PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910513

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910513

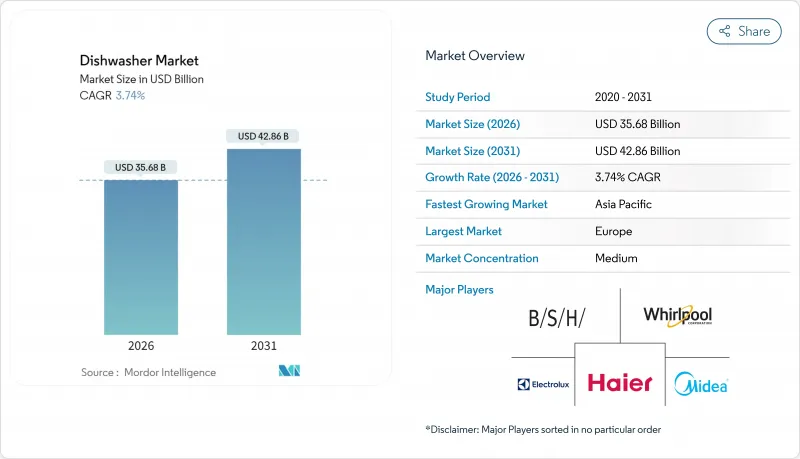

Dishwasher - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The dishwasher market is expected to grow from USD 34.39 billion in 2025 to USD 35.68 billion in 2026 and is forecast to reach USD 42.86 billion by 2031 at 3.74% CAGR over 2026-2031.

Demand momentum is tied to renovation-driven household upgrades that became entrenched when remote work increased kitchen usage, while global energy- and water-efficiency mandates compress replacement cycles and steer consumers toward premium, regulation-compliant models. Smart-home ecosystem adoption further boosts the dishwasher market through remote diagnostics, predictive maintenance, and voice-controlled convenience that raise perceived appliance value and accelerate upgrade decisions. Manufacturers also capitalize on scale efficiencies in electronic components that gradually reduce average selling prices without eroding margins, thereby widening the addressable customer base in emerging regions. Supply-chain recalibrations have trimmed pandemic-era semiconductor bottlenecks, yet ongoing vigilance is required to prevent cost spikes in controllers and sensors that remain essential for connected features. Regional performance diverges strongly: Europe leverages entrenched penetration and replacement demand to hold the largest share, whereas Asia-Pacific gains pace on urbanization and rising disposable incomes. Competitive intensity stays moderate, with the top five players controlling 56.4% of 2024 revenues, so scale economies coexist with feature-led differentiation that lets innovators defend price premiums.

Global Dishwasher Market Trends and Insights

Surge in Post-Pandemic Home Renovation

Kitchen modernization surged during extended lockdowns, and dishwashers shifted from discretionary purchases to fixtures viewed as essential for household efficiency. Homeowners now integrate dishwashers within whole-kitchen renovation packages rather than treating them as isolated replacements, thereby locking in higher average unit revenues. The trend dovetails with aesthetic preferences for seamless cabinetry, which amplifies demand for built-in models that disappear behind custom panels. Promotional pricing and cost-takeout programs, Whirlpool shaved USD 300 million from its 2024 cost base, have preserved margins while attracting value-focused renovators. Remodel-driven sales also stabilize seasonal fluctuations because renovation projects span multiple months, smoothing quarterly shipment patterns. The driver's medium-term influence is expected to persist as remodeling backlogs and aging housing stocks keep replacement demand elevated even after pandemic effects recede.

Rising Water- & Energy-Efficiency Regulations

Efficiency mandates tighten performance thresholds, compelling both accelerated replacement cycles and R&D spending that yield next-generation, resource-conserving models. The U.S. Department of Energy is targeting <= 3.5 gallons per cycle for standard units by April 2027, a benchmark already steering manufacturers toward redesigned spray arms, optimized pump systems, and auto-dosing detergents. State initiatives add complexity: Maryland now requires certification in regional efficiency databases, raising compliance documentation costs but also leveling the field for high-efficiency incumbents. In Europe, Eco-design rules continue to influence global engineering roadmaps by mandating energy labels that reward water-saving cycles. Companies able to exceed these benchmarks gain marketing leverage and can command premiums by quantifying long-term utility bill savings to eco-conscious buyers. The long-term regulatory push, therefore, underpins sustained innovation funding while marginalizing laggards that cannot amortize redesign expenses.

High Repair & Maintenance Costs

Sophisticated control boards, Wi-Fi modules, and precision sensors improve functionality yet raise the price of spare parts and specialized labour, elevating lifetime ownership costs. Consumers increasingly purchase extended warranties, implicitly acknowledging the risk of costly breakdowns. Service technicians must now possess software diagnostic skills, and scarce expertise can lengthen repair lead times, undermining user satisfaction. Right-to-repair legislation aims to democratize access to parts and manuals, but coverage remains patchy; Middleby's typical one-year warranty plus paid extensions illustrates standard industry practice. Elevated repair expense encourages some owners to defer replacements or revert to handwashing, trimming potential demand. In markets where labour costs are high, repairing older units can rival the price of a new mid-tier appliance, complicating replacement decisions.

Other drivers and restraints analyzed in the detailed report include:

- Penetration of Smart-Home Ecosystems

- Growth of Compact Urban Households

- Consumer Preference for Handwashing in Asia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Built-in dishwashers recorded a robust 7.02% CAGR outlook through 2031, even as freestanding units retained 53.72% 2025 revenue leadership within the dishwasher market. Built-ins benefit from aesthetic alignment with modern cabinetry, and property developers now specify them in mid-priced condominiums, accelerating first-time installations. ASPs remain elevated USD 400 to USD 1,200 yet consumers accept higher costs because integrated layouts free floor space and deliver quieter operation that suits open plan living. The segment also plays a pivotal role in capturing the smart-kitchen opportunity, since builders can pre-wire for connectivity, enhancing user stickiness to brand ecosystems. Declining controller costs narrow the price gap against freestanding formats, lowering adoption barriers without diluting brand equity. Luxury homebuyers increasingly demand panel-ready finishes, stimulating premium SKUs that upsell third racks and interior LED lighting. As a result, built-in advances are vital to sustaining top-line expansion for brands facing volume plateaus in mature regions.

Freestanding dishwashers still dominate the dishwasher market because renters and budget-conscious owners value plug-and-play flexibility and lower ticket prices. Manufacturers preserve volume via refresh cycles that add third racks, auto-release doors, and quieter motors, but margins face pressure from price competition sparked by new Asian entrants. Portable and countertop models unlock growth pockets among urban singles and retirees who prioritize minimal installation complexity. Samsung's rollout of third-rack freestanding units demonstrates strategy convergence that blurs traditional feature gaps between formats. While unit growth is modest, freestanding share remains critical for factory scale utilization and emerging-market penetration, where housing stock often lacks cabinetry infrastructure. Continued innovation is expected to sustain relevance, yet the format's growth ceiling remains lower than that of built-ins given space optimization trends.

The Dishwasher Market Report is Segmented by Product Type (Freestanding, Built-In), Application (Residential, Commercial), Distribution Channel (Multi-Brand Stores, Exclusive Stores, Online, Other Distribution Channels), and Geography (North America, South America, Europe, Asia-Pacific, Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe accounted for 29.05% of the 2025 dishwasher market revenues, anchored by mature penetration rates and stringent EU Eco-design standards that compel frequent upgrades. Consumers prize quietness and full-panel integration, prompting sustained demand for premium features that protect margins. Replacement cycles shorten whenever Brussels tightens energy labels, and makers like BSH leverage local engineering hubs to field rapid product refreshes. Rental stock modernization programs funded by green-housing grants also inject a steady volume. While unit growth is modest, value appreciation stemming from advanced connectivity and noise ratings preserves revenue growth in the low single digits. Dealer networks remain robust, and after-sales services enhance customer stickiness amid intensifying competition.

Asia-Pacific is set to be the fastest-growing contributor, wielding a 7.05% CAGR to 2031, propelled by urbanization, rising middle-class incomes, and government infrastructure initiatives. Chinese domestic shipments approached 1.94 million units even as exports hit 5.8 million, signalling both local appetite and supply-chain strength. Manufacturers pursue localization, installing chopstick racks and high-temperature "rice paste" cycles to overcome cultural hand-washing inertia. Price tiers span from USD 250 local brands to USD 1,400 European imports, catering to diverse purchasing power. Smart-home readiness resonates among tech-affine millennials, accelerating feature adoption. Yet logistical challenges in tier-three cities and variable after-sales networks temper near-term upside. Long-term growth hinges on sustained marketing education and joint ventures that embed distribution deeper into inland clusters.

North America delivers steady mid-single-digit growth underpinned by renovation cycles tied to aging housing stock and rising remote-work routines that increase kitchen usage frequency. DOE regulations shape product pipelines, and proposed rollbacks create temporary planning uncertainty that may delay some model introductions. Latin American markets, particularly Brazil and Mexico, are rebounding from currency volatility as appliance credit programs gain traction; Whirlpool registered 4% net sales growth in its Latin American operations during 2024. Middle Eastern and African regions remain underpenetrated; infrastructure and affordability barriers linger but hotel pipeline projects create beachheads for commercial units. Canadian demand mirrors U.S. trends yet lean more heavily toward premium quietness features due to smaller average home sizes.

- BSH Hausgerate GmbH (Bosch-Siemens)

- Whirlpool Corporation

- Electrolux AB

- Haier Smart Home Co.

- Midea Group

- LG Electronics

- Samsung Electronics

- Panasonic Corp.

- SMEG S.p.A

- Arcelik A.S.

- Hisense Group

- ASKO Appliances

- Miele & Cie. KG

- Koninklijke Philips N.V.

- Fagor Electrodomesticos

- Robam Appliances

- Bajaj Electricals

- IFB Industries

- Glen Dimplex

- Sub-Zero Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Post-Pandemic Home Renovation

- 4.2.2 Rising Water- & Energy-Efficiency Regulations

- 4.2.3 Penetration of Smart-Home Ecosystems

- 4.2.4 Growth of Compact Urban Households

- 4.2.5 Declining Average Selling Price of Built-in Units

- 4.2.6 Hospitality Expansion in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 High Repair & Maintenance Costs

- 4.3.2 Consumer Preference for Hand-Washing in Asia

- 4.3.3 Supply-Chain Volatility in Key Components

- 4.3.4 E-waste Disposal Compliance Burden

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Freestanding

- 5.1.2 Built-in

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Multi-Brand Stores

- 5.3.2 Exclusive Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Peru

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 BSH Hausgerate GmbH (Bosch-Siemens)

- 6.4.2 Whirlpool Corporation

- 6.4.3 Electrolux AB

- 6.4.4 Haier Smart Home Co.

- 6.4.5 Midea Group

- 6.4.6 LG Electronics

- 6.4.7 Samsung Electronics

- 6.4.8 Panasonic Corp.

- 6.4.9 SMEG S.p.A

- 6.4.10 Arcelik A.S.

- 6.4.11 Hisense Group

- 6.4.12 ASKO Appliances

- 6.4.13 Miele & Cie. KG

- 6.4.14 Koninklijke Philips N.V.

- 6.4.15 Fagor Electrodomesticos

- 6.4.16 Robam Appliances

- 6.4.17 Bajaj Electricals

- 6.4.18 IFB Industries

- 6.4.19 Glen Dimplex

- 6.4.20 Sub-Zero Group

7 Market Opportunities & Future Outlook

- 7.1 Rapid Adoption of Connected Kitchen Suites

- 7.2 Rental-Economy Demand for Compact Countertop Units