PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910477

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910477

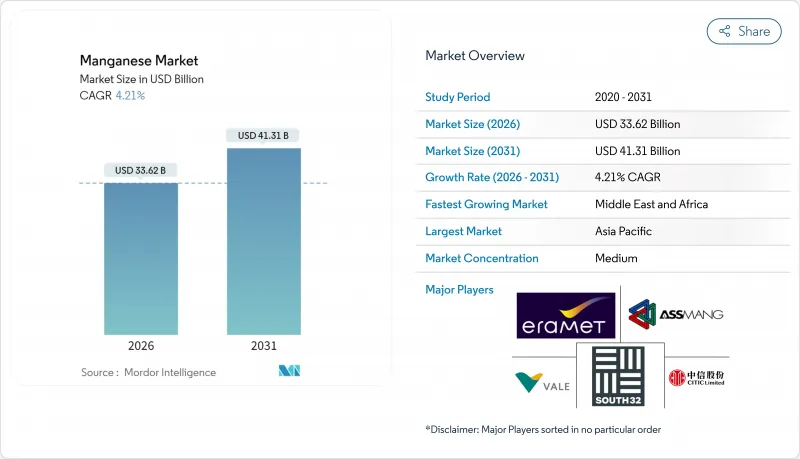

Manganese - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Manganese market is expected to grow from USD 32.26 billion in 2025 to USD 33.62 billion in 2026 and is forecast to reach USD 41.31 billion by 2031 at 4.21% CAGR over 2026-2031.

Traditional steel-grade alloys still dominate; however, rapid growth in battery-grade and high-purity specialties is reshaping trade routes and prompting new refinery investments outside China. Cyclone damage at South32's GEMCO mine and labor unrest in Gabon have tightened ore supply, elevating spot prices and prompting Western buyers to secure long-term contracts. Hydrogen-based direct reduced iron (DRI) projects in Europe and India are raising ferromanganese intensity per tonne of crude steel, while lithium-manganese-iron-phosphate (LMFP) cathodes for heavy-duty electric vehicles are expanding high-purity manganese demand. Governments in the United States and Saudi Arabia are subsidizing domestic ferroalloy and sulfate capacity to reduce dependence on Chinese refining, a policy trend likely to reinforce above-GDP expansion in the Manganese market.

Global Manganese Market Trends and Insights

Electrification of Heavy-Duty Vehicles Accelerates HP-Mn Demand

Heavy-duty electric trucks and buses are increasingly turning to LMFP cathodes, which have a higher manganese content than traditional LFP chemistries, effectively increasing the manganese usage per kilowatt-hour. Element 25's Louisiana refinery, backed by a U.S. DOE grant, will produce and supply high-purity manganese sulfate, circumventing Chinese intermediaries. In a notable shift, automakers are now willing to pay a premium for feedstock that is both traceable and low-carbon, leading to the establishment of a two-tier pricing structure in the manganese market. As a result of these developments, Western policy incentives are driving up demand for battery-grade supplies, ensuring continued growth even amid fluctuations in steel cycles. This evolving landscape is prompting traditional ore miners to either move downstream or collaborate with refiners, all in an effort to maintain their market foothold.

Steelmakers' Switch to Hydrogen-DRI Raises HC FeMn Intensity

Hydrogen-based DRI-EAF pathways necessitate more manganese additions compared to blast-furnace routes, primarily because DRI pellets have a lower residual manganese content. Pilot plants in Sweden and Germany validated these increased alloy additions during their 2024 commissioning. India's National Green Hydrogen Mission, which aims to boost green hydrogen production by 2030, could increase the country's demand for ferromanganese. Suppliers of ferromanganese harnessing low-carbon power are set to gain significantly, especially as EU carbon border taxes impose penalties on coal-intensive grade imports. This surge in alloy consumption not only strengthens the current market but also paves the way for the long-term growth of the Manganese market.

Rapid LFP Adoption Curbs Cathode-Grade Mn Growth

In 2024, passenger EV manufacturers increased the share of LFP cathodes, displacing manganese-based chemistries and casting a shadow on the immediate demand for cathode-grade materials. A rise in LFP translates to a reduction in manganese sulfate demand. Should LFP's market share continue to increase by 2028, the battery-grade manganese sector may fall short of previous projections. While producers are adapting by crafting refineries that can switch to electrolytic metals for steel additives, this added flexibility comes with a hike in capital expenses. As a result, the Manganese market's growth is being restrained, even as LMFP sees parallel advancements.

Other drivers and restraints analyzed in the detailed report include:

- Western OEM Off-Take Deals for HPMSM Diversify Supply

- Infrastructure-Grade Silico-Manganese Demand in India and ASEAN

- Ore-Port Bottlenecks in South Africa Cap Export Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alloys accounted for 67.75% of the manganese market demand in 2025, primarily driven by the addition of ferromanganese and silicomanganese to finished steel. With rising hydrogen-DRI capacities in Europe and India, alloy intensity has increased, supporting steady volume growth. Electrolytic manganese dioxide is poised for 6.17% growth, driven by demand from portable electronics and emerging grid-storage initiatives. Other end-uses, including feed, water treatment, and ceramics, are growing in tandem with GDP, providing volume stability to the manganese market. The resurgence of EMD is largely attributed to zinc-manganese batteries, which have caught the attention of utility-scale pilots in California's DOE. Additionally, steelmakers grappling with EU carbon tariffs are increasingly seeking certified low-carbon alloys, creating a premium niche in the broader commodity market.

The Manganese Market Report is Segmented by Application (Alloys, Electrolytic Manganese Dioxide, Electrolytic Manganese Metals, and Other Applications), End-Use Sector (Industrial, Construction, Power Storage and Electricity, and Other End-Use Sectors), Ore Grade (Battery Grade, High Purity Grade, Standard Grade, and Technical Grade), and Geography (Asia-Pacific, and More). Market Forecasts are Provided in Value (USD).

Geography Analysis

The Asia-Pacific region absorbed 54.20% of the global manganese market in 2025, primarily driven by China's demand, which was largely for steel and battery materials. India, buoyed by infrastructure investments and expansions in silico-manganese at Tata Steel and MOIL, also made significant contributions. Japan and South Korea have established themselves as key players in the electrolytic manganese metal industry, exporting high-purity products throughout the region. Despite being resource-rich, Africa processed only a small portion of its manganese ore domestically, with the bulk exported, a consequence of its limited refining capacity. The Middle East and Africa Manganese market is forecast to grow at a 5.86% CAGR to 2031, driven by South Africa's efforts to alleviate rail constraints and Saudi Arabia's push for downstream investments.

North America accounted for a smaller share of global manganese demand in 2025. However, with the commissioning of Element 25's refinery in Louisiana, the localization of battery-grade supply could bolster this share. Canada is actively pursuing manganese deposits in Quebec, while Mexican steel mills are ramping up capacity to cater to U.S. automotive clients. Europe, holding a moderate share, grapples with challenges from the Carbon Border Adjustment Mechanism (CBAM), nudging buyers towards Norwegian hydro-powered alloys and recycled feedstock. Notably, Eramet's "eraLow" brand is capitalizing on renewable electricity to secure contracts with EU flat-steel producers.

South America, contributing a smaller portion to global manganese demand, sees Brazil leading in alloy consumption and exports from Vale's Azul mine. Meanwhile, Argentina's burgeoning lithium sector is indirectly driving up demand for manganese, particularly for cathode precursors. With regional efforts to cultivate battery supply chains, there's potential for increased intra-continental processing, reshaping the Manganese market dynamics. The trajectory of Latin American nations moving up the value chain will hinge on infrastructure enhancements and green energy initiatives.

- African Rainbow Minerals Limited.

- Anglo American plc

- Assore Limited (Assmang Proprietary Limited)

- BHP

- CITIC LIMITED

- Consolidated Minerals Limited.

- Element 25 Limited

- Eramet

- Giyani Metals Corp

- Jupiter Mines Limited

- Manganese Metal Company (Pty) Ltd.

- MOIL LIMITED

- Ningxia Tianyuan Manganese Industry Group Co. Ltd

- NIPPON DENKO CO. LTD

- OM Holdings Ltd.

- POSCO M-TECH.

- South32

- Tata Steel

- Vale

- Vibrantz

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of heavy-duty vehicles accelerates HP-Mn demand

- 4.2.2 Steelmakers' switch to hydrogen-DRI raises HC FeMn intensity

- 4.2.3 Western OEM off-take deals for HPMSM diversify supply

- 4.2.4 Infrastructure-grade silico-manganese demand in India and ASEAN

- 4.2.5 Geo-political ore disruptions (Gabon, Australia) lift prices

- 4.3 Market Restraints

- 4.3.1 Rapid LFP adoption curbs cathode-grade Mn growth

- 4.3.2 Ore-port bottlenecks in South Africa cap export volumes

- 4.3.3 High-carbon ferroalloy CO2-footprint faces carbon-border taxes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Alloys

- 5.1.2 Electrolytic Manganese Dioxide

- 5.1.3 Electrolytic Manganese Metals

- 5.1.4 Other Applications

- 5.2 By End-use Sector

- 5.2.1 Industrial

- 5.2.2 Construction

- 5.2.3 Power Storage and Electricity

- 5.2.4 Other End-use Sectors

- 5.3 By Ore Grade

- 5.3.1 Battery Grade

- 5.3.2 High Purity Grade

- 5.3.3 Standard Grade

- 5.3.4 Technical Grade

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 African Rainbow Minerals Limited.

- 6.4.2 Anglo American plc

- 6.4.3 Assore Limited (Assmang Proprietary Limited)

- 6.4.4 BHP

- 6.4.5 CITIC LIMITED

- 6.4.6 Consolidated Minerals Limited.

- 6.4.7 Element 25 Limited

- 6.4.8 Eramet

- 6.4.9 Giyani Metals Corp

- 6.4.10 Jupiter Mines Limited

- 6.4.11 Manganese Metal Company (Pty) Ltd.

- 6.4.12 MOIL LIMITED

- 6.4.13 Ningxia Tianyuan Manganese Industry Group Co. Ltd

- 6.4.14 NIPPON DENKO CO. LTD

- 6.4.15 OM Holdings Ltd.

- 6.4.16 POSCO M-TECH.

- 6.4.17 South32

- 6.4.18 Tata Steel

- 6.4.19 Vale

- 6.4.20 Vibrantz

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment