PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910507

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910507

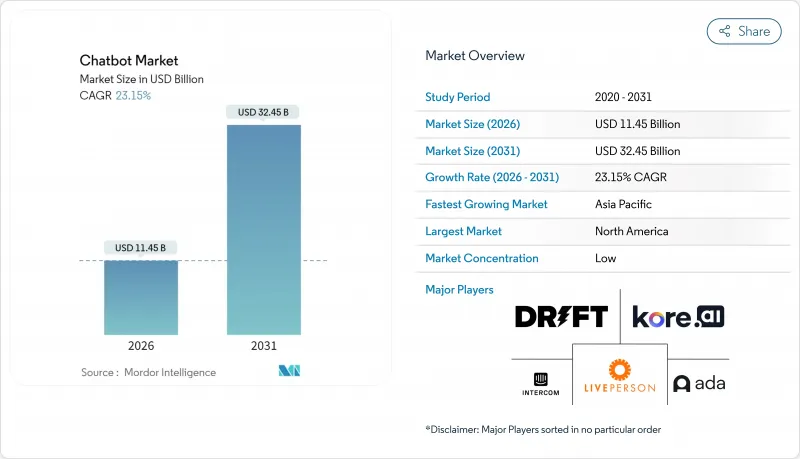

Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Chatbot market is expected to grow from USD 9.30 billion in 2025 to USD 11.45 billion in 2026 and is forecast to reach USD 32.45 billion by 2031 at 23.15% CAGR over 2026-2031.

This sustained expansion is propelled by ubiquitous messaging-app reach, rapid advances in large-language-model performance, and mounting cost pressures on traditional contact-center operations. Customer experience leaders now prioritize autonomous, always-on channels that lower service costs while sustaining human-like interactions across voice, text, and multimodal interfaces. Platform vendors respond by embedding retrieval-augmented generation, multilingual models, and fine-tuned domain agents that reduce development cycles and democratize deployment. As enterprises seek measurable ROI, vendors emphasize outcome-linked pricing, proactive compliance tooling, and verticalized knowledge packs that accelerate time-to-value in regulated industries. Competitive intensity is rising as global hyperscalers, independent specialists, and CX outsourcers consolidate capabilities through acquisitions, partnerships, and strategic capital infusions.

Global Chatbot Market Trends and Insights

Explosion of Messaging-App User Base

WhatsApp now serves 3 billion users and supports 175 million daily business conversations, giving the Chatbot market an immense, ready-made distribution channel. Businesses have opened 764 million WhatsApp Business accounts that achieve 98% open rates versus 20% for email, dramatically lowering acquisition costs. The broader messaging ecosystem engages more than 200 million businesses worldwide, creating strong network effects that improve bot ROI across retail, banking, and healthcare. Firms leverage rich-media templates that shift interactions from marketing prompts to full-funnel transactions without requiring app downloads. As user familiarity rises, message-based journeys become the default interface for service queries, order tracking, and in-channel payments.

Breakthroughs in Large-Language-Model NLP

The launch of GPT-4.5 and expected GPT-5 models enabled chatbots to manage complex multi-turn dialogues with near-human fluency. Enterprises such as Morgan Stanley showcased GPT-4 for internal knowledge retrieval, reducing advisor search time and boosting compliance confidence. Vendors embed retrieval-augmented generation so bots pull real-time data yet maintain conversation flow, addressing historical knowledge-cutoff limits. Yellow.ai orchestrates multi-LLM pipelines over 16 billion annual conversations, selecting specialized models per query to optimize cost and accuracy. These innovations cut training-data demands and open advanced conversational AI to SMEs lacking large labeled datasets.

Integration Complexity and Legacy Data Silos

Enterprises with decades-old systems face month-long timeline overruns when wiring chatbots into mainframes, CRMs, and ERPs. Forty-seven percent of firms build generative AI in-house to control data pipelines, reflecting integration anxiety. Middleware orchestration, real-time synchronization, and stringent security vetting inflate project budgets and delay full rollout, especially in banking and telecom, where data fragmentation is acute. As a result, greenfield digital-native firms gain time-to-market advantage, pressing incumbents to invest in API modernization.

Other drivers and restraints analyzed in the detailed report include:

- 24/7 Customer-Support Cost Pressure

- Self-Service Mandates in Digital CX Strategies

- Privacy/Regulatory Compliance Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform and software offerings retained a 64.12% share of the Chatbot market in 2025, underscoring their role as foundational infrastructure. Services, however, outpace overall growth at a 24.12% CAGR through 2031. Enterprises increasingly seek advisory, integration, and optimization expertise as conversational AI complexity rises. Yellow.ai packages full-lifecycle support covering strategy, custom model tuning, and ongoing governance, driving services demand. For clients, expert partners mitigate integration pain points and ensure compliance, turning vendor know-how into tangible business outcomes that justify premium fees.

Implementation consulting is often bundled with managed-service SLAs that guarantee uptime, retraining, and quarterly performance reviews. This shift nudges revenue mix toward recurring service contracts, smoothing vendor cash flows. As AI tooling matures, differentiation hinges less on base technology and more on outcome-driven engagement, favoring providers with deep vertical playbooks and robust partner ecosystems. The Chatbot market expects continued platform consolidation alongside a flourishing services layer that captures expanding wallet share.

Customer support commanded 41.82% of the Chatbot market share in 2025, reflecting high ticket volumes and proven ROI. HR and recruiting use cases, however, register the quickest rise with a 24.86% CAGR through 2031. Bots prescreen candidates, schedule interviews, and answer policy questions, freeing HR teams for high-touch activities. Enterprises report 90% automation of repetitive inquiries and accelerated time-to-hire, translating into measurable productivity gains.

Sales and marketing bots nurture leads via personalized drip conversations, while IT service-desk agents reset passwords and diagnose hardware issues. Emerging internal knowledge assistants aggregate structured and unstructured content, cutting search cycles. This functional diversification underscores conversational AI's versatility and cements its status as a core automation pillar rather than a niche support add-on.

The Chatbot Market Report is Segmented by Component (Platform/Software and Services), Application (Customer Support, Sales and Marketing, and More), Deployment Mode (Cloud and On-Premise), Organization Size (Small and Medium Enterprises and Large Enterprises), End-User Industry (Retail and ECommerce, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.72% to the Chatbot market size in 2025, anchored by early LLM adoption and high labor costs that sharpen automation payback. U.S. financial institutions and retailers implement advanced voice-plus-vision agents, and Canadian enterprises tap GPT-4 for internal knowledge retrieval. Mature digital infrastructure and vibrant venture funding support continuous experimentation that spills over into Latin America through nearshore service hubs.

Asia-Pacific posts the fastest 24.71% CAGR through 2031 as governments back AI investments and mobile commerce proliferates. China poured USD 2.1 billion into AI projects, India's chatbot segment grows 25% annually, and Singapore positions itself as an AI governance testbed. High smartphone penetration and super-app ecosystems generate massive conversational traffic, accelerating adoption in banking, travel, and public services. Local vendors tailor multilingual bots to regional dialects, fostering inclusive digital access.

Europe advances under the shadow of the EU AI Act, balancing innovation with rigorous compliance. Germany, France, and the U.K. integrate chatbots into manufacturing, healthcare, and public administration, with annual compliance budgets absorbed into total cost of ownership calculations. Standardized governance frameworks enhance cross-border collaborations and set de-facto global norms. Emerging regions, South America, the Middle East, and Africa benefit from falling cloud costs and expanding broadband, unlocking greenfield deployments across telecom, energy, and transport.

- LivePerson, Inc.

- Kore.ai, Inc.

- Ada Support Inc.

- Intercom, Inc.

- Drift.com, Inc.

- Yellow.ai Pvt. Ltd.

- Cognigy GmbH

- Freshworks Inc.

- Gupshup Technology India Pvt. Ltd.

- Boost.ai AS

- Rasa Technologies GmbH

- SnatchBot SA

- Tidio Poland Sp. z o.o.

- Chatfuel, Inc.

- Aivo Technologies, Inc.

- Inbenta Holdings, Inc.

- Senseforth.ai Labs Pvt. Ltd.

- BotsCrew, Inc.

- Quiq, Inc.

- LiveChat Software S.A.

- Zendesk, Inc.

- Artificial Solutions International AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of messaging-app user base

- 4.2.2 Breakthroughs in large-language-model (LLM) NLP

- 4.2.3 24/7 customer-support cost pressure

- 4.2.4 Self-service mandates in digital CX strategies

- 4.2.5 Voice-first and multimodal bot convergence

- 4.2.6 LLM-powered internal knowledge automation

- 4.3 Market Restraints

- 4.3.1 Integration complexity and legacy data silos

- 4.3.2 Privacy/regulatory compliance concerns

- 4.3.3 Hallucination-driven brand-risk

- 4.3.4 Scarcity of vertical-grade training datasets

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Platform/Software

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Customer Support

- 5.2.2 Sales and Marketing

- 5.2.3 HR and Recruiting

- 5.2.4 IT Service Management

- 5.2.5 Others

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises (SMEs)

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Retail and eCommerce

- 5.5.2 BFSI

- 5.5.3 Healthcare

- 5.5.4 Travel and Hospitality

- 5.5.5 Telecom and IT

- 5.5.6 Government and Public Sector

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 LivePerson, Inc.

- 6.4.2 Kore.ai, Inc.

- 6.4.3 Ada Support Inc.

- 6.4.4 Intercom, Inc.

- 6.4.5 Drift.com, Inc.

- 6.4.6 Yellow.ai Pvt. Ltd.

- 6.4.7 Cognigy GmbH

- 6.4.8 Freshworks Inc.

- 6.4.9 Gupshup Technology India Pvt. Ltd.

- 6.4.10 Boost.ai AS

- 6.4.11 Rasa Technologies GmbH

- 6.4.12 SnatchBot SA

- 6.4.13 Tidio Poland Sp. z o.o.

- 6.4.14 Chatfuel, Inc.

- 6.4.15 Aivo Technologies, Inc.

- 6.4.16 Inbenta Holdings, Inc.

- 6.4.17 Senseforth.ai Labs Pvt. Ltd.

- 6.4.18 BotsCrew, Inc.

- 6.4.19 Quiq, Inc.

- 6.4.20 LiveChat Software S.A.

- 6.4.21 Zendesk, Inc.

- 6.4.22 Artificial Solutions International AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment