.4.2 AC above 7 kW - 22 kW (Semi-fast)

- 5.4.3 DC above 22 kW (Fast / Ultra-fast)

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Israel

- 5.5.4 Egypt

- 5.5.5 South Africa

- 5.5.6 Nigeria

- 5.5.7 Kenya

- 5.5.8 Qatar

- 5.5.9 Oman

- 5.5.10 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Tesla Inc.

- 6.4.2 BYD Co. Ltd.

- 6.4.3 Hyundai Motor Co.

- 6.4.4 Kia Corp.

- 6.4.5 Volkswagen AG

- 6.4.6 Nissan Motor Co. Ltd.

- 6.4.7 BMW Group

- 6.4.8 Toyota Motor Corp.

- 6.4.9 Stellantis N.V.

- 6.4.10 Mercedes-Benz Group AG

- 6.4.11 Renault Group

- 6.4.12 Jaguar Land Rover Ltd.

- 6.4.13 Zhejiang Geely Holding

- 6.4.14 Lucid Group

- 6.4.15 Ceer Motors

- 6.4.16 Togg A.S.

- 6.4.17 General Motors Co.

- 6.4.18 SAIC-MG Motor

- 6.4.19 Ford Motor Co.

- 6.4.20 Rivian Automotive Inc.

7 Market Opportunities & Future Outlook