PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910500

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910500

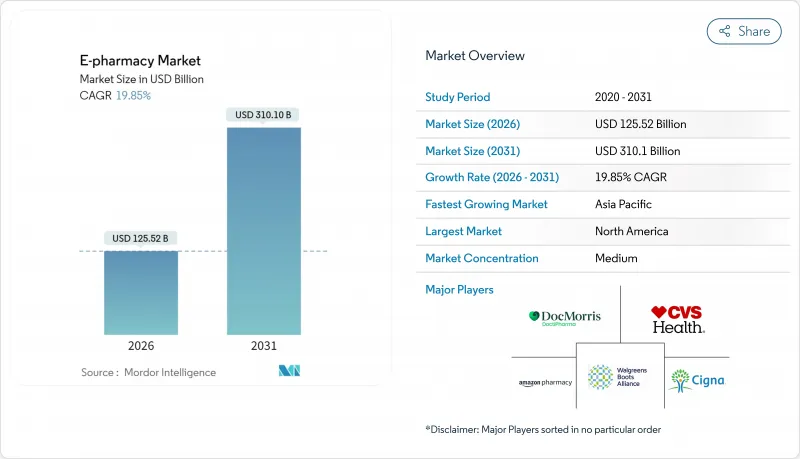

E-pharmacy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The E-pharmacy market was valued at USD 104.73 billion in 2025 and estimated to grow from USD 125.52 billion in 2026 to reach USD 310.1 billion by 2031, at a CAGR of 19.85% during the forecast period (2026-2031).

This expansion is anchored in national e-prescribing mandates, insurer backing for mail-order fills, and capital flows into automated fulfillment hubs. Economies of scale are growing as payors and pharmacy benefit managers route scripts to allied digital dispensers, while robotic picking lines now handle temperature-sensitive biologics, opening new specialty margins. The resulting convenience and transparent pricing are shifting patient loyalty away from brick-and-mortar counters toward online platforms, forcing traditional outlets to accelerate omnichannel investments or face volume erosion. In parallel, aging populations and mobile health apps are converting one-time shoppers into subscription users, creating predictable demand patterns that strengthen supplier negotiations.

Global E-pharmacy Market Trends and Insights

Mandatory Nationwide E-Prescribing Rollouts

Electronic mandates in the United States, the Nordics, and several Asia-Pacific markets are embedding digital pharmacy touchpoints directly into physician workflows. Instant script transmission eliminates handwriting errors and shortens fill times, encouraging older patients to adopt home delivery services. Online pharmacies gain prime visibility at the moment of care, displacing the historical advantage held by storefront counters. Health-system studies show lower primary-non-adherence rates once e-prescribing becomes compulsory, strengthening the growth outlook for the E-pharmacy market.

Mobile Health App Integration

Pharmacy checkouts inside wellness apps now feature biometric log-ins, Buy-Now-Pay-Later plans, and loyalty wallets. These conveniences cut reorder friction and boost repeat purchases among young caregivers juggling household prescriptions. Cross-selling of nutraceuticals during refill sessions lifts basket sizes, validating the commercial merit of deeper app engagement. Early pilots reveal double-digit gains in monthly active users where medication reminders sync with smartwatch alerts.

Cross-Border Regulatory Fragmentation

Dispensers operating in multiple jurisdictions must reconcile divergent license rules, privacy standards, and controlled-substance lists. Compliance overhead raises fixed costs, creating entry barriers that insulate early-moving regionals but delay broader scale. In Europe, some firms maintain parallel fulfillment centers to satisfy data-localization statutes, eroding cost advantages and slowing cross-border rollouts.

Other drivers and restraints analyzed in the detailed report include:

- Aging Populations and Subscription Delivery

- Strategic Alliances Between Payors/PBMs and E-Pharmacies

- Rogue Online Pharmacies and Consumer Trust

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Prescription lines accounted for 71.62% of 2025 revenue, positioning them as the economic backbone of the E-pharmacy market. Chronic-disease patients often juggle multiple therapies, so consolidating refills through one portal simplifies adherence while lifting lifetime value per user. The segment's robust penetration also provides a reliable volume base that sustains automated picking investment. OTC products, though smaller at 28.38%, are forecast to rise at an 17.65% CAGR as self-care culture spreads and same-day courier networks expand. Their faster trajectory diversifies platform revenue streams and reduces dependence on insurer reimbursements.

Consumer comfort with digital clinical flows is easing brand-to-generic switches, supporting payer formulary goals without face-to-face counseling. Meanwhile, wellness brands leverage the same checkout infrastructure to bundle vitamins with chronic-care scripts, a tactic that blends preventive and therapeutic commerce. Subscription-based medications for hypertension or lipid disorders now ship in discreet quarterly parcels, reinforcing stickiness while undergirding the long-run E-pharmacy market size outlook.

Cold-and-flu remedies captured 24.08% of 2025 category revenue, benefiting from high-incidence winters that incentivize doorstep delivery. Vendors augment these orders with thermometer and sanitizer add-ons, quietly expanding average ticket value whenever outbreaks spike. Vitamins and dietary supplements, though presently smaller, are projected to log a 20.95% CAGR to 2031, outstripping most other wellness SKUs. AI-driven quizzes translate blood-panel insights into personalized bundle offers, lifting conversion rates and embedding preventive care into routine pharmacy interactions.

Skin-care, dental, and weight-management items now collectively approach half of all non-prescription turnover, transforming dispensaries into full-scale health-and-beauty hubs. Discreet packaging for dermatology treatments meets privacy expectations that physical aisles struggle to match. As cosmetic labs roll out teledermatology advisories, cross-selling potential rises further, broadening the total accessible E-pharmacy market.

The E-Pharmacy Market Report is Segmented by Drug Type (Prescription Drugs and Over-The-Counter (OTC) Drugs), Product Type (Skin Care, Dental, and More), Therapeutic Area (Diabetes, Cardiovascular, and More), Platform (Mobile Users and Desktop Users), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.88% of global revenue in 2025, cementing its role as the primary laboratory for new service models. In the United States, insurer incentives for 90-day mail order and the retreat of rural drugstores have opened access voids that digital couriers readily bridge. Same-day pilots now reach 45% of the population, resetting expectations for last-mile speed. Canada's single-payer system is testing medication-plus-telehealth bundles that could redefine payer contracting, while Mexico's fintech tie-ins let rising middle-income shoppers split prescription costs over installments, injecting affordability into chronic-care adherence.

Asia-Pacific stands out as the fastest climber, with a 21.74% CAGR projected through 2031. India's smartphone base and the Ayushman Bharat Digital Mission are catalyzing electronic health records that route scripts online. Chinese conglomerates fold pharmacy into super-apps, achieving scale benefits that shrink per-order logistics cost and expand the E-pharmacy market. Japan's regulatory insistence on initial in-person consults slows uptake, but Australia's permissive stance on OTC e-sales accelerates category breadth, displaying the region's regulatory heterogeneity.

Europe ranks third by turnover, yet policy harmonization is unlocking fresh demand. The Cross-Border Electronic Prescription framework lets residents redeem scripts while traveling, smoothing adherence and buoying cross-market traffic. Germany's eRx rollout is funneling prescriptions to online incumbents, whereas France's secure-hosting mandate spurs domestic warehousing investment. In the United Kingdom, post-pandemic digital loyalty remains sticky even as high-street pharmacies reopen, underscoring a durable channel shift. Central and Eastern Europe are rising on improved broadband and balanced oversight, illustrating convergence toward Western models.

South America, the Middle East, and Africa still represent smaller slices, but sustained double-digit growth underscores catch-up potential. Clarifying online dispensing statutes and smartphone affordability programs are pivotal catalysts. Where cold-chain gaps persist, regional innovators partner with courier firms to pilot insulated locker delivery, foreshadowing infrastructure upgrades that will gradually enlarge the global E-pharmacy market.

- CVS Health

- Walgreens Boots Alliance

- Cigna

- Optum

- The Kroger

- Amazon Pharmacy (PillPack)

- Giant Eagle

- Axelia Solutions

- Netmeds

- Apollo Pharmacy

- DocMorris

- Flipkart Health+

- JD Health International

- Alibaba Health Information Tech

- Chemist Warehouse Group

- GoodRx Holdings Inc.

- Capsule Corp.

- Alto Pharmacy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Nationwide E-Prescribing Rollouts

- 4.2.2 Mobile Health App Integration

- 4.2.3 Aging Populations and Subscription Delivery

- 4.2.4 Strategic Alliances Between Payors/PBMs and E-Pharmacies

- 4.2.5 Heavy Investment in Automated, Cold-Chain-Enabled Fulfillment and Same-Day Logistics

- 4.3 Market Restraints

- 4.3.1 Cross-Border Regulatory Fragmentation

- 4.3.2 Rogue Online Pharmacies and Consumer Trust

- 4.3.3 Ongoing Advertising and Promotion Restrictions for Prescription and Controlled Drugs

- 4.3.4 High Last-Mile Delivery Costs and Limited Digital Infrastructure in Rural/Low-Income Regions

- 4.4 Regulatory & Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Type

- 5.1.1 Prescription Drugs

- 5.1.2 Over-the-Counter (OTC) Drugs

- 5.2 By Product Type

- 5.2.1 Skin Care

- 5.2.2 Dental

- 5.2.3 Cold & Flu

- 5.2.4 Vitamins & Dietary Supplements

- 5.2.5 Weight Management

- 5.2.6 Other Product Type

- 5.3 By Therapeutic Area

- 5.3.1 Diabetes

- 5.3.2 Cardiovascular

- 5.3.3 Respiratory

- 5.3.4 Gastrointestinal

- 5.3.5 Other Therapeutic Area

- 5.4 By Platform

- 5.4.1 Mobile Users

- 5.4.2 Desktop Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 CVS Health Corporation

- 6.3.2 Walgreens Boots Alliance

- 6.3.3 Cigna Corporation (Express Scripts Holdings)

- 6.3.4 Optum Rx Inc.

- 6.3.5 The Kroger Co.

- 6.3.6 Amazon Pharmacy (PillPack)

- 6.3.7 Giant Eagle Inc.

- 6.3.8 Axelia Solutions (Pharmeasy)

- 6.3.9 Netmeds.com

- 6.3.10 Apollo Pharmacy

- 6.3.11 DocMorris (Zur Rose Group AG)

- 6.3.12 Flipkart Health+

- 6.3.13 JD Health International

- 6.3.14 Alibaba Health Information Tech

- 6.3.15 Chemist Warehouse Group

- 6.3.16 GoodRx Holdings Inc.

- 6.3.17 Capsule Corp.

- 6.3.18 Alto Pharmacy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment