PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910509

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910509

Salad Dressing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

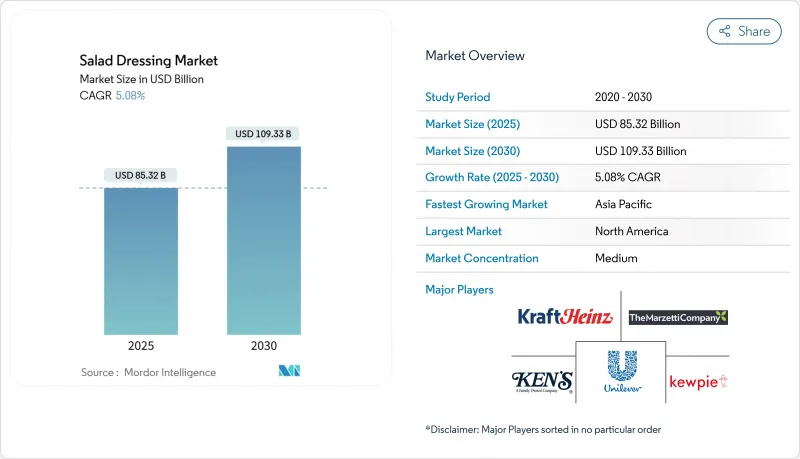

The salad dressing market was valued at USD 85.3 billion in 2025 and estimated to grow from USD 89.58 billion in 2026 to reach USD 114.27 billion by 2031, at a CAGR of 4.99% during the forecast period (2026-2031).

This growth is driven by consistent household demand, a rebound in the food service sector, and an increasing inclination towards premium, organic, and plant-based recipes. In 2024, sales of organic groceries in Germany saw a 5.7% uptick from the previous year, as reported by Bund Okologische Lebensmittelwirtschaft (BOLW). Factors such as broader flavor experimentation, swift upgrades in cold-chain logistics, and the convenience of squeeze or pouch packs are driving high shelf turnover. Meanwhile, sustainability initiatives are enhancing brand loyalty. Manufacturers are channeling investments into formulation technologies that extend shelf life without the need for artificial preservatives, thereby broadening their export potential. The competitive landscape is heating up, with regional specialists, artisanal start-ups, and global giants vying for prime spots on retail end-caps and restaurant menus.

Global Salad Dressing Market Trends and Insights

Increasing Popularity of Gourmet and Artisanal Salad Dressings

Artisanal brands are setting new benchmarks for pricing, reshaping consumer expectations in the process. McCormick's selection of Aji Amarillo as its 2025 Flavor of the Year underscores a broader industry shift towards globally-inspired, sophisticated taste profiles, helping products stand out in saturated retail spaces. Kroger's trend analysis reveals a notable expansion of Caesar dressing, now gracing not just salads but also pizzas and pastas, highlighting the versatility of premium formulations. In 2024, small-scale producer Dress It Up Dressing, a Certified B-Corp, showcases the power of authenticity narratives, raking in an impressive USD 4 million annual revenue. Their success underscores the willingness of health-conscious consumers to pay a premium for perceived quality and ethical sourcing. Urban markets, with their higher disposable incomes and adventurous palates, are witnessing a pronounced surge in this premiumization trend. As the artisanal segment continues its upward trajectory, traditional manufacturers face a pivotal challenge: balancing the efficiencies of mass production with the allure of craft positioning to stay competitively relevant.

Expansion of Organic and Plant-Based Salad Dressing Options

In 2024, organic food sales surged by 5.2%, hitting the USD 65.4 billion mark. The Organic Trade Association forecasts a steady 5.1% compound annual growth rate through 2028, a trend that's directly benefiting organic dressing formulations. Highlighting this industry shift, Kewpie Corporation's GREEN KEWPIE plant-based dressing line has made waves with its innovative approach: a 20% reduction in plastic usage through packaging redesigns, all while boosting the volume from 180ml to 200ml. This move underscores the harmonious blend of sustainability and functionality in modern product development. The plant-based trend is no longer confined to traditional vegetarian circles. Flexitarian consumers are now at the forefront, championing the mainstream acceptance of dairy-free and egg-free products. Certifications like the Plant-Based Lifestyle Lab offer third-party validation, bolstering consumer trust in plant-based claims. Thanks to advancements in emulsification technology, plant-based dressings are now achieving textures once thought exclusive to egg-based counterparts, dismantling a significant barrier to broader acceptance. This segment's robust growth is a testament to a wider societal shift, with an increasing emphasis on environmental sustainability and health, cutting across all demographic lines.

Stringent Food Safety and Labeling Regulations

FDA regulations under 21 CFR 169.150 set strict compositional standards for salad dressings, mandating at least 30% vegetable oil and 4% liquid egg yolk equivalents. These requirements limit formulation flexibility for manufacturers aiming to optimize costs. The 2022 FDA Food Code, recognizing sesame as the ninth major allergen, necessitates thorough labeling updates and possible reformulations for products with sesame-derived ingredients. This compliance challenge, with its associated costs, tends to weigh more heavily on smaller manufacturers. Current Good Manufacturing Practice standards, as outlined in 21 CFR Part 117, require a hazard analysis and risk-based preventive controls. Meeting these standards demands significant investments in quality assurance infrastructure and documentation systems. pH standardization mandates for shelf-stable dressings, set between 2.3 and 4.0, restrict ingredient choices and necessitate specialized acidification processes, complicating production. Such regulatory challenges not only deter new entrants into the market but also provide a competitive edge to established players, who benefit from their existing compliance infrastructure and regulatory know-how.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Transparency and Clean-Label Products

- Innovations in Sustainable and Convenient Packaging Solutions

- Rising Raw Material Costs and Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, ranch dressing commands a dominant 21.05% market share, underscoring its deep-rooted appeal among American consumers and its widespread adoption in quick-service and casual dining restaurants. Poppyseed dressing, on the other hand, is the fastest-growing segment, boasting a 6.08% CAGR through 2031. This surge is fueled by consumers' growing appetite for unique flavor profiles and premium branding strategies. In April 2025, Hidden Valley Ranch unveiled seven new flavors, such as Cajun Blackened Ranch and Sweet BBQ Ranch. This move underscores how industry leaders harness brand equity to venture into new taste territories while staying true to their core identity. While Italian dressing rides the wave of Mediterranean diet trends and serves dual roles as a salad dressing and marinade, French dressing finds itself overshadowed by the emergence of more refined flavor profiles.

Balsamic dressing enjoys consistent growth, buoyed by health-conscious consumers and its adoption in upscale restaurants. However, challenges in Italian grape production pose supply constraints, leading to cost pressures that could hinder accessibility. The "Other Product Types" category showcases innovations like miso-tahini blends and globally-inspired formulations, highlighting a trend of increasing consumer adventurousness. Dole's September 2025 launch of Apple Harvest salad kits, featuring a distinctive apple cider vinaigrette, exemplifies how product bundling can familiarize consumers with new dressing varieties while boosting sales. This evolving segmentation hints at a blurring of traditional categories, as manufacturers chase differentiation through innovative flavors and cross-cultural fusions.

In 2025, the conventional segment commands a dominant 75.55% market share, bolstered by well-established supply chains, cost efficiencies, and extensive distribution networks that cater to a wide array of consumers. Yet, organic alternatives are on the rise, boasting a robust 6.78% CAGR through 2031. This surge not only eclipses the growth of conventional options but also underscores a pivotal shift in consumer values, leaning more towards health, sustainability, and transparency. Supporting this trend, the Organic Trade Association forecasts a 5.1% annual growth for organic foods until 2028, with salad dressings riding the wave of this organic food resurgence.

While the USDA National Organic Program's certification standards pose entry challenges, they simultaneously fortify established organic producers, allowing them to spread certification costs over larger volumes. Thanks to premium pricing, the organic segment enjoys margins that help counterbalance the heightened costs of ingredients and certifications, making it a lucrative avenue for profit-seeking manufacturers. In response, traditional manufacturers are adopting hybrid strategies, rolling out organic product lines alongside their conventional offerings to appeal to a broader consumer base. These evolving dynamics hint at a steady, albeit gradual, shift in market share towards organic alternatives, propelled by changing generational preferences and a growing availability of organic ingredients, which is steadily diminishing cost premiums.

The Global Salad Dressing Market is Segmented by Product Type (Balsamic Dressing, Ranch Dressing, Italian Dressing, Poppyseed Dressing, French Dressing, and More), by Category (Conventional and Organic), by Form (Dry and Ready-To-Eat), by Distribution Channel (Foodservice and Retail), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commanded a dominant 43.25% share of global sales, driven by a deep-rooted salad culture, an expansive restaurant network, and a penchant for premium brands. The May 2024 debut of Kraft Heinz's Pure J.L. KRAFT in Canada, featuring unique offerings like Pomegranate Zaatar, underscores the region's appetite for globally-inspired flavors. With clearer regulations and enhanced cold-chain logistics, North America stands as a robust platform for both innovation and production geared towards exports.

Asia Pacific is poised for a 6.85% CAGR growth trajectory leading up to 2031. This growth is fueled by urban consumers gravitating towards Western food formats, while domestic players introduce flavors tailored to local palates. A testament to this trend is Kewpie's 2023 foray into lighter plant-based offerings, showcasing how regional firms are aligning global health trends with local cultural nuances. As e-commerce gains traction and refrigerated logistics improve, access to salad dressings expands beyond major cities, bolstering the market in emerging economies.

Europe, despite its maturity, wields significant influence, particularly through its stringent sustainability mandates that set global packaging standards. The bloc's newly introduced anti-deforestation law is set to tighten provenance documentation on palm-based emulsifiers. While this could elevate costs, it may also catalyze a shift towards reformulating with domestically sourced oils. Meanwhile, South America, the Middle East, and Africa, though smaller players, are witnessing a surge as retail modernization aligns with evolving dietary preferences. Here, strategies like price-tiered SKUs and smaller pack sizes are pivotal in tapping into this burgeoning demand.

- Unilever PLC

- The Kraft Heinz Company

- Ken's Foods Inc.

- T. Marzetti Company

- Kewpie Corporation

- Mizkan Holdings Co. Ltd.

- Ventura Foods LLC

- Conagra Brands Inc.

- Dr. Oetker KG

- Remia International

- Veeba Food Services Pvt Ltd

- Campbell Soup Company

- Hormel Foods Corporation

- Hidden Valley (Clorox)

- McCormick & Company Inc.

- Ajinomoto Co. Inc.

- Nestle S.A.

- Kikkoman Corp.

- Kenko Mayonnaise Co.

- Pinnacle Foods LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Popularity of Gourmet and Artisanal Salad Dressings

- 4.2.2 Expansion of Organic and Plant-Based Salad Dressing Options

- 4.2.3 Rising Demand for Transparency and Clean-Label Products

- 4.2.4 Innovations in Sustainable and Convenient Packaging Solutions

- 4.2.5 Technological Advancements in Product Development and Distribution

- 4.2.6 Growing Consumer Interest in Global and Regional Flavor Profiles

- 4.3 Market Restraints

- 4.3.1 Stringent Food Safety and Labeling Regulations

- 4.3.2 Rising Raw Material Costs and Price Volatility

- 4.3.3 Increasing Competition and Market Saturation

- 4.3.4 High Costs of Sustainable and Innovative Packaging

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Balsamic Dressing

- 5.1.2 Ranch Dressing

- 5.1.3 Italian Dressing

- 5.1.4 Poppyseed Dressing

- 5.1.5 French Dressing

- 5.1.6 Other Product Types

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Form

- 5.3.1 Dry

- 5.3.2 Ready-to-Eat

- 5.4 By Distribution Channel

- 5.4.1 Foodservice

- 5.4.2 Retail

- 5.4.2.1 Hypermarkets / Supermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Specialty Retailers

- 5.4.2.4 Online Retail

- 5.4.2.5 Other Off-Trade Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Unilever PLC

- 6.4.2 The Kraft Heinz Company

- 6.4.3 Ken's Foods Inc.

- 6.4.4 T. Marzetti Company

- 6.4.5 Kewpie Corporation

- 6.4.6 Mizkan Holdings Co. Ltd.

- 6.4.7 Ventura Foods LLC

- 6.4.8 Conagra Brands Inc.

- 6.4.9 Dr. Oetker KG

- 6.4.10 Remia International

- 6.4.11 Veeba Food Services Pvt Ltd

- 6.4.12 Campbell Soup Company

- 6.4.13 Hormel Foods Corporation

- 6.4.14 Hidden Valley (Clorox)

- 6.4.15 McCormick & Company Inc.

- 6.4.16 Ajinomoto Co. Inc.

- 6.4.17 Nestle S.A.

- 6.4.18 Kikkoman Corp.

- 6.4.19 Kenko Mayonnaise Co.

- 6.4.20 Pinnacle Foods LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK