PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910510

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910510

Men's Grooming Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

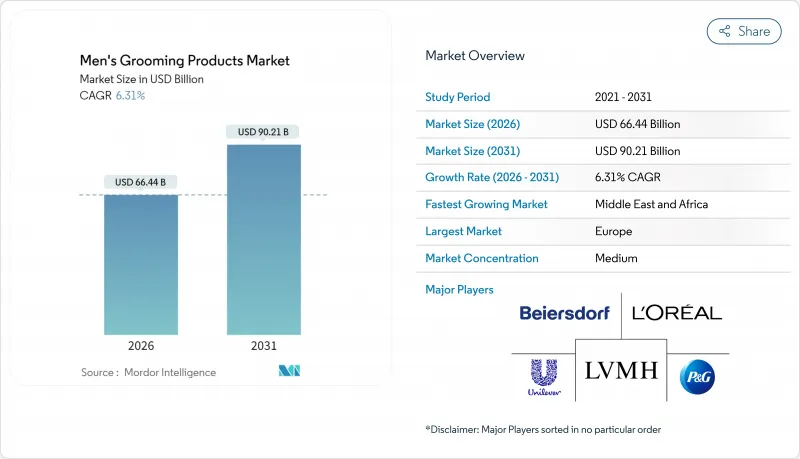

The men's grooming products market was valued at USD 62.50 billion in 2025 and estimated to grow from USD 66.44 billion in 2026 to reach USD 90.21 billion by 2031, at a CAGR of 6.31% during the forecast period (2026-2031).

Rising disposable incomes, social media influence, and shifting cultural perceptions of masculinity are encouraging men to adopt multifaceted self-care routines that now mirror long-established female beauty behaviors. Premiumization, ingredient transparency, clean-label demand, and rapid device innovation are expanding category breadth, while sustainability concerns are reshaping packaging design and raw-material selection. This is driving the growth in the number of organic products. For instance, according to the Bundesanstalt fur Landwirtschaft und Ernahrung, as of December 2024, a total of 109,567 products in Germany carried organic labels. Competitive momentum is intensifying as global conglomerates acquire agile digital-native brands to secure growth niches. Meanwhile, omnichannel retail strategies are widening consumer access and fostering data-driven personalization, reinforcing the long-term expansion narrative for the men's grooming products market.

Global Men's Grooming Products Market Trends and Insights

Expansion of Men's Skincare and Specialized Routines

Men's skincare adoption accelerates beyond traditional aftershave applications, with specialized formulations addressing specific concerns like acne, aging, and sensitivity. According to a survey by Hot Pepper Beauty Academy in August 2023, face wash emerged as the top cosmetic choice for male consumers in Japan. The survey revealed that 49% of Japanese men purchased at least one face wash product in the past year. In line with this, Dove Men+Care's Advanced Care Face + Body Cleansing collection launch in January 2025 targets dry repair, sensitive calm, and acne clear segments, reflecting 80% male consumer interest in advanced skincare solutions. Similarly, Estee Lauder's Lab Series expansion into Amazon Premium Beauty demonstrates institutional confidence in male skincare sophistication, emphasizing science-backed formulations for educated consumers. Suntory Wellness's KIZEN launch in the US market achieved 90% satisfaction rates in pre-launch testing, with 92% specifically satisfied with moisturizing properties, indicating formulation precision drives adoption. This expansion creates new revenue streams while elevating average selling prices across product portfolios. Moreover, FDA cosmetic regulations under the Modernization of Cosmetics Regulation Act of 2022 ensure safety standards that build consumer confidence in specialized formulations, driving the market's growth.

Growing Market for Beard Care and Styling

Beard care evolves from basic maintenance to sophisticated styling systems, with specialized tools and formulations creating distinct market segments. For instance, Highland's "The Wash" launch addresses hair thinning concerns among consumers under 35. Additionally, in 2023, Cosmetica Italia reported that shaving soaps and gels led to men's care product consumption in Italy, capturing a notable 58.4% share. Patent developments include compositions for hair loss prevention and treatment, incorporating natural extracts like shikimic acid and ursolic acid, expanding therapeutic applications. Moreover, beard styling tools integrate precision engineering with ergonomic design, creating premium price points that justify investment in specialized manufacturing capabilities. NSF/ANSI 305 standards for organic personal care products enable premium positioning for natural beard care formulations, further supporting the market's growth.

Intense Market Competition

Market saturation in developed regions intensifies competitive pressure, compressing margins and requiring increased marketing investments to maintain share. Suave's relaunch with 34 new products priced under USD 6 in June 2025 demonstrates value positioning strategies, emphasizing competitive pricing against premium brands like Olaplex through "dupe culture" marketing. Procter & Gamble's grooming segment experienced net sales of USD 1.68 billion despite 4% unit volume increases as of June 2025, indicating pricing pressure from competitive dynamics. Moreover, private label expansion threatens branded manufacturers, with retailers developing sophisticated formulations that match branded performance at lower price points. Digital-native brands like Harry's and Dollar Shave Club disrupted traditional distribution models, forcing established players to invest heavily in direct-to-consumer capabilities and subscription services. Thus, competitive intensity accelerates consolidation, as demonstrated by major acquisitions like Unilever's Dr. Squatch purchase, creating barriers for smaller independent brands seeking market access.

Other drivers and restraints analyzed in the detailed report include:

- Technological Innovations in Grooming Tools

- Rise of Natural and Organic Products

- Environmental Concerns Associated with Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shaving products maintained a 24.35% market share in 2025, reflecting established consumer habits and repeat purchase patterns, while skincare products achieved an 8.11% CAGR through 2031, indicating fundamental shifts in male grooming priorities. Traditional shaving categories, including pre-shave, post-shave, and razors and blades, benefit from technological innovations like Panasonic's Series 900s, featuring 70,000 cutting actions per minute and Responsive Beard Sensor+ Technology. Hair care products experience steady growth through specialized formulations addressing thinning concerns, with Highland's "The Wash" targeting consumers under 35 who invest in preventative care. Other product types, including fragrances and body care, expand through celebrity partnerships, exemplified by Aramis' Intuition launch with Dwyane Wade as global ambassador in May 2025.

Skincare acceleration stems from sophisticated consumer education and targeted formulations addressing specific concerns like acne, aging, and sensitivity. Dove Men+Care's Advanced Care Face + Body collection launch in March 2023 demonstrates market sophistication, with 80% of men expressing interest in advanced skincare solutions. Similarly, Lab Series expansion into Amazon Premium Beauty in August 2024 emphasizes science-backed formulations for educated consumers seeking clinical efficacy. Patent developments include compositions for treating urushiol-induced contact dermatitis using lysine, addressing skin irritation concerns that drive skincare adoption. Moreover, FDA cosmetic regulations under MoCRA ensure safety standards that build consumer confidence in specialized skincare formulations, supporting premium price positioning across the category.

Mass market products command 72.85% market share in 2025, demonstrating broad consumer accessibility and established distribution networks, while premium segments achieve 7.52% CAGR through 2031, reflecting consumer willingness to invest in superior formulations and experiences. Premium positioning benefits from technological innovations like Philips' i9000 Prestige Ultra, featuring AI-driven coaching and precision engineering. Mass market strategies focus on value positioning, exemplified by Suave's relaunch with 34 products priced under USD 6 in March 2025, targeting consumers seeking premium performance at accessible price points.

Premium growth acceleration stems from consumer sophistication and willingness to invest in personalized experiences that deliver superior results. For instance, Dr. Squatch's USD 1.5 billion valuation in June 2025 demonstrates premium natural positioning effectiveness, with Unilever's acquisition targeting international expansion of high-margin formulations. Similarly, Scotch Porter's recognition as the fastest-growing US male grooming brand reflects premium positioning success, achieving over 70% growth while emphasizing community impact and holistic wellness approaches. Moreover, patent protection enables premium pricing through technological differentiation, with L'Oreal filing over 370 international applications in 2023, including smart grooming innovations. Mass market resilience stems from distribution accessibility and repeat purchase patterns, though margin pressure from private label expansion requires continuous innovation to maintain competitive positioning.

The Men's Grooming Products Market is Segmented by Product Type (Skin Care Products, Hair Care Products, Shaving Products, and More), Price Range (Mass and Premium), Category (Conventional and Natural, and Organic), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Regional dynamics, shaped by cultural nuances, economic trajectories, and evolving consumer preferences, define the global men's grooming products market. Europe, with its deep-rooted appreciation for premium offerings and a well-established brand landscape, commands the largest market share. In 2025, Europe accounted for 27.45% of global revenues, bolstered by legacy luxury brands, unified EU cosmetic regulations, and a consistent cost structure. While Western Europe leans towards upscale fragrances and cutting-edge anti-aging solutions, Eastern Europe boasts cost-effective manufacturing and a burgeoning middle-class appetite. Sustainability trends from the Nordics are swiftly gaining traction, pushing for wider adoption of recyclable packaging. Countries like the U.K., Germany, and Italy lead the continent's demand for natural formulations and established grooming routines. North America, closely trailing Europe, thrives on its affluent consumer base, heightened brand awareness, and the emergence of the "metrosexual" trend, with notable investments in high-tech grooming devices and subscription services.

In the Middle East and Africa, an impressive 8.36% CAGR positions it as the fastest-growing region. Dubai's strategic logistics zones and Saudi Arabia's Vision 2030 retail initiatives are paving the way for global grooming brands. Factors like a youthful urban demographic, heightened social media influence, and a surge in tourism are propelling consumption. While South Africa serves as a pivotal distribution hub, Nigeria holds promise for future growth, contingent on stabilizing spending power.

North America stands at the forefront of tech-centric grooming solutions and rapidly expanding direct-to-consumer brands. Suntory's KIZEN moisturizer, boasting a 90% satisfaction rate in U.S. trials, underscores the market's receptiveness to scientifically formulated imports. Canadian consumers echo U.S. preferences, especially favoring clean labels, while Mexico's maquiladora system facilitates razor assembly near the border. The Asia-Pacific region presents a dual narrative: Japan and South Korea lead in innovation, while India and China drive volume, each year welcoming millions of new entrants to the men's grooming arena.

- Procter & Gamble Co.

- Beiersdorf AG

- L'Oreal SA

- Edgewell Personal Care Co.

- Unilever PLC

- Natura & Co Holding SA

- LVMH Moet Hennessy Louis Vuitton SA

- Chanel Ltd.

- Coty Inc.

- Combe Inc.

- Koninklijke Philips N.V.

- Panasonic Corp.

- Harry's Inc.

- Dollar Shave Club

- Beardbrand LLC

- Marico Ltd.

- Scotch Porter LLC

- Johnson & Johnson Services Inc.

- Kao Corp.

- Braun GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of men's skincare and specialized routines

- 4.2.2 Growing market for beard care and styling

- 4.2.3 Technological innovations in grooming tools

- 4.2.4 Rise of natural and organic products

- 4.2.5 Personalization and customization

- 4.2.6 Premiumization trend

- 4.3 Market Restraints

- 4.3.1 Intense market competition

- 4.3.2 Environmental concerns associated with packaging

- 4.3.3 Fluctuating raw material costs

- 4.3.4 Allergic reactions and skin sensitivities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Skin Care products

- 5.1.1.1 Face Wash

- 5.1.1.2 Moisturizers

- 5.1.1.3 Face Mask

- 5.1.1.4 Other Skin Care Products

- 5.1.2 Hair Care products

- 5.1.2.1 Shampoo and Conditioners

- 5.1.2.2 Styling Products

- 5.1.2.3 Hair Colorants

- 5.1.2.4 Other Hair Care Products

- 5.1.3 Shaving Products

- 5.1.3.1 Pre-Shave

- 5.1.3.1.1 Shaving Cream

- 5.1.3.1.2 Pre-Shave Oil

- 5.1.3.1.3 Shaving Soap

- 5.1.3.1.4 Other Pre-Shave Products

- 5.1.3.2 Post-Shave

- 5.1.3.2.1 After-Shave

- 5.1.3.2.2 Balms

- 5.1.3.2.3 Other Post-Shave Products

- 5.1.3.3 Razors and Blades

- 5.1.3.1 Pre-Shave

- 5.1.4 Other Product Types

- 5.1.1 Skin Care products

- 5.2 By Price Range

- 5.2.1 Mass

- 5.2.2 Premium

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Natural and Organic

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Specialty Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Retail Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Procter & Gamble Co.

- 6.4.2 Beiersdorf AG

- 6.4.3 L'Oreal SA

- 6.4.4 Edgewell Personal Care Co.

- 6.4.5 Unilever PLC

- 6.4.6 Natura & Co Holding SA

- 6.4.7 LVMH Moet Hennessy Louis Vuitton SA

- 6.4.8 Chanel Ltd.

- 6.4.9 Coty Inc.

- 6.4.10 Combe Inc.

- 6.4.11 Koninklijke Philips N.V.

- 6.4.12 Panasonic Corp.

- 6.4.13 Harry's Inc.

- 6.4.14 Dollar Shave Club

- 6.4.15 Beardbrand LLC

- 6.4.16 Marico Ltd.

- 6.4.17 Scotch Porter LLC

- 6.4.18 Johnson & Johnson Services Inc.

- 6.4.19 Kao Corp.

- 6.4.20 Braun GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK