PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910497

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910497

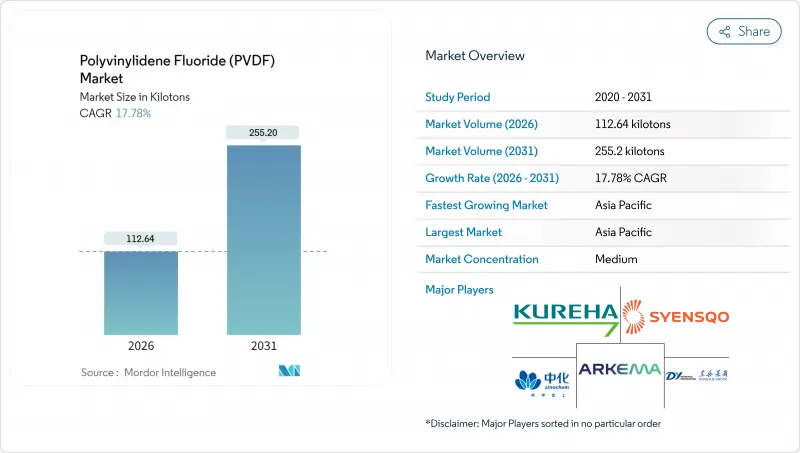

Polyvinylidene Fluoride (PVDF) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Polyvinylidene Fluoride market is expected to grow from 95.64 kilotons in 2025 to 112.64 kilotons in 2026 and is forecast to reach 255.2 kilotons by 2031 at 17.78% CAGR over 2026-2031.

Persistent electrification of transportation, accelerating clean-room construction for sub-10 nm chips, and infrastructure projects that specify longer-lasting architectural finishes all reinforce a multi-year demand runway. Producers that combine backward integration into vinylidene fluoride monomer, localized capacity near cell-manufacturing hubs, and application-engineering support in clean-room systems secure durable competitive advantages. Conversely, price volatility in China's oversupplied spot market highlights the need for disciplined capacity addition and long-term feedstock contracts. Government incentives-most notably the United States' USD 178 million grant that anchors North America's first world-scale plant-signal that strategic policy support will remain pivotal in balancing regional supply maps and ensuring PVDF availability for critical industries.

Global Polyvinylidene Fluoride (PVDF) Market Trends and Insights

EV-battery production surge

Automakers' multibillion-dollar electrification roadmaps create direct pull-through for specialized binders that maintain electrode integrity across thousands of charge cycles. Syensqo's Augusta complex will supply PVDF for more than 5 million EV battery packs annually, a scale made viable by the USD 178 million Department of Energy award that anchors domestic cathode-binder chains. Vertical integration by leading cell makers tightens specification windows, raising per-pack PVDF loading to 15-50 g kWh as confirmed by the German automotive association VDA. As gigafactory clusters proliferate in the United States, Europe, and India, producers with local capacity gain freight-cost advantages and proximity to qualification, reinforcing regional supply security. These dynamics collectively raise baseline consumption and channel margins, making the Polyvinylidene Fluoride market a core beneficiary of the EV pivot.

Demand for chemical-resistant coatings

Architectural specifiers continue to migrate to PVDF coil-coating systems that surpass AAMA 2605 performance thresholds in terms of color retention, gloss stability, and chalk resistance. Building codes in Florida, Texas, and typhoon-prone APAC coastal zones increasingly mandate these premium finishes, extending repaint cycles to 30 years and lowering whole-life facade costs. Industrial segments echo the trend: chemical processors retrofit steel tanks with PVDF topcoats that endure aggressive acids and bases, mitigating corrosion downtime and regulatory penalties. With infrastructure stimulus bills prioritizing resilient public buildings, the coatings value chain expects stable volume growth even in macro-downturn scenarios, reinforcing the Polyvinylidene Fluoride market's defensive attributes.

Raw-material (VF2) price volatility

China's spot PVDF price dropped within six months as rapid capacity expansion outstripped Li-ion binder demand. Because vinylidene fluoride accounts for 65-70% of PVDF cash cost, such swings compress margins and disrupt long-term purchasing agreements. Western converters shield themselves through index-linked formula contracts, but Asian mid-tier extruders remain exposed, prompting speculative stock builds that amplify volatility. Until supply rationalizes, procurement teams will prioritize diversified sourcing and consider tolling arrangements to stabilize feedstock availability in the Polyvinylidene Fluoride market.

Other drivers and restraints analyzed in the detailed report include:

- Semiconductor clean-room expansion

- Oil and gas corrosion-control piping

- PFAS-related regulatory scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Li-ion battery binders held a commanding 33.62% share of the Polyvinylidene Fluoride market size in 2025 and are forecast to grow at a 31.05% CAGR through 2031, reflecting the material's entrenched role in high-energy-density cell chemistries. Leading automakers specify PVDF binders for next-generation nickel-rich cathodes because alternative polymers undermine cycle life and rate capability. Simultaneously, higher loading levels in silicon-enhanced anodes elevate per-cell consumption, multiplying baseline tonnage requirements.

Coatings and paints are expected to contribute steady mid-single-digit growth as infrastructure funding accelerates facade retrofits in the United States and green-building mandates in Europe. Wire and cable insulation gains a share in data-center power networks, where low-smoke, halogen-free standards are displacing PVC jackets. Films, sheets, and membranes address niche segments-ranging from gas-separation modules to specialty packaging for aggressive solvents-where PVDF's barrier properties justify premium pricing. Pipes and fittings serve semiconductor and chemical processes, with unit volumes sensitive to fab expansion cycles, yet they command the highest gross margins in the Polyvinylidene Fluoride market.

The Polyvinylidene Fluoride Market Report is Segmented by Application (Li-Ion Battery Binders, Coatings and Paints, Pipes and Fittings, Films and Sheets, and More), End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 56.12% of global shipments in 2025 and is projected to grow at a 20.10% CAGR through 2031. Although rapid supply buildouts sparked price volatility, proximity to customers and scale economies keep APAC firmly positioned as the hub of low-cost production. Japan reinforces the region's technology edge: Kureha's USD 470 million (JPY 70 billion) expansion at its Iwaki plant will deliver specialty grades tailor-made for high-nickel cathodes while government subsidies safeguard strategic autonomy. India and South Korea are adding incremental demand through nascent gigafactory pipelines and growing consumer electronics assembly, broadening regional depth within the Polyvinylidene Fluoride market.

North America's share advances on the back of re-shoring policies and the Inflation Reduction Act, which requires U.S.-sourced battery materials to unlock full EV tax credits. Syensqo's Augusta facility will be the continent's largest single-line PVDF plant, underpinning local supply for five million batteries each year. Complementing binders, Arkema's 15% capacity hike at Calvert City secures high-purity grades for semiconductor customers building fabs in Arizona and Ohio. Mexico's border manufacturing corridor imports U.S. PVDF for automotive harnesses, while Canada's oil-sands operators specify corrosion-proof piping, adding multi-segment pull.

Europe balances growth with regulatory scrutiny as the bloc's Green Deal phases out PFAS in non-essential packaging but preserves exemptions for battery and aerospace uses. Germany anchors demand through automaker battery JVs and BASF's cathode-active-material projects, whereas France and the Netherlands drive architectural-coating volumes for retrofit programs that target net-zero building envelopes. The region's stringent environmental standards promote the adoption of PVDF solutions with proven life-cycle benefits, yet they also increase compliance costs, creating a bifurcated landscape where best-in-class suppliers thrive amid tightening regulations in the Polyvinylidene Fluoride market.

South America, the Middle East, and Africa remain emerging theatres. Brazil's pre-salt oil fields and Saudi Arabia's downstream chemical complexes require PVDF pipe, albeit in lower total tonnage. African mining ventures are exploring PVDF membrane technology for acid-mine drainage treatment, creating niche growth opportunities that elevate the technology's profile in resource-driven economies.

- Arkema

- Dongyue Group

- Gujarat Fluorochemicals Limited

- Hubei Everflon Polymer Co., Ltd.

- Kureha Corporation

- RTP Company

- Sinochem

- Syensqo

- Zhejiang Juhua Co., Ltd.

- ZheJiang Yonghe Refrigerant Co.,Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-battery Production Surge

- 4.2.2 Demand for Chemical-resistant Coatings

- 4.2.3 Semiconductor Clean-room Expansion

- 4.2.4 Oil and Gas Corrosion-control Piping

- 4.2.5 3-D-printing Aerospace Parts

- 4.3 Market Restraints

- 4.3.1 Raw-material (VF2) Price Volatility

- 4.3.2 PFAS-related Regulatory Scrutiny

- 4.3.3 Limited VF2 Monomer Capacity

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of Substitutes

- 4.6.4 Competitive Rivalry

- 4.6.5 Threat of New Entrants

- 4.7 End-use Sector Trends

- 4.7.1 Aerospace (Aerospace Component Production Revenue)

- 4.7.2 Automotive (Automobile Production)

- 4.7.3 Building and Construction (New Construction Floor Area)

- 4.7.4 Electrical and Electronics (Electrical and Electronics Production Revenue)

- 4.7.5 Packaging (Plastic Packaging Volume)

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Application

- 5.1.1 Li-ion Battery Binders

- 5.1.2 Coatings and Paints

- 5.1.3 Pipes and Fittings

- 5.1.4 Films and Sheets

- 5.1.5 Wire and Cable Insulation

- 5.1.6 Others (Membranes, etc.)

- 5.2 By End-User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Building and Construction

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Machinery

- 5.2.6 Packaging

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Australia

- 5.3.1.6 Malaysia

- 5.3.1.7 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 Italy

- 5.3.3.4 United Kingdom

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Nigeria

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arkema

- 6.4.2 Dongyue Group

- 6.4.3 Gujarat Fluorochemicals Limited

- 6.4.4 Hubei Everflon Polymer Co., Ltd.

- 6.4.5 Kureha Corporation

- 6.4.6 RTP Company

- 6.4.7 Sinochem

- 6.4.8 Syensqo

- 6.4.9 Zhejiang Juhua Co., Ltd.

- 6.4.10 ZheJiang Yonghe Refrigerant Co.,Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs