PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910508

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910508

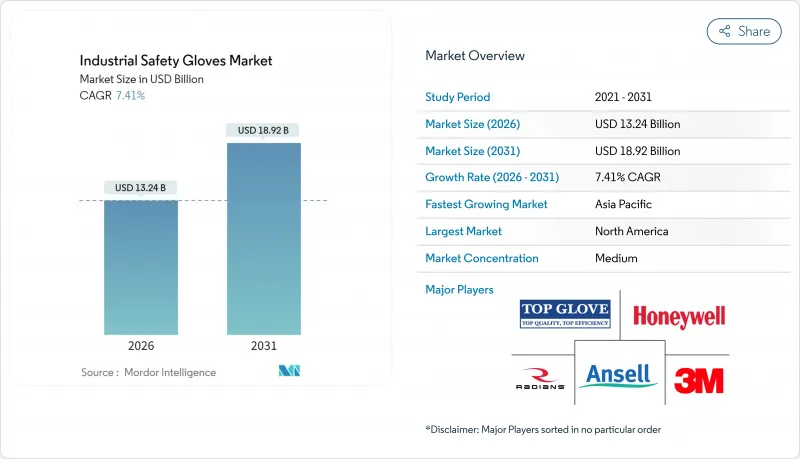

Industrial Safety Gloves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Industrial safety gloves market size in 2026 is estimated at USD 13.24 billion, growing from 2025 value of USD 12.33 billion with 2031 projections showing USD 18.92 billion, growing at 7.41% CAGR over 2026-2031.

The industrial safety gloves market continues to grow because regulatory bodies raise protection thresholds, end-use industries automate production lines, and material science delivers lighter yet stronger fibers. North America maintains leadership through strict OSHA oversight and a mature manufacturing base, while Asia-Pacific's rapid industrialization and harmonizing standards accelerate its adoption curve. Segment momentum signals a pivot toward cut-, heat- and chemical-resistant variants that combine dexterity with multi-hazard protection. Companies that align Research and Development with emerging risks secure long-term contracts, insulating sales from economic cycles and reinforcing the industrial safety gloves market as an essential spend rather than a discretionary purchase.

Global Industrial Safety Gloves Market Trends and Insights

Stringent occupational health and safety regulations globally

Regulatory enforcement has intensified significantly in recent years, with authorities adopting stricter measures to ensure workplace safety and compliance. In 2024, OSHA (Occupational Safety and Health Administration) has ramped up its efforts, conducting over 370,000 workplace inspections. This represents a significant 12% increase compared to previous years . The agency has shifted its focus from traditional enforcement methods to predictive compliance frameworks. Companies are now required to actively identify and mitigate hazards before incidents occur, rather than responding reactively. The adoption of AI-powered violation detection systems has further empowered regulators to analyze and identify patterns of non-compliance across various industry sectors. This technological advancement is driving companies to reassess their approach to safety equipment investments, as the risk-reward balance has fundamentally changed. Similarly, European markets are following this trend by updating the EN 388:2016+A1:2018 standards. These updates now mandate more rigorous cut-resistance testing methodologies, which many existing glove products fail to meet. This regulatory alignment across regions is establishing a global benchmark for protection standards. As a result, low-quality alternatives are being effectively removed from the supply chains of developed markets, ensuring higher safety and compliance levels.

Increasing awareness regarding workplace safety and worker protection

Increasing awareness regarding workplace safety and worker protection is a significant driver of the Industrial Safety Gloves Market. As employers and employees become more conscious of the risks associated with industrial work environments, the demand for reliable protective gloves grows. This heightened awareness stems from stringent safety regulations and compliance requirements enforced by organizations such as OSHA, which mandate the use of personal protective equipment (PPE) to minimize workplace injuries. Companies are increasingly investing in advanced safety gloves to ensure worker health, reduce accident-related downtime, and avoid legal liabilities. Additionally, training programs and safety campaigns have educated the workforce on the importance of protective gloves, further boosting market uptake. Growing emphasis on creating safer work environments across industries like manufacturing, construction, and oil and gas significantly propels the adoption of industrial safety gloves, driving market growth worldwide.

Volatility and rising cost of raw materials such as latex, nitrile, and other polymers

Volatility and rising costs of raw materials such as latex, nitrile, and other polymers present a significant restraint to the Industrial Safety Gloves Market. Raw material prices are highly sensitive to fluctuations due to factors like supply chain disruptions, geopolitical tensions, and varying crude oil prices, which directly impact the production costs of gloves. Since many materials like synthetic rubber (nitrile) and latex are petroleum-derived, any increase in oil prices leads to higher costs for manufacturers. Additionally, tariffs and trade policies, such as increased import duties on glove raw materials and finished products, exacerbate price instability and production expenses. These cost pressures can erode profit margins and force manufacturers to increase glove prices, potentially limiting demand. To manage these challenges, companies are exploring alternative materials, diversifying supplier bases, and improving supply chain resilience to mitigate the effects of raw material price volatility. This restraint requires strategic planning by market participants to maintain competitive pricing while ensuring product quality and safety compliance.

Other drivers and restraints analyzed in the detailed report include:

- Growth of end-use industries like automotive, construction, mining, chemicals, and oil and gas

- Escalating injury rates and accidents in industrial environments

- Intense competition from low-cost, low-quality glove producers/markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The industrial safety gloves market in 2025 is predominantly led by latex gloves, holding the largest market share of approximately 34.18%. This dominant position is attributed to latex's well-established presence and its excellent elasticity, comfort, and fit, which make it a popular choice across various industries. Latex gloves offer reliable protection against biological hazards, chemicals, and abrasions, making them especially favored in healthcare, food processing, and automotive sectors. Their versatility and widespread availability add to latex's market strength. Despite challenges from synthetic alternatives, latex gloves have sustained strong demand due to their cost-effectiveness and trusted performance. The extensive application base and long-term industry acceptance solidify latex as the leading material segment in the industrial safety gloves market.

In contrast, the High-Performance Polyethylene (HPPE) segment is recognized as the fastest growing, boasting a robust CAGR of 8.55% through 2031. This accelerated growth reflects the manufacturing sector's shift toward automated processes, which introduce new and complex cut hazards necessitating superior hand protection. HPPE gloves are engineered to deliver advanced cut resistance, making them highly suitable for industries such as automotive, construction, and metal fabrication. As workplace safety standards evolve and the need for specialized protective gear intensifies, HPPE gloves benefit from rising adoption. The fiber technology behind HPPE contributes not only enhanced protection but also light weight and comfort, addressing worker ergonomics. The segment's growth is underscored by increasing demand for innovative safety solutions amid industrial automation trends globally.

The reusable gloves segment commands a significant 76.55% market share in 2025, underscoring its dominance across various industrial applications. This substantial share reflects the economic advantages offered by reusable gloves, as their durability and ability to withstand repeated use make them highly cost-effective over time despite higher initial purchase prices. Industries such as manufacturing, construction, and automotive rely heavily on reusable gloves due to their robust protection against mechanical hazards, chemicals, and abrasion. The longevity and resilience of these gloves reduce the frequency and expense of replacements, making them a preferred choice for tasks involving prolonged glove use. Additionally, advancements in materials and ergonomic designs have enhanced user comfort and safety, further propelling the demand for reusable gloves. The segment's market leadership is also supported by rising workplace safety regulations mandating the use of high-quality protective gear.

Conversely, disposable gloves are the fastest-growing segment, expanding at a compound annual growth rate (CAGR) of 7.05%. This rapid growth is primarily driven by their prevalent use in the healthcare sector and laboratories where contamination control and hygiene are paramount. Disposable gloves ensure a single-use safety protocol that minimizes cross-contamination risks, which is critical in medical, pharmaceutical, and food handling environments. The heightened focus on sanitary conditions, especially post-pandemic, has intensified the demand for disposable options despite the higher recurring cost compared to reusable gloves. Moreover, increasing healthcare infrastructure development and stringent regulatory frameworks globally are fueling this segment's expansion. Innovations such as powder-free and allergen-free gloves also contribute to their growing preference, making disposable gloves indispensable in maintaining hygiene and safety standards across high-risk sectors.

The Industrial Safety Gloves Market Report is Segmented by Material Type (Latex, Nitrile, Vinyl, and More), Product Type (Disposable Gloves, Reusable Gloves), Functionality (Cut-Resistant, Chemical-Resistant, and More), End-User (Automotive, Food Industry, Pharmaceutical, and More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a commanding 32.36% market share, bolstered by stringent regulatory enforcement via OSHA and a deeply ingrained industrial safety culture that prioritizes worker protection over mere cost considerations. This market leadership is a testament to decades of evolution in workplace safety, with companies now embedding comprehensive hand protection programs into their core operational excellence initiatives, rather than viewing them as mere compliance checkboxes. Recent updates, such as the ANSI/ISEA 105-2024 standard revisions, have refined cut-resistance testing methodologies, prompting product enhancements in both the manufacturing and construction sectors. Additionally, Canada's resource extraction industries are driving regional demand, especially for cold-weather gloves that not only ensure dexterity in frigid temperatures but also offer mechanical protection against hazards in mining and forestry.

Asia-Pacific is set to be the fastest-growing region, with an anticipated CAGR of 8.65% through 2031. This growth is fueled by swift industrialization and a growing adoption of safety standards in emerging economies. In China, as the manufacturing sector expands, each new facility spurs demand for specialized protective equipment across various hazard categories. Furthermore, China's alignment with international regulatory standards is purging low-quality alternatives from its supply chains. Meanwhile, Japan and South Korea are at the forefront of regional innovation, pioneering advanced material development and integrating automation, both of which necessitate sophisticated hand protection solutions. Southeast Asian nations, buoyed by foreign direct investment, are not only importing international safety standards but also advanced manufacturing technologies. This influx is generating a pressing demand for premium protective equipment that aligns with global OEM standards.

Europe experiences steady growth, driven by regulatory compliance frameworks that prioritize continuous improvement over mere adherence to minimum standards. Recent updates to the region's EN 388:2016+A1:2018 standard necessitate enhanced testing methodologies, a challenge many existing products face. This gap presents lucrative opportunities for suppliers who can offer superior protection performance. Germany's robust automotive and chemical sectors are fueling demand for specialized gloves that boast a combination of protective features. In contrast, Nordic nations are placing a premium on sustainability, favoring reusable products with longer service lives. While Brexit continues to cast shadows on supply chain logistics, a strategic regulatory alignment with EU standards ensures product compatibility across European markets, granting major suppliers significant economies of scale.

- 3M Company

- Ansell Limited

- Top Glove Corporation Berhad

- Radians, Inc.

- Honeywell International Inc.

- Hartalega Holdings Berhad

- The Glove Company

- MCR Safety

- Unigloves (UK) Limited

- Superior Glove Works Ltd.

- Globus Group

- Atlantic Safety Products

- Supermax Corporation Berhad

- Ammex Corporation

- ATG Intelligent Glove Solutions

- Protective Industrial Products, Inc.

- Adenna LLC

- Kossan Rubber Industries Bhd

- Bunzl Plc

- Semperit AG Holding

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent occupational health and safety regulations globally

- 4.2.2 Increasing awareness regarding workplace safety and worker protection

- 4.2.3 Growth of end-use industries like automotive, construction, mining, chemicals, and oil and gas

- 4.2.4 Escalating injury rates and accidents in industrial environments

- 4.2.5 Technological innovations in glove materials (e.g., high-performance fibers, nanotechnology)

- 4.2.6 Rising demand for disposable gloves, especially from healthcare and pharmaceutical sectors

- 4.3 Market Restraints

- 4.3.1 Volatility and rising cost of raw materials such as latex, nitrile, and other polymers

- 4.3.2 Intense competition from low-cost, low-quality glove producers/markets

- 4.3.3 Product commoditization and price pressures limiting profitability

- 4.3.4 Limited adoption and awareness of PPE in several emerging economies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE )

- 5.1 By Material Type

- 5.1.1 Latex

- 5.1.2 Nitrile

- 5.1.3 High-Performance Polyethylene (HPPE)

- 5.1.4 Vinyl

- 5.1.5 Neoprene

- 5.1.6 Others

- 5.2 By Product Type

- 5.2.1 Disposable Gloves

- 5.2.2 Reusable Gloves

- 5.3 By Functionality

- 5.3.1 Cut-resitant Gloves

- 5.3.2 Chemical-resistant Gloves

- 5.3.3 Heat/Flame-resistant Gloves

- 5.3.4 Others

- 5.4 By End-User

- 5.4.1 Automotive

- 5.4.2 Construction

- 5.4.3 Food Industry

- 5.4.4 Pharmaceutical

- 5.4.5 Mining

- 5.4.6 Oil and Gas

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Netherlands

- 5.5.2.7 Russia

- 5.5.2.8 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 Australia

- 5.5.3.4 South Korea

- 5.5.3.5 Indonesia

- 5.5.3.6 Vietnam

- 5.5.3.7 Malaysia

- 5.5.3.8 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 3M Company

- 6.4.2 Ansell Limited

- 6.4.3 Top Glove Corporation Berhad

- 6.4.4 Radians, Inc.

- 6.4.5 Honeywell International Inc.

- 6.4.6 Hartalega Holdings Berhad

- 6.4.7 The Glove Company

- 6.4.8 MCR Safety

- 6.4.9 Unigloves (UK) Limited

- 6.4.10 Superior Glove Works Ltd.

- 6.4.11 Globus Group

- 6.4.12 Atlantic Safety Products

- 6.4.13 Supermax Corporation Berhad

- 6.4.14 Ammex Corporation

- 6.4.15 ATG Intelligent Glove Solutions

- 6.4.16 Protective Industrial Products, Inc.

- 6.4.17 Adenna LLC

- 6.4.18 Kossan Rubber Industries Bhd

- 6.4.19 Bunzl Plc

- 6.4.20 Semperit AG Holding

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK