PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910482

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910482

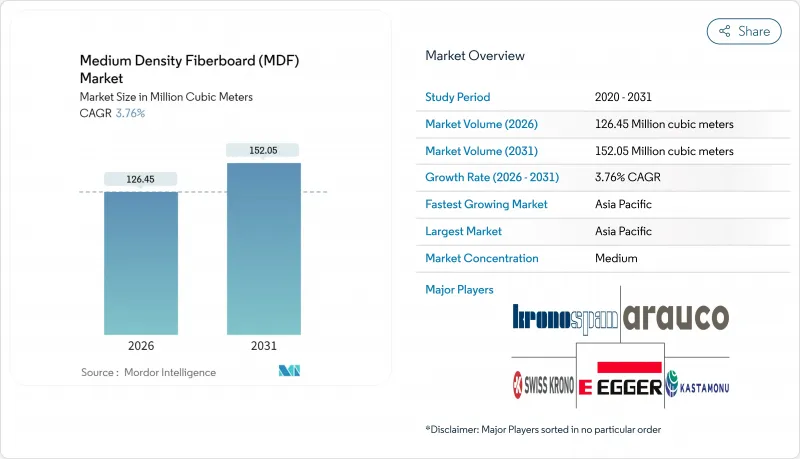

Medium Density Fiberboard (MDF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Medium Density Fiberboard market is expected to grow from 121.87 million cubic meters in 2025 to 126.45 million cubic meters in 2026 and is forecast to reach 152.05 million cubic meters by 2031 at 3.76% CAGR over 2026-2031.

This expansion continues even as global panel capacity grows more slowly, because producers increasingly rely on process upgrades, bio-based resins and circular manufacturing to lift output quality rather than pure tonnage. MDF's superior machinability, uniform core and smooth face make it the preferred substrate for ready-to-assemble (RTA) cabinets, doors and shelving, allowing furniture makers to achieve consistent painted and laminated finishes. Asia-Pacific commands 60.72% of 2024 production as Vietnam, India and other cost-competitive hubs add lines to serve both domestic housing programs and offshore furniture contracts, while North America and Europe concentrate on premium low-VOC grades to satisfy tightening emission rules. Price volatility for wood fiber and urea-formaldehyde resin remains a short-term challenge, yet manufacturers are offsetting cost spikes through energy-efficient refining, backward integration in timberlands, and adoption of polymeric MDI binders that cut formaldehyde out-gassing.

Global Medium Density Fiberboard (MDF) Market Trends and Insights

Rapid Capacity Additions in Asia-Pacific Furniture Manufacturing Hubs

Vietnam's July 2024 start-up of a 600 m3 day line supplied by Siempelkamp underscores how exporters are back-integrating into panel production to secure feedstock and logistics certainty. Similar projects in Indonesia and the Philippines lift regional panel self-sufficiency, reduce freight exposure, and allow furniture OEMs to align substrate specs with customer finishing systems. Contractors expanding in Vietnam also establish satellite assembly lines in Cambodia and Laos to diversify labor and port risk, a pattern that multiplies MDF demand beyond the host country. Chinese producers, facing higher electricity tariffs, relocate incremental capacity to lower-cost Mekong provinces to protect margins while maintaining proximity to import customers. The medium density fiberboard market benefits as line debottlenecking and new-plant commissioning collectively add more than 6 million m3 of annual nameplate capacity in Southeast Asia between 2024 and 2026.

Recovery in Global Residential Renovation Spending Post-Pandemic

Houzz's 2025 homeowner sentiment survey shows kitchen and bath remodel intentions back at pre-pandemic highs, translating to heightened demand for cabinet-grade MDF panels in North America. Increased mortgage refinancing in the United States frees up discretionary funds, while energy-efficiency rebates spur window and door replacements that often specify MDF jambs and casings. In Europe, the pace is steadier because elevated energy prices delay bigger projects, yet MDF volumes hold as smaller tasks such as closet re-fronting favor thinner, paint-ready boards. Suppliers of water-repellent and fire-rated grades enjoy price premiums, offsetting resin cost inflation. The broader renovation upturn therefore underwrites baseline growth even if new housing starts soften in mature economies.

Volatile Wood and Urea-Formaldehyde Prices Pressuring Margins

Surging pulpwood demand from biomass energy plants in Germany and Japan tightens log supply, lifting delivered fiber costs by 9% between Q4 2024 and Q2 2025. Concurrently, natural-gas-linked methanol contracts spike, pushing urea-formaldehyde resin prices to a 15-month high. German MDF panel prices rose 1.26% in April 2024, yet producers failed to fully pass through hikes because RTA furniture buyers lock prices six months in advance. Mills mitigate volatility by shifting to in-house resin plants that blend urea with lower-cost soy flour extenders. Some Southeast Asian producers adopt longer-chip furnish to cut refining energy, but this approach risks lower face smoothness, underscoring the trade-off between cost and quality.

Other drivers and restraints analyzed in the detailed report include:

- Shift From Plywood/Particleboard to Smoother MDF for RTA Furniture

- Government-Backed Affordable Housing Programs in India and SE Asia

- Competition From Substitute Decorative Panels (Melamine PB, WPC)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The furniture segment captured 51.10% of 2025 volume, anchoring the medium density fiberboard market size near 62.28 million m3. Over 2026-2031, cabinet doors, drawer fronts and shelving sustain a 4.04% CAGR as consumers replace dated kitchens with painted shaker styles that rely on defect-free MDF cores. European builders favor moisture-resistant green-core panels for bath vanities, while North America shifts to thicker 18 mm boards for frameless cabinetry. Flooring uses, mainly laminate substrate, stabilize as luxury vinyl tile keeps displacing wood-look laminate, yet MDF remains pivotal in budget flooring where dimensional stability matters less than price.

Upgraded furniture lines integrate antibacterial laminates and super-matte lacquers, both demanding ultra-fine-sanded surfaces that particleboard struggles to provide at competitive cost. Producers in Brazil and Turkey advance value retention by co-laminating paper foil in-line, thereby shipping component blanks that reduce customer processing steps. Lightweight MDF variants leveraging poplar furnish penetrate premium interior doors by cutting leaf weight 20%, easing hinge load. These innovations reinforce the medium density fiberboard market as the substrate of choice whenever surface perfection and machinability underpin product differentiation.

The Medium Density Fiberboard Report is Segmented by Application (Furniture, Cabinet, Flooring, Molding/Door/Millwork, Packaging System, and Other Applications), End-Use Industry (Residential, Commercial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

Asia-Pacific solidified its lead with 60.30% of 2025 production, a position strengthened by policy-driven housing schemes in India and Vietnam that funnel predictable MDF offtake. China remains the single-largest producer, but rising electricity tariffs and stricter environmental audits encourage outbound investment to lower-cost ASEAN states. The region's medium density fiberboard market share therefore rises in qualitative value even as incremental capacity growth disperses across multiple countries. Indian producers, aided by Biesse CNC localization hitting 80% domestic content, now meet cabinetmakers' precision-routing needs and reduce lead times for export orders.

North America's 20.15% share rests on renovation-heavy panel demand, especially for frameless kitchen cabinetry where MDF's paintability justifies a price premium over plywood. U.S. mills in Georgia and North Carolina exploit abundant fast-growing pine and well-developed rail networks, sustaining competitive delivered pricing into the Midwest. Canadian suppliers capitalize on boreal fiber certification to win LEED projects while exporting surplus to the northeastern United States.

Europe emphasizes circular economy compliance. Germany and Poland install sander-dust briquette boilers and optical-sorting lines to reclaim fiber from production waste, thereby raising fiber recovery yield to 11% of intake by 2027. The EU's 2026 formaldehyde cap compels upgrades to blow-line resin dosing and in-line press sealing, costs that many small mills cannot absorb, likely spurring consolidation. Southern Europe rebounds from earlier recessions, and Spain's kitchen cabinet export surge lifts Iberian MDF utilization above 90%.

- ARAUCO

- EGGER

- Fantoni SpA

- Finsa

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Masisa

- MDF Mekong

- Pfleiderer Deutschland GmbH

- Roseburg Forest Products

- Sonae Arauco

- Swiss Krono Group

- Unilin Panels

- VRG Dongwha MDF

- West Fraser

- Weyerhaeuser Company

- Yildiz Entegre

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Capacity Additions in Asia-Pacific Furniture Manufacturing Hubs

- 4.2.2 Recovery in Global Residential Renovation Spending Post-Pandemic

- 4.2.3 Shift From Plywood/Particleboard to Smoother MDF for RTA Furniture

- 4.2.4 Government-Backed Affordable Housing Programs in India and SE Asia

- 4.2.5 Adoption of Pmdi/Bio-Based Resins Unlocking Premium Low-VOC Segments

- 4.3 Market Restraints

- 4.3.1 Volatile Wood and Urea-Formaldehyde Prices Pressuring Margins

- 4.3.2 Competition from Substitute Decorative Panels (Melamine PB, WPC)

- 4.3.3 Rising Chinese Electricity Tariffs Inflating Fibre-Refining OPEX

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Furniture

- 5.1.2 Cabinet

- 5.1.3 Flooring

- 5.1.4 Molding, Door, and Millwork

- 5.1.5 Packaging System

- 5.1.6 Other Applications

- 5.2 By End-Use Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Institutional

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ARAUCO

- 6.4.2 EGGER

- 6.4.3 Fantoni SpA

- 6.4.4 Finsa

- 6.4.5 Georgia-Pacific Wood Products LLC

- 6.4.6 GREENPANEL INDUSTRIES LIMITED

- 6.4.7 Kastamonu Entegre

- 6.4.8 Kronoplus Limited

- 6.4.9 Masisa

- 6.4.10 MDF Mekong

- 6.4.11 Pfleiderer Deutschland GmbH

- 6.4.12 Roseburg Forest Products

- 6.4.13 Sonae Arauco

- 6.4.14 Swiss Krono Group

- 6.4.15 Unilin Panels

- 6.4.16 VRG Dongwha MDF

- 6.4.17 West Fraser

- 6.4.18 Weyerhaeuser Company

- 6.4.19 Yildiz Entegre

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment