PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910468

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910468

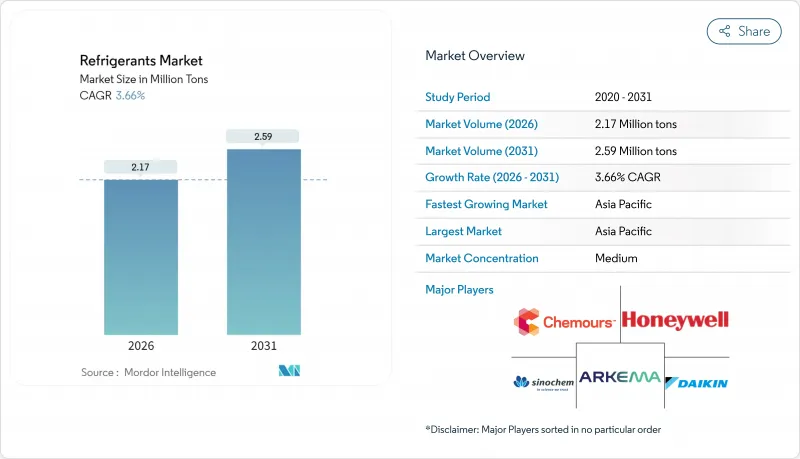

Refrigerants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Refrigerants market is expected to grow from 2.09 million tons in 2025 to 2.17 million tons in 2026 and is forecast to reach 2.59 million tons by 2031 at 3.66% CAGR over 2026-2031.

The core growth engines are the accelerated adoption of low-global-warming-potential (GWP) formulations, mandatory phase-downs of hydrofluorocarbons (HFCs), and expanding thermal-management needs across cooling, transport, and cold-chain logistics. Regulation-driven product substitutions, electrified-vehicle heat-pump integration, and multi-temperature pharmaceutical logistics expand the refrigerant market opportunity while intensifying demand for natural and hydrofluoro-olefin (HFO) alternatives. At the same time, raw-material cost swings and quota-induced supply bottlenecks keep price volatility high, prompting manufacturers to optimize capacity footprints and portfolio mixes. Midstream distributors are forming strategic sourcing alliances with chemical majors to secure compliant molecules ahead of regional cut-off dates, while downstream equipment makers fast-track system redesigns compatible with A2L and A3 classifications. These converging forces collectively reinforce a medium-single-digit growth trajectory for the refrigerant market through 2030.

Global Refrigerants Market Trends and Insights

High Demand for Room and Car Air-Conditioners in Emerging Asia

Rapid urbanization is pushing residential cooling deeper into tier-2 and tier-3 city households while the automotive sector simultaneously swaps internal-combustion platforms for electric drivetrains. China's heat-pump shipments are projected to hit 50 million units annually by 2030, and India's household air-conditioner penetration remains under 10%, underscoring significant latent demand. Japan's revised F-Gas Law and South Korea's efficiency management program impose GWP ceilings that funnel procurement toward propane, R-32, and shortlisted HFO blends. Vehicle OEMs in the region are standardizing R-1234yf for cabin and battery loops, accelerating molecule transition volumes throughout Asia-Pacific. Together, residential uptake and e-mobility adoption underpin the largest absolute tonnage additions in the refrigerant market during the forecast window.

Electrified-Vehicle Thermal-Management Requirements

Electric vehicle (EV) battery chemistries demand narrow temperature windows for longevity and charging speed. R-1234yf enjoys 95% penetration in new U.S. light-duty vehicles, with 220 million cars worldwide now equipped, while legacy fleets adopt retrofit kits that swap out R-134a for the same molecule. Heat-pump architectures unifying cabin heating and battery cooling are spreading into mass-market segments, spurring consumption of blended A2L fluids optimized for -30 °C to +45 °C efficiency curves. Compressor suppliers have cut scroll noise by 6 dBA through housing and inverter tuning, a key specification for premium EV models. The aggregate effect widens the addressable refrigerant market for mobility applications through mid-decade.

Stringent Global HFC Phase-Down (Kigali, EU F-Gas)

EU Regulation 2024/573 cuts HFC quotas from 60% of baseline levels in 2025 to 15% in 2036, with full phase-out targeted by 2050. Similar freezes under the Kigali Amendment pressure all producers simultaneously, tightening supply and elevating spot prices across the refrigerant market. Operators installing new systems must adopt automated leak detection above 500 tCO2e capacity, raising compliance budgets and reallocating capital away from volume growth. The resulting uncertainty slows decision cycles for large installations, shaving nearly two percentage points from projected CAGR during mid-transition years.

Other drivers and restraints analyzed in the detailed report include:

- Ultralow-Temperature Freezers for mRNA-Type Vaccines

- Carbon-Credit Monetization for Natural Refrigerants

- High First-Cost and Handling Risk of Flammable A3/A2L Gases

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrocarbons commanded 49.02% refrigerant market share in 2025 on the back of exemption status under multiple F-Gas schedules and compelling cost-of-ownership economics. Market leaders report double-digit shipment growth into residential heat-pumps and plug-in commercial cabinets, while global roll-outs of R-290 split units accelerate in regions adopting MEPS revisions. Hydrofluoro-olefins are delivering the fastest 9.86% CAGR, propelled by automotive and stationary HVAC debuts where regulatory cut-off dates for GWP greater than 750 fluids are imminent. Collectively, these two low-GWP segments offset contracting fluorocarbon tonnage, anchoring overall refrigerant market growth.

Downstream, the refrigerant market size for inorganic options such as ammonia and CO2 continues to expand in large food-processing plants and big-box supermarkets. Engineers pair CO2 in low-stage loops with synthetic high-stage fluids for efficiency gains, an architecture validated by recent COP comparisons across cascade permutations. Data-center immersion cooling and pharma freezers add pocket growth for CO2, while ammonia remains entrenched in warehouse chillers. Natural-refrigerant carbon-credit programs further sweeten the business case, ensuring sustained share migration away from legacy HFCs.

The Refrigerants Market Report is Segmented by Type (Fluorocarbons, Inorganics, Hydrocarbons, Other Types), Application (Refrigeration, Air-Conditioning, Other Applications), End-User Industry (Residential and Commercial Buildings, Food and Beverage Processing, Pharmaceuticals and Healthcare, Automotive and E-Mobility, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa).

Geography Analysis

Asia-Pacific's 50.10% refrigerant market share in 2025 reflects the region's outsized manufacturing base, urban temperature spikes, and supportive policy frameworks. China's room-air-conditioner exports grow with domestic uptake, locking in bulk R-32 and R-290 flows through vertically integrated supply chains. India's Production Linked Incentive (PLI) scheme for white goods includes grants for low-GWP refrigerant R&D, expediting local component ecosystems. Japan and South Korea anchor advanced-material development for A2L blends, exporting formulation know-how across the region. Southeast Asian economies follow with cold-chain infrastructure funding, reinforcing Asia-Pacific's reinforced leadership of the refrigerant market.

North America tracks a balanced path as the U.S. AIM Act mandates an HFC consumption-cap glide path while simultaneously turbo-charging demand for HFOs in HVAC retrofits. Chemours logged a 40% surge in Opteon sales during Q1 2025, enabled by its Corpus Christi capacity expansion. Canada's carbon-pricing architecture further skews equipment specifications toward natural refrigerants in food retail, whereas Mexico's industrial corridor demands process-cooling fluorocarbons under transitional GWP ceilings.

Europe navigates the tightest regulatory straitjacket. F-Gas 2024 quotas and eco-design rules push OEMs to deploy R-290 heat-pumps at scale, supported by German and French subsidy pools. Transcritical CO2 has become the default supermarket specification even in southern climates thanks to high-ambient optimization packages. The United Kingdom maintains an independent quota system but mirrors EU timelines, keeping the refrigerant market outlook convergent across the continent.

Emerging regions across South America and Middle East & Africa constitute the long-tail of the refrigerant market. Delayed phase-down schedules prolong HFC demand, yet rising per-capita cooling expectations seed future low-GWP adoption cycles. Infrastructure gaps are being addressed through multilateral development-bank programs that bundle cold-chain logistics with agricultural productivity mandates.

- A-Gas International Ltd

- AGC Inc.

- Arkema

- Brothers Gas

- Daikin Industries, Ltd.

- Dongyue Group

- Gulfcryo.

- Harp International Ltd

- Honeywell International Inc

- Linde PLC

- Messer SE & Co. KGaA

- Navin Fluorine International Ltd

- Orbia

- Shandong Yuean Chemical Industry Co., Ltd

- Sinochem Holdings Corporation Ltd

- SRF Limited

- The Chemours Company

- Zhejiang Juhua Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High demand for room and car air-conditioners in emerging Asia

- 4.2.2 Expansion of refrigerated warehousing and 3PL cold-chain nodes

- 4.2.3 Electrified-vehicle thermal-management requirements

- 4.2.4 Ultralow-temperature freezers for mRNA-type vaccines

- 4.2.5 Carbon-credit monetisation for natural refrigerants

- 4.3 Market Restraints

- 4.3.1 Stringent global HFC phase-down (Kigali, EU F-Gas)

- 4.3.2 High first-cost and handling risk of flammable A3/A2L gases

- 4.3.3 Boom-bust price swings for next-gen HFO molecules

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Fluorocarbons

- 5.1.1.1 Hydrochlorofluorocarbons (HCFC)

- 5.1.1.2 Hydrofluorocarbons (HFC)

- 5.1.2 Inorganics

- 5.1.2.1 Ammonia

- 5.1.2.2 Carbon Dioxide

- 5.1.2.3 Other Inorganics

- 5.1.3 Hydrocarbons

- 5.1.3.1 Isobutane

- 5.1.3.2 Propane

- 5.1.3.3 Other Hydrocarbons

- 5.1.4 Other Types (Hydrofluoro-olefins (HFO))

- 5.1.1 Fluorocarbons

- 5.2 By Application

- 5.2.1 Refrigeration

- 5.2.1.1 Domestic

- 5.2.1.2 Commercial

- 5.2.1.3 Transportation

- 5.2.1.4 Industrial

- 5.2.2 Air-Conditioning

- 5.2.2.1 Stationary Room/Packaged

- 5.2.2.2 Chillers

- 5.2.2.3 Mobile

- 5.2.3 Other Applications

- 5.2.1 Refrigeration

- 5.3 By End-user Industry

- 5.3.1 Residential and Commercial Buildings

- 5.3.2 Food and Beverage Processing

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Automotive and e-Mobility

- 5.3.5 Chemicals and Petrochemicals

- 5.3.6 Other Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A-Gas International Ltd

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Brothers Gas

- 6.4.5 Daikin Industries, Ltd.

- 6.4.6 Dongyue Group

- 6.4.7 Gulfcryo.

- 6.4.8 Harp International Ltd

- 6.4.9 Honeywell International Inc

- 6.4.10 Linde PLC

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 Navin Fluorine International Ltd

- 6.4.13 Orbia

- 6.4.14 Shandong Yuean Chemical Industry Co., Ltd

- 6.4.15 Sinochem Holdings Corporation Ltd

- 6.4.16 SRF Limited

- 6.4.17 The Chemours Company

- 6.4.18 Zhejiang Juhua Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment